Justin Sullivan

Despite reporting its first sequential decline in production volumes in two years for the second quarter in early July, which was largely expected due COVID disruptions to operations at its Shanghai facility, the Tesla stock (NASDAQ:TSLA) still rallied more than 10% during the week. The stock has also recouped its intraday losses sustained last week after Twitter (TWTR) filed a lawsuit against Tesla CEO Elon Musk on the failed $44 billion buyout deal. The resilience observed in the Tesla stock in recent weeks underscores investors’ favourable response towards the electric vehicle (“EV”) titan’s unmatched strength in getting productions back up to pace following unprecedented disruptions earlier on in the quarter, with June volumes setting a new record as the “highest vehicle production month in Tesla’s history”.

Tesla shares maintained its uptrend momentum in post-market trading Wednesday after reporting an earnings beat, and reaffirming its long-term multi-year growth target of 50% despite “losing more builds in Q3 than expected” due to the ongoing supply chain disruptions. The results underscore investors’ focus on signs that the EV pioneer can defy risks of a slowing economy in the near-term as well as a fluid situation on global supply chain constraints, and deliver a back-end weighted year, which we had discussed in our most recent 2Q22 preview for the emerging industry. Tesla’s investors have also responded positively on the company’s surprise sale of 75% of its total Bitcoin holdings, which added $936 million to the company’s balance sheet. Despite related impairment costs, which were not specifically disclosed, due to the recent turmoil in the crypto sector, Tesla’s ability to stage an earnings beat still underscores the strength of its margins compared to rivals in its peer group.

While Tesla finds itself in the safe zone still for now, macro uncertainty through the second half of the year as the global economy grapples with runaway inflation and tightening monetary policies is expected to complicate the near-term growth trajectory for the EV company, as well as the broader peer group, nonetheless. In addition to macro challenges outside of Tesla’s control, the EV pioneer, which has benefited from years of first mover advantage, is now also facing heightened long-term competition risks as both pure-plays and legacy automakers try to take a piece of the burgeoning market.

And this situation begs the question of whether Tesla will inevitably succumb to a similar fate as Netflix (NFLX) – also an industry disruptor – which saw more than 70% of its market value vanish in the first half of the year following multiple consecutive quarters of deceleration and lost market share to competition. While Tesla’s robust demand environment continues to support pricing gains and market share gains in the fast-expanding EV industry, its hard-to-comprehend and hard-to-justify valuation requires continued perfect execution on growth promises that include best-in-class profit margins through economies of scale, as well as dominance in the market for next-generation mobility technologies like driverless Robotaxis over the longer-term. This is further corroborated by the stock’s mild gains in post-market trading Wednesday, which suggests that the second quarter results and 2H outlook commentary provided were largely in line with investors’ expectations that have already been priced into the stock.

With consumers gaining access to a wider range of EV choices to satisfy different preferences and budgets, and Tesla’s premium offerings still pricing out more than half of the American population, the long-term risks of market share erosion make an inevitable headwind for the EV titan. While 2H will be a tell-tale on whether Tesla’s performance can continue to defy the near-term macro uncertainties over when inflation and Fed rate hikes will peak, and how a potential recession will play out, risks of intensifying competition over the mid- to longer-term remain a prominent challenge that investors should not overlook.

Tesla 2Q22 Earnings Overview

As previously reported, Tesla posted a sequential decline in delivery volumes during the second quarter as expected due to the three-week COVID-induced lockdown at its critical Shanghai manufacturing plant earlier in the period. The EV market leader produced 258,580 vehicles (+25% y/y; -15% q/q) in the second quarter and delivered 254,695 vehicles (+27% y/y; -18% q/q).

