ozgurdonmaz

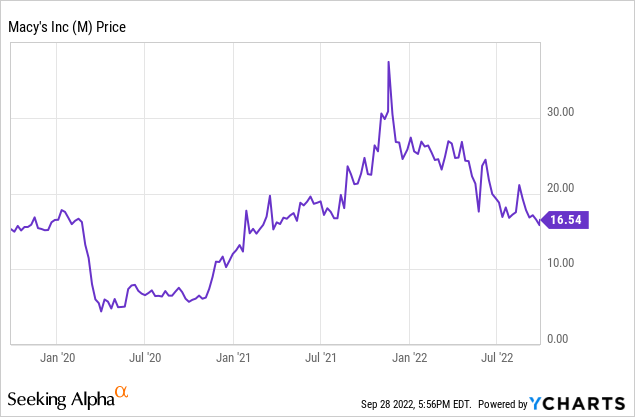

Less than a year ago, Macy’s (NYSE:M) shares soared to a multiyear high of $37.95: more than double the pre-pandemic share price. At the time, Macy’s was on the way to posting record adjusted EPS for fiscal 2021. Moreover, investors were salivating about the prospect that the retailer (under pressure from Jana Partners) could spin off its e-commerce business at a sky-high valuation.

The party didn’t last long, though. Macy’s still expects to post strong earnings results in fiscal 2022, albeit not quite at the level of its 2021 performance. Yet Macy’s stock has fallen more than 50% from the high it reached last November, bottoming out near $15 earlier this week before recovering somewhat. Fears about inventory imbalances, the impact of inflation on consumers’ discretionary budgets, and growing recession risks have all weighed on the share price.

However, the selling pressure appears massively overdone. Buying shares of an economically-sensitive discretionary retailer with volatile margins may seem extremely counterintuitive in the current macro environment. Yet Macy’s stock currently offers one of the best opportunities in the market for investors with a 3-plus-year time horizon. Let’s take a look.

Another boom-and-bust cycle

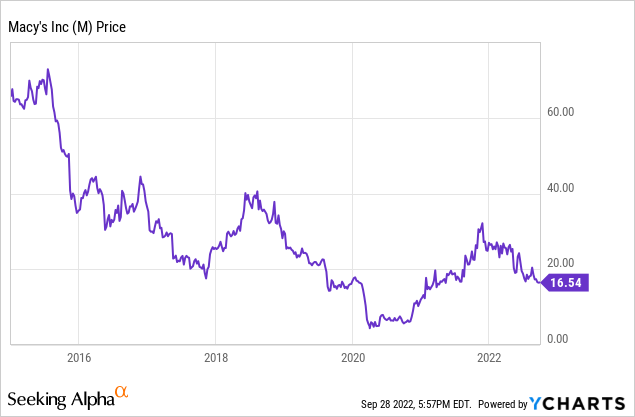

Just two and a half years ago, Macy’s stock plummeted below $5 in the early days of the COVID-19 pandemic. Investors feared that the pandemic would aggravate the so-called “retail apocalypse” and put the final nail in Macy’s coffin.

Indeed, Macy’s recorded an adjusted EBITDA loss of $830 million in the first half of 2020. The company had to delay payments to suppliers, issue debt on unfavorable terms, and slash CapEx to the bone to survive.

However, Macy’s did survive intact. That allowed it to capitalize on a swift demand recovery in 2021. For the full year, comparable sales increased 3% compared to fiscal 2019, with comp sales growth averaging roughly 7% for the last three quarters of the fiscal year.

Moreover, this strong demand came against a backdrop of tight inventory across the industry. This allowed Macy’s (like many of its peers) to cut back on discounting and dramatically expand its profit margin compared to pre-pandemic levels. For the full year, adjusted EBITDA totaled $3.3 billion, up from $2.3 billion in fiscal 2019, representing a 4-point margin improvement.

This rapid turnaround, combined with some irrational exuberance about the possibility to create value by spinning off Macy’s e-commerce business, helped propel Macy’s stock from single-digit territory in November 2020 to a high of nearly $38 a year later.

Entering 2022, management expected profitability to come back to earth a bit. Macy’s initial full-year guidance (see slide 29) called for its adjusted EBITDA margin to recede from 13.6% last year to between 11% and 11.5%. However, the company anticipated modest margin expansion thereafter.

