MikeMareen/iStock Editorial via Getty Images

Investment Thesis

Reach for the stars, and if you don’t grab ’em, at least you’ll fall on top of the world

I hope that everyone here recognizes the lyrical genius of Mr. Worldwide himself, especially this line is taken from Pitbull’s song Give Me Everything.

I can’t help but feel like CEO (sorry, Technoking) of Tesla, Inc. (NASDAQ:NASDAQ:TSLA) Elon Musk found himself inspired by these lyrics. He certainly has a habit of reaching for the stars – whether it’s quite literally thanks to SpaceX, or the fact that he has a habit of making wild promises & setting goals that go far beyond the realms of “ambitious.”

Yet Mr. Musk has found himself falling on top of the world, as Tesla has had a fantastic few years and continues to make impressive progress on full self-driving. Tesla continues to reach for the stars, but will they just come crashing down to earth? I put the company through my investing framework to find out.

Business Overview

Tesla has pioneered electric vehicle technology since its inception almost 20 years ago, and the company appears to have reached an inflection point over the past 5 years – moving from the brink of bankruptcy in 2018 to a trillion dollar company in 2021.

Tesla is primarily an automotive company right now, and it has four car models:

- Model S: a 4-door, high performance sedan

- Model 3: a 4-door, mid-size sedan designed for the mass-market

- Model X: a mid-size, high-performance SUV

- Model Y: a company SUV built on the Model 3 platform

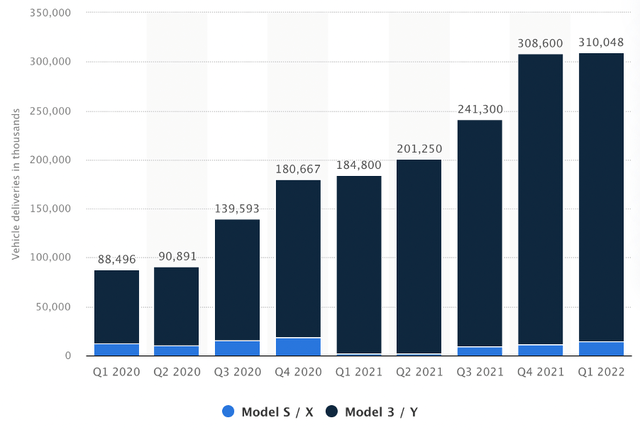

The rollout of Tesla’s Model 3 helped transform the business over the past 5 years. Its mass-market appeal and more affordable price point certainly turned Tesla from an up-and-coming EV company to a genuine automotive business. The below chart highlights just how important the Model 3 has been to Tesla over recent years.

Tesla also offers additional products for energy generation and storage. These include Powerwall, a lithium-ion battery storage product designed for a home, Megapack, an energy storage solution for much larger facilities, and Solar Roof, which is well… a solar powered roof.

The company also has also invested in a significant amount of vertical integration and additional solutions, including but not limited to:

- In-house developed battery and powertrain technology

- Self-Driving technologies, with offerings such as Autopilot and FSD (Full self-driving).

- A network of Tesla Superchargers, which offer high-speed EV charging for Tesla owners

- A direct-to-consumer sales approach through its website, and an international network of company owned stores

- An insurance product which was launched in California in 2019, and has expanded into more and more states

It would be possible to do a dedicated article on every single one of these additional solutions – but I don’t want to write a novel, at least not yet. That is before considering the future products that Tesla could potentially offer, such as the cybertruck, a network of robotaxis, and Elon Musk’s new favorite toy – the Optimus robot. Whilst I don’t expect all of these ideas to succeed, I do like to see a company with optionality, and Tesla has this in abundance.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition. Right now, I believe that Tesla has a number of competitive advantages.

The first moat worth highlighting is the network effect that Tesla has. Its vehicles are substantially more technologically advanced and interconnected than those of the incumbent manufacturers, and as such Tesla is able to generate a wealth of data from every mile that is driven.

