jetcityimage/iStock Editorial via Getty Images

Our Tesla Pitch – Tesla Needs A ‘Soft Landing’ (To Use Fed Speak) In Order to Sustain Growth Rates; If They Can’t, The Stock Has Room to Negatively Re-rate

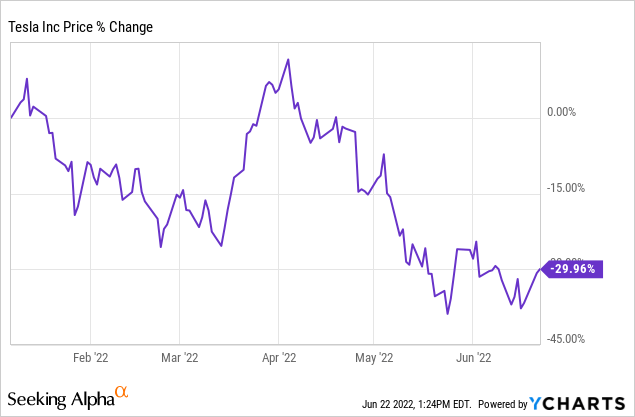

We’ve been in the bull camp or at least neutral on Tesla (NASDAQ:NASDAQ:TSLA) since Q4 of 2018. That changed in January, as we called out market risk driving negative real returns in the stock.

That was our call then. At the time the Fed was set to taper bond purchases at an accelerated rate, and rate hikes were likely on the horizon as inflation accelerated. We made the call in spite of our fundamental business optimism.

The call now is different. We still love the business, it’s hard not too. The problem is we think growth is going to run into a wall, at least over the medium-term. If our call in January was a macro-market call, this call is more of a macro-economic call.

Consensus sell-side expectations are calling for EPS growth of ~79% and ~30% in ’22 and ’23. Expectations are calling for top-line growth of ~59% and ~33% in ’22 and ’23 from $85.64B to $114.39B.

These are high expectations against a high base. Now, if Tesla can navigate the long lead times on product mix before the macro environment overly-devolves, maybe they can navigate a soft-landing and the stock can stay stable. This is the pervasive ‘Musk’ factor that has enabled Tesla to pull a rabbit out of the hat many-a-time.

This factor is our reason for caution and pessimism, but not outright taking a short position, at least not right now.

Core Thesis – As The Economy Slows, And Tesla Raises ASPs to Boost Margins & Offset Inflation, New Order-flow Could Decelerate

The heading of our thesis seems pretty self-explanatory, but its worth delving into each component of this a little deeper. At this point in time, our base case is that the US economy is already in a recession or will enter one this year. Economic productivity and growth is likely to slow from here, not speed up. Growth in labor and input costs is net-constrictive on the economy. We think Tesla is recognizing both of these factors, leading to massive price hikes to cushion margins.

They can do this for two reasons: (a.) a massive order backlog, and (b.) an incredibly strong brand. On the first note, Model Y LR lead times are six to nine months out. That is incredibly long and highlights one of two things: either (a.) Tesla is facing a massive surplus of demand, or (b.) supply is constrained. We think the real answer is both.

The secular theme of BEV adoption is in full-swing, and Tesla has the technology, the design-appeal, and the brand to capitalize on the shift in demand trends. And while debatable, some see high maintenance and gasoline prices have likely accelerated the value prop transition towards EVs somewhat.

Additionally, autos have been one of the primary verticals negatively impacted by disrupted supply chains. Component shortages, overseas shipping, factory closures etc. have disrupted Tesla and many other auto OEMs in getting new builds off production lines. We think with time, and with the ramp-up in Shanghai, Berlin, and Texas, Tesla’s overall supply will increase, and this dynamic will fade a bit.

Nonetheless, tight supply resulting from mostly existential factors is allowing Tesla to lift prices and thus bolster margins, a dynamic that we question the long-term validity of.

We think that as interest rates rise and consumer spending weakens (or at least shifts), demand for big ticket items (like housing and autos) will slow materially. While Tesla can lean into their current order backlog to sustain deliveries, we question the ability of Tesla to refill this backlog over time if consumer-end trends are weakening. Simply put, where is the deliveries growth in $50K+ cars going to be when the consumer is backed against the wall?

This begs a few questions, how long will weak consumer trends in medium to luxury autos last? Additionally, how long before Tesla depletes its order backlog? What is the rate that this backlog refills? Will Tesla resort to price cuts (hurting unit margins) to generate incremental demand? These are all questions, questions that are difficult to answer with any degree of certainty.

When going long a name, and backing up a Buy rating, we need a degree of valuation support to reflect uncertainty.

If the economy slows, we question Tesla’s ability to hit the aforementioned consensus revenue and earnings growth estimates, and even against those estimates, we question the valuation support you have. Tesla’s trading at ~6.5x cons. ’23E sales, and ~45x cons. ’23E earnings.

We like the business, but are these multiples reflective of safety in the current environment? No. Too much uncertainty with too little valuation support gets us to where we are now.

