blinow61

Shell Midstream Partners, L.P. (NYSE:SHLX) is likely to go private within the next 12 months, as the energy sector privatizes its midstream limited partnerships. Given the industry’s economics at present, the company’s share price is on an upward trend that will persist regardless of what happens with its market status. That puts shareholders in a strong position to earn a huge premium on Shell’s (SHEL) first proposal. This is a very low-risk opportunity for investors.

Shell Midstream Partners’ Assets

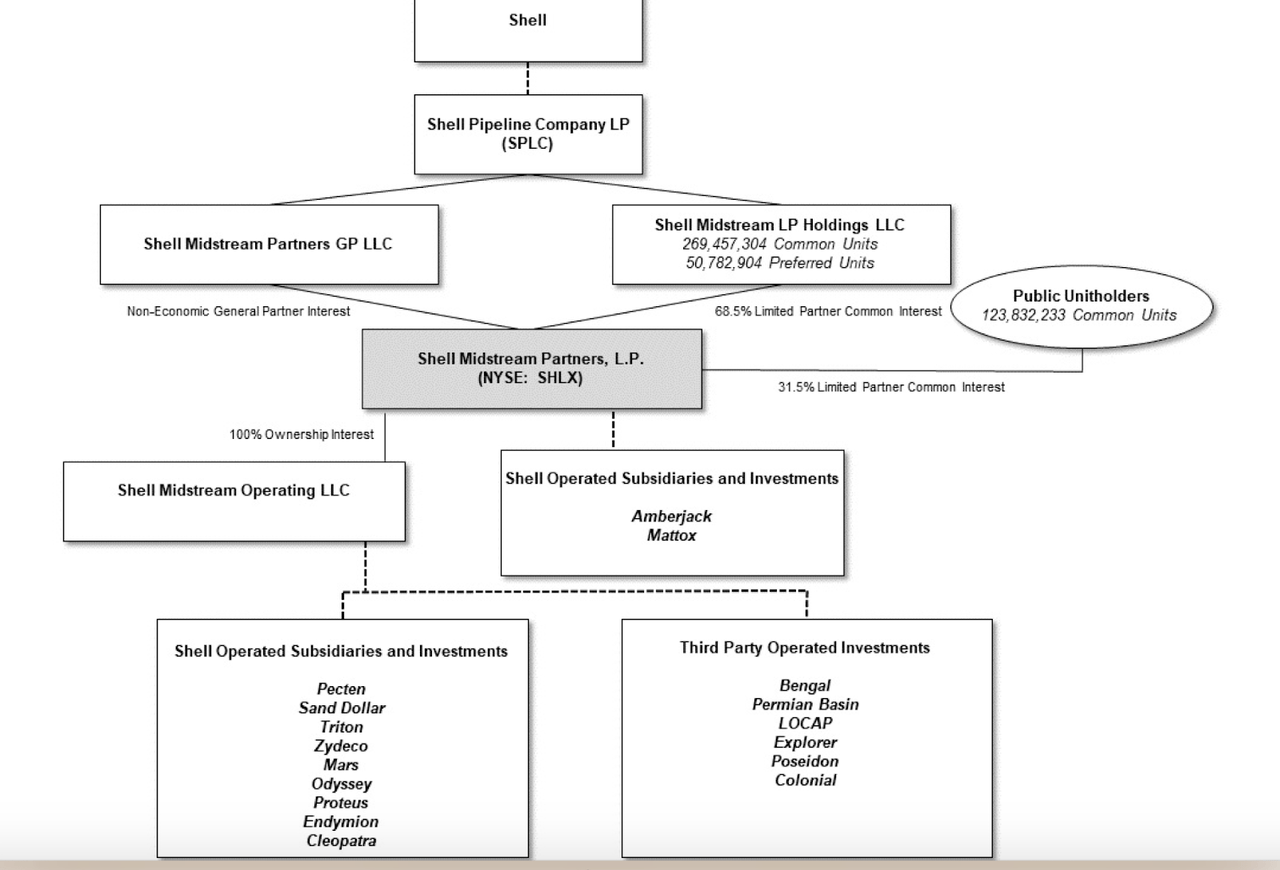

Shell Midstream Partners LP was formed by Shell on March 19, 2014. It operates pipeline and other midstream and logistics assets through its wholly-owned subsidiary, Shell Midstream Operating LLC, or through direct ownership.

2021 10-K

The company’s assets can be categorized as being of three forms:

-

Crude oil and refined products pipelines and terminals that transport crude oil to the Gulf Coast and Midwest and transport refined products from there to major demand centers;

-

Storage tanks and financing receivables for the staging and transportation of intermediate and finished products;

-

Natural gas and refinery gas pipelines that serve the Gulf Coast.

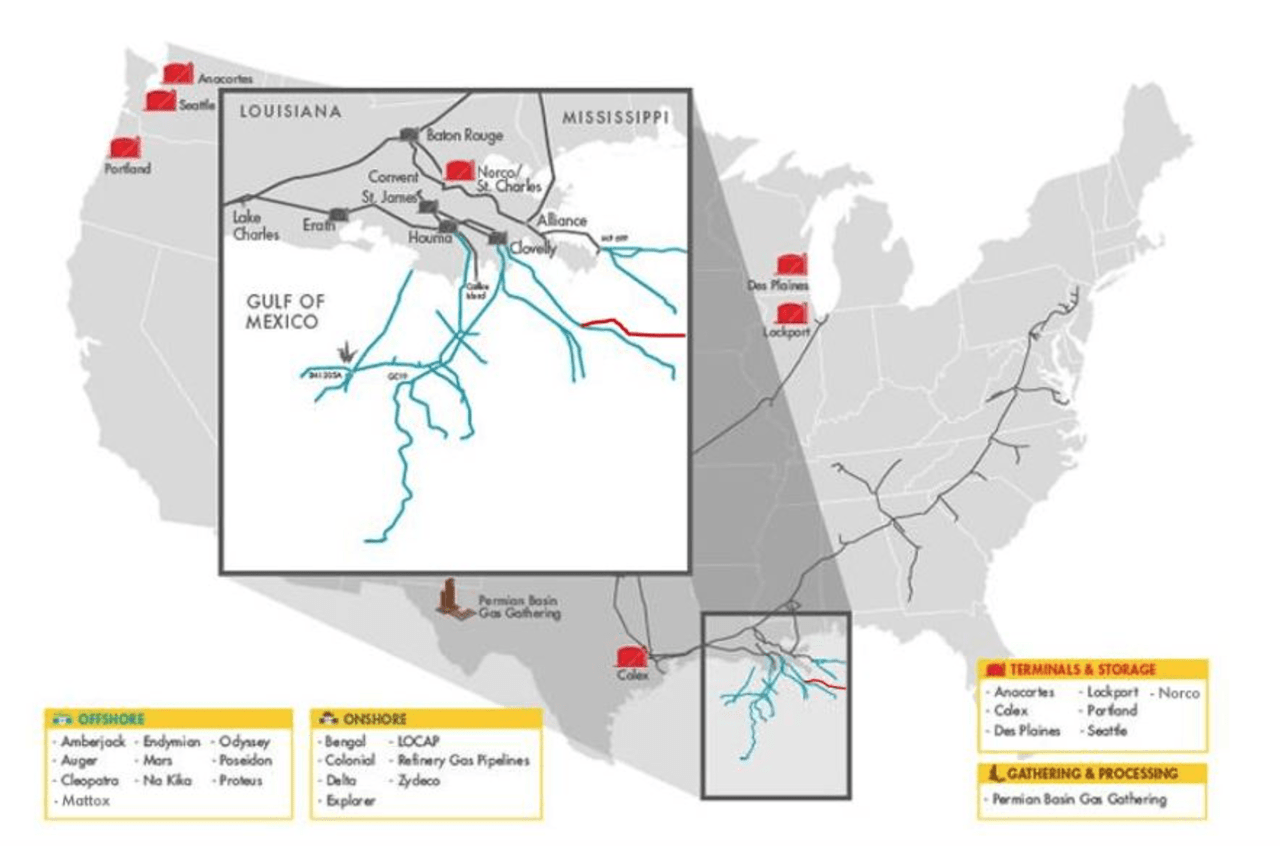

The geographical distribution of the company’s assets is shown in the map below.

“Overview of Assets”, Shell Midstream Partners LP

Explaining Past Dismal Historic Stock Performance

Since its initial public offering (IPO), when the Shell Midstream Partners’ LP opened at $32 per share, the company’s stock price performance has returned a compound return of over -9.6% per year, destroying shareholder value.

Google Finance

Asset Growth Effects

Midstream limited partnerships (MLPs) were popular a decade ago, because of their high dividend yields (Shell Midstream Partners has a dividend yield of 8.42%) in a low interest rate environment. Investors placed a bet on stable stock prices and high dividend yield, delivering them healthy positive returns. In 2014, Shell Midstream Partners had a price-to-earnings (P/E) ratio of over 422! Investors were hungry for MLPs. What they did not account for was the possibility of equity prices nose-diving.

The company’s dismal performance is reflective of the performance of the energy sector since the Great Recession of 2008. For example, over the last five years, the MSCI World Energy Index has returned 5.34%, compared to 7.67% for the MSCI World Index. Not only has energy underperformed the broad market, energy has made its gains with higher risks, with the MSCI World Energy Index having a Sharpe Ratio of 0.29 in that 5-year period, compared to 0.46 for the MSCI World Index.

The energy sector is one in which the major drivers of returns are asset growth effects: asset growth is inversely related to future returns in an environment in which no firm has pricing power, and everyone is instead forced to grow their assets when the price is high and rising, and contract assets when prices are declining. This can be seen from the company’s own results: between 2014 and 2021, the company dramatically scaled assets from $730 million to over $2.3 billion.

Capital Flight

This general pattern was a result of MLPs following the general economics of energy firms. The industry is, famously, one of boom and bust cycles. Between 2006 and 2014, the sector’s total debt grew from $1 trillion to $2.5 trillion. Annual capital expenditure in the 2000 and 2013 period more than doubled. As assets grew, so did excess supply. Yet, at the midpoint of the decade, oil fell from $100 per barrel (bbl), to less than $28/bbl in 2016. Oil wells were rendered unprofitable, and many producers found themselves struggling.

According to the U.S. Energy Information Administration, in 2015, more than 80% of the U.S. oil industry’s operating cash flow was used for debt servicing. Capital expenditure was reduced by half as firms strove to improve their cash position and profitability. In the years 2016 and 2017, 300 American oil firms went bankrupt, 250,000 jobs were lost, and $250 billion in capital was destroyed. Annual capital expenditure plunged from $800 billion in 2014 to less than $500 billion in the years 2016 to 2019.

The industry has also suffered a flight of capital as ESG investors have abandoned the market. For instance, since October 2021, the Stichting Pensioenfonds ABP, the Netherlands’ pension fund for government employees, has been selling off its energy positions regardless of their profitability. Not only are investors leaving the industry, but firms within the industry are being pushed to reorient their activity away from oil & gas. For example, Engine No. 1 defeated Exxon Mobil’s (XOM) management in a bid to shift the company toward renewables.

