martin-dm

Article Thesis

Advanced Micro Devices (NASDAQ:NASDAQ:AMD) has slumped massively in recent months. The company has a strong product lineup and is gaining market share and management is positive about its future. At the same time, AMD is priced for a massive downturn in end markets, even though the market is not factoring that into the share prices of customers such as Apple (AAPL) yet. With AMD trading at a historically low valuation and being able to buy back shares cheaply, it looks attractively priced during the current market panic.

Positioned For Long-Term Growth

Advanced Micro Devices looks like a company that should grow at an above-average rate over the medium to long term, no matter whether there is a temporary downturn in the very near term or not. The company offers attractive products that allow it to gain market share in important end markets, such as data centers.

AMD’s EPYC processors have advantages over competing data center products when it comes to energy efficiency, for example. That’s becoming a better and better argument for data center companies to buy AMD’s products, as the global energy crisis has made electricity costs explode around the world. In Europe, for example, electricity costs have gone up by several hundred percentage points. Since electricity costs are a major part of data center expenses, companies will be inclined to go with AMD’s products that use resources more efficiently and that will allow them to save money when it comes to operating expenses.

AMD is pursuing its data center approach via M&A as well, e.g. by acquiring Pensando. This acquisition closed in summer and expands AMD’s capabilities in the data center space. Its chips help perform “overhead” functions in data centers more efficiently, which helps AMD establish itself further as the efficiency leader in the data center space, providing significant competitive advantages versus peers that aren’t offering products that are comparably energy efficient and therefore running at comparatively low costs.

Advanced Micro Devices’ business growth in the data center space has been well above the industry average, as the company was able to grow its revenue in this area by 83% year over year during the most recent quarter, outperforming NVIDIA (NVDA), which is also struggling in the GPU space, and especially Intel (INTC), which saw its data center revenue fall year over year.

The data center market overall is forecasted to grow at a low-double digit rate over the next couple of years, which is pretty attractive already. But since AMD has been gaining market share for quite some time, and since rising energy costs make its energy-efficient product lineup even more appealing, I believe that it is highly likely that AMD will grow at a significantly faster pace than the overall market going forward. For the current quarter, AMD has guided towards revenue growth of 55% year over year, led by data center growth.

Of course, growth will not always be this high. Right now it’s partially fueled by M&A, which will not always be the case. On top of that, the law of large numbers dictates that maintaining a very high relative growth rate becomes harder over time, thus investors will have to accept a slower revenue growth rate in the long run. But at current valuations, AMD is almost priced for a no-growth scenario, and its growth will be very solid still. Even if AMD were to grow its revenue by just 15% a year over the next couple of years, that would be highly attractive, considering its very undemanding current valuation.

Advantaged Versus Peers

Versus its two core peers Intel and NVIDIA, AMD looks very advantaged. Intel is struggling in many different ways, e.g. by losing market share in the data center space, by seeing its margins come under pressure, and due to its free cash flow being very weak — even negative. NVIDIA is better-positioned than Intel, but looks nevertheless like it is struggling more than AMD on an operational basis. Its data center business growth rate is strong, but not as strong as that of AMD. It is also way more exposed to the cryptocurrency bear market, which has resulted in slumping GPU sales for NVIDIA as cryptocurrency miners buy less equipment. Last but not least, NVIDIA still trades at a pretty high valuation, unlike Advanced Micro Devices. A higher valuation naturally allows for more downside potential and makes the more expensive stock riskier, all else equal.