Unfortunately, a sharp shift in demand away from “pandemic” categories like casual apparel and home furnishings has forced Macy’s to ramp up promotional activity. Last month, the company cut its full-year adjusted EBITDA margin forecast to 10.5%.

With inflation remaining stubbornly high and economic growth stalling out, investors are understandably worried that sales and margin trends will continue to deteriorate. As a result, Macy’s stock has tumbled 56% from last November’s high.

This time is different

The plunge in Macy’s share price since last fall marks the fifth time since 2015 that Macy’s stock has fallen more than 50% in less than a year. Bears have seen each subsequent rally as nothing more than a dead-cat bounce. At best, the skeptics think Macy’s stock is on a roller-coaster ride to nowhere, with lots of ups and downs but no prospect of gains for long-term investors.

Yet Macy’s is in a much better position to handle a downturn than it was just a few years ago. First, over the past three years, Macy’s has invested in numerous tools to optimize inventory allocations, improve its markdown management, and reduce e-commerce fulfillment costs. These efforts will all help Macy’s mitigate the gross margin impact of sales declines in a recessionary environment.

Second, Macy’s has invested in several new brand partnerships recently: most notably, a tie-up with Toys R Us. By October, every full-line Macy’s store will have a Toys R Us shop inside. This will help drive customer traffic, particularly during the holiday season. And because Macy’s had a negligible toy business before the pandemic, the revenue from these shops will be nearly all incremental.

Third, Macy’s has rolled out its Macy’s Backstage off-price concept nationally over the past few years. It currently has nearly 300 Backstage locations (mainly located inside full-line stores): up from around 150 in late 2018 and roughly 50 a year before that. Backstage gives Macy’s a valuable tool to serve customers whose discretionary budgets are being pinched.

While these factors should mitigate the impact of economic weakness on the company’s results, Macy’s is still a cyclical business. As such, it is likely to report lower revenue and earnings in fiscal 2023 if the U.S. economy experiences a recession next year.

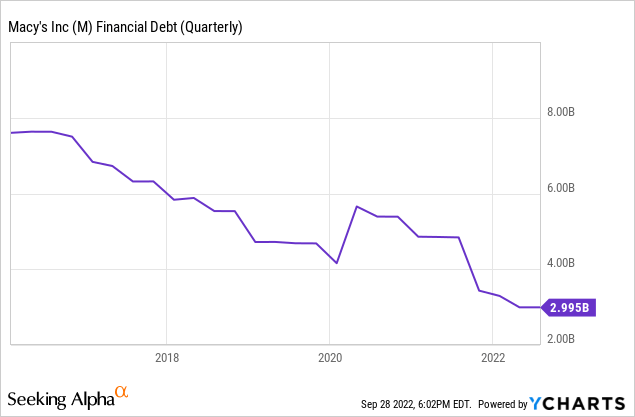

Fortunately, Macy’s has a powerful tool to turn near-term share price weakness into long-term upside for investors: share repurchases. Between 2016 and 2020, Macy’s had to devote all of its excess cash after dividend payments to debt reduction, as falling earnings put severe pressure on its leverage ratio. That prevented it from capitalizing on the periodic declines in Macy’s stock.

By contrast, Macy’s is entering the current downturn in a very strong financial position, having reduced gross debt by more than 60% since early 2016 (from $7.6 billion to $3 billion). Leverage is now comfortably below its target and Macy’s has no material debt maturities until the late 2020s. That will allow it to use excess cash flow for share repurchases.

Macy’s exited the second quarter with $1.4 billion remaining on its share repurchase authorization. The company typically generates at least $1 billion of free cash flow in the fourth quarter, which could pave the way for substantial buybacks next quarter. Macy’s also completed a $49 million asset sale last month, bringing in additional cash, with more asset sales in the pipeline.

I expect Macy’s to complete the current buyback program within the next 18-24 months. At current prices, that would reduce its share count by about 30%. That would offset some of the potential pressure on EPS in 2023 while contributing to long-term EPS growth.

