salarko/iStock Editorial via Getty Images

Thesis Summary

Tesla, Inc. (TSLA) recently reported its second quarter results, leading the stock to rally on the day. However, the company also disclosed that it had sold a large part of its Bitcoin (BTC-USD) holdings, and the cryptocurrency has performed poorly since.

Tesla’s recent Bitcoin sales lead many to speculate what this means for crypto. Investors wonder: Has Elon Musk lost faith in Bitcoin? Does this mean he expects lower prices?

In this article, I go into the history of Tesla’s Bitcoin purchases and sales and what they mean for the company and Bitcoin.

Tesla and Bitcoin, a Short Story

Tesla reported its second quarter results last week, and though a lot can be said about its growth prospects and margins, I’d like to focus today on the effect this latest report had on Bitcoin.

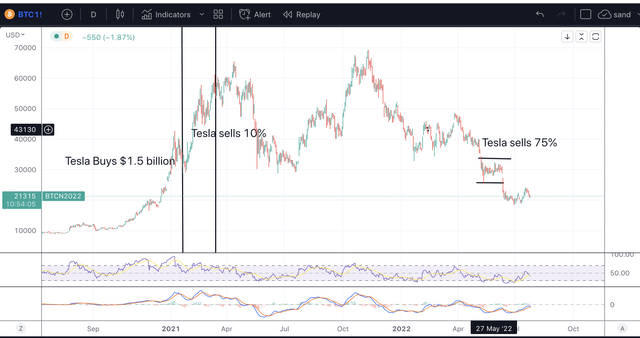

Tesla and Bitcoin Performance (TradingView)

As we can see in the chart above, the company’s Q2 results sent the stock up by over 10% on the day, while Bitcoin began to fall.

It is a well-known fact that Musk has been a crypto enthusiast for some time now, which led him/Tesla to purchase $1.5 billion in Bitcoin at the beginning of 2021. The company sold 10% of its holdings shortly after, citing liquidity concerns, which increased Tesla’s cash by $272 million.

Fast-forward to Q2 2022, and Tesla has announced that it has shaved off 75% of its remaining holdings. According to the quarterly report, this has netted Tesla a profit of $64 million on a sale worth $936 million. However, the company also recorded an impairment loss on its remaining $170 million. This corresponds with Tesla’s average acquisition cost being close to $29,000.

As stated by Musk himself, the sales were made to increase liquidity due to the uncertainty created by the Chinese COVID lockdowns:

Yes, actually, it should be mentioned that the reason we sold a bunch of our Bitcoin holdings was that we were uncertain as to when the COVID lockdowns in China would alleviate. So it was important for us to maximize our cash position, given the uncertainty of the COVID lockdowns in China.

Some investors might wonder whether Musk has lost faith in Bitcoin and crypto or whether the unconventional billionaire is simply trying to time the market better.

Is Tesla Done with Bitcoin?

Trying to predict what Musk is planning to do, let alone why he does what he does, is perhaps a fool’s errand. This is the man who recently pulled out of a multibillion-dollar deal with Twitter Inc. (TWTR).

Having said that, we have concrete indications that show Elon is still a “Bitcoin bull”. For starters, he expressly noted in the earnings call that the door was still open in the future to buy more Bitcoin.

We are certainly open to increasing our Bitcoin holdings in future. So this should not be taken as some verdict on Bitcoin.

Source: Earnings call

On top of that, it is also worth mentioning that Tesla is still holding on to all of its Dogecoin (DOGE-USD). Although there is no direct reporting of how much DOGE, we can estimate the current value to be close to $15 million.

Has Tesla Profited From Bitcoin?

The most critical issue for investors is how Bitcoin purchases have affected the bottom line.

Let’s crunch some numbers.

Tesla invested $1.5 billion in Bitcoin. At an average price of $29,000 per Bitcoin, meaning they bought roughly 52,000 Bitcoin. They then sold 10%, 5,200 BTC, for $272 million. This implies that Tesla sold when Bitcoin was priced at $52,000, quite close to the ATH.

In Q2 of 2022, Tesla sold 75% of its Bitcoin, leaving 25%. According to Bitcoin Treasuries, Tesla still owns 10,800 Bitcoin, meaning they sold 32,400 out of their remaining 43,200 Bitcoin for $936 million. Interestingly, this implies that Tesla sold its Bitcoin for $28,888, just beneath their average acquisition price.

The chart below illustrates this sequence of events.

Tesla Bitcoin History (Author’s work)

In terms of absolute profit, Tesla invested $1.5 billion to buy 52,000 BTC. They sold Bitcoin worth $272 million in 2021 and $936 million in 2022, netting $1.2 billion. On top of that, the company still owns 10,800 Bitcoin, valued at $248.4 million today. Therefore, after one year, Tesla is just about breaking even on its Bitcoin investments.

What Does This Mean For Bitcoin?

Though there’s perhaps more relevant information to unpack from Tesla’s quarterly report, Tesla’s Bitcoin sales have grabbed the most headlines. So what does this ultimately mean for the world’s first cryptocurrency?

As a Bitcoin investor, I am not concerned about the sales. I don’t think Elon has changed his mind on Bitcoin, nor do I see the tide turning regarding the institutional adoption of Bitcoin. If anything, we are seeing the normalisation of Bitcoin as another financial asset. Furthermore, as mentioned above, Tesla’s sales are due to liquidity concerns.

The big picture is simple. We are entering the deep end of this latest Bitcoin capitulation event. We have many indicators explaining this, which I have explained before, such as the Realized Price and the 200-week MA. In a deep capitulation, even large entities are forced to sell. Tesla is only the last in a long line of institutions forced to sell, including miners in recent weeks. But to the seasoned Bitcoin investors, this is evidence that the bottom is near.

Tesla has stated that it is still open to buying Bitcoin. However, the company has liquidity needs, just like Bitcoin miners. As private investors, we generally have the privilege of not being constrained by this, which is why this is the time to not follow the herd and “buy when others are fearful”.

Be the first to comment