bunhill/E+ via Getty Images

Inflation and Stock Exits

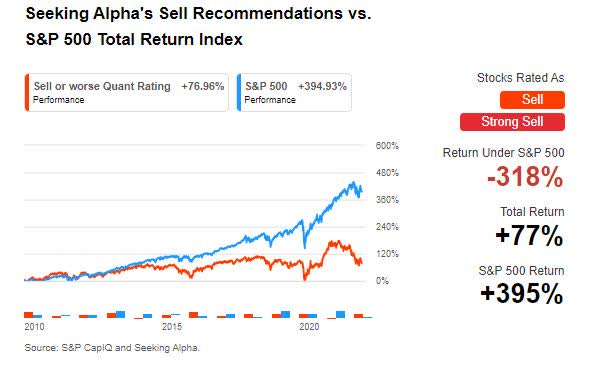

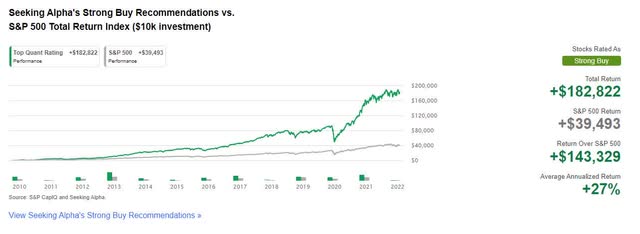

Market volatility has investors on edge, with many going to cash as others shop for bargains that may see an uptick in the coming months. There are a number of stocks that carry negative analyst ratings, poor fundamentals, lag in their sectors, and will perform poorly. Seeking Alpha Quant Ratings’ Sell Recommendations below have underperformed the S&P 500 for more than a decade using quantitative data. In this environment, we strive to select stocks that will perform well, while also highlighting the worst performers.

Seeking Alpha Sell Recommendations (Seeking Alpha Premium)

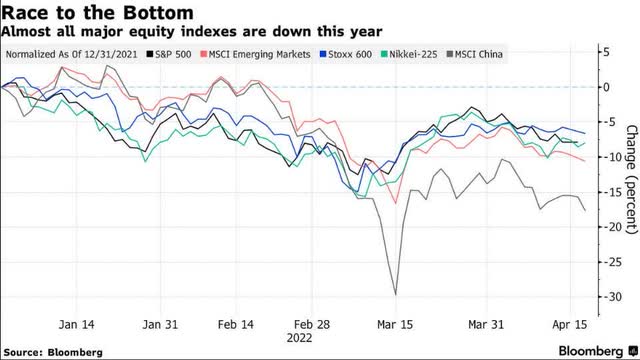

Inflation, rising interest, and recession fears, coupled with geopolitical uncertainty around the globe, have a number of sectors taking a beating, so much that U.S. stocks are experiencing the largest outflows of the year, to the tune of $15.5B.

Major Equity Index Outflows

Major Equity Index Outflows Jan-April 13, 2022 (Bloomberg)

Looking at the chart above, equity indexes are experiencing quite a decline. While some sectors like energy and materials have experienced inflows, we believe investors should avoid catching the falling knife, which describes the five stocks discussed in this article.

Top 5 Stocks to Avoid in 2022

We believe investors should avoid adding stocks with questionable performance to their portfolios with severe declines year-to-date and falling. On a downward trend with investment characteristics that have historically indicated poor future performance, each stock comes with a warning banner and is at high risk of performing poorly.

1. Green Dot Corporation (NYSE:GDOT)

-

Market Capitalization: $1.49B

-

Quant Sector Ranking (as of 4/19): 605 out of 623

-

Analysts’ Downward Earnings Estimate Revisions: 10

-

Quant Rating: Strong Sell

Financial technology and bank holding company Green Dot Corporation is on a downward trend as its price return for one year has declined nearly 40%. Green Dot targets under-banked customers and small businesses and is best known for Walmart’s MoneyCard and TurboTax Debit Card. The card offers reloadable prepaid debit cards and deposit account programs. In addition to a declining stock price, customer reviews are dismal. According to SiteJabber reviews, “Green Dot has a consumer rating of 1.45 stars from 362 reviews indicating that most customers are generally dissatisfied with their purchases. Consumers complaining about Green Dot most frequently mention customer service, monthly fee, and direct deposit problems. Green Dot ranks 20th among Debit Card sites.” Trustpilot reviews are even worse, with 94% of reviews rated ‘Bad.’ The worst reviews come from ComplaintsBoard.com, with 257 written reviews complaining about Green Dot Bank. Many complaints also go directly to Intuit TurboTax. When TurboTax clients select to have their fee deducted from their refund, they unknowingly have agreed to have the IRS send the refund to Green Dot Bank. For many TurboTax customers, the only way they are informed of their missing refund is by calling the IRS directly. The IRS then notifies the TurboTax customer of the funds’ deposit with Green Dot Bank. After that, TurboTax customers find it very difficult to get their funds back from Green Dot.