Valuing Macy’s stock

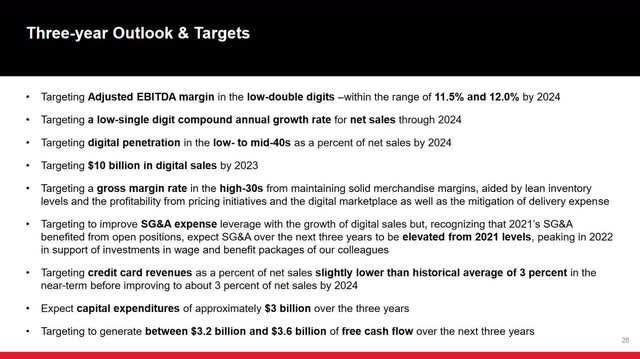

Earlier this year, Macy’s set out broad financial goals for the next three years. It is targeting low-single-digit sales growth over that period and an adjusted EBITDA margin between 11.5% and 12% by 2024.

Source: Macy’s Q4 2021 Earnings Presentation, slide 28.

To be conservative for valuation purposes, I will assume little or no near-term revenue growth and a 10%-11% adjusted EBITDA margin in 2024. This would translate to adjusted EBITDA between $2.5 billion and $2.9 billion and adjusted net income of $1.1-$1.4 billion.

Assuming a 30% reduction in Macy’s diluted share count (i.e., the current $1.4 billion share buyback program is completed near current prices but no further repurchases take place), the company would have 194 million shares outstanding. The net income range would translate to adjusted EPS of approximately $5.70-7.20.

Even at a very conservative valuation of 7 times earnings, the low end of this EPS range would support a $40 price target for the end of 2024. At a still-modest 10 times earnings multiple, the high end of the range would make Macy’s stock worth $72 at that time. Of course, if Macy’s actually hit its stated financial goals, the stock price could rise even further.

Key risks

As a purely discretionary retailer, Macy’s could face substantial sales and margin erosion if the U.S. economy experiences a sharp downturn.

During the Great Recession, Macy’s sales fell by approximately 11% and EPS fell by more than a third over a two-year period. If the company were to misjudge the environment and order too much inventory, leading to big markdowns, the margin damage from a recession would be significantly worse.

From a longer-term perspective, brutal retail industry competition represents the biggest threat to Macy’s business. The company’s top line is lower than it was a decade ago. Some brands have pivoted away from selling to department stores in favor of direct-to-consumer channels. Macy’s has also lost market share to off-price stores, discounters, and pure-play e-commerce companies.

Macy’s has cut costs aggressively in recent years, leaving limited room to wring out incremental efficiencies if revenue declines resume. With wage rates likely to continue rising, it could be hard to maintain a double-digit EBITDA margin unless Macy’s can stabilize its market share.

Upside far outweighs downside

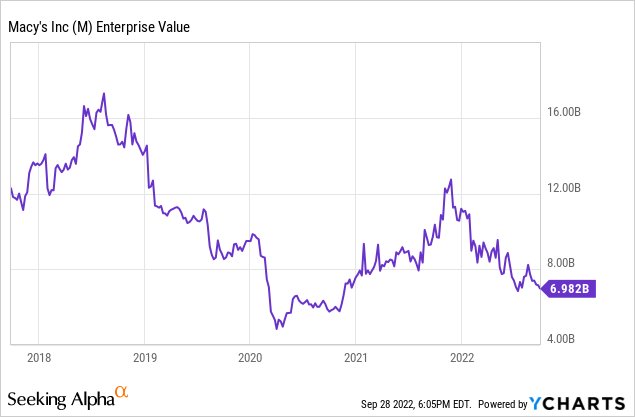

While these risks should not be ignored, Macy’s real estate value provides substantial protection against the risk of a permanent downturn in its core business. In April 2020, at the height of the COVID-19 pandemic, I estimated that Macy’s real estate was worth over $10 billion. By contrast, the company’s enterprise value has fallen to just $7 billion, down by more than 50% from mid-2018.

If anything, I think Macy’s real estate is more valuable than my 2020 estimate, given that most malls recovered very well from the COVID-19 pandemic. In an orderly liquidation, the net proceeds from Macy’s selling its real estate and other assets and settling all of its liabilities would likely exceed the current stock price.

Meanwhile, if Macy’s strategic initiatives to support sales and profitability are remotely successful, Macy’s stock could surge to $40 or more within a few years.

As long as Macy’s continues to generate free cash flow and sell excess property to bolster its balance sheet, the company will be able to capitalize on near-term share price weakness to shrink its share count and build value for long-term shareholders. Thus, investors should welcome the possibility of further share-price declines, rather than fearing them.

At $16, Macy’s stock offers a lopsided opportunity for long-term investors. As such, it is the largest position in my investment portfolio.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment