Novo Nordisk (NYSE:NVO) is one of the companies I am most confident about. The reason is quite simple: Novo Nordisk has one of the best and widest moats I know (see here for further details). In the following article, I will look at the annual results for fiscal 2021 and will especially focus on the growth potential Novo Nordisk has in the years to come. But we will also try not to ignore potential risks Novo Nordisk might be facing and despite Novo Nordisk is a great business, the stock is not cheap right now.

Annual Results

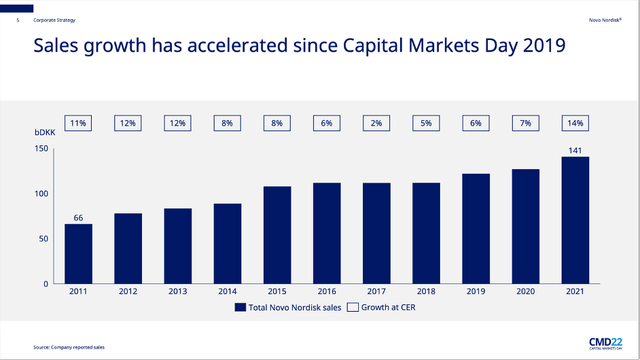

When looking at the fiscal 2021 results, we see a continuous improvement and Novo Nordisk has certainly returned to its “old strength” with double-digit growth rates. In 2016 and 2017 investors were quite shocked as Novo Nordisk suddenly reported revenue growth rates in the low single digits (especially in 2017, Novo Nordisk was a huge disappointment with only 2% revenue growth). But this also created a buying opportunity when Novo Nordisk could be purchased for as little as DKK 220 (about $30).

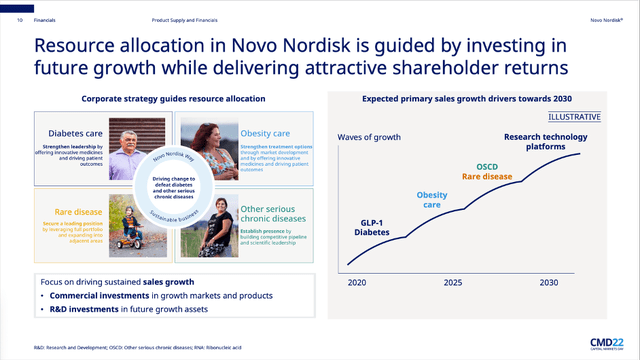

Novo Nordisk Capital Markets Day 2022

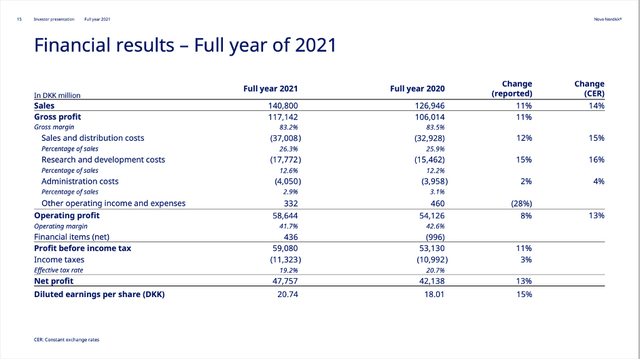

Since then, sales growth has improved again and especially in 2021 it accelerated further with net sales being DKK 140,800 million resulting in 10.9% reported growth compared to net sales of DKK 126,946 million in fiscal 2020. At constant exchange rates, revenue growth was even 14% year-over-year. Operating income also increased 8.3% year-over-year (13% at CER) from DKK 54,126 million in fiscal 2020 to DKK 58,644 million in fiscal 2021. And finally, diluted earnings per share increased from DKK 18.01 in fiscal 2020 to DKK 20.74 in fiscal 2021 – resulting in 15.2% year-over-year bottom line growth.