Tesla’s record-setting June volumes helped cushion the impact on both the company’s top- and bottom-line performance due to pronounced early-quarter COVID disruptions – to which Musk had alluded to as “supply chain hell”. The company recorded second quarter revenues of $16.9 billion (+42% y/y; -10% q/q), which was largely in line with the average consensus estimate of about $16.8 billion (+40% y/y; -10% q/q). Specifically, auto sales (ex-credit sales) grew 45% y/y (-12% q/q) to $14.3 billion in the second quarter, underscoring strength in both Tesla’s pricing gains following multiple MSRP increases this year, as well as its ability in getting vehicles into customers’ hands despite unprecedented production challenges.

Adjusted earnings also beat expectations at $2.27 per share, compared with the average consensus estimate of about $1.80 per share. Auto margins (ex-credit sales) came in at 26%, which was lower than the prior quarter’s 30% as expected due to additional ramp-up costs at the new Berlin and Austin facilities, higher per vehicle fixed costs for units produced in Shanghai due to the April lockdown, as well as higher input costs.

Most importantly, Tesla reiterated its multi-year growth target of 50% despite unprecedented supply chain and production challenges during the second quarter. Management has alluded the decision to expectations of continued improvements in global supply chain bottlenecks in the second half, as well as added production capacity from the Shanghai plant’s ongoing expansion and continued ramp-up at the Berlin and Austin facilities.

Specifically, investors are expecting a “record-breaking second half of 2022” as guided by Musk, which is a reasonable estimate considering strong June productions, as well as expanded annual capacity at Fremont (from 600,000 units to now 650,000 units) and Shanghai (from more than 450,000 units to now more than 750,000 units), and positive progress on ramping up Berlin and Texas. But from a dollar perspective, the company is expecting potential FX headwinds due to the strong dollar, continued margin impact from “Austin and Berlin ramp inefficiencies” (especially considering Europe’s worsening energy crunch), as well as the fluid situation over evolving supply costs due to still-constrained availability.

Tesla’s Near-Term Regional Trends

Global EV adoption has continued to defy the cyclical nature of the broader automotive sector, with strong take rates still, despite a global auto sales slump due to ongoing supply shortages. The broader automotive sector has yet to see structural demand destruction as a result of tightening financial conditions, which is corroborated by the 0.8% increase in auto sales in June, implying “there is still enough momentum for the U.S. economy to grow during the rest of the year as consumers find ways to cope with surging inflation”.

However, with EV input costs continuing to surge, and the burden being passed on to consumers through recurring sticker price hikes – as in the case of Tesla – the looming economic downturn poses risks of delayed or permanently lost vehicle sales in the near-term, which cannot be ignored. And over the mid- to longer-term, the increasing roll-out of new EV models across different vehicle and price segments is also poised to erode Tesla’s market share based on its current state, which primarily caters to the premium over the mass market segment.

Mid-Long Term Market Share Erosion Risks

In addition to the near-term macro headwinds observed across Tesla’s core markets (further explained here), the EV titan faces a bigger, and more structural risk of market share erosion over the mid- to longer-term as competition intensifies. The next decade will be an era of electrification with significant opportunities for the sector as EVs take the center stage. The European Federation for Transport and Environment predicts more than 300 available EV models within the European automotive market by 2025, while the IHS Markit predicts more than 130 available EV models in the U.S. by 2026, which is equivalent to the number of ICE options available in the market today.

Specifically, in Tesla’s largest U.S. market where it currently commands a 75% share of annual EV sales, the emerging sector’s penetration rate surpassed the 5% inflection point in the first half of the year, marking the beginning of rapid mass market adoption. More than 25% of American population have identified EVs as their choice of preference when purchasing their next car, compared to 16% in 2019.

While the trends may appear as favourable tailwinds for Tesla on the surface, a deeper dive would reveal that many prospective buyers are alluding to the increasing availability of different EV models for their preference. The increasing availability of non-Tesla EV models across a wide array of performance, range capability, and price categories is what has encouraged rapid mass market EV adoption in the U.S., heightening risks of share erosion for Tesla over the longer-term.