GDOT Revisions Grade (Seeking Alpha Premium)

Although GDOT took advantage of unemployment benefits and stimulus to increase its asset balance to $3.9B, analysts are not keen on the future of this company. A poor Q4 EPS of $0.27 missing by $0.04 resulted in 10 FY1 Down revisions in the last 90 days, which hasn’t aided its price decline. Green Dot stated, “In our Money Movement segment, revenue declined year-over-year, primarily due to our decision not to renew a significant low-margin reload partner during Q4 2020, which we’ve discussed on our prior earnings calls. Overall, our Money Movement segment revenue declined $8 million or 17%, and profit declined $1 million or 10%,” said George Gresham, Green Dot CFO & COO. While GDOT’s balance sheet is not in the best shape, it seems the real issue at hand is the poor customer satisfaction.

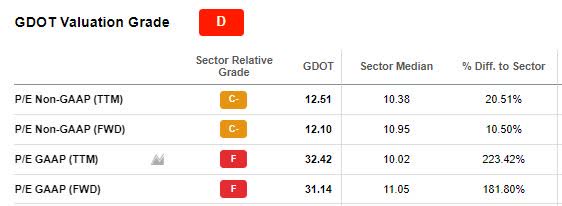

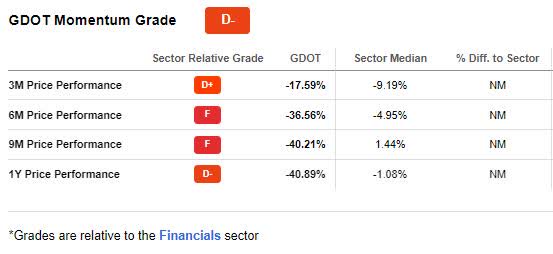

GDOT Valuation & Momentum

With a D Valuation Grade and D- Momentum, GDOT is at high risk of performing badly. Both current and forward P/E ratios are an F, at 32.42x (223.42% difference to the sector) and 31.14x (181.880% difference to the sector), respectively.

GDOT Valuation (Seeking Alpha Premium)

Suffering several setbacks that include significant leadership turnover, loan delinquency that is likely to increase with inflation and rate hikes, plus competition from neobanks, GDOT may not recover soon.

Neobanks, which are internet-only, like leading company Chime, have gained in popularity, providing digital banking through mobile devices and secure debit and credit card transactions. As more companies like Discover, Capital One, Square, and PayPal enter the fintech space, offering innovative payment solutions, the decline in momentum that Green Dot is facing may become more significant.

GDOT Momentum Grade (Seeking Alpha Premium)

In addition to servicing costs related to stimulus payments during the pandemic taking a toll on GDOT, recession fears and inflation costs are mounting. Expect the prospects of customer defaults to increase. The underlying metrics for this stock are less than ideal, so it’s crucial to evaluate the characteristics of stocks to avoid losing money, including our second pick, Wayfair.

2. Wayfair Inc. (NYSE:W)

-

Market Capitalization: $11.35B

-

Quant Sector Ranking (as of 4/19): 454 out of 485

-

Analysts’ Downward Earnings Estimates Revisions: 27

-

Quant Rating: Strong Sell

Consumers are pulling back from household projects amid rising costs and home prices. Supply chain constraints create major delays in furniture orders, causing e-commerce housewares and furniture company Wayfair Inc. to see the effects. The company is down approximately 48% YTD and nearly 70% in one year from its March 2021 all-time high. The company is suffering from declines in the housing market. Still, competition from big-box retailers like Amazon (AMZN) is creating headwinds, as increasing customer acquisition costs means more spending on marketing for Wayfair to compete with aggressive marketing by big-name retailers.

Wayfair Warning Banner (Seeking Alpha Premium)

Despite the household furniture industry seeing significant growth during the height of the pandemic with Wayfair’s online sales growth rate peaking at 57.4% in 2021, supply-chain disruptions, competition, and severe discounting have caught up with Wayfair, resulting in factory closures and jammed ports globally, resulting in revenue declines, disappointing profitability, and limited tailwinds for growth.

