Spencer Platt

The speculative bubble of 2021

After collapsing rapidly during the outbreak of the pandemic, the market has experienced one of the fastest recoveries in history. From a bear market due to a global pandemic, it quickly moved into a bull market where irrational euphoria reigned. “This time is different” and “this company is the future” were once again the most touted phrases in the latest speculative bubble that burst in 2021. Most of the stocks that were considered “the future” in 2021 to date have gotten as much as a 90% collapse, and this has affected even established companies. Nvidia (NVDA), for example, lost 65% because it was trading at a price not in line with its fair value: no matter how much money a company makes, there will always be the possibility of overpaying for it.

This last concept is what I consider the most important in this bearish thesis, because it is why I believe Tesla, Inc. (NASDAQ:TSLA) is overvalued. Even though Tesla has already collapsed about 40% and is overall a great company, there is no basis in my opinion to believe that it can be worth that much. A 40% collapse is still too little compared to the expected future cash flows, and that is what I will try to argue in this article. There is still too much general euphoria about this stock, a sign that market sentiment in general has not yet bottomed out.

Before I begin, I would like to point out that my intention is not to discredit Tesla since I am not questioning Tesla as a company, but simply its price per share, which is a completely different concept.

How will Tesla’s revenues react in the midst of tightening monetary policy?

Since last year, the behavior of the major central banks has changed rapidly as we have moved from an expansionary to a highly tightening monetary policy. An increase in interest rates of 50 or 75 basis points per month has become the new norm, as the goal is to reduce as much as possible an inflation at 40-year highs. Raising reference interest rates generates a dramatic change for all other financial transactions that impact the real economy, including a financing for a car.

To understand how tight monetary policy is impacting financing for a Tesla, we can look at the APR, the actual annual cost of funds, including any fees and additional costs.

- In December 2021, the APR for financing the purchase of a Tesla was 2.49% (36-72 months).

- Currently, the APR for financing the purchase of a Tesla is 4.74% (36-72 months).

So, in about 10 months, there has been an increase in the APR of 2.25%, while the FED Funds Rate, on the other hand, has increased by 2.48%. So, the APR increased more slowly than the FED Funds Rate, but overall the cost of buying a Tesla through financing increased significantly in less than 1 year. Moreover, for a person with questionable creditworthiness, financing could cost much more.

It is impossible to know a priori where the FED Funds Rate will be in a year, but if it rises further as expected, a further rise in the APR would be inevitable. Since the macroeconomic picture is not the best, it is not encouraging to pay a high interest rate for a Tesla that is already quite expensive. My focus is on Tesla, but obviously it extends to the entire automotive industry.

Finally, I would like to add one more personal point regarding the duration of this tight monetary policy. This recession cannot be fought by reducing interest rates because it would only fuel the inflationary spiral, so it is different from previous ones. Interest rates must necessarily remain high, at least until inflation is gone. This could lead the FED Funds Rate, and consequently the APR, to remain high for quite a long time, with major consequences for consumer credit. Since the automobile industry is highly cyclical and dependent on customers’ ability to repay financing, Tesla could experience significant difficulties in this not-so-unlikely scenario.

How will the automotive industry react during a recession?

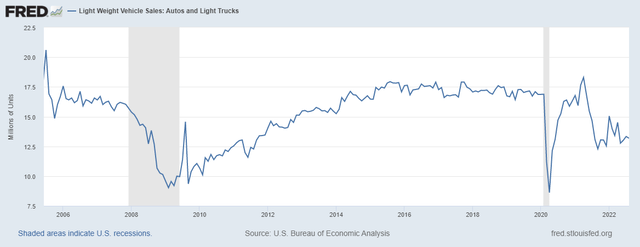

The purchase of a car is a large expense for most households, which is why during a recession it is likely to be postponed until the right economic conditions exist. This phenomenon creates a reduction in car sales, and we can observe this from data provided by the Federal Reserve Bank of St. Louis.

Federal Reserve Bank of St. Louis

Sales of cars and light trucks plummeted by about 40% both during the pandemic and during the sub-prime mortgage crisis. The current recession is not comparable with the previous two because the triggers are different, but the ultimate consequences could be similar. Looking at the graph, a descent actually already has taken place, but we are still a long way from the approximately 9 million vehicles sold in 2009 and 2020, probably because the worst effects of rising interest rates are not yet so tangible: it took about 4 years to reach the 2009 lows. Monetary policy does not have an immediate impact on the real economy; it has a lag of several months, if not years, and recovery may not be immediate. If fewer cars are sold, obviously Tesla’s revenue growth rate could be affected.

What is Tesla’s market share and how can it evolve in the future?