3 Key Countering Strengths

While Musk has repeatedly expressed his priority for procuring sufficient raw materials and ramping up productions over managing intensifying competition, the latter is now becoming an inevitable risk to Tesla that also demands immediate attention. Both EV upstarts and legacy automakers have collectively pledged more than $500 billion towards developing electrified models and related technologies over the next five years, an effort that is poised to drive share losses for Tesla and make it more difficult for the industry leader to expand margins further over the longer-term.

Yet, Tesla still has a few tricks under its belt that will help it insulate against the kind of material deceleration in market share gains experienced by its disruptive tech peer Netflix in recent months. These include continued diversification of its product portfolio, maximizing capitalization of near-term pricing gains, and maintaining a supply advantage.

1. Diversification Of Product Portfolio

Tesla’s introduction of the lower priced “Model 3” and “Model Y” in 2017 and 2020, respectively, marked a huge success in catapulting the brand to the global stage. Today, Model 3/Y sales collectively account for more than 90% of quarterly deliveries. Although the Model 3/Y are priced at a much lower rate compared to its premium counterparts “Model S” and “Model X”, they yield greater margins and were made to better appeal to mass market demand. This is further corroborated by strong take rates of the Model 3/Y vehicles in recent years across Europe and China. Tesla continues to dominate with the Model 3 consistently being Europe’s best-selling EV. The EV maker also remains a strong market share gainer in China, with the Model 3/Y holding the title of second and third bestselling EV in the region.

The China-made Model Y boasts a competitive price tag starting at under $51,000, but earns a profit margin of close to 30% for Tesla, while the industry average hovers at only 8% to 10%. And now, with Model 3 and Model Y sales leading the way, not only does Tesla’s fundamentals benefit from better margins, but the trend also underpins rapid global EV adoption and robust demand for new energy vehicles around the world. The introduction of Model 3/Y has effectively bolstered Tesla’s market leadership in recent years from both a unit sales and fundamental earnings standpoint.

Yet, an even more economical option is likely needed by mid-decade when global EV adoption is expected to accelerate rapidly in order for Tesla to stay competitive and relevant within the increasingly crowded landscape. The cost controls realized from ongoing manufacturing efficiencies exhibited through Tesla’s 30%+ auto margins sets a strong foundation for the speculated release of a $25,000 model, or “Model 2”, which would grant the EV titan access to an even more price sensitive market segment, and drive sustained volume growth over the longer-term. It will also make a competitive offering to prevent material market share losses to other mass market legacy auto manufacturers like China’s BYD (OTCPK:BYDDF / OTCPK:BYDDY) and Hyundai / Kia (OTCPK:HYMLF / OTCPK:HYMTF / OTCPK:HYMPY), as well as EV upstarts like Fisker (FSR), which are gradually gaining traction in the nascent industry with their respective budget-friendly offerings.

Although Musk had recently stated that Tesla is not working on the rumoured $25,000 compact car at the moment, and is prioritizing the launch of Cybertruck slated for mid-2023, as well as the development of autonomous mobility instead, we view the former as a critical requirement to stay competitive and achieve the company’s long-term sales target of 20 million vehicles per year by the end of the decade. While the anticipated commercial success of Tesla’s autonomous driving software, Full Self-Driving (“FSD”), and robotaxis are expected to drive substantial margin expansion for the company when materialized, related development will still require significant capital outlays over coming years. FSD and robotaxis will also likely “take longer to commercialize” than the speculated Model 2, and potentially risk lost volume growth over the longer-term.

2. Maximizing Near-Term Pricing Gains

Inventory shortages across the U.S. due to ongoing production challenges and supply chain constraints have pushed the average price of new vehicles to an all-time high. EVs are now priced at $61,000 on average due to the surge in raw material and component costs, pricing out the majority of American buyers from the new-car market. However, the 45% of American households that earn more than $75,000 per year are becoming increasingly inclined to make a luxury EV purchase, given average priced mass market alternatives are not any less costly.

