raisbeckfoto

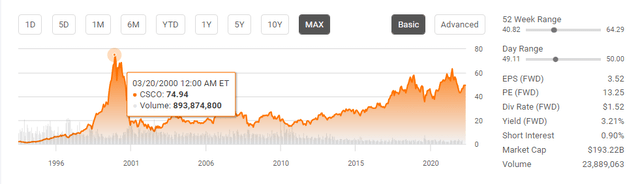

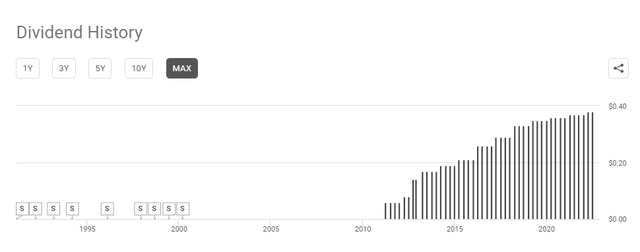

Cisco Systems (NASDAQ:CSCO) has got to be one of the most frustrating technology companies in the market. I say this because CSCO is the backbone of countless networks, it’s arguably one of the most important technology companies, yet the stock has done nothing in over 2 decades. Everyone is well aware that many companies didn’t survive the dot-com bubble and that companies traded at some of the most ridiculous valuations during that period. In the winter of 2000, Credit Suisse First Boston analyst Paul Weinstein called Cisco “potentially the first trillion-dollar market cap company” as it rose to the 2nd largest company behind Microsoft (MSFT). CSCO’s shares peaked at around $75 during the dot-com bubble, and more than 2 decades later, CSCO has never grown past its former market cap even though its financials have grown across the board. When you look at the tech leaders who emerged out of the dot-com era, CSCO tremendously impacted the technology sector but not the markets. I believe CSCO is one of the most frustrating technology companies because it took almost 2 decades to make a run on $60 per share, and every time it tries to continue forward, the stock breaks down. While long-term shareholders have collected a dividend since 2011 and had 11 years of consecutive annual dividend growth, CSCO isn’t the same life-changing stock that it was in the 90s. While CSCO has been a sore spot for some investors, it could present an interesting opportunity going forward for new investors. CSCO just delivered its fiscal year 2022 results, and CSCO is back to growth.

The 90s were CSCOs ‘Golden Era’ and it’s unlikely to return

From March 1991 to March 2000, CSCO split 9 times which created a tremendous amount of wealth for investors. I found a chart that showed CSCO’s share price splits in April of 1990 is $23.50. Hypothetically if you had purchased 100 shares in 1990 of CSCO and held them through 2000, you would have seen your shares split 9 times throughout the decade.

Over the decade, your 100 shares would have become 28,800 shares through the 9 splits. Even if you rode CSCO down from the split-adjusted highs of $75 in 2000 to $11.23 in September of 2002 when the bubble burst, your original investment of $2,350 in 1990 for 100 shares would be worth $323,424. If you were lucky enough to sell on the way down around $40, your total sale would have accounted for $1.15 million. Except for Apple (AAPL) and Tesla (TSLA) very few companies have split their shares as frequently in recent times, helping to create shareholder value. The philosophy around splits not adding value upfront is correct as the company’s market cap doesn’t change, but over time it allows more investors to get in at lower prices, and when shares appreciate, every point up is worth more to shareholders. CSCO has not split its shares since 2000 and is unlikely to be in a position where it can replicate creating value for its shareholders the way it did in the 90s, but that doesn’t mean it is 100% dead money today.

