jetcityimage/iStock Editorial via Getty Images

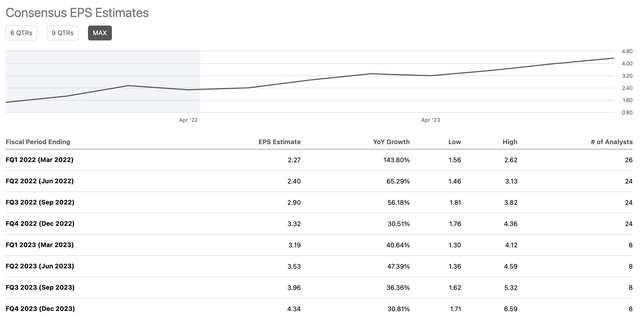

Tesla (NASDAQ:TSLA) will report earnings soon, and the company’s financial results should skyrocket. Analysts expect the company to report approximately $17.8 billion in revenues and $2.27 in EPS for Q1 2022. While the anticipated 71% revenue surge is massive, I expect the company will do better. Tesla delivered a record-shattering production and deliveries report in early April. Moreover, the company is becoming increasingly more efficient and profitable each quarter. Tesla should beat consensus estimates and will likely report revenues and EPS towards the high-end of analysts’ projections. Moreover, Tesla’s stock has several positive catalysts, including a constructive technical setup, significant growth prospects, and an upcoming stock split. I’m not selling a single share prior to earnings, as this constructive backdrop should power Tesla’s stock to new ATHs.

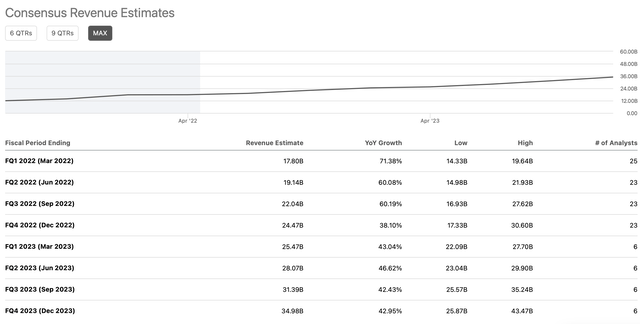

Tesla’s Technical Setup

Tesla recently pulled back to the $1,000 support level and is now going through a healthy consolidation phase. It looks like the stock is preparing for a move higher. We see the full stochastic around 17 here, which should turn higher soon. This technical gauge illustrates a possible momentum change shortly. Therefore, we should see a move towards the $1,150-1,250 crucial resistance level soon, after which we could see a breakout to new ATHs.

Q1 Estimates And Future Forecasts

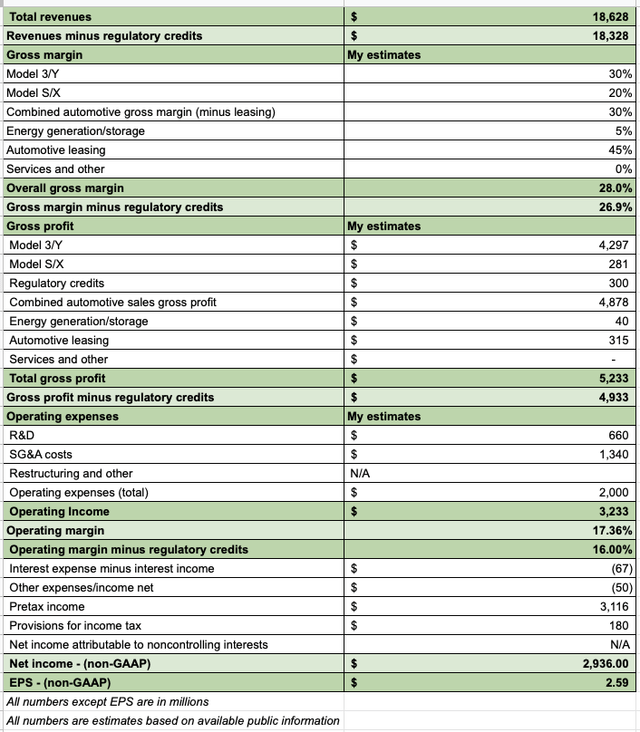

EPS (Seeking Alpha) Revenues (Seeking Alpha)

First, I want to draw your attention to the great growth expectations in future quarters. Also, while we don’t see analysts’ projections beyond 2023, Tesla likely has an abundant growth runway ahead. I expect the company’s revenue growth to remain relatively high (above 20%) through 2030. Growth is the single most crucial factor that sets Tesla apart from its traditional competitors in the automotive industry. Tesla’s revenues should continue expanding by 40-50% in 2023, and we should continue seeing robust double-digit growth in future years.

Tesla could deliver around $84 billion in revenues this year (consensus estimates). According to analysts, the company should provide about $120 billion in revenues next year. This dynamic represents a YoY revenue growth rate of approximately 43%, and the company should continue expanding revenues as we advance. Tesla likely has a very long growth runway ahead, and we will probably continue seeing its stock commanding high P/E multiples due to the enormous growth potential it offers.

