Olemedia

Investment Thesis

Despite the products of Tenable (NASDAQ:TENB) being rated higher than its competitors, its revenue growth rates being decent, and its losses being manageable, Tenable is priced cheaper than almost all the competitors. Based on this, I believe that Tenable is a good buying opportunity.

In this article, I will describe:

• An introduction of Tenable

• Historical performance

• Factors influencing future performance

• Comparison of valuation and other stats

• My final take

Introducing Tenable

Tenable, Inc. is a cybersecurity firm, founded in 2002 and went public on the Nasdaq in 2018.

The company provides solutions related to “cyber exposure”, which essentially has uses such as to control, analyze, and compare cybersecurity risk.

Tenable offers products that enable insight into a range of security concerns, such as vulnerabilities, misconfigurations, internal and regulatory compliance breaches.

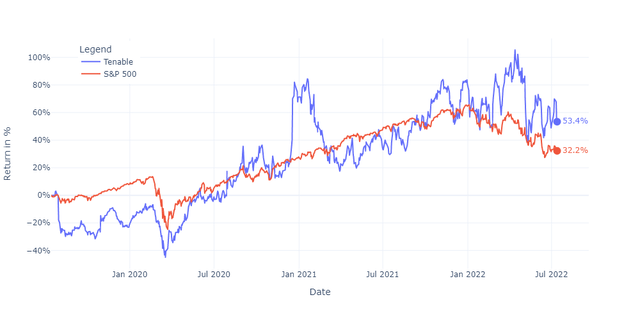

Their stock has been performing relatively well for the last three years and even outperformed the S&P 500:

Stock Performance Tenable (Prices from Yahoo Finance)

Historical Performance

Growth rates (Year-over-year)

|

index |

2019 |

2020 |

2021 |

Last 4 quarters |

|

Revenue |

32% |

24% |

22% |

25% |

|

Gross Profit |

31% |

23% |

19% |

20% |

Source: Seeking Alpha

Margins (% of revenue)

|

index |

2019 |

2020 |

2021 |

Last 4 Quarters |

|

Gross Profit |

82% |

82% |

80% |

79% |

|

Selling, General & Admin |

83% |

67% |

66% |

67% |

|

Research & Development |

24% |

23% |

21% |

21% |

|

Net Income |

-27% |

-9% |

-8% |

-10% |

|

Free Cash Flow Margin |

-8% |

9% |

16% |

13% |

Source: Seeking Alpha

Their revenue growth has been very stable and robust. While it’s still investing a lot in SG&A and R&D expenses due to the company being in its growth phase, its net income is negative, yet manageable.

The latest annual report shows that the revenue growth in 2021 can be mainly attributed to capabilities of attracting enterprises, as the number of enterprise client increased from 1,455 to 1,882. Furthermore, a large portion of the growth was international expansion, as U.S. revenue increased 17% while international revenue increased 32%.

In the next section, I will describe certain factors that could further influence the future performance of Tenable.

Factors Influencing Future Performance

Great market opportunity

I believe that the security and vulnerability management market has plenty of growth left. The major driving factors contributing to the high growth rate of the security and vulnerability management market include:

- an increase in vulnerabilities around the world,

- high monetary losses due to a lack of security and vulnerability management solutions,

- stringent regulatory standards and data privacy compliances,

- a surge in the adoption of IoT and cloud trends,

- the integration of advanced technologies such as AI and ML with security and vulnerability management solutions.

Furthermore, nearly every company is fragile for security attacks, thus I believe the market to be huge.

Highly rated product

People rate the products of Tenable an average of 4.6 out of 5 on Gartner.

Frequently mentioned likes are:

- Simplicity of deployment

- Its vulnerability scans, in fact, provides discoveries and, more importantly, correct findings.

Both the ease of use and effectivity are praised, which are essential characteristics for the success of software.

Frequently mentioned dislikes are:

- Presume that the user has a certain amount of understanding

- Lack of apps integration

- Small adjustments requested to increase user effectiveness

Lack of app integration and small adjustments to increase user effectiveness should be fixable in the longer term, as the company keeps investing quite a bit in its R&D department.

Furthermore, Tenable was named a leader in industrial control systems security by an independent research firm. Another research firm published its Worldwide Device Vulnerability Management Market Shares, 2020 to highlight the leading global Vulnerability Management vendors. Tenable was named the market leader for the third year in a row. The research firm attributes Tenable’s success to its robust acquisition strategy, which allows Tenable to uncover more vulnerabilities across a broader range of attack surfaces. They also attribute Tenable’s success to its ability to consolidate vulnerability data from multiple sources into a unified platform, and then use that data to assist you prioritize the vulnerabilities that pose the highest risk. This is in line with the reviews on Gartner.

Overall, I believe that the products are very much liked by both its users as well as experts.

Intense competition

The cybersecurity solutions industry is fragmented, fiercely competitive, and ever-changing. Tenable competes with a variety of existing and developing cybersecurity software and services suppliers, as well as in-house solutions. Its competitors include: vulnerability management and assessment vendors such as Qualys (QLYS) and Rapid7 (RPD); diversified security software and services vendors such as CrowdStrike (CRWD); endpoint security vendors with nascent vulnerability assessment capabilities such as Palo Alto Networks (PANW); public cloud vendors and companies such as Palo Alto Networks that offer cloud security solutions (private, public, and hybrid cloud); and providers of point solutions that compete with some of the features present.

Gartner shows that most of the products of these companies score 0.1 to 0.3 out of 5 lower than the products of Tenable.

While the competition is intense, I believe that Tenable is able to compete well due to its higher reviews, named a leader by several research firms, and increasing investments in its product effectiveness. The fact that Tenable is liked by clients is also evidenced from the significant increase of enterprise clients in 2021.

Comparison of Valuation and Other Stats

I computed several valuation and performance-based statistics for Tenable and compared it to several other players engaged in the cybersecurity space:

| PS Ratio | Gross Margin | Price to Gross Profit | Profit margin | PE Ratio | 3Y sales growth | Market Cap (billions USD) | |

| Tenable | 8.96 | 79% | 11.34 | -10% | – | 23% | 5.17 |

| Qualys | 11.06 | 78% | 14.18 | 22% | 52.08 |

13% |

4.37 |

| Rapid7 | 7.04 | 68% | 10.35 | -28% | – | 29% | 4.05 |

| CrowdStrike | 24.81 | 73% | 33.99 | -11% | – | 70% | 40.16 |

| Palo Alto Networks | 9.57 | 69% | 13.87 | -8% | – | 23% | 49.15 |

Source: Seeking Alpha

Tenable, due to its high gross margin and low PS ratio, is cheaper than Qualys and Paulo Alto Networks, while having the same or higher revenue growth rate. Rapid7 is cheaper but posts a loss margin of almost 30%, while the loss margin of 10% of Tenable looks much more manageable. Based on these statistics, I believe that Tenable is rather cheaply priced compared to the other players.

My Final Take

The revenue growth of Tenable has been very stable and robust. While it’s still investing a lot in SG&A and R&D expenses due to the company being in its growth phase, its net income is negative, yet manageable. I believe the revenue growth trend to continue despite the intense competition, as its products are highly rated by both experts and users. Despite its products being rated higher than its competitors, its revenue growth rates being decent and its losses being manageable, Tenable is priced cheaper than almost all the competitors. Based on this, I believe that Tenable is a good buying opportunity.

Be the first to comment