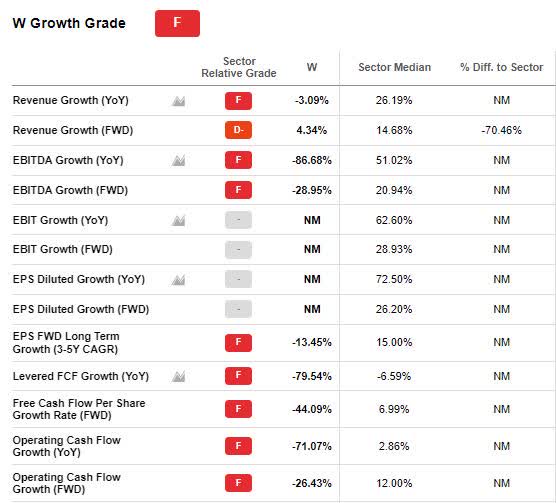

W Growth and Profitability

In the last 90 days, 27 analysts have given this stock a downward revision, following poor performance and greater than expected Q4 earnings loss. Supply chain constraints severely impacted Q4 Revenue, which experienced more than an 11% decline. EPS of -$0.92 missed by $0.22 and revenue figures of $3.25B missed by nearly $25M. “On a segment basis, U.S. net revenue declined 8.8% from Q4 last year, while international net revenue declined by 23% year-over-year and 24.4% on a constant currency basis…However, we do believe our trends largely mirrored broader e-commerce softness in the period,” said Michael Fleisher, Wayfair CFO during the earnings call.

W Growth Grade (Seeking Alpha Premium)

Wayfair’s price performance is on the decline. Looking at the company’s 9M price performance of -63.57% versus the Consumer Discretionary sector median of -19.80%, Wayfair has bearish momentum well below the sector median, which is why this stock is a strong sell.

W Momentum Grade (Seeking Alpha Premium)

Despite Wayfair priding itself on delivery speed and product breadth, mass-market retailers offer better discounts and faster delivery speeds, and diversified products. Wayfair is competing in a largely commoditized retail space that should continue to experience major headwinds, like the next pick, ROKU.

3. ROKU Inc. (NASDAQ:ROKU)

-

Market Capitalization: $15.07B

-

Quant Sector Ranking (as of 4/19): 212 out of 214

-

Analysts’ Downward Earnings Estimates Revisions: 17

-

Quant Rating: Strong Sell

Consumer demand is shifting, whereby companies like ROKU Inc. and its subsidiaries are plummeting amid supply chain challenges and increasing competition. ROKU, the TV streaming provider’s business model may be outdated, as consumers are seeking less costly services that can be canceled at any time without penalty. According to SA News, Big streaming rivals are also on the decline following disappointing results from Netflix from its shrinking subscriber base in the first quarter.

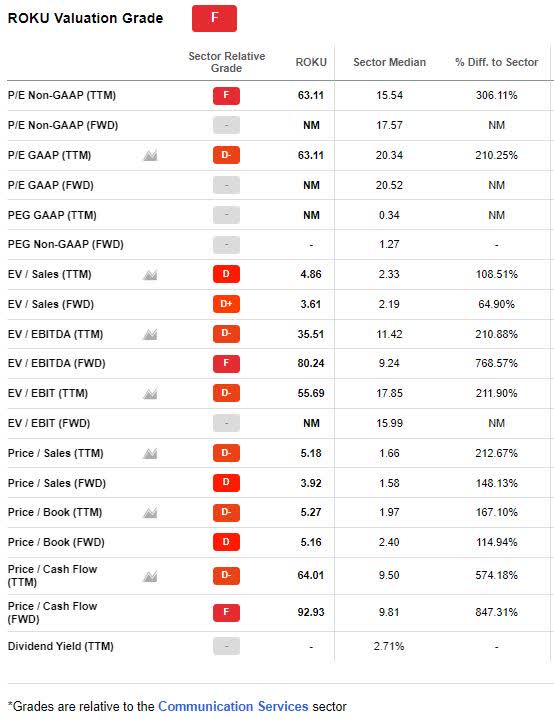

Severely overvalued at more than 300% above its sector peers, ROKU gets a big fat F for valuation! Its current P/E ratio of 63.11x is more than 306% above its sector, and increased competition from Amazon, who launched a new line of smart TVs last year, indicates dwindling growth prospects as the company continues to decelerate.

ROKU Valuation Grade (Seeking Alpha Premium)

Roku has been on a downward trend over the last year. Losing a whopping 70% in share price and currently trading at $112/share, down from a 52-week high of $490.76, the stock’s underlying valuation metrics are unimpressive.

ROKU Growth

ROKU has had great success with subscriber growth in the last five years and continues to scale despite a slowdown in its active account growth rate. The company has had solid subscribership in the previous five years but has yet to generate operating income. With considerable competition from names like Apple TV, Amazon Fire TV, and Google Chromecast, should ROKU’s competitors choose to apply more resources and marketing towards their streaming platforms, they could blow ROKU clear out of the water.

ROKU Warning Banner (Seeking Alpha Premium)

Roku anticipates spending $1B on operations to increase its market share. “Despite lower growth in Q1, Roku reiterated full-year 2022 growth in the mid-30s. Going into the report, analysts were expecting 36% annual growth. The ad platform missed analyst expectations at $703 million compared to $732 million expected. EBITDA was a miss with company guidance for $55 million compared to the consensus for $79 million in the upcoming Q1” writes, Seeking Alpha Marketplace author Elisabeth Kindig. Although the tv and video streaming sector are popular, limited profits and costs to operate pose problems. Our quant ratings and overall thoughts about this company are that ROKU is bearish and will continue its downward trend, as will the next stock pick.

4. Diversey Holdings, Ltd. (NASDAQ:DSEY)

-

Market Capitalization: $2.52B

-

Quant Sector Ranking (as of 4/19): 254 out of 259

-

Analysts’ Downward Earnings Estimate Revisions: 10

-

Quant Rating: Strong Sell

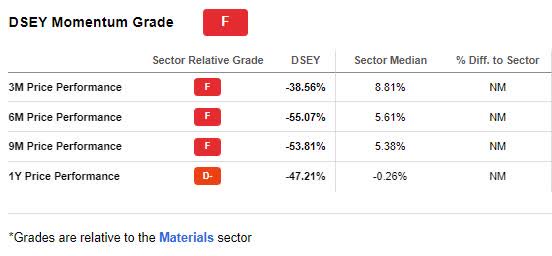

Specialty chemical company Diversey Holdings, Ltd. supplies worldwide cleaning solutions to institutional and food and beverage companies. With a $1.86B net debt load and negative revenue growth, this stock’s momentum is bearish.

DSEY Momentum Grade (Seeking Alpha Premium)

The average 90-day trading volume for DSEY was just above one million and given the 10-day average has dropped to 630,000, the negative indicator suggests a lack of buying interest. As we look at the above price performance with an F grade, it’s clear DSEY is performing well below its sector peers.

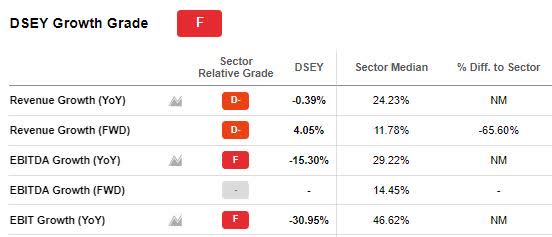

DSEY Growth & Profitability

Diversey experienced a significant decline during the height of the pandemic and hopes to recapture a minimum of $220M in lost revenue. “Our Institutional segment, which represents approximately three-fourths of our business in revenue, saw revenue decline 3.5% versus Q4 2020…this decline is not reflective of our run-rate revenue and underlying growth rate as we head into 2022. Our base Institutional business continues to recover with 17% revenue growth in the quarter as compared to fourth quarter 2020. However, this was offset by infection Prevention’s 51% decline as compared to the elevated demand in fourth-quarter 2020 although it was still more than 20% above 2019 levels,” said Todd Herndon, Diversey CFO, during the Q4 Earnings Call.

DSEY Growth Grade (Seeking Alpha Premium)

DSEY has 10 FY1 Down revisions following the latest earnings report in the last 90 days. Additionally, the company has Cash From Operations (TTM) of $-88.7M compared to the Materials sector median of $356.5M. Although DSEY’s overall valuation grade is a C, its forward P/E GAAP ratio is 31.72x, more than 129% above the sector. Given its poor momentum and overall grades which rank the company 254 out of 259 in its sector, DSEY is a strong sell. Compared to the S&P 500, stocks rated Sell or worse are down 20% on average per year over the last 10 years, and our final pick is on that trajectory.