|

Date |

Split |

Original Shares |

New Share Count |

|

3/17/1991 |

2 for 1 |

100.00 |

200.00 |

|

3/22/1992 |

2 for 1 |

200.00 |

400.00 |

|

3/21/1993 |

2 for 1 |

400.00 |

800.00 |

|

3/20/1994 |

2 for 1 |

800.00 |

1,600.00 |

|

2/19/1996 |

2 for 1 |

1,600.00 |

3,200.00 |

|

12/16/1997 |

3 for 2 |

3,200.00 |

4,800.00 |

|

9/15/1998 |

3 for 2 |

4,800.00 |

7,200.00 |

|

6/21/1999 |

2 for 1 |

7,200.00 |

14,400.00 |

|

3/822/2000 |

2 for 1 |

14,400.00 |

28,800.00 |

Cisco delivered a strong Q4 and Fiscal 2022

Shares of CSCO came out of the gate strong on Thursday, climbing over 5% on an earnings beat. CSCO delivered $13.1 billion of revenue in Q4, which was a $320 million top-line beat, and Non-GAAP EPS of $0.83, which was a bottom line beat of $0.01. CSCO is generating some momentum as Morgan Stanley (MS) analyst Meta Marshall increased his price target to $48 a share from $46, while Raymond James analyst Simon Leopold kept an outperform rating on CSCO with a $59 target which is slightly lower than its previous target of $63.

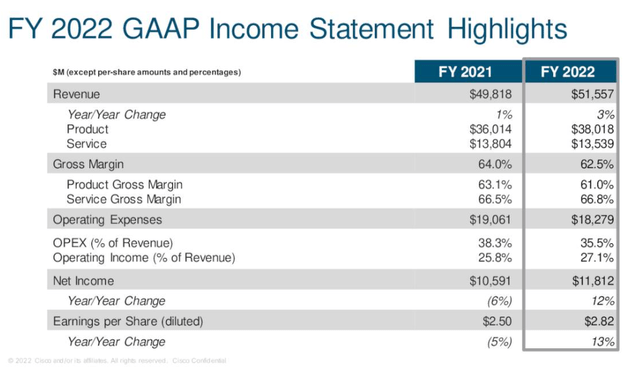

I am taking the fiscal year 2022 results as a positive for CSCO as they continued to navigate impacts from the global supply chain. Total revenue in FY22 was $51.6 billion, an increase of 3%, while CSCO exceeded $10 billion in net income on both GAAP and Non-GAAP methodologies. On a GAAP basis, net income was $11.8 billion, an increase of 12%, and EPS was $2.82, an increase of 13% YoY. On a non-GAAP basis, net income was $14.1 billion, an increase of 3%, and EPS was $3.36, an increase of 4% YoY. CSCO also generated $13.2 billion in cash from operations in FY 2022 and $12.51 billion in FCF.

IN FY22, CSCO delivered on its KPIs as record product orders fueled its backlog to the highest level in CSCO’s history. FY22 marked the 2nd largest year of revenue, and CSCO’s transition to generating a significant portion of revenue from subscriptions has been achieved. CSCO is going into 2023 with a record product backlog as annual product growth was 14%. One of the most exciting aspects was that the remaining performance obligations (RPO) totaled more than $31 billion, and cancellation levels are below pre-pandemic levels, which sets the stage for strong revenue growth in FY23. Roughly $17 billion of CSCO’s RPO will be recognized as revenue in FY23.

I am happy with CSCO’s results, and there are a lot of positive takeaways. While revenue from services slightly declined, it made up 26.26% of CSCO’s revenue mix. CSCO is diversifying away from being completely dominated by hardware sales, and this is important because every piece of hardware sold is a potential customer for monthly services. I am not upset that products remained at 73.74% of CSCO’s revenue because we saw an additional $2 billion in product sales YoY. CSCO’s total operating expenses declined YoY, and in an inflationary environment, this is a huge accomplishment. CSCO’s net income grew 12% YoY; its EPS grew 13% YoY, and its backlog should provide an optimal landscape for FY2023. CSCO is guiding that revenue should grow 4-6% in FY 2023 and provided Non-GAAP earnings per share guidance of $3.49 to $3.56, which is also a 4 – 6% YoY. Overall, CSCO is back to firing on all cylinders, is back to growth, is generating large amounts of profits, and is guiding up for future forecasts.

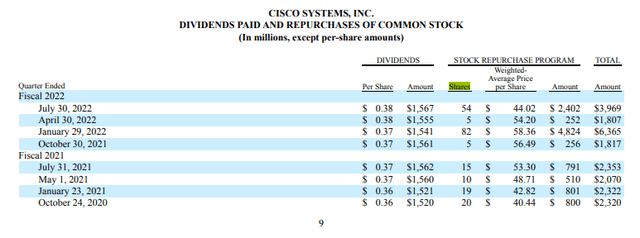

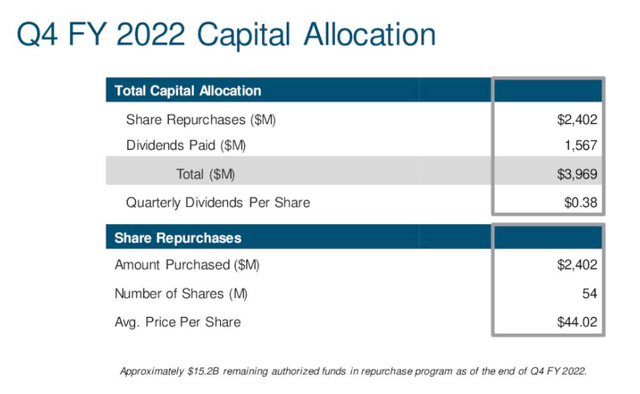

Cisco is generating value for shareholders through dividends and buybacks

It’s hard to find companies that are as shareholder-friendly as CSCO. Putting AAPL aside, CSCO has to be in the running for the top companies returning capital to shareholders. CSCO is operating at strong margins allowing them to generate solid cash flow year after year. In Q4 2022, CSCO returned nearly $4 billion to shareholders, $2.4 billion in buybacks, and $1.57 billion in dividends. CSCO bought 54 million shares at an average price of $44.02 per share. For the entire FY22, CSCO returned approximately $14 billion in buybacks and dividends. CSCO repurchased $7.7 billion of shares and paid $6.2 billion in dividends. This also marked CSCO’s 11th consecutive year of dividend increases.

It’s hard not to get excited about these numbers. CSCO ended FY22 with 4.17 billion shares outstanding. Over the past decade, CSCO has repurchased 1.12 billion shares, decreasing its shares outstanding by -21.17%. In the 2nd half of 2021, CSCO repurchased 87 million shares at an average price of $58.25. CSCO loved its stock in the high $50s and is showing the street that it continues to love its price in the mid $40s. Shares of CSCO may not be making all-time highs, but every quarter CSCO is increasing shareholder returns by buying back shares and rewarding shareholders with a larger than average dividend.

Investing in Cisco for the company it is today, not the wealth-creating vehicle that it was

I am not investing in CSCO for the company it was in the 90s, I am investing in CSCO for the company it has grown into. Splitting 9 times in a decade will probably never happen again for CSCO, and the opportunity for wealth creation probably isn’t the same as it once was. That doesn’t mean that CSCO is a bad investment, it’s just a different investment. I am looking at CSCO as a utility company in the tech sector. Currently, CSCO is paying a dividend yield that slightly exceeds 3%, I am getting annual dividend increases, and every year CSCO is buying back billions of dollars worth of shares. CSCO is diversifying its revenue mix to incorporate services, and with products continuing to grow, there is more opportunity to drive additional revenue from services. I think that eventually, CSCO could reach all-time highs, even if it means waiting a few years. In the shorter term, I wouldn’t be surprised if CSCO makes a run into the mid to high $50s in the 2nd half of 2022. CSCO is back on the growth trail and is increasing guidance, so I am not too concerned about retesting the June lows anytime soon. If, for some reason, the market declines and CSCO follows, I think it will just create a more attractive buying opportunity for CSCO than it does today.

Be the first to comment