This has given them a lead in autonomous driving, as the company has been able to analyze the ever-growing masses of data received from its FSD programs, following which they are able to iterate and rollout improved versions. Tesla is still yet to completely crack full self-driving, but once (or if) it does, it will be transformational for both the company and the world. The below quote from CEO Musk clearly shows his excitement combined with an awareness that this has been a long time coming, yet has never arrived:

Well, with respect to full self-driving, of any technology development I’ve ever been involved in, I’ve never really seen more kind of false dawns or where it seems like we’re going to break through, but we don’t, as I’ve seen in full self-driving. And ultimately, what it comes down to is that to solve full self-driving, you actually have to solve real-world artificial intelligence, which is — which nobody has solved. The whole road system is made for biological neural nets and eyes. And so, actually, when you think about it, in order to solve for full self-driving, we have to solve neural nets and cameras to a degree of capability that is on par with or really exceeds humans.

And I think we will achieve that this year. The best way to reach your own assessment is to join the Tesla full self-driving beta program where we have over 100,000 people right now enrolled in that program, and we expect to broaden that significantly this year. So, that’s my recommendation, is join the full self-driving beta program and experience it for yourself and take note of the rate of improvement with every release. And we put out a new release roughly every two weeks. And you’ll see a little bit of two steps forward, one step back. But overall, the rate of improvement is incredibly quick.

So, Musk thinks FSD will be achieved this year – I’m sure he’s never said that before…

Regardless, the amount of data that Tesla has been able to obtain for FSD is unmatched by competitors, and the network effect is this: more data leads to improved FSD, improved FSD leads to more customers buying Teslas and using FSD, more customers using FSD results in more data, and more data leads to improved FSD. Humans have been trying to crack autonomous driving for a long time, but this network effect may well provide the best opportunity yet.

Another network effect that I think is more realistic & sometimes overlooked is with insurance, probably because it’s not as exciting as the idea of robotaxis. Yet it is a similar story to the one above; Tesla has a very connected network of cars with tons of data, and this should enable them to offer data-driven insurance to customers that ends up being increasingly accurate as this network grows.

Tesla also benefits from some switching costs, and this is driven by their network of Superchargers. The company has worked hard to build out this network & ensure that Tesla drivers can access these Superchargers easily – but, originally these were only available for Tesla drivers. This is clearly a switching cost, but Tesla has recently trialed opening up its Supercharger network to non-Tesla EVs. Whilst this reduces Tesla’s competitive advantage, I think it was always going to be eroded away over time as EV adoption increases – so perhaps this pilot is Tesla’s way of getting ahead of the curve?

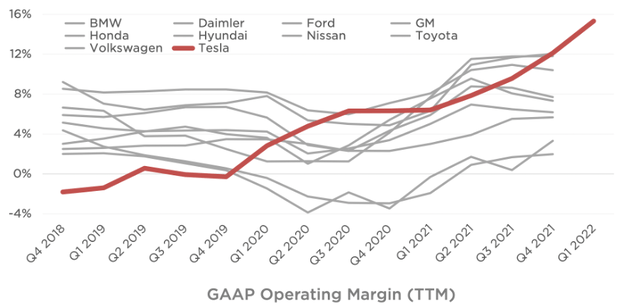

Tesla also has the benefit of low-cost production, driven by their vertical integration on battery technology, direct-to-consumer sales, and the ultra-efficient Gigafactories. In fact, a view of their TTM operating margin compared to the incumbents is quite incredible – particularly when you consider that Tesla continues to be less established, and probably has even more room to expand these margins, particularly with the potential for additional software offerings.