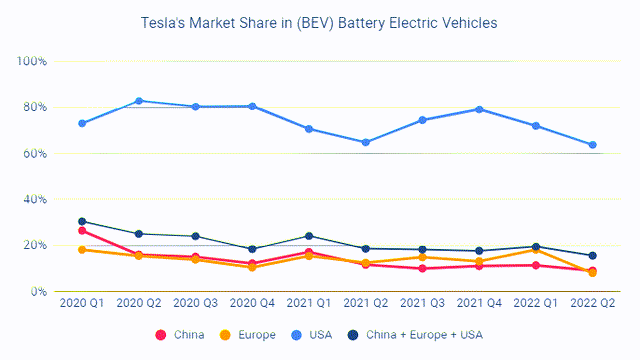

To date, there is no question that Tesla is the most important company in the sale of electric vehicles (“EVs”), but this leadership may be momentary. Taking it for granted that Tesla will be the undisputed leader for years to come would be a mistake, since the market in which it operates has historically been highly fragmented. Although Tesla is the company with the highest brand loyalty, other automotive companies are beginning to nibble away at its EV market share.

As we can see, each geographic region shows a decline in Tesla’s market share, particularly the United States. It is difficult, if not impossible, to see where the market share will stabilize, but it is not reasonable to expect the U.S. market share to be 63.80% in the long run.

It must be said, however, that since the electric car market is strongly growing, all this has not negatively impacted Tesla’s revenues, which continue to grow unabated. The reduction in market share will have a major impact when demand for electric vehicles stabilizes. In any case, this trend signals that other automakers are beginning to offer viable alternatives.

Regarding this last aspect, we can partly relate it back to the current economic environment. Current prices to buy a Tesla are not low; in fact, they start at $46,990 for a Model 3 Rear-Wheel Drive. Amid a severe global economic slowdown, spending around $50,000 on a car is not so obvious, and competitors may sell their cheaper models more easily. The Nissan Leaf starts at $27,400, the Chevrolet Bolt EV at $31,000. Obviously, in terms of quality these models are not comparable to a Model 3, but after all they are much cheaper. As well as these models, others will be released in the following years and will have a much more affordable base price. The sale of a cheaper model is also planned for Tesla, but the release of the Model 2 (starting from $25,000) is unlikely before 2025.

In summary, my expectation is that the current economic slowdown combined with rising interest rates may disincentivize the acquisition of luxury cars, including the models sold by Tesla. Cheaper alternatives might benefit. Tesla currently has the highest brand loyalty score due to the quality of its cars, but that could fade in the long run as the automotive industry has always been highly fragmented. Throughout history there has never been one automotive company that has blatantly dominated over others, but rather groups of companies operating as if an oligopoly. This trend is already underway, but since demand for EVs remains strong, this is not yet affecting Tesla’s revenues.

Selling 20 million electric vehicles per year by 2030: how realistic is it?

Expectations of future growth are everything for this company, otherwise much higher multiples than its competitors could not be justified. According to the company’s claims, the goal is to sell 20 million vehicles per year, but is that really possible? Let’s break down some numbers to see how feasible this goal is.

- In 2021 Tesla sold 935,950 vehicles; in 2022, excluding Q4, 912,000 were sold. Goldman Sachs predicts that in the whole of 2022 about 1.4 million units will be sold, so a promising Q4 is expected. It will be interesting to see whether Tesla will be able to sell about 500,000 vehicles in Q4 despite the sharp increase in interest rates.

- In 2021, Toyota sold more cars worldwide, about 10.5 million units. Its cars are designed mainly for the lower-middle class, which is why they are so popular. Tesla’s goal is therefore to sell about twice as many as Toyota by 2030. Since the Tesla brand is primarily accessible to the upper-middle class, I am skeptical about achieving this goal even considering the possible launch of the Model 2 by 2025.

- Doing some calculations quickly, with an average price of $70,000 per car sold, by 2030 the company is expected to earn revenues of about 1.40 trillion. Currently, Tesla is in the automotive field among the most profitable companies with a net income margin of 14.20%. Assuming it remains the same by 2030 (although competition will be increasingly fierce), Tesla will record a profit of about $200 billion. Last year, Toyota generated profits of $23.41 billion, Volkswagen €15.42 billion, BMW €12.38 billion, Daimler €23 billion, Stellantis €14.20 billion, Ford $17.93 billion and GM $10 billion. The sum of the profits of the major automakers accounts for slightly more than half of the estimated profits for Tesla in 2030. It is true that the average price per car sold and the 2030 net income margin are two arbitrary values chosen by me, but it is clear that there is more than one doubt about selling 20 million cars by 2030. Moreover, about 70 million cars have been sold each year since 2010; even assuming there is an increase to 80 million by 2030, I find it unlikely that 1 in 4 cars sold will be a Tesla.

Overall this goal seems unrealistic to me, but of course I could be wrong.

How much is Tesla worth?

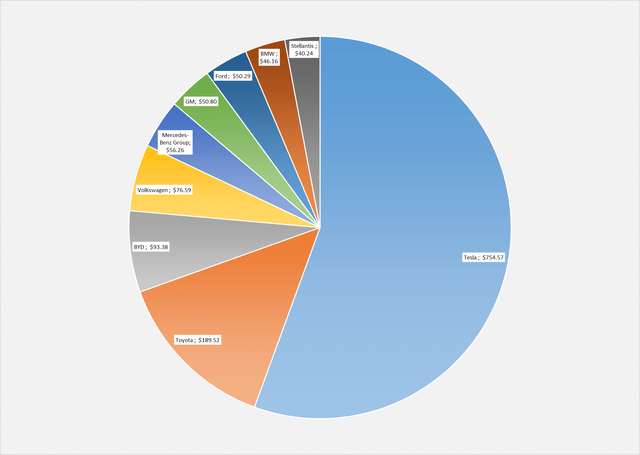

Before making a series of discounted cash flow (“DCF”) calculations based on different scenarios, I would first like to show a chart. Within it are included the world’s major automakers with a market cap above $40 billion.

