jetcityimage

We’re only about a week away from electric vehicle maker Tesla (NASDAQ:TSLA) reporting its Q2 results on Wednesday, July 20th. This is likely to be the most difficult quarter to handicap for the company in some time, primarily given the Shanghai factory shut down for a good chunk of the quarter. Today, I will examine some of the key items to watch for next week.

First, we know that production and deliveries took a sizable sequential hit, even with two new factories in Berlin and Austin starting to ramp production. Total vehicles delivered were down more than 55,000 units from Q1’s record, with Shanghai unable to produce for a good chunk of April, and limited production for a number of weeks when the factory did reopen. Currently, the Street is looking for revenues of $17.16 billion and non-GAAP EPS of $1.87, as compared to $18.76 billion and $3.22, respectively, in Q1 of this year.

Tesla’s average selling prices (excluding credit sales) will benefit from rising prices, a higher mix of S/X sales in the quarter, and a lower overall percentage of leased vehicles in the total. On the flip side, a stronger dollar during Q2 should have provided a headwind to the company’s topline. For those that include credit sales in their overall numbers, that number is expected to come down quite a bit sequentially given the large one-time benefit reported in Q1.

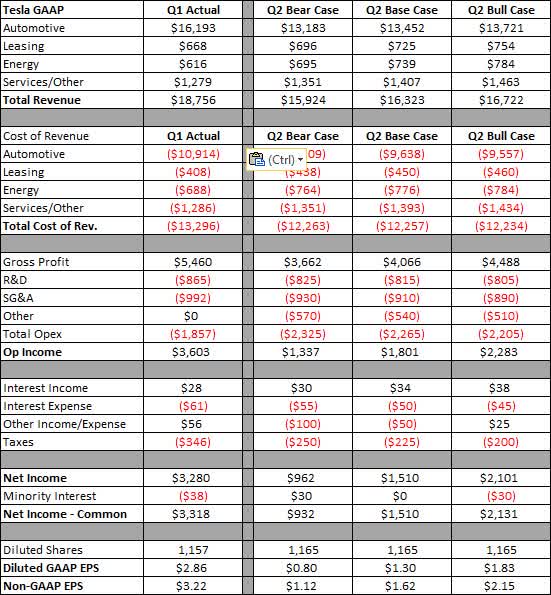

The most important item I’ll be looking at will be margins. Between the factory ramps, Shanghai shutdown, loss of credit sales, and cost inflation, Tesla margins are expected to take a hit in Q2. I’m currently looking for total automotive gross margins on a GAAP basis to decline by about 4 percentage points from Q1 levels, coming in at almost 29%. I do think we’ll see some cost savings on the operating side, but then you have major restructuring charges and an impairment on the Bitcoin holding that should ding the bottom line by more than half a billion dollars, pre-tax. In the graphic below, you can see my usual three earnings cases, with dollar values in millions except per share amounts.

Tesla Three Earnings Cases (Author’s Estimates, Company Q1 Results)

At the moment, my base case looks a bit weaker than the Street. First of all, there are some analysts that don’t seem to have updated their numbers recently, since the high revenue estimate on the Street is nearly $20 billion. That makes no sense given the massive drop in deliveries from Q1. If we get more realistic estimates in, the average should drop a few hundred million at least. On the bottom line, I can say the same thing, plus we also don’t know which analysts have included the huge Bitcoin charge and restructuring costs in their estimates. Thus, I won’t be as much concerned as how the headline results compare to the Street next Wednesday, unless there is a major difference, but will focus more on how those numbers came to be.

The second major item investors will be watching for will be a complete update on production. The Shanghai factory is expected to be shut down for a couple of weeks this month for production upgrades, which could allow it to have its best quarter ever. Key Tesla watcher Troy Teslike is calling for 365,000 deliveries during the current Q3. He has the street average nearly 25,000 above that, but figures estimates might come down as analysts factor in the Shanghai closure and temporary Berlin shutdown. Barring another Covid shutdown in China or some other major adverse event, Tesla is expected to set quarterly production and delivery records, which makes sense now that it has four factories that are fully operational (minus brief pauses).

With us now a couple of weeks into the second half of the year, Tesla could also provide an update on some of its currently delayed projects. The Semi was supposed to be here in 2019, with the Roadster in 2020, and Cybertruck in 2021. None of those products are currently available, and for some, they are just hopes for next year if all goes right. Investors and consumers are also waiting to hear how the full self-driving software package is coming, as that is key to the Tesla robotaxi business that was supposed to be here over 18 months ago.

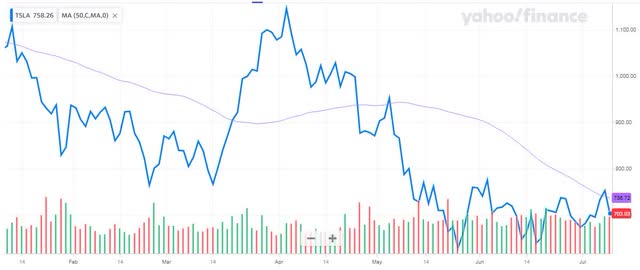

As for Tesla shares, they are currently trading towards their lows for 2022. As the chart below shows, they again lost their 50-day moving average (purple line) on Monday. The Elon Musk Twitter (TWTR) saga continues to provide an overhang, with the social media company headed to court to enforce the Tesla CEO’s purchase. If Twitter is successful, Elon Musk may have to sell more shares of Tesla, depending on how much side funding he can cobble together. The Musk aura also took a slight hit Monday evening after an unexpected failure of a rocket booster for SpaceX, raising questions about the near-term path of the Starship program.

Tesla 6-Month Chart (Yahoo! Finance)

Next week, Tesla will report its Q2 results, which are going to be very messy. The Shanghai shutdown cost a lot of sales and will hurt margins, along with the production ramp at two new factories. Production and deliveries are expected to soar from here, a key reason why the average price target on the Street implies more than $200 of upside from here, despite that number coming down $100 off its recent high. For these gains to occur, Tesla will need to show that the growth story is moving ahead at full speed while investors also hope that the Twitter saga can go away sooner rather than later.

Be the first to comment