Riding on these trends, alongside its robust demand environment, Tesla has repeatedly sought to pass on increasing input costs through to customers via price hikes this year, with the latest being a 3% to 5% bump across its line-up in the U.S. and a 5% increase for the Model Y Long Range in China. Yet, the raised price tags have not deterred buyers from Tesla. The EV maker has continued to sell out across China, Europe and the U.S., with lengthy delivery wait times out to July 2023 on the Model Y Long Range.

The combination of persistent price increases, paired with extended lead times across all of Tesla’s major markets underscore the EV maker’s unmatched pricing power within the burgeoning industry that still benefits from robust demand despite the current softening in consumer sentiment. Combined with continued production ramp-up across the production facilities it has installed across all major EV markets spanning the U.S., Europe and China, Tesla is expected to benefit from persistent pricing gains over the near- to mid-term, a phenomenon it should maximize capitalization on before the rapid introduction of new mass market models trigger a structural moderation in demand over the longer-term. For now, the pricing gains are also expected to further Tesla’s trajectory for additional auto margin expansion through the remainder of the year to compensate for challenges experienced in the second quarter, and beyond 30% in the long run.

3. Supply Advantage

While Musk has repeatedly stressed that “supply constraints are the biggest brake on Tesla’s growth” over competition from legacy automakers and EV pureplay start-ups, the measures he has taken as a result are expected to pay off in the longer-term. Specifically, Tesla has long stuck to its commitment towards bolstering procurement of key raw materials, such as lithium, used in batteries. As mentioned in our recent 2Q22 EV preview, the industry remains a function of supply. Specifically, automakers are expecting critical chip supply to remain constrained through the near-term, while a bigger overhang remains on the almost-certain deficit of key battery materials like lithium, nickel, cobalt and manganese needed over the longer-term to support continued EV adoption. Due to the projected lithium deficit in the latter parts of the decade when EV adoption ramps up, Tesla’s prescient focus on key material procurement today will potentially help it “regain share if others struggle for supply” in the long-run.

Due lithium miners’ decision to “slow or halt expansions and new projects during a two-year lithium price slump through the middle of 2020”, compounded by extended COVID disruptions, supply of the raw material has struggled to keep up with re-accelerated demand in recent years arising from the global transition to electric. Yet, accelerating efforts on electrifying the transportation sector is bound to increase lithium demand by fivefold before 2030. Prices have already quadrupled over the past year, moving in tandem with the acceleration in global EV adoption. Similar trends are expected for nickel demand, which is expected to surge from 400,745 tons used in the first quarter of the current year, towards 1.5 million tons by the end of the decade. The recent war in Ukraine, as well as ensuing sanctions levied on Russia has also exacerbated current supply constraints, given the latter possesses close to a fifth of the world’s capacity for refined nickel used in EV batteries.

Tesla has repeatedly called out the procurement of lithium supply its “biggest challenge”, while peers like Rivian (RIVN) have echoed similar remarks. The EV industry is expected to suffer from a widespread lithium shortage by the end of the decade – representing the next big supply bottleneck following the ongoing chip shortages that have upended the automotive sector in recent years. Specifically, “all the world’s cell production combined represents well under 10% of what [EV makers] will need in 10 years, meaning 90% to 95% of the supply chain does not exist” at the moment. And regarding lithium-ion battery supplies, Tesla had recently estimated it will need “more than three terabyte hours for EVs and energy storage by 2030”, while the current global industry’s supply capacity is only at about one terabyte. Considering it can take up to 10 years to get a lithium mine set up, the industry-wide lithium supply deficit will likely be here to stay for the long haul.

This has accordingly encouraged ramped up efforts by Tesla in securing long-term contracts with raw material suppliers all over the world, including Vale SA, Talon Metals, BHP Group, and Ganfeng Lithium. The measures are expected to act as a hedge against rising costs and dwindling availability of key commodities used in batteries over the longer-term and provide Tesla with both a supply and cost advantage over rivals as global EV adoption continues to accelerate.

