noel bennett/iStock Editorial via Getty Images

Introduction

KBC Group (OTCPK:KBCSF) (OTCPK:KBCSY) is a Belgian bank and insurance company with activities in several Central European and Eastern European countries. Although the bank continues to look out for bolt-on acquisitions like the 1B EUR acquisition of Raiffeisen’s (RAIFFY) (OTCPK:RAIFF) Bulgarian subsidiary which closed last week and now makes KBC the largest bank in Bulgaria, I think the bank will now focus on keeping its balance sheet in good shape until we see how the Ukrainian-Russian war will actually play out.

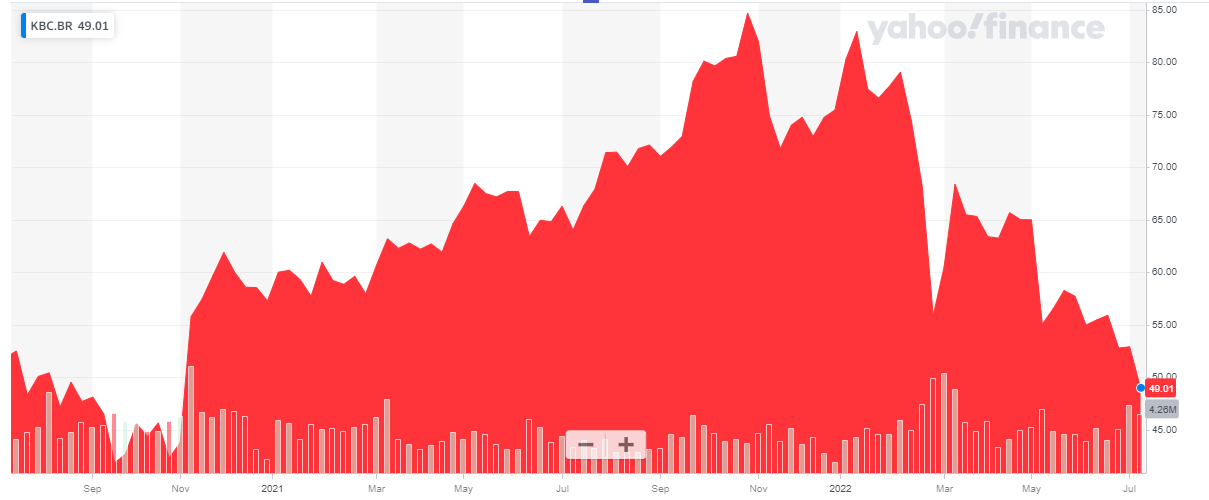

Yahoo Finance

Considering the bank’s main listing is on Euronext Brussels, I’d strongly recommend you to effectively use the Brussels listing to trade in KBC Group’s securities. The average daily volume is 670,000 shares and is generally pretty stable considering this is a large cap with a market capitalization just under 22B EUR. The ticker symbol in Belgium is KBC.

2022 was expected to be a decent transition year

In the past few quarters, I have been discussing the situation of some of the ‘overcapitalized’ banks in Western Europe. While I certainly appreciate an additional buffer in CET1 capital on top of the minimum required capital level as requested by the regulators, there’s a big difference between how big of a safety net one should maintain. I mentioned this ‘issue’ in the ING article, but ABN AMRO has the same ‘issue’: it’s just overcapitalized.

KBC Group also is one of those over-capitalized banks. The bank got away with a big scare in the 2008 Global Financial Crisis but pledged to do things differently. The state support was repaid as fast as practically possible and KBC has been running a safe balance sheet and capital allocation program. A substantial portion of the earnings was retained on the balance sheet as equity, and this has helped to keep the CET1 ratio at a very high level despite pursuing some bolt-on acquisitions in Eastern Europe of banks and insurance companies with weaker capital ratios.

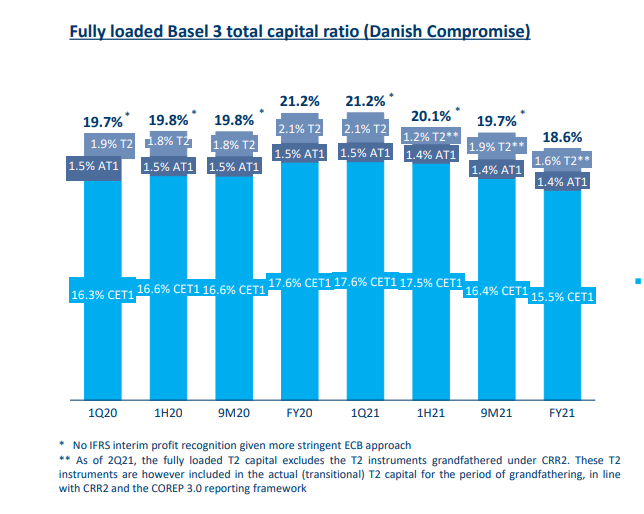

KBC Group Investor Relations

The CET1