Tesla Q1’22 Investor Presentation

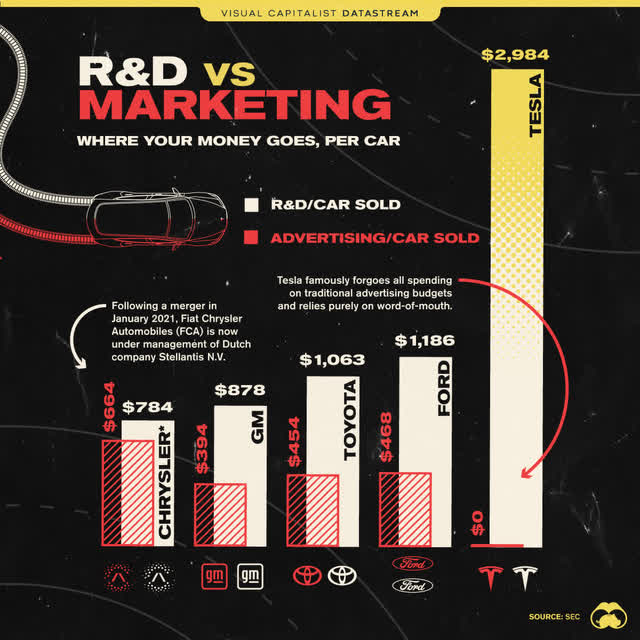

The final moat that I’ll give Tesla credit for is their brand, and I don’t think anyone can argue with this – but just in case you want to, I’ll add in the below graphic comparing Tesla’s ad-spending per car sold back in 2021.

This is another one of the many reasons why Tesla is able to churn out industry-leading margins.

Despite this lack of marketing, demand is still substantially outweighing supply, as per Elon Musk on the Q1’22 conference call:

I should mention that it may seem like maybe we’re being unreasonable about increasing the prices of our vehicles, given that we had record profitability this quarter, but the wait list for our vehicles is quite long. And some of the vehicles that people will order, the wait list extends into next year. So, our prices of vehicles ordered now are really anticipating supplier and logistics cost growth that we’re aware of and believe will happen over the next 6 to 12 months. So, that’s why we have the price increases today because the car ordered today will arrive, in some cases, a year from now. So, we have a very long wait list, and we’re obviously not demand-limited. We are production-limited by — very much production-limited.

As you can also see, a strong brand gives pricing power & this is just one other lever Tesla can pull in order to keep delivering strong financial results.

All in all, there are several powerful economic moats that should help Tesla protect itself from the ever-emerging competition.

Outlook

I’ll be honest, it’s pretty difficult to give an exact figure on the potential opportunity for Tesla – particularly if the company succeeds with its full self-driving, the robotaxi network, or even the Optimus robot. I think all any shareholder needs to know is that the opportunity is huge, and it’s only getting bigger.

If I take a step back and focus solely on the EV market, the opportunity remains both fast growing and enormous. According to Facts and Factors, the global electric vehicle market is expected to grow from a size of $185 billion in 2021 to $980 billion by 2028, implying a CAGR of 24.5% over that period – with Tesla leading the charge (geddit?).

Management

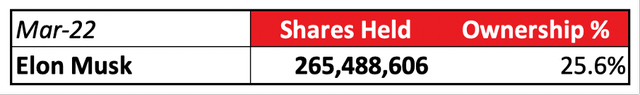

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. I’ll start by highlighting that, even though Elon Musk is not the founder of Tesla, he certainly has his heart and soul in the business. If he walks like a founder and talks like a founder, I’m more than happy to consider Elon Musk a founder.

Tesla Q1’22 Investor Presentation

I also want to invest in companies where leadership has skin-in-the-game, and Mr. Musk has this in abundance. This is a CEO who understands what skin-in-the-game truly means, as he shows in this 2019 tweet.

But do the numbers back that up? They certainly do, as Elon Musk owns ~25% of the company – no wonder he’s the richest man in the world!