Fundamental And Valuation Update

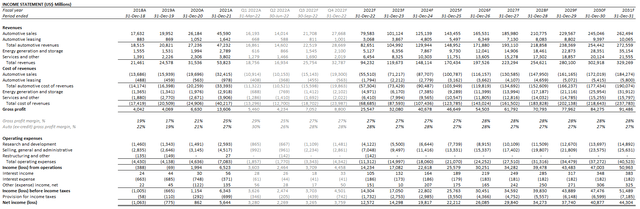

Adjusting our most recent forecast for Tesla’s actual second quarter performance, as well as management’s reiterated guidance for 50% growth in the current year based on improving supply chain challenges and continued ramp-up across all production facilities, we are projecting total revenue of $94.2 billion by the end of the current year. Specifically, we expect deliveries to land between 1.4 million and 1.5 million vehicles in the current year, which is in line with consensus estimates, and generate auto sales (ex-credits) of $79.9 billion (+75% y/y) considering continued pricing gains on a higher average selling price.

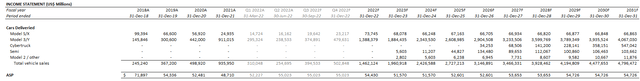

Tesla Revenue and Delivery Forecast (Author)

While auto gross margins have dipped in the second quarter as expected due to ramp-up inefficiencies at the new Berlin and Austin facilities, COVID disruptions at the Shanghai facility, and increasing input costs, we expect continued improvements to the three challenges in 2H, which would help caress the figure back towards 30%. However, we continue to caution downside risks pertaining to China’s fluid COVID situation, especially given the country’s unwavering compliance to stringent measures against the virus, as well as the worsening energy crunch in Europe, which could inflict further disruptions to Tesla’s business that are outside of its control.

Tesla Financial Forecast (Author)

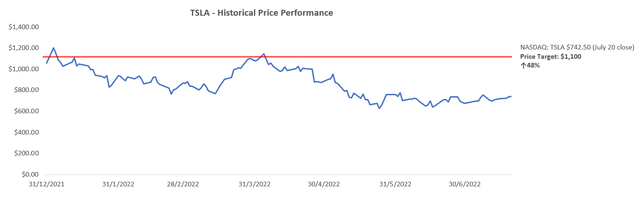

We are maintaining our price target of $1,100 on the stock, which would represent upside potential of close to 50% based on the last traded price of $742.50 on July 20th. The key valuation assumptions applied in our analysis considers Tesla’s persistent push into dominating global EV sales over coming years despite intensifying competition, as well as its unmatched manufacturing capabilities and continued leadership in connected-vehicle software development, which is set to be a core driver of sustained margin expansion through the longer-term to support its valuation premium against peers.

Tesla Valuation Forecast (Author) Tesla Valuation Forecast (Author)

Tesla_-_Forecasted_Financial_Information.pdf

Final Thoughts

Market share loss will be inevitable for Tesla in coming years, as benefits enjoyed from its first mover advantage and the lack of competition over the past decade start to fade with the rapid introduction of new offerings across various vehicle and price segments by both EV pureplays and legacy automakers. Yet, based on Tesla’s robust second quarter results and still-favourable 2H outlook despite looming economic challenges, the EV titan is expected to maintain strong market share and price gains in the near-term – it continues to sell every unit it makes, with demand outpacing supply by wide margins still.

Market share erosion risks are expected to be pronounced around mid-decade though, when its competitors’ offerings start to ramp up and global EV adoption accelerates further on increasingly urgent government mandates. However, we do not expect a lasting, material share erosion in the longer-term for Tesla, considering its major supply advantage in the industry. The company’s diligent procurement of long-term supplies of key materials – something it can do to attract vendors today thanks to its industry-leading volumes and big checkbook which few EV start-ups can match – is expected to help it hedge against the imminent cost and shortage impacts over the longer-term, and potentially help it recapture any lost share from rising competition in coming years, while also maintaining its outperformance against peers in terms of profitability as the global transition to electric continues.

Be the first to comment