Musk Knows This, Hence The Layoffs

Additionally, we think that management is well aware of these problems. Musk’s ‘bad feeling’ about the economy? The layoffs? A potential cost-cutting measure to support cash generation through a tougher time. Tesla isn’t unique in laying off employees. If you’ve been tracking the news, Big Tech in general has been finding reasons to reduce headcount.

We think fundamentally, management is planning ahead of the growth cliff by reducing headcount now, a move that we think will save money and agony over the medium term.

Long-Term Story Intact, But We Question Terminal Margins

Over the long haul, the story is still pretty clear on Tesla. We continue to believe they have the best product, technology, infrastructure, and brand in the BEV market. A BEV market that is still very early in its adoption curve, and a market Tesla is very early in fully capturing across the use-case spectrum (trucks, semis, compacts, etc.)

We think that as new order flow cools, and Tesla works through its existing backlog, investors will have to digest a period of materially slower revenue and deliveries growth. This is to be expected when you sell $50,000+ electric vehicles into a slower demand environment.

Over the long-haul, we continue to applaud Tesla’s technology lead (particularly in manufacturing and cell tech, as well as cell-to-pack integration), solid brand (default name in BEVs), infrastructure (massive supercharging grid), and product design.

On the margin front, as a thought exercise however, we are slightly concerned. Based on prior work we have done, and work we have seen float around the sell-side and third-party shops, teardown analyses of your average Model 3 indicate that cost of manufacturing is ~$35K-~$36K per unit (prior to input cost inflation). While Tesla is able to sell at a ripe markup right now because of (a.) tight supply, (b.) the built in excuse (to the consumer) of inflation, and (c.) a massive order backlog, we question the long-term strategic direction. Assuming Tesla cannot materially reduce cost per unit of manufacturing, would they maintain margins and sacrifice volume and thus deliveries and revenue growth, or reduce margins to ‘normalized’ levels to pick up growth volume. Our bet would be on the latter, considering how mission-driven Musk & Co. are on accelerating broader market adoption at least over the long-term. Over the short-term, we think Musk’s recent strategic direction would emphasize a more defensive strategy.

We think to fuel mass market EV adopt, long-term, Tesla needs to move down market. Additionally, we think gross margins might have to come in as inflation comes in and the supply-demand dynamic rebalances.

Valuation

In terms of valuation, we think the stock is difficult to price. In the environment we are in, where the macro picture is uncertain and rates are rising at all durations of the yield curve, multiples are compressing pretty materially. When we explore what a base case valuation for the stock is, you have to keep in mind the uncertainty profile on the business right now: we don’t know what steady-state gross margins are, we don’t know where optionality stands (autonomy+energy in particular), and there’s a lot of value creation already priced in.

It’s hard to give reasonable estimates for out-year numbers because there are a lot of moving parts to juggle. We’ll use the year 2030 as a basic reference number. What does 2030 BEV adoption look like relative to the overall auto market? What use cases (semis, pickups, etc.) are yet to be covered. What is Tesla’s market share within BEVs? Terminal CapEx requirements?

It’s a lot, and hard to predict reasonably.

For our part, we think the environment is fundamentally too uncertain. We’re going to use average consensus estimates and the high and low estimates on the street to give investors a general valuation framework for what we would consider the reasonable base case, bull case, and bear case.

Base Case: Our base case look takes cons. ’22 earnings and puts a 45x multiple on them. Pretty simple, we think the multiple is relatively warranted assuming Tesla can continue to grow as viciously as they have been. If Tesla can hit a high 70s growth pace for full year, in-line with consensus, then you’re looking at ~$545 on the share price assuming 45x.

Bear Case: Our bear case look implies the bottom end of the sell-side earnings range for ’22, which implies closer to high 30s earnings growth for the full year. You put a multiple closer to 30x to reflect a higher medium-term risk profile, and you’re looking at ~$279/share.

Bull Case: Our bull case looks at the top end of ’22 sell-side earnings estimates, which implies earnings growth of ~113% y/y. We use a 75x multiple to reflect this more optimistic long-term view, and to reflect the optimism of a soft-landing scenario. That gets us to $1,085/share in the bull case.

These are some pretty loose scenarios, and these aren’t driven by any proprietary model work. Right now, because of the supply chain dynamics and the backlog depletion dynamics, it seems nearly impossible to make accurate forecasts to fit the reality of the company right now. As a result, we are using our base, bear, and bull case multiples and price targets to reflect our qualitative sentiment on the state of the company and the risks it faces medium term.

Conclusion

In conclusion, while we have generally liked the business model, the product, and the technology, we are very cautious on the stock. We see a growth cliff emerging on the horizon, and would wait to buy shares until after growth decelerates. That, according to some checks, could be as soon as the next couple weeks when Tesla reports 2Q deliveries. Maybe it’s later on as the company works through its massive order backlog. Nevertheless, we are cautious. Reiterating Sell, all targets reduced.

Tesla Logo (Tesla)

Be the first to comment