Hiroshi Watanabe

When the pandemic struck, there was uncertainty about how businesses would cope. Central banks opened up the liquidity taps, and technology came to the rescue, with cloud providers as a critical player in the new scheme of things. These hyperscalers quickly became remote operations’ backbone (and thus major beneficiaries). Yet, two and a half years later, as we again head into winter, the world is faced with an unyielding Fed. The Fed’s stance on tightening, coupled with the US dollar’s reserve currency status, has been forcing tighter monetary conditions, despite people over the last 30 months having gotten used to serious money. The war between inflation and shrinking demand in light of drying liquidity has led to recessionary fears and demand contraction across industries and geographies.

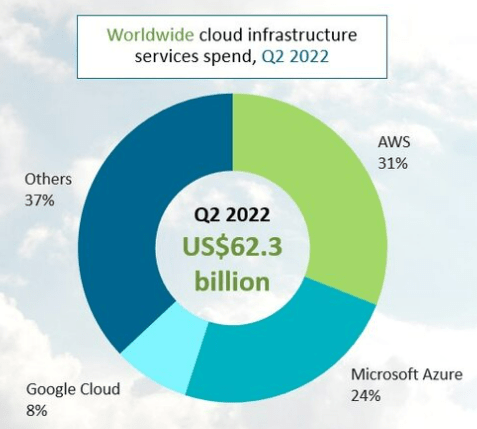

Per Canalys, in Q2 2022, cloud spending increased by 33% to $62.3 billion.

Canalys

While cloud companies continue to see growth, they all have cited varying flavours of demand softness across geographies and customers.

We look at the significant trends highlighted over Q2, trying to make sense of how all cloud dynamics can potentially impact the second half and beyond. In this edition of Masters of Cloud, we have dropped VMWare (VMW) since the company is now part of Broadcom (AVGO). We also look at SAP (SAP), given the company’s European exposure.

Amazon Web Services or AWS

The pack leader continues to see growth, although the longer commitments with customers have been accompanied by some discounts, which have also been reflected in the AWS margin softness from 35% in 1Q 2022 to 29% in Q2 2022.

Another aspect of the margin weakness is due to investments. As Amazon (AMZN) continues to invest internationally, margin pressure should not surprise. The company is a beast and has shown resilience over the years. We only have a couple of major observations:

- Andy Jassy: The man is now at the helm of the company and not just AWS, and AWS is still Amazon’s only major cash cow (yes, advertising has been positive, but it is still tied to the retail business).

- International expansion: Amazon plans to have 24 more availability zones across eight global regions. While the company has been acknowledging the profitability challenges in the developing markets, it still believes in chasing volume for growth. Although there has been some success in turning profitable in the more developed economies of Europe, the Russia – Ukraine conflict is unlikely to make things easier.

As inflation continues to hurt everyone equally (and Amazon a bit more, due to the bigger trading business) and the competition continues to edge closer (Microsoft (MSFT) and Google (GOOG) (GOOGL) Cloud are both much more prominent now), in the interest of making the cloud business more incisive, the thought of splitting AWS and non-AWS business may cross Jassy’s mind (Amazon: A Tale Of 2 Businesses).

Microsoft Azure

The customers’ realization that value unlocking from the cloud does not happen just from the move to the cloud but from incremental innovation. While Azure has continued to grow at 40%+, Microsoft’s last quarter saw a consistent deceleration on the back of consumption softness. And the company has also been following the AWS strategy of sacrificing pricing to ensure growth. However, Microsoft has a definite advantage with its suite of products (Office 365, etc.) that help in the stickiness. While Microsoft of the yesteryears was looked down upon for bundling Internet Explorer with Windows, the company proudly embraces partners across system integrators and other hyperscalers to allow for an interoperable cloud despite claiming that the Microsoft Cloud is the best-of-breed offering there is.

Horizontally speaking, we’re working on building the skills and capacity based across the systems integrator ecosystem, the either the large globals, like the Accentures and EYs and KPMGs and PwCs of the world, or the smaller local players that focus in a given geography

Our incident and event management solution, we call Sentinel, operates across AWS across Google Cloud Platform, and across Azure

SAP is our largest partner, we also have a portion of our portfolio that competes with SAP

we have a model with them, where you can run applications on Azure, and directly connect back into the Oracle Cloud infrastructure for your data environment

And so of course, that means that, as much as we tried to provide pervasive value across the Microsoft Cloud, customers will make decisions that are non-Microsoft decisions, and we need to still serve their needs and we have an accountability to make them successful.