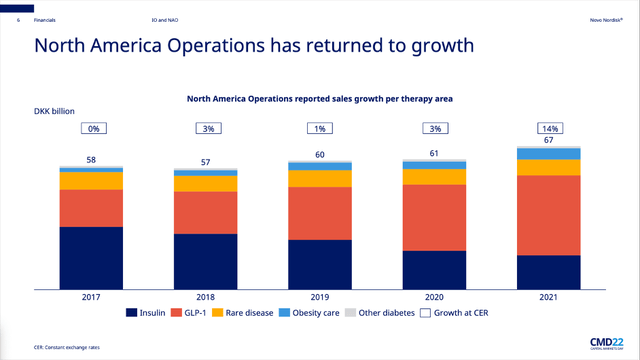

Novo Nordisk Q4/21 Presentation

And once again, Novo Nordisk could keep its gross margin extremely stable (83.2% in fiscal 2021 compared to 83.5% in fiscal 2020). Operating margin declined a bit from 42.6% in the year before to 41.7% in fiscal 2021, but that is no reason to worry. It is also reaffirming, that Novo Nordisk can grow its North America Operations again. Stagnating sales in North America in the years 2017 till 2020 were a problem and reason for concern. But in 2021, sales of its North America Operations increased from DKK 61 billion to DKK 67 billion – resulting in 14% year-over-year growth in constant exchange rates.

Novo Nordisk Capital Markets Day 2022

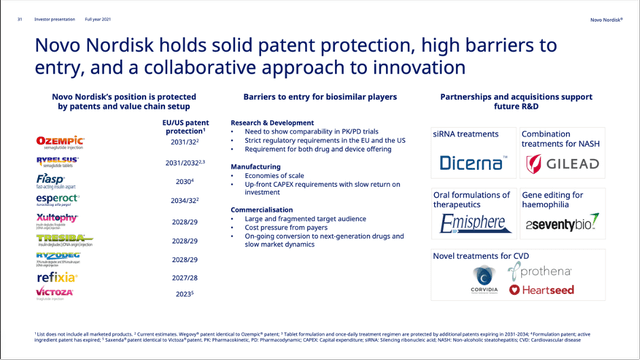

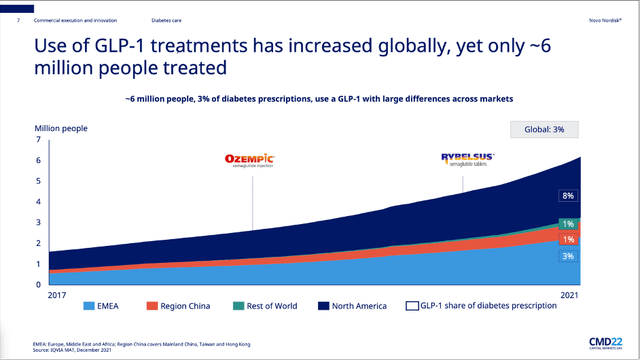

The main drivers of growth continue to be Novo Nordisk’s GLP-1 products as well as the obesity care products. Total GLP-1 sales increased from DKK 41,831 million to DKK 53,597 million. And while Victoza sales decreased from DKK 18,747 million to DKK 15,054 million, they were probably just cannibalized by the strong Ozempic growth as sales increased 59% YoY to DKK 33,705 million. Ozempic is now responsible for almost 24% of total sales and it can be dangerous for a company when a huge part of sales is stemming from just one product. However, Ozempic is patent protected until 2031 in the European Union and until 2032 in the United States. And finally, Rybelsus, which is also patent protected until 2031/2032 could grow sales 158% to DKK 4,848 million. The second driver of growth were the obesity care products Saxenda and Wegovy. Total sales increased from DKK 5,608 million in fiscal 2020 to DKK 8,400 million in fiscal 2021 – 50% year-over-year growth.

Growth

And while I was always confident, that Novo Nordisk while continue to grow with a solid pace, the picture is constantly improving and right now we can be very optimistic that Novo Nordisk will continue with a high pace. We can be optimistic due to several combining factors. In the last few years, Novo Nordisk lost patent protection for some of its major products, but right now most of the blockbusters are patent protected at least until 2028. Only Victoza and Saxenda will lose patent protection in 2023.

