Dimitrios Kambouris

Thesis

Tesla (NASDAQ:TSLA) investors are likely still nursing their wounds after seeing the world’s leading EV maker’s stock fall back to re-test its May lows, as we posited in a post-Q2 update (Sell rating). We had urged investors to capitalize on the rally toward its August highs to cut exposure, as we postulated that the market was setting up TSLA for a steeper decline.

Accordingly, TSLA has underperformed the S&P significantly since our update, losing more than 25%, compared to the S&P 500 ETF’s (SPY) 12.2% fall. We deduce that TSLA is likely at a near-term bottom, as the market forced weak holders who bought in the summer to give up their shares. Hence, some long-term TSLA bulls could feel the urge to buy the dips, expecting TSLA to recover markedly moving forward.

However, we urge investors to be very cautious about making that assumption, even at the current levels. Our analysis shows that the market has already de-rated TSLA, so its premium valuation is set to be digested further.

Moreover, with a global recession that could put further pressure on consumer discretionary spending, TSLA might not have what it takes to sustain its growth premium at these valuations. Furthermore, BYD Company (OTCPK:BYDDF) has been making significant inroads in China, overtaking Tesla as the largest NEV maker. China’s leading EV makers are also penetrating Europe aggressively, intensifying their competition against Tesla, even as it ramps production in the “money furnace” Giga Berlin.

We discuss why we believe the market would likely continue to force further selloffs in the medium term against TSLA’s unsustainable valuation multiples, regardless of what happens to Elon Musk’s Twitter (TWTR) deal.

Notwithstanding, given the likely near-term consolidation in its current May re-test, we believe the market could draw in dip buyers to stage a short-term rally before punishing TSLA holders further.

As such, we revise our rating from Sell to Hold for now and urge investors looking to reduce exposure at the next rally.

Don’t Be Fooled By TSLA’s NTM PEG Ratio

We have often repeated that the market is not dumb. Obviously, it knows that TSLA last traded at an NTM PEG ratio of less than 1x. Note that Tesla’s NTM EPS is estimated to increase by more than 50% YoY against an NTM PE of 44.1x, resulting in an NTM PEG of 0.88x. Hence, some Tesla bulls were calling out the market’s “foolishness” in forcing TSLA down to its May lows, as it’s too cheap for its growth cadence.

We urge investors to remember that the market is forward-looking. Just like how TSLA outperformed the market significantly over the past ten years (10Y total return CAGR: 61.1%) even though it was free cash flow (FCF) negative through FY18. We believe the market looks way ahead for solid high-growth stocks in their ability to assume market leadership.

Early Tesla investors have undoubtedly made a considerable fortune in TSLA by placing their conviction in CEO Elon Musk & team. However, with Tesla’s growth rates set to fall markedly through FY25, we urge these investors to revisit their growth assumptions. That means TSLA’s earnings multiples must come down significantly to justify much slower growth ahead. Here’s why.

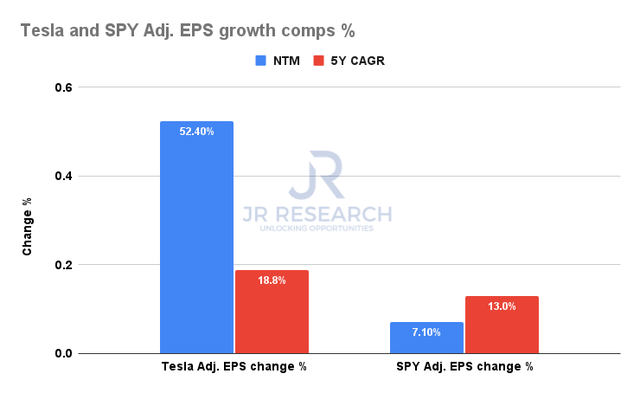

Tesla and SPY Adjusted EPS change % comps (S&P Cap IQ)

As seen above, the Street consensus (bullish) still expects Tesla to post an NTM adjusted EPS growth of 52.4%, well above the SPY’s revised 7.1% growth.

We will know in the coming week as Tesla reports its Q3 earnings release (October 19) whether these estimates are still too optimistic, given worsening macro headwinds and a Q3 deliveries cadence that underperformed. However, these estimates have likely reflected its weaker growth momentum in Q3, as the revised EPS estimates suggest growth of 64% YoY, down from August’s estimates of 71% growth.

As such, investors should expect Q4’s growth to normalize further, potentially matching the pace seen in its relatively weaker Q2. Hence, we believe that may have given investors the “false impression” that the worst may have been priced into TSLA. Think again.

As seen above, the consensus estimates also project that Tesla’s adjusted EPS growth could slow markedly through FY25, resulting in an EPS CAGR of just 18.8% through FY25. Hence, it’s a significant deceleration from its current cadence, which investors are urged to pay attention to.

In contrast, the SPY is expected to recover its near-term weakness through FY25, with a CAGR of 13%, up from its NTM EPS growth of just 7.1%. If that’s not enough, consider that Tesla’s consumer discretionary peers are expected to notch a 5Y EPS CAGR of nearly 29% (according to Refinitiv estimates), with an NTM P/E of just 23.2x.

So, TSLA is expected to grow much slower than its sector over the next five years, but is priced at a much higher premium at the current levels. Is that sustainable? We urge Tesla bulls to be very cautious here.