If you look at what’s in the Microsoft Cloud, you need the best of AWS, the best of Google, the best of Salesforce, the best of Zoom, the best of Octave, the best of CrowdStrike, and you’d have to hope like hell, that some integrator wove that together for you perfectly to get what you can get from the Microsoft Cloud.

Source: GS Conference notes from SA

We think Microsoft’s reach and experience on the industrial metaverse are likely to keep Azure growing, with the other products funneling in customers. However, some challenges could be from competitive challenges arising from the likes of Google.

Google Cloud

While the cloud is the cash cow for Amazon, it continues to be an investment for Google – Q2 2022 saw a 36% y/y growth in Google’s cloud revenues with an operating loss of $858 million vs $591 million a year ago.

As the cash cow, the search business has seen some weakness due to the macroeconomic upheaval of the day.

Although Google remains committed to continuing to invest in the cloud, benefiting from strengths in its ability to unify data to glean insights from data and edge computing, Sundar Pichai’s proclamation of becoming more prudent with spending in times of economic uncertainty contrasts with Google Cloud’s need for cash.

And then, in terms of your margin question, our view continues to be that this is an extraordinary opportunity. It’s a long-term opportunity and enterprise customers are still early in their move to the cloud. And so, we do very much have that debate that same question that you posed is the right one, which is a trade-off as between revenue growth and immediate profitability. And what we’re focused on is ensuring that we’re investing to support the long-term growth and given the upside that we see. And so, continue to focus on it and are looking at the path to profitability, path to cash flow positive to drive attractive returns. That’s obviously in the overall model of it, but very much believe in the long-term growth and believe this is the right level of investment across the business, go to market, the product teams continuing to build it out globally.

Source: Q2 2022 Google Earnings from SA

Google’s technological superiority among the hyperscalers is likely to continue allowing it to attract customers. However, it remains to be seen how soon Google’s technology advantage can help the cloud business achieve profitability.

Given the overall macro, while Google management may be inclined towards extending investments to the cloud, it may cause a bit of a challenge with the existing cash-cow businesses witnessing belt-tightening.

Oracle Cloud Infrastructure or OCI

The following sums up the market’s surprise at Oracle’s (ORCL) performance:

A little surprised to see your strong results here when most software companies, other than some of the pure security names really faltered some against the macro backdrop. And frankly, you just didn’t hear.

Source: 1Q 2023 Oracle Earnings from SA

Far from surprise, we look forward to the next leg of Oracle’s growth, where Ellison claims that AWS’ notable customer will soon be shifting to Oracle.

Some of our previous views can be found here:

- Oracle Is Becoming Prominent Again

- Oracle: Resilience In Growth Momentum Could Lead To Outperformance

While Microsoft has categorically pointed out consumption weakness, Oracle has been talking about acceleration in consumption.

The growth in the autonomous database, the technological superiority of the OCI, the compelling value proposition of running mission-critical workloads on OCI, etc., are all arguments that now seem to be fructifying into strong cloud growth of 30%+. To us, a couple of things stand out:

- Cerner’s integration appears to be complete, which is remarkable and speaks volumes about the business case for the Autonomous database and OCI. Oracle’s results getting signed within a week of the quarter end is also a strong endorsement of the company’s product set.

- The talk about NVIDIA (NVDA) and the Tokyo Stock Exchange takes Oracle into some very serious territory, purely from the technology needed to support these applications.

Additionally, the mere acknowledgement of the way forward to be a multi-cloud environment shows how long Oracle has come forward.

The additional investment in sales and engineering talent on the ground chimes well with the overall narrative of increasing growth from the migration of Oracle databases and new logo wins. As a result, we have been bullish on Oracle.

SAP

SAP has had a rough time, with the European aspect of business getting affected severely by the Russia – Ukraine conflict.

While license growth has been slower, and the company has also dialed back on hiring, the SAP management has shown tremendous confidence in its ability to defend its new guidance (considering the hit from the Russian conflict).

While the market skepticism could subside if the company delivers on its year-end plans, we think the supply chain-linked offerings of SAP’s business are unique.

with Samsung and other players in the semiconductor industry, we are now moving them with RISE with SAP, not only to the cloud, but we’re actually building a very resilient supply chain. We are moving them to the network where they find millions of suppliers and buyers also for their industry and then we are building a resilient supply chain.