Energy Inertia

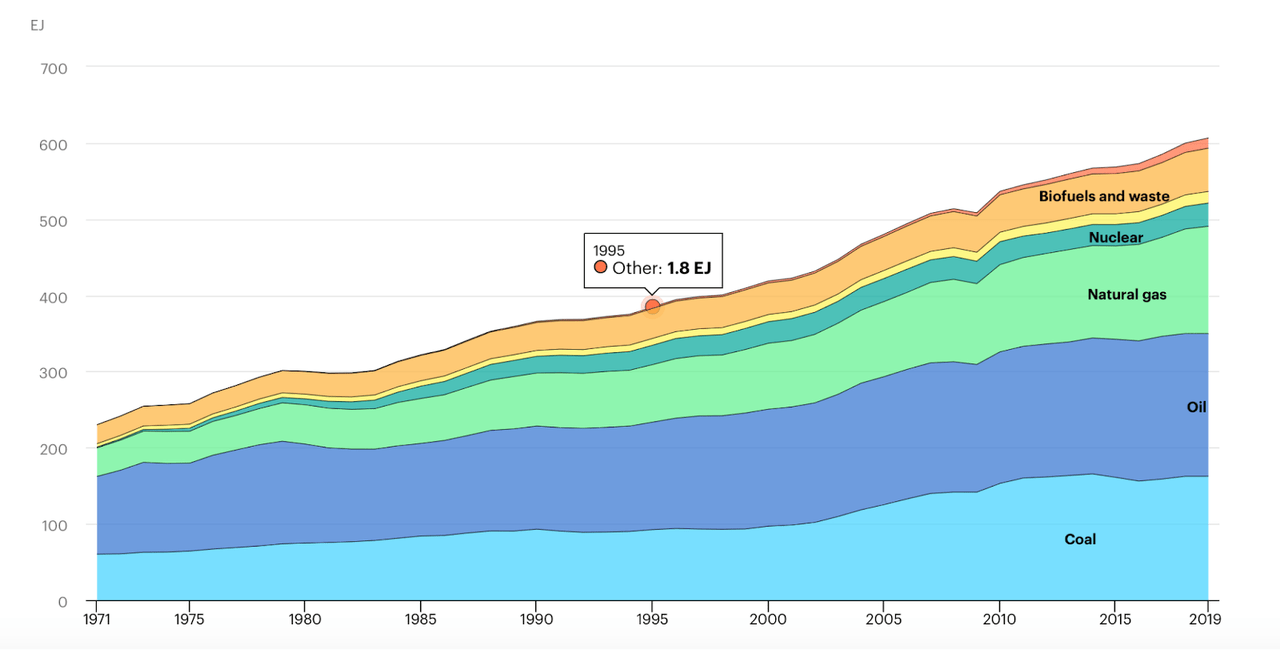

A leading narrative driving capital flight has been that fossil fuels are on their way out and that the industry is headed toward a doomsday scenario. Yet, this narrative ignores reality. As the chart from the International Energy Agency shows, oil and gas remain the two primary sources of energy, with the share of gas growing sharply between 1971 and 2019.

International Energy Agency

Rather than rapid energy transformation, the world is characterized by energy inertia.

Supply-Side Shocks Have Changed the Market

Despite the company’s terrible stock price performance, its financial results have been positive. Although returns on invested capital (ROIC) in 2014 were a very low 3.04%, by 2015, they were 29.3%. However, they fell sharply from then to 2020, when they bottomed at 13.8%. In 2021, ROIC was 14.2% and stands at 14.5% today. The company has turned a corner thanks to global energy markets going on a strong bull run, due to a combination of supply-side shocks such as the pandemic, the effects of Russia’s invasion of Ukraine, and the industry’s capital discipline has kept production stable.

These supply-side shocks, coupled with industry (and one must state, OPEC capital discipline), has led to energy price inflation, a situation that is likely to remain even in the event of Saudi Arabia and the United Arab Emirates agreeing to an increase in oil production. Economist, Kenneth Rogoff, expects energy prices to continue to rise, despite a widespread narrative of energy’s Armageddon. The World has joined Nouriel Roubini in forecasting a period of 1970s style stagflation.

In short, whereas industry economics doomed the market to a period of dismal returns, current conditions will lift energy stock prices. Indeed, since its 27 March 2020 bottom of $9.53 per share, Shell Midstream Partners has bounced back, compounding its share price by over 2.5% per month.

Shell’s Offer

In February 2022, shareholders received a non-binding proposal from its general partner, Shell Pipeline Company LP, to buy the rest of the company’s shares, at $12.89. This is in line with a broader trend of taking MLPs private. The logic behind MLPs has disappeared in light of the Trump tax cuts, and the incentives for Shell and its peers to reduce costs and earn a healthy yield by bringing MLPs within the corporate umbrella. Furthermore, Shell can use Shell Midstream Partners to expand production offshore. With general conditions improving, the share price is likely to edge up and Shell will have to up its bid. That will give investors a healthy return on their investment.

The current share price is 10.6% higher than the first proposal. Chevron Corp. (CVX) took Noble Midstream Partners LP private after a second proposal in which they paid a 14.4% premium on their first proposal. BP plc (BP) took BP Midstream Partners LP private after paying a 13.4% premium on their first proposal. The price has already exceeded 10% of the initial offer, so, to make the deal attractive, it would likely have to exceed those two numbers. At a bare minimum, a second bid would have to be around 15% premium, which would price Shell Midstream Partners at $14.82 per share. Below that, and investors could argue that the share price’s upward trend suggests that they would do better holding their shares than selling them.

Conclusion

Shell Midstream Partners is headed out of the public markets. The question is one of price. We have established that trends are pushing energy prices up, and with them, the stock price of energy firms. Due to that, the company is likely to be bought at a healthy premium to the first proposal. The share price has grown strong enough since the March 2020 bottom, and conditions have aligned to make the company’s prospects so much more attractive, that Shell is likely to have to pay a bigger premium than Chevron and BP paid to take their MLPs private. This represents a very simple, low-risk deal for investors.

Be the first to comment