Tesla 2021 Proxy Filing / Excel

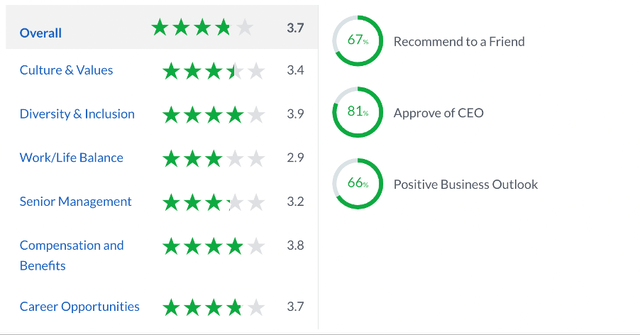

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Tesla gets somewhat underwhelming scores from the ~7,000 reviews left by employees. Any score over 4.0 is impressive, and Tesla fails to obtain this in any category. The score is particularly low on Work/Life Balance, which probably isn’t a surprise to anyone – whilst Elon Musk has undoubtedly driven the world forward with some of his companies, he also has a reputation of being tough to work for. He has incredibly high expectations from himself and those around him – unfortunately, this appears to have led to a culture within Tesla that I would not be too happy with as a shareholder.

Financials

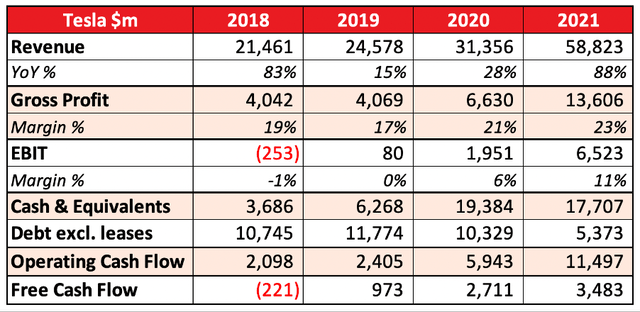

Tesla’s financial profile over the last few years is something of a turnaround story, starting with their balance sheet. Back in 2018, the company had almost 3x as much debt as they had cash. Fast-forward to 2021, and that has completed flipped, with cash now representing more than 3x their debt. This has been driven by the company’s ability to ramp up sales and bring in additional cash flow to shore up the balance sheet, as well as raising funds through additional share offerings. The bankruptcy risk to Tesla around 2018 was well documented, but clearly now it is a company in an extremely robust financial position that will serve it will for the future.

Revenue growth has been lumpy over this period, at times impacted by the needed ramp up of its production facilities as well as the impact of lockdowns during the pandemic – but 2021 saw revenue absolutely soar as the world opened up again, and consumer spending took off like a rocket.

Margins and cash flow for this business are impressive, whichever way you look at it. The EBIT margin has seen astounding expansion for such a capital-intensive business, and similarly the ~$11.5 billion in operating cash flow in 2021 is incredibly strong. It makes you wonder how a business goes from the brink of bankruptcy to a cash generating machine in just a few years.

Valuation

As with all high growth, innovative companies, valuation is tough – and for a company who believe their future products to be life changing, it is even more difficult. I believe that my approach will give me an idea about whether Tesla is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