Christian speaks a lot about the ability to be able to manage your supply chain disruptions, your ability to be able to source and manage our supplier base in a very diverse and realtime environment. They are consistent and strong. And so the core part of the portfolio, we see really strong demand and pipeline going forward, And I don’t expect that to change because even in a difficult environment, those needs become more apparent than ever.

Source: Q2 2022 SAP Earnings from SA

While Ellison has been talking about beating SAP, we think should the macro improve, the company could surprise on the upside on the back of its cloud use case in the supply chain. However, considering the European situation to be a rather volatile one, we remain in a wait-and-watch mode.

IBM Hybrid Cloud and System Integration Capabilities

The only non-hyperscaler in this discussion, IBM (IBM) is focused on becoming the key player in the hybrid-cloud market. The company complements Microsoft’s view: On the one hand, Microsoft does not want to expand its services organization and lean on its partners; on the other hand, IBM has been investing through the certification of thousands of its people across AWS, Azure, SAP and Salesforce (CRM). Even the company’s inorganic initiatives have been geared towards acquiring capabilities towards building partner capabilities and IBM’s hybrid cloud platform.

While IBM’s Q2 was hit by the currency strengthening and the Russia conflict, we think IBM’s growing focus towards helping structure multiple clouds could become a key differentiator for the company. It is worth reminding that VMWare and RedHat both now exist as part of larger companies, and since Broadcom also has a semi-focus, IBM becomes the only real ‘hybrid-cloud’ play in town! With over 4,000 IBM clients adopting its hybrid-cloud platform, Arvind Krishna’s RedHat buy seems to be resonating with the market.

Although the cloud has been gaining momentum overall, estimates suggest that 70% of the workloads have yet to move to the cloud.

Coupled with the growing interoperability that most hyperscalers (even Oracle!) have embraced, having a single integrated fabric across clouds can help alleviate security and application deployment challenges.

Another reason that favors IBM is the company’s ‘platform-neutral’ position. IBM is essentially now in the business of helping customers with their cloud journeys and business transformation. To a client, it is a great deal of comfort that their system integrator (or SI) has no cloud ownership. Instead, the SI has excellent relationships with all. In some sense, IBM is becoming a horizontal specialist. The company is pushing the frontiers of artificial intelligence or AI for interactions in financial institutions, deal evaluation (IBM claims that one of its customers generated $200 million of improvement in their loan book) and data extraction from documents. The AI use cases can easily span mission-critical works and thus allows IBM to further embed itself in verticals.

Conclusion

The market for cloud and its growth is far from saturation. While no company or sector is likely to remain untouched by the changing macroeconomic and geopolitical landscape, cloud businesses have inherent resilience built into them due to the dependence of their customers on their clouds. Our key takeaways for the near to medium term are as follows:

- A rather interesting indicator of potential growth is management commentary around growth in salesforce supporting cloud – the sentiment on hiring can give a good sense of how the cloud momentum is likely to be in the next couple of quarters.

- Hyperscalers have been sweetening the deals by offering credits to soften inflation’s blow to customers and coax them into long contracts.

- To avoid running up large bills that many perceive as defying the benefit of moving to the cloud, hyperscalers are working with customers to prioritize the projects they want to undertake. In addition, the consultative approach builds deeper relationships and allows the hyperscalers to get a better flavor of the industry dynamics.

- There is not a single cloud vendor that has now not embraced multi-cloud interoperability. In addition to freeing customers from lock-ins, the interoperability also allays customer concerns around security.

- One particularly striking aspect is around the sales motion, which is now shifting to leveraging dependence versus pure customer need – lift and shift is no longer the recommended move. Instead, to realize value, a customer must have a roadmap – analytics on data, etc., which makes the cloud vendor an indispensable part of the customers’ operating business.

- Hyperscalers are becoming vertical/niche focused – Azure is looking at the industrial metaverse applications in the cloud, Google at edge computing, Oracle at healthcare, SAP in the supply chain, and even IBM is trying to sharpen its horizontal focus with AI in mission-critical areas.

From a stock perspective, we continue to like Oracle and IBM ahead of the others, with IBM appearing somewhat of a contrarian play given its performance last quarter.

We look forward to readers’ views of what they have been observing in the market.

Previous articles in this series:

Be the first to comment