As can be observed, Tesla has a market cap that exceeds that of all other automakers combined. Yet, on paper, Tesla’s profits are greater only than BYD Company Limited (OTCPK:BYDDF) and General Motors (GM) considering the last 12 months. The market apparently assumes that Tesla’s profits will increase much more than those of its competitors. This may be very likely, but still I do not see how it can justify such a wide gap.

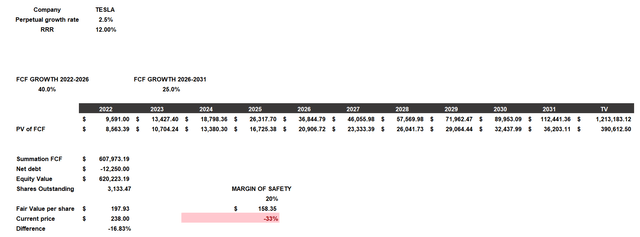

Beyond this hardly reassuring aspect, I will now proceed to discount Tesla’s future cash flows to calculate an indicative fair value. Three different scenarios will be shown, trying to cover a wide range of assumptions. Each model has the following common characteristics:

- Required rate of return (RRR) of 12%; Tesla is a high-risk investment with beta of 2.19, so I expect a return above the long-term average market return.

- 2022 free cash flow will be estimated by TIKR Terminal analysts.

- Shares outstanding and net debt are taken from TIKR Terminal

- Perpetual growth rate of 2.50%.

The only divergence will be the free cash flow growth rate from 2023 to 2031.

Best-case scenario

In this scenario, I assumed free cash flow growth of 40% until 2026, and then 25% until 2031.

Personally, I believe this scenario is even too positive, but I wanted to include it anyway. Assuming 40% growth for an automotive company for the next 4 years in the midst of a recession causes me not a few doubts. In 2031, Tesla is expected to generate free cash flow of $112 billion: basically, the competition will have been more than beaten. Despite all these rosy assumptions, Tesla would still be overvalued since it would have a fair value of about $198 per share.

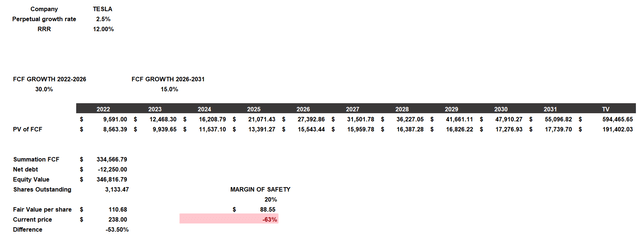

Normal case scenario

In this scenario, I assumed 30% growth until 2026 and then 15% growth until 2031. Achieving a free cash flow of $55 billion in 2031 would still be an incredible achievement that would probably make Tesla the automotive company with the highest free cash flow. The fair value per share would be about $110.

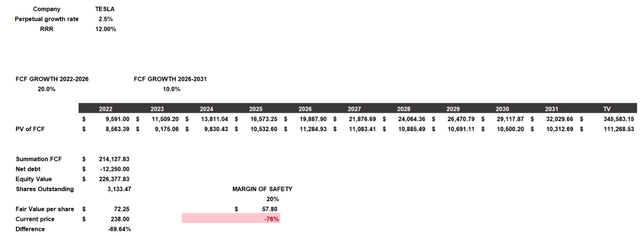

Worst-case scenario

In the worst-case scenario, I considered 20% growth until 2026 and then 10% growth until 2031. The fair value per share is only $72, so Tesla would be significantly overvalued under these assumptions. But is this scenario so unlikely and negative? With free cash flow of $32 billion in 2031 Tesla would still be among the top companies in the world in its industry based on free cash flow (if not the first).

Overall, in every scenarios adopted, Tesla is overvalued. In the positive scenario, I tried to justify the current price by including a very high growth rate, but even that was not enough. After all, such a result was already predictable after comparing Tesla’s market cap with that of its competitors.

Final Thoughts

Tesla is a solid company with higher profit margins than its competitors, as well as unrivaled brand loyalty. Its growth rate in recent years has been impressive, and it is likely to be a major player in the green transition.

Despite these excellent premises, I do not currently consider it a good investment: one must separate the value of a company from appreciation for the products it sells. Many of us appreciate Tesla cars, there is no question, but that does not detract from the fact that the company may be overvalued. Discounting future cash flows, I don’t think there are reasonable assumptions that can justify the current price; there is still too much hype around this company. Elon Musk’s influence on the global landscape is certainly an important factor keeping Tesla’s price per share high, but how long can this situation last?

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment