Justin Sullivan

What’s happened?

Other automakers’ misfortunes have been Tesla’s (NASDAQ:TSLA) gain. While Tesla is commonly seen as a luxury vehicle, it is taking sales from not just all the luxury automakers, but all the mainstream categories as well. Tesla’s flawless navigation through the supply chain means not only higher production for Tesla, but higher demand as other automakers struggle with very high starting prices that are mostly out of their control.

In addition to supply chain hurdles, traditional automakers have struggled with dealerships driving up prices well above MSRP via price markups and mandatory accessories. Manufacturers like Ford (F), which historically have good relations with dealerships, are now starting to show their frustration with dealers. To counter this (and to get a bigger piece of the pie themselves), manufacturers have focused on building higher priced configurations of their vehicles, but that hasn’t stopped the strong consumer from driving up prices further.

For the shopper, this is a double whammy. With manufacturers prioritizing higher-priced variants and dealerships applying extreme markups to those units, in July the average retail price for a new car rose to an all-time high of $48,142 and the average monthly payment is now $733. In fact, the average retail price is now higher than the starting price of a Model 3, even after a $10,000 price increase over the last year. In today’s market, an entry-level Tesla is no longer a luxury vehicle.

My local dealership here in Southern California sells a top-of-the-line Honda Accord Touring for nearly the same price as a Standard Range Model 3 and according to the salesman, they’ve been selling every one that they get. With mainstream vehicles having luxury prices, it’s no wonder Tesla is taking sales from the mainstream segment.

While we may never see inventory levels like we did prior to the pandemic that allowed incentives and dealer discounts to bring prices well below MSRP, I believe buying a car at MSRP will eventually happen. This will give shoppers the much-needed choice they need.

Tesla: Now a luxury within reach

So how does the price of a Model 3 today compare with an Accord versus Honda’s intention, and versus prices from a few years ago? It’s hardly a splurge in today’s market.

A Model 3 costs “just” 30% more than the cheapest Honda Accord I can find, a Sport trim priced at $35,975 including markups, and the salesman assured me that they sell every one they get without discount. That’s a model that doesn’t even have heated cloth seats; leather would cost an additional $1500 and at that point a Model 3 would be just 25% more for a huge upgrade in terms of brand and features.

Obviously, this is due to inflated prices and was never the intention. If a buyer could pick up an Accord LX (the cheapest trim) for an MSRP of $26,520 without those pesky markups, the cost of a Standard Range Model 3 would be more than 80% higher. You can argue that a Model 3 is worth the higher price tag but the problem is that with so few options today, a Tesla is far more appealing today than it was a few years ago (especially with fuel and maintenance savings). It’s easy to see why Tesla is taking so many sales from the mainstream segment. In fact, according to Tom Libby from S&P Mobility, about half of Model 3 and Y buyers have a mainstream product in their garage, which he finds extraordinary.

Even if we consider 2019 prices when a Model 3 was just $37,000, it was still more than 50% higher than the MSRP of an Accord LX at the time, and that’s excluding past dealer discounts and manufacturer incentives that could drive the price thousands below MSRP.

With higher prices thanks to supply chain woes, Tesla has been able to bring in record profitability. Unfortunately, there are signs that these conditions are starting to fade.

The market is shifting

It’s important to note that the strong consumer has been incredibly helpful in driving prices through the roof, but there are signs that the consumer’s spending habits are changing.

Over the past few months, when it comes to the new car market, buyers just haven’t had a choice. Someone is going to buy that overpriced car on the lot, however foolish it may be. Thankfully, the used car market is showing signs of stability, and since more than 40 million used cars were sold in the US last year (22 million via retailers), a look at this segment is a good indicator of car shopping behavior when provided a choice.

If you’re unfamiliar, here’s an example of how prices have been in the used market. In Southern California, a certified pre-owned 2021 Civic LX (base model) with 28,000 miles has a retail price of $28,655, which is 35% higher than its original MSRP of $21,250.

ochondaworld.com

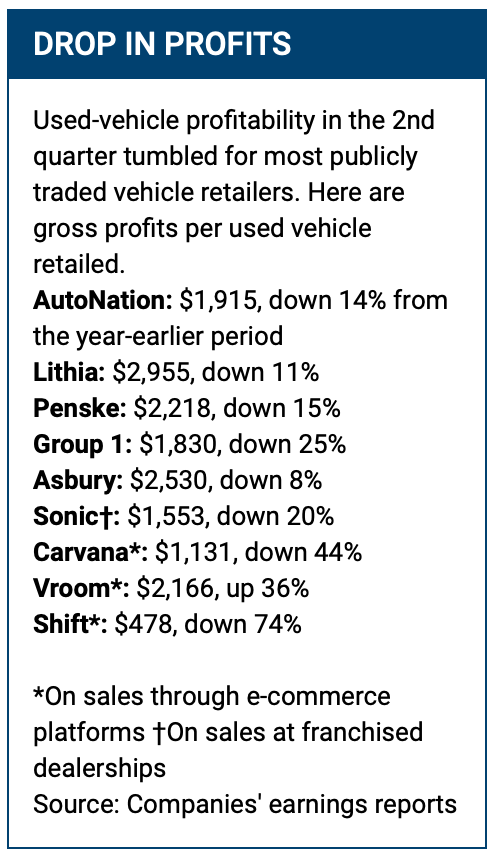

Autonews.com

Last quarter, used vehicle profitability plunged. AutoNation’s (AN) used vehicle gross profit declined by 22% from the prior quarter and 14% from last year, while Group 1 (GPI) saw profits dive 25%. Online used car retailers are also seeing profits plunge, with Carvana (CVNA) posting a loss of more than a billion dollars thanks to a 44% decline in gross profits from last year. See the chart to the right for more.

The majority of CEOs from major public car retailers discuss the consumer’s reluctance to pay big premiums for vehicles as they were previously. Penske (PAG) CEO said that higher prices are “taking some people out of the market”. Group 1 Automotive’s CEO stated that demand is shifting to lower price points. Asbury Automotive Group CEO David Hult said that consumers were “impulsively buying” six months ago but are now more cautious. According to Cox Automotive, used car prices are trending down and should be a source of deflation in the months ahead.

In other words, the buying frenzy for overpriced used vehicles is over and it’s reasonable to believe that this will translate into the new car market as soon as production stabilizes.

Signs of New Car Production Rebound

Nobody is yet sure when new car production will fully rebound, or even recover to levels where shoppers can buy cars without massive markups, however there is some promising signs starting to surface.

In June, UK car production was back on the rise, up 5.6% from the year earlier thanks to an ease in some supply chain issues. According to LMC Automotive, the Global Light Vehicle selling rate rose for the third consecutive month to 90 million units/year in July, which it noted as the best performance for the year so far thanks to a rebound in China and South America. US sales remain down, but the sales decline by 11.6% was the smallest decline since January. Finally, according to AutoForecast Solutions, automakers lost just 6,800 vehicles in weekly production due to the chip shortage and that was one of the smallest losses since the chip shortage began in early 2021.

Conclusion

For the better part of the last year, Tesla’s applaudable performance despite supply chain woes has come with great benefit. For starters, shoppers of ICE vehicles have faced extreme price pressure due to automakers prioritizing well-equipped variants of their vehicles and dealerships adding steep markups to these already high-priced cars.

However, there are signs of a weakening consumer. In the used market, consumers are (thankfully) showing signs of reluctance when faced with the purchase of a used base model Civic for nearly 30 grand. Auto retailers are making it clear that the buying frenzy is over. In addition, there’s a glimmer of hope that production is starting to ease. We still need more data, but it’s reasonable to believe that the supply chain will ease eventually.

When that time comes, Tesla will be facing lower mainstream vehicle prices and will likely find it more difficult to bite into these high-volume segments so easily. Of course, Tesla would also benefit from any supply chain easing, but at the expensive of what’s been a driver of the stock’s recent run up: high gross margins and profitability in addition to growth. Initially, there was a selloff after its most recent earnings report, with the red flag being margin contraction. Further margin contraction due to pricing pressure may not be taken lightly by investors, especially if it were perceived as an indicator of reduced demand.

Be the first to comment