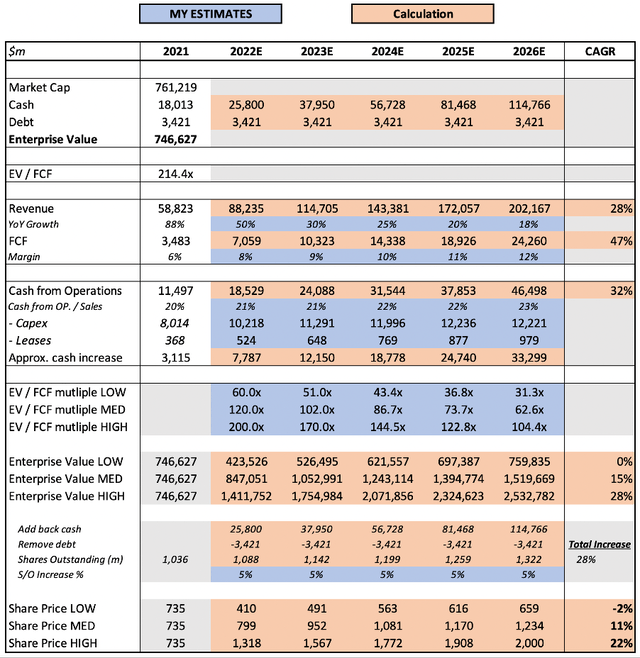

My model assumes revenue growth of 50% for 2022, following Tesla’s guidance of 50% YoY growth in vehicle deliveries driven by the continued strong demand and production ramp up despite the continued issues in Shanghai. I have then assumed a slowdown in revenue growth through to 2026. It’s perfectly reasonable to think that this is too conservative, however I would always prefer to be too conservative rather than too optimistic.

I have also assumed a gradual margin expansion as Tesla continues to benefit from its scale, and those investments in vertically integrated aspects of its business start to play out.

I assumed that shares outstanding will increase by 5% annually through to 2026. Tesla has a history of diluting shareholders, however I still think that this assumption is prudent – as Tesla continues to produce more cash, I doubt it will continue to dilute shareholders at a dramatic rate.

Finally, I’ve chosen a wide range of EV / FCF multiples for the low, medium, and high scenario. This represents my own uncertainty about the future of Tesla, the fact that it is priced for a lot of success, but also the fact that it could see success that is far beyond my imagination.

Put this all together, and my mid-range scenario implies an 11% CAGR of Tesla shares from today through to 2026.

Risks

There are a number of potential risks for Tesla, as my fellow Seeking Alpha highlights in this detailed article. I do think the approach is very “glass half empty,” but it is useful for potential shareholders to familiarize themselves with these risks.

In my eyes, there are a couple of main risks. First is competition – EVs are growing in popularity, and there are a number of new EV-specialist car manufacturers as well as the incumbents who are all coming to do battle with Tesla. Clearly, Tesla has a huge head start, but shareholders should keep an eye on any competitors who appear to be closing this gap.

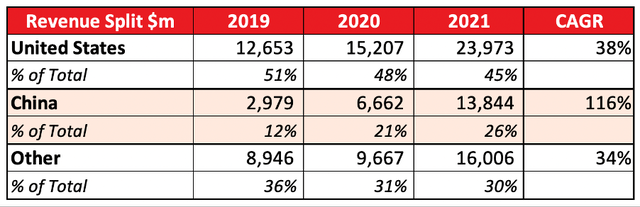

The second risk primarily relates to China. Clearly there are geopolitical risks, and China is also one of the most competitive markets for electric vehicles – and, it’s likely to grow and be the largest. If Tesla is impacted by geopolitics, then it could suffer greatly. Just take a look at the below table of car sales over the past few years to see the impact that China is having on Tesla’s business, with its growth outpacing the US and Other substantially.

The final risk is that of a recession, which could certainly be looming. Whilst I think Tesla does benefit from secular tailwinds, I would not be surprised to see consumers cut back on spending for new, somewhat luxury cars – and I’d expect the automotive industry to be hit particularly hard.

Summary

An investment in Tesla is certainly not for the faint hearted, and I want to highlight that my current view on Tesla is a tentative buy rating. I wouldn’t be surprised to hear either of the following statements in 2030:

“Remember when we used to drive cars? The fact that we’ve got these Tesla robotaxis is crazy when you think about it, they’ve taken over the world!”

Or

“Tesla sure was overhyped. They really struggled in China, and in the end they ended up just being a car company – despite what I’d seen on Reddit, poor Elon.”

Personally, I believe that Tesla does have a bright future – even if I can’t predict it with much certainty, there are so many tailwinds driving this brilliant company forward. The share price today offers a much more attractive risk / reward profile, and that I why I would be happy to add this ground-breaking company to my investment portfolio.

Be the first to comment