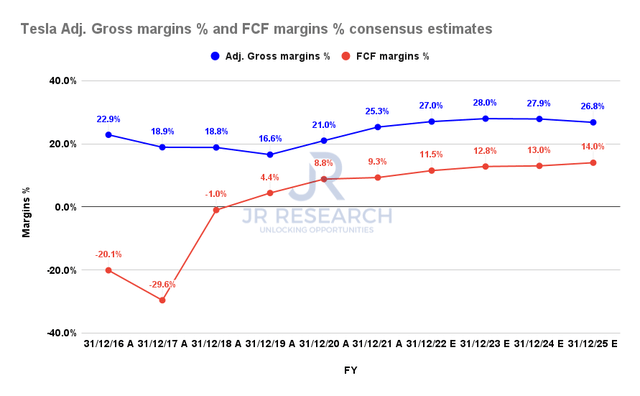

Tesla Adjusted gross margins % and FCF margins % consensus estimates (S&P Cap IQ)

Morgan Stanley (MS) highlighted in a recent commentary that Tesla’s margins could have peaked/peaking. It added: “[Tesla] is passing through peak margins right now, with headwinds ramping up into year-end. Namely, the costs associated with 2 gigafactory ramps are expected to hamper the metric.”

The consensus estimates indicate that Tesla’s gross margins are expected to peak in FY23 before falling through FY25. Hence, it’s expected to affect the growth cadence of its FCF growth, suggesting the market should de-rate TSLA further.

Our analysis suggests the de-rating had already started for TSLA. The market is smart, as it anticipates that TSLA’s growth premium is not sustainable.

TSLA Has Been De-rated By The Market

As seen above, TSLA has kept up with its NTM FCF trend since its March 2020 bottom. However, the trend has started to deviate, even though it’s expected to post an FCF growth of more than 90% in FY22.

As we indicated in our earlier discussion, the market is looking way ahead and does not expect the leading EV maker to maintain its growth cadence. Hence, Tesla bulls must expect further value compression to digest its growth premium and bring it closer to its auto and sector peers.

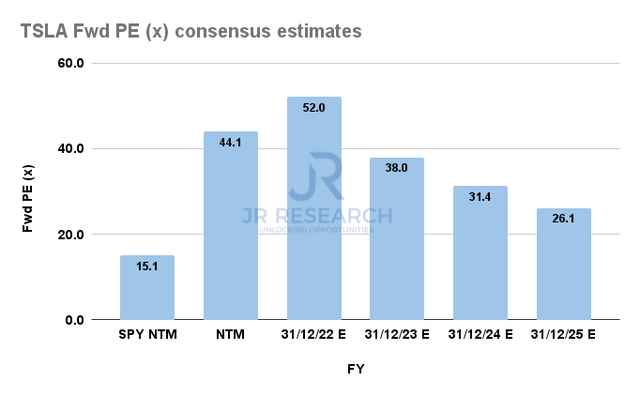

TSLA and SPY Forward PE consensus estimates (S&P Cap IQ)

As seen above, TSLA is priced at an FY25 earnings multiple of 26.1x at the current levels, which is still way higher than the S&P 500’s NTM P/E of 15.1x. Also, according to S&P Cap IQ data, TSLA’s NTM P/E of 44.1x remains well above its auto peers’ median NTM P/E of 3.6x.

There’s a significant growth premium embedded in TSLA stock that can’t justify slowing growth even at the current levels. Moreover, we believe the market should be looking at further digesting TSLA’s FY25 earnings, given the heightened risks of global competition, as legacy OEMs and China’s leading EV makers ramp production further.

Hence, bringing TSLA’s FY25 multiple down by at least another 30% to 40% is not unthinkable based on the current estimates.

Is TSLA Stock A Buy, Sell, Or Hold?

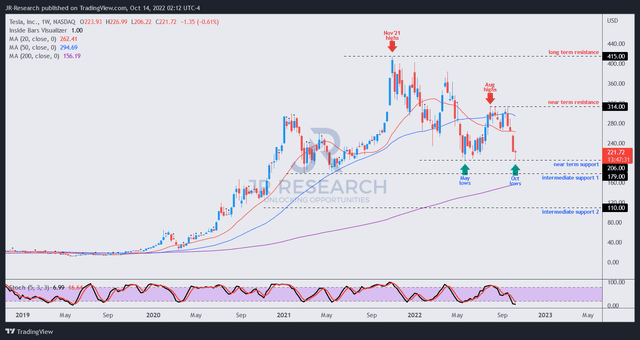

TSLA price chart (weekly) (TradingView)

Given the steep selloff in TSLA from its August highs to re-test its May lows, we are satisfied that its near-term downside has been reflected (nothing falls in a straight line).

Hence, we expect a consolidation at the current levels to draw in dip buyers, potentially leading to a short-term rally before meeting significant selling pressure.

Our analysis suggests that TSLA has likely lost its medium-term uptrend decisively, with August’s rejection against its 50-week moving average (blue line) validating our thesis. Hence, investors are urged to consider our view that the market has de-rated TSLA and sees further compression in its valuation as necessary to de-risk its execution risks through potentially slowing growth.

Buying the dips against a decisive change in trend is not recommended, and investors should wait patiently for its next rally to cut further exposure.

We expect a subsequent re-test of its “intermediate support 1” (20% downside), with an eventual bottom in between that support and its “intermediate support 2” (up to 50% downside).

Hence, we urge investors to be cautious about adding more exposure at the current levels. Instead, they should wait for the next rally to cut more exposure and let the staunch Tesla bulls catch the falling knives.

Accordingly, we revise our rating on TSLA from Sell to Hold.

Be the first to comment