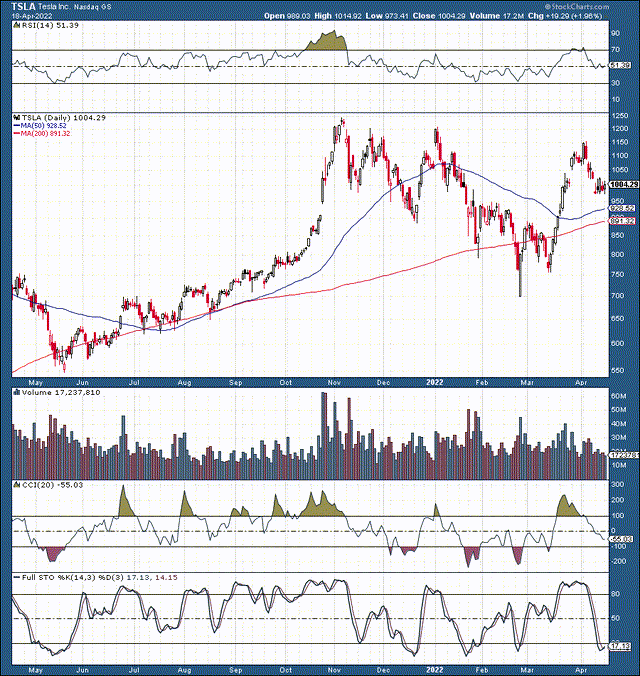

This quarter, we see that the company expects a sharp rise in revenues and EPS this quarter. The consensus is for a 144% YoY surge in EPS and a 71% increase in revenues. While the consensus analysts’ estimate is $17.8 billion in revenues, my estimate is $18.63 billion. Moreover, many analysts expect Tesla to deliver around $2.27 in EPS, but my estimate is for $2.59 this quarter.

My Q1 Estimates For Tesla

In addition to better than anticipated revenues and earnings, I suspect Tesla can report record efficiency and profitability numbers. I’m projecting that the company’s gross margin will come in at about 28%, and the company’s operating margin could be around 17% this quarter. Even if we remove regulatory credits from the equation, Tesla’s operating margin can still be about 16%, in my view. People questioned Tesla’s profitability prospects, but Tesla is much more profitable than other automakers now.

Tesla delivered an operating margin of nearly 15% in its last quarter, significantly higher than other automakers. For instance, Ford’s (F) operating margin has typically been around 2-3% in recent years. The company’s operating margin also dipped into negative territory recently. General Motors (GM) operating margin is more stable than Ford’s, but it has been trending only around 5-9% in recent quarters. Even the highly profitable Toyota (TM) has recently delivered an operating margin of approximately 10%, its highest. Honda Motor’s (HMC) operating margin has been about 6-7% lately, its highest.

Tesla’s gross margin has been trending around 25-30% for several quarters. Last quarter, the company reported an automotive gross margin of 30.6% and a total GAAP gross margin of 27.4%. In Q3 2021, Tesla delivered a total gross margin of around 27% and an operating margin close to 15%. Traditional automakers like Ford and GM typically have gross margins of about 10-15%, and their Japanese counterparts like Honda and Toyota have gross margins of around 20%. However, as the company grows more efficient due to economies of scale and high production standards, Tesla’s profitability numbers have been much more robust than its counterparts lately.

The Stock Split

Last time Tesla’s stock split, the company’s shares skyrocketed. Since the split announcement in the summer of 2020, the stock has appreciated about sixfold. Now, I’m not saying that we’ll see similar returns if Tesla splits its stock again, but we will likely see positive price action around and after the next split time. Tesla will put the split to a vote, and it will likely pass soon. We may see another 5 for one or a 10 for one stock split. A ten for one split would probably put the company’s shares at only around $100-150. This decreased stock price should attract more retail investors and investors looking to implement options strategies while owning Tesla’s shares. Generally, the split should positively affect sentiment and price action, and the stock could have a significant rally as a result.

The Bottom Line

I suspect that Tesla will beat its upcoming earnings report, and the stock will probably move higher. The company will likely report better top and bottom-line numbers and better efficiency metrics. Tesla is growing more efficient and profitable due to its economies of scale capabilities and other productivity advantages. We can see that Tesla has become more profitable than its competitors in the automotive industry. Moreover, the company has significant growth momentum and should continue growing revenues in the coming years. Tesla has considerable growth prospects and substantial profitability potential, making its stock attractive. Additionally, the company should go through another stock split soon, and we have a very constructive technical setup now. I’m not selling a single Tesla share, as I expect the stock to outperform going into earnings here and longer-term.

Risks To Tesla

Risks exist for Tesla, and there are quite a few. The company may miss earnings and revenue estimates. Furthermore, a slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla here. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider the risks carefully before committing any capital to a Tesla investment.

Be the first to comment