Buybacks Are Getting More Efficient By The Day

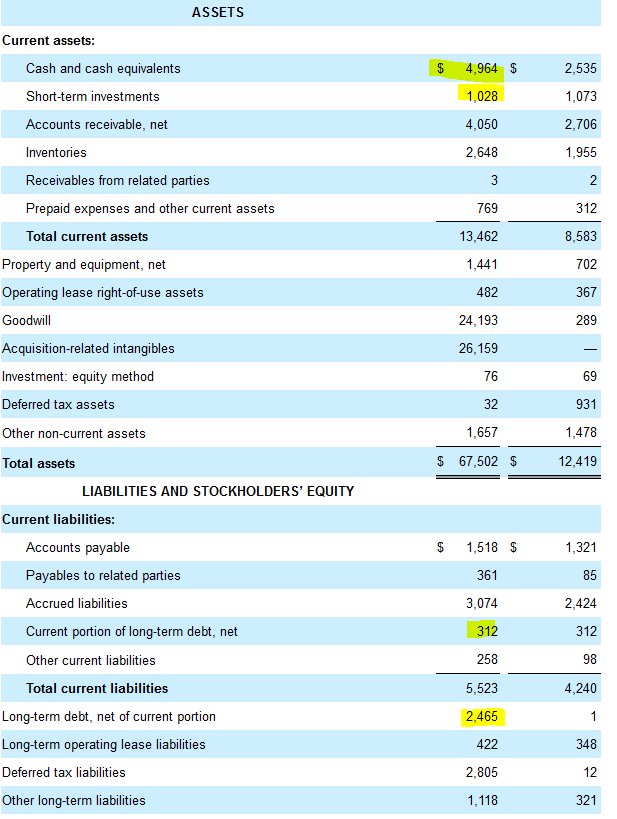

Advanced Micro Devices is a company that operates with a very clean balance sheet. The most recent 10-Q shows the following data:

AMD 10-Q

Netting the cash position against AMD’s debt gets us to a net cash pile of $3.2 billion. A net cash position naturally reduces risks for a company during any kind of crisis or downturn. In the current rising rates environment, a net cash position also protects AMD versus rising interest expenses, a headwind that will pressure the profitability of more indebted companies over the coming years.

But AMD’s net cash position also means that the company has great optionality when it comes to further M&A, and that Advanced Micro Devices can be aggressive with shareholder returns if it wants to. AMD is currently not paying any dividend, and I believe this will remain the case. Thus, shareholder returns would come in the form of stock repurchases. At the current valuation, and considering AMD’s strong long-term growth potential, those buybacks could be highly value generating, I believe. Every share that AMD buys back at the current very undemanding valuation means that future profits will be distributed over a lower number of shares, increasing each remaining share’s portion of the “earnings pie” forever.

AMD’s management seems to agree with that assessment, which is why the company has hiked its share repurchase authorization to $12 billion this year. That covers around 11% of the company’s current market capitalization. If fully executed at or close to current valuations, this repurchase program could thus have a large impact on AMD’s share count, in turn giving a nice boost to the company’s earnings per share. Much has been said about Apple’s buybacks, but those averaged only around 4% per year in the past — and even that had a pretty large impact over several years. Since AMD is currently trading with an earnings yield of 7%, it could buy back shares way more aggressively than Apple did in the past (on a relative basis). This is especially true in case AMD decides to spend some of the cash it currently holds on its balance sheet.

Since AMD is not operating its own fabs, unlike Intel, for example, there is little need to spend on capital investments. AMD thus is able to generate strong free cash flows relative to the net profits it generates — unlike Intel. In fact, AMD’s free cash flow over the last twelve months was slightly higher than its net profit. If that remains the case going forward, AMD could easily buy back shares at a high single digit pace over the next couple of years. But let’s assume that AMD only buys back 5% of its shares per year, which would be more than covered by net profits and free cash flows. If AMD manages to do that, while growing its revenue by 10% a year, it could generate earnings per share growth in the 15% region even without growing its margins at all. Analysts are currently expecting AMD to grow its revenue by more than 10% a year through 2025, and the combination of a strong market growth rate and AMD’s market share gains makes me believe that growth of more than 10% is pretty likely. But even if growth were to come in at 10%, below expectations, the earnings growth outlook would still be quite compelling. That’s a nice setup for investors — even in a somewhat bearish scenario where AMD underperforms versus current estimates, growth would still be compelling.

AMD: Priced For Disaster

AMD is growing at a 50% rate this year. Over the next couple of years, growth will slow down, as takeovers are lapped. But still, the company’s strong positioning in major growth markets such as data centers positions it well for further business growth. Combine this with some buybacks, and strong earnings per share growth over the next couple of years can be expected.

And yet, AMD is now trading at a pretty low valuation. Based on current estimates, Advanced Micro Devices trades for just 14.5x this year’s net profits. That’s well below the broad market’s valuation, and also very cheap relative to how NVIDIA is valued — even though NVIDIA will grow less this year.

Add a clean balance sheet, and AMD looks set up for compelling returns over the next couple of years. In the near term, volatile markets could make AMD drop lower, but I do believe that there is a very high likelihood that AMD will trade materially higher a couple of years from now. The company’s very strong and industry-leading operational execution, a strong product lineup, and the ability to buy back shares cheaply should make for compelling total returns over a couple of years.

Be the first to comment