Daniel Balakov

Overview

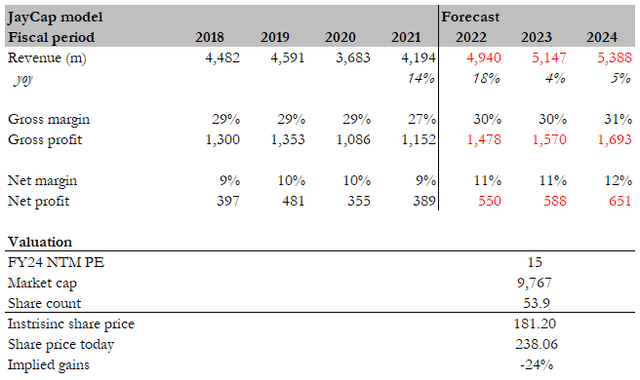

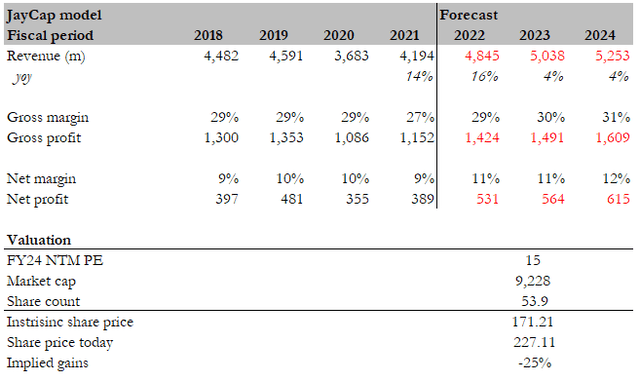

Despite the recent anticipated success (after the 3Q22 earnings report), I continue to view Hubbell Inc. (NYSE:HUBB) as overvalued (24% downside) since my last report. Where the market has extrapolated peak earnings into the future, the short thesis has not changed much; however, I do think the market will recognize HUBB’s intrinsic value when growth slows beginning in FY23 and beyond. Nothing fundamental has changed except the growth acceleration over the past few quarters, so there is little explanation for why HUBB should suddenly trade at a premium to peers. Based on the consensus estimate of $651 million in earnings for FY24, I continue to believe HUBB should trade back to peers’ levels (15x forward earnings), or $181.20 in FY23.

Short trade technicals:

- Duration: 6 to 12 months

- Short interest % of float: 2.4%

Valuation update

Despite the higher consensus estimates, I believe the share price will fall by 24% in the coming quarters. The key changes in my model are the higher consensus estimates, particularly the increase in net income from $615 million to $651 million in FY24. Even at a 15x normalized peer group multiple, HUBB still has a 20%+ downside from its current share price.

3Q22 earnings valuation update (Author’s estimates) Initial valuation model (Author’s estimates)

Earnings update

After adjusting for one-time items, HUBB’s EPS came in at $3.08, well above the consensus estimate of $2.68, which was driven almost entirely by Utility. The Utility segment’s organic growth was 28%, and margins were 18.6%. The electrical division outperformed projections, posting 10% organic growth and 14.8% adjusted operating margins. Contrary to the general public’s expectation of $151 million, free cash flow came in at $194 million.

Moreover, HUBB raised its adjusted EPS guidance for 2022 from $9.40 to $9.80 to $10.25 to $10.45. The current organic growth forecast by management is 18-29%, up 3-4 percentage points from the previous forecast of 13-15%. In addition, management expected M&A to contribute 1%, while foreign exchange would provide a 1% headwind. The increase in guidance is based on the expectation of rising prices and volumes in comparison to the original 4% of volume and 5% of price 2022 guidance. While the higher earnings base should keep FCF dollars relatively stable, management has lowered their FCF conversion target to 90% (from 95% previously) due to increased capex as they seek to accelerate investment. High single-digit to high-teen year-over-year growth is implied by the guidance for adjusted fourth-quarter EPS of $2.23 to $2.43. Based on historical seasonality, I anticipate a sequential decline in revenues in the low to mid-single digits and organic growth of 12-15% in the final quarter.

My view on earnings

As a result of a significant beat and raise in a lukewarm macro environment, Hubbell appears to be lending credence to the argument that secular trends in the electrical markets can overcome cyclicality (which I believe is only for the short-term, and things should reverse after FY23). On the other hand, the fact that storms only have a small positive effect shows that this demand is real.

I still think this is a valuation short, but there are some positive indicators that may soften the blow, including utility spending coming before other electrification pieces like electric vehicle (EV) infrastructure, a simpler product portfolio having fewer supply chain hurdles, and the ability to realize metals deflation sooner thanks to the use of LIFO. These reasons seem to be why HUBB’s valuation is trading at these very high levels.

This quarter’s standout, Utility, was propelled by thematic drivers that are expected to last well into next year, so the short thesis is most likely to be realized after FY23. According to management, Utility’s backlog has been steadily increasing as orders have outpaced revenue. Utility customers are making proactive investments to upgrade aging infrastructure, which is driving demand for grid modernization and electrification. The segment as a whole saw a rise in volume in the low double digits and a rise in price in the mid-teens. The sequential increase in volumes was in the middle single digits, suggesting that supply constraints are relaxing. The electrical sector also had a good quarter, though its results were closer to those expected.

In the 3Q22 earnings commentaries, managers have reported continued robust demand from consumers in all of their target markets, including those outside of their residential sectors (particularly lighting). Single-family dwellings contributed a few percentage points to the overall decline. Even though the management hasn’t noticed any major slowdown in markets outside of residential, they are still susceptible to the volatile macro environment.

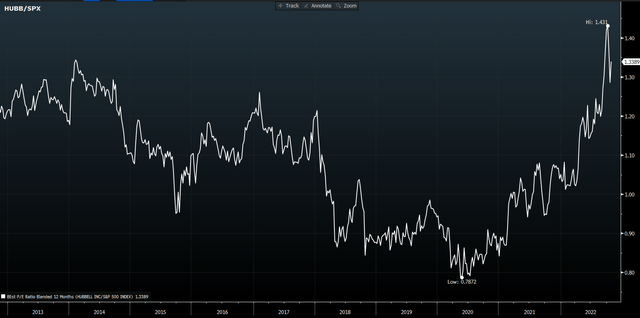

Valuation vs S&P index is still near an all-time high

While the ratio of HUBB forward PE to S&P has decreased slightly in recent weeks, I must emphasize that there is still a lot of room to fall. It does not make sense to me that this asset is trading at such a high premium when there has been no structural change in the business.

HUBB vs SPX forward PE ratio (Bloomberg)

Red Flags

Metal prices

Recent developments suggest that the prices of metals are beginning to level off and even slightly recover. This could keep the market’s mood stable, which is bad for the short thesis because it could keep the valuation premium in place.

Management guidance

This was a risk that I had mentioned in the past, and it appears to have come into play in the earnings for the 3Q22, where management raised its guidance and the market responded positively to it. This risk will almost certainly continue to exist until HUBB reports earnings that are below market expectations (i.e., when earnings slow in FY23).

Conclusion

HUBB’s current share price is still overvalued. Though other factors do play a role, the market is assigning a higher-than-average multiple due to the perceived “higher growth” over the past few quarters, as the stock has benefited from the supply chain crisis and rising commodity prices, resulting in elevated growth. As commodity prices are currently declining, I do not believe this growth can be maintained. Valuation for HUBB should return to its peers’ levels once growth slows post-FY23.

Be the first to comment