Novo Nordisk Q4/21 Presentation

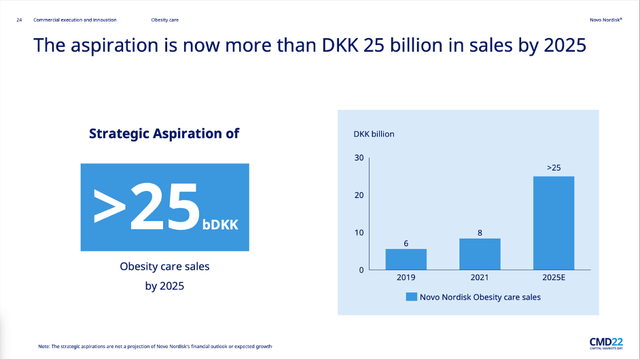

And aside from products not losing patent protection in the foreseeable future, the recently launched products as well as the pipeline will contribute to revenue growth in the years to come. First, we can expect obesity care sales to increase in the years to come. Novo Nordisk is targeting obesity care sales to be at least DKK 25 billion in 2025 and with a market share of 73%, Novo Nordisk is the dominant leader in this market.

Novo Nordisk Capital Markets Day 2022

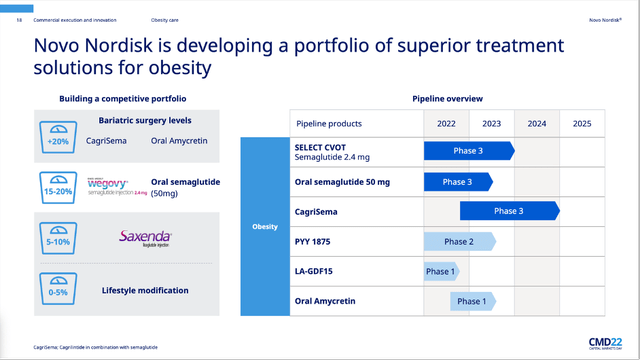

And growth will be achieved by the two already approved products – Saxenda and Wegovy. As far as I know, Novo Nordisk has not disclosed sales numbers for Wegovy yet, but a Jefferies analyst predicts that the drug already made about DKK 700 million in the last three months of 2021. And Wegovy sales growth might slow down a bit as a contract manufacturer filling syringes for Wegovy temporarily stopped deliveries in December 2021. As consequence, Novo Nordisk is expecting fewer new weekly patient initiations in the first half of 2022, but the company will still be able to meet demand in the second half of 2022. And while Novo Nordisk did not report sales for Wegovy, we know that the number of total weekly prescriptions is already exceeding Saxenda. Wegovy had about 22,000 weekly prescriptions in January 2022 while Saxenda had about 10,000 weekly prescriptions. And aside from Saxenda and especially Wegovy driving sales in the next few years, Novo Nordisk also has a solid pipeline of products, which are already in phase III and are expected to be launched in 2023 or 2024.

Novo Nordisk Capital Markets Day 2022

Novo Nordisk’s anti-obesity medications will certainly be one of the drivers of growth. However, GLP-1 products are also expected to continue growing in the years to come. And although the use of GLP-1 treatments has increased globally (between 2015 and 2020, the market for GLP-1 medications increased with a CAGR of 24.9%), only 6 million people are treated right now. These are only 3% of total diabetes prescriptions and Novo Nordisk is seeing huge growth potential for GLP-1 in the years to come.

Novo Nordisk Capital Markets Day 2022

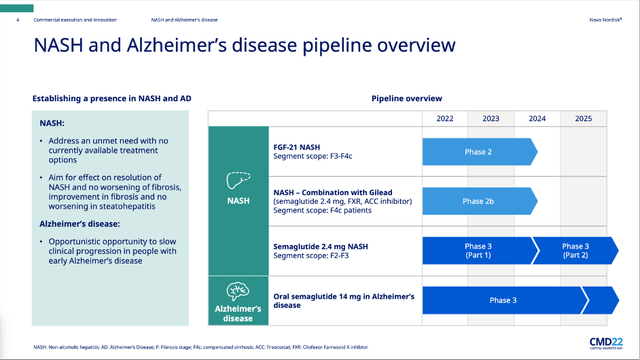

And for the years to come, Novo Nordisk also has its Nash and Alzheimer’s disease pipeline. And products could contribute to sales from 2025 going forward. And when looking at drugs to treat Alzheimer’s disease, several companies already failed in the past and when looking at the pipeline for NASH, several products are only in phase II and a lot can happen before they finally contribute to revenue.

Novo Nordisk Capital Markets Day 2022

Summing up, Novo Nordisk seems to have a clear path until 2030 with several “waves of growth” – consisting especially of GLP-1 products as well as anti-obesity medications in the next few years.