5. Cricut, Inc. (NASDAQ:CRCT)

-

Market Capitalization: $2.98B

-

Quant Sector Ranking (as of 4/19): 467 out of 485

-

Analysts’ Downward Earnings Estimate Revisions: 5

-

Quant Rating: Strong Sell

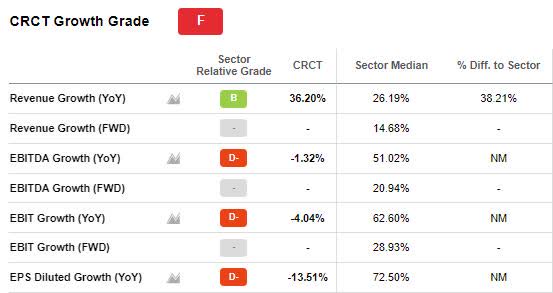

Cricut, Inc. is a unique technology company that turns ideas into designs that are ultimately made into handmade goods. Declining margins and supply chain constraints have caused a significant decline over the last year for CRCT. Cricut has also seen revenue decline over the last two quarters, resulting in an F Growth Grade.

CRCT Growth and Profitability

Cricut has seen a significant decline in earnings since FQ3 2021. With a recent EPS of $0.05 missing by -$0.19 and revenue of $387.83M missing by -$19.69M, investors slashed its shares by more than 20% given analysts had forecasted CRCT to earn 24 cents/share on its sales, yet only reported 5 cents/share.

CRCT Growth Grade (Seeking Alpha Premium)

“Shares fell hard on the earnings report for several reasons. Cricut sold fewer machines in the fourth quarter of 2021 than in 2020. This likely means pandemic tailwinds are ebbing. Growth in the company’s cash cow materials business will likely be hampered by slowing machine sales in the coming quarters,” wrote Seeking Alpha Marketplace author The Insiders Forum.

Although growth in Cricut’s subscriptions has been solid with more than 2 million new users, accessory purchases were down and gross margins saw a sharp decline from 33.6% to 27% for Q4. “From an EBITDA standpoint, we were at the low end of our long-term target range. We still are facing pressures from freight and warehousing and other inflationary pressures. We’re starting to feel more of the increase in raw materials, and that is the reason why we’re working on a price increase,” said Marty Peterson, Cricut CFO during the Q4 Earnings Call.

CRCT Warning Banner (Seeking Alpha Premium)

Cricut, like the other stock picks, is at a high risk of performing badly. With characteristics historically associated with poor future stock performance, decelerating momentum, five FY1 Down Revisions, and an F grade for growth, our quant ratings give this stock a strong sell. If you are seeking stocks in the same sector, consider our Top Consumer Discretionary Stocks that possess excellent factor grades and quant ratings. For our final stock to avoid right now, let us shift to the financial sector.

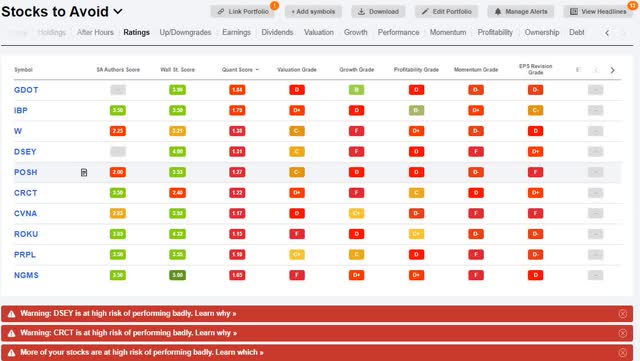

Other Stocks To Avoid in 2022

Heed our warning banners. In addition to the top five stocks I’ve discussed, below is a screen that includes some popular names and other stocks that you may also want to steer clear of. Poshmark (POSH), Carvana (CVNA), Purple Innovation, Inc. (PRPL), Neogames S.A. (NGMS), and Installed Building Products, Inc. (IBP) all come with a warning: these stocks are at high risk of performing poorly. You can learn why these stocks are at risk of performing poorly by clicking the warning banner for more information on each of these companies.

10 Quant Rated Stocks to Avoid

Other Stocks to Avoid Screener (Seeking Alpha Premium)

Conclusion

Seeking Alpha’s Top-Rated Stocks have beaten the S&P 500 by 1300% over the last ten years, and our strong sell recommendations are based upon the same quantitative model. In times of market volatility, investors seek investments that will perform well while attempting to avoid those that may fall. The five stocks to avoid lack growth and profitability, some are overvalued, and in the current landscape, all roads are leading to a strong sell.

Seeking Alpha’s Strong Buy Recommendations vs S&P 500 (Seeking Alpha Premium)

Check out the Grades on your stocks or consider our investment research tools to help ensure you are furnished with the best resources to make informed investment decisions. Finding knowledgeable investment resources is also a great way to be a successful investor in volatile or rallying markets.

Be the first to comment