Novo Nordisk Capital Markets Day 2022

Risks

Of course – like every other business – Novo Nordisk is also facing risks and three risks seem worth mentioning. We wrote above that Novo Nordisk’s North America operations are also growing with a high pace again. Nevertheless, the United States are still trying to limit the cost of insulin and about three weeks ago, the House of Representatives voted on the “Affordable Insulin Now” act. And while it is unclear how the Senate will vote, it also remains to be seen how it will impact insulin makers like Novo Nordisk.

We could also mention the supply chain issues once again. In December 2021, when the news broke, the stock declined quite steep as investors suddenly seemed frightened. And similar to the effects of the “Affordable Insulin Now” act, it remains to be seen if the problems with the contract manufacturer will have a negative effect on fiscal 2022 results.

And finally, as Novo Nordisk is focusing more and more on type 2 diabetes and obesity, people could start living healthier, which would be great for those individuals and society, but could undermine the growth potential of the business. This would hardly affect type-1 diabetes and insulin sales, but GLP-1 and anti-obesity medication sales if people would live healthier and not become obese. It would also reduce the number of type-2 diabetics. However, I don’t consider this scenario likely.

Intrinsic Value Calculating

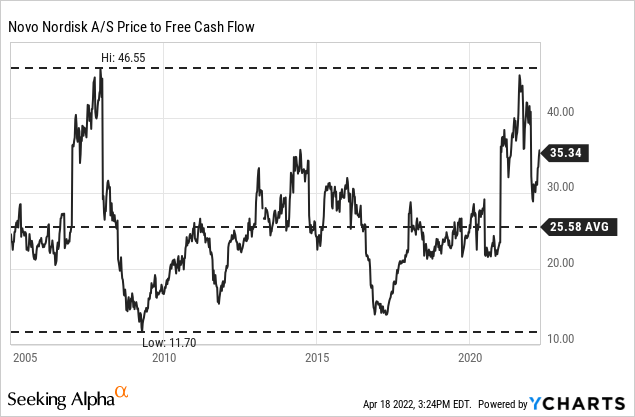

In my opinion, Novo Nordisk is still overvalued. We can start by looking at the price-free-cash-flow ratio and right now, Novo Nordisk is trading for 35 times free cash flow. When looking at the valuation multiples since 2005 (the oldest data we have here), Novo Nordisk is clearly trading above the average P/FCF ratio, which is 25.58. And although Novo Nordisk was trading as high as 45 times free cash flow in the past, we should not make the mistake and see Novo Nordisk as a bargain right now.

And an intrinsic value calculation is also showing that Novo Nordisk is not cheap right now. As basis for our discount cash flow calculation, we can take the midpoint of Novo Nordisk’s free cash flow guidance for fiscal 2022, which is DKK 52.5 billion. For perpetuity, we take 6% growth (as always when dealing with wide moat companies). In our base scenario, we assume 10% growth for the next ten years. This leads to an intrinsic value of DKK 760 and the stock would be fairly valued right now.

We can also use a rather bullish scenario and assume 13% growth for the next ten years. 13% is the CAGR of the last ten years (and this is still one of the lowest 10-year EPS CAGRs in the past as average growth rates were as high as 20% in the past). But when calculating with 13% growth for the next 10 years followed by 6% growth till perpetuity, it would lead to an intrinsic value of DKK 939 for Novo Nordisk.

If you are familiar with my articles and my style of investing, you know that I am rather a bit cautious and I don’t want to calculate with too optimistic numbers. But I still consider it likely, that Novo Nordisk will be able to grow in the low-to-mid teens in the next few years.

Conclusion

In my opinion, Novo Nordisk continues to be a hold and I will certainly not sell my position. But I also won’t add to my position as Novo Nordisk is not a good buy right now. I would like to increase my Novo Nordisk position at some point – as it is a great long-term investment – but I will wait for a similar buying opportunity as we had in 2016 and 2017.

While I won’t add myself right now, you probably won’t make a huge mistake in my opinion when you purchase Novo Nordisk and hold over the long run (at least for one decade). But we should also not be surprised if the stock has a larger setback or might trade sideways for several years as the current valuation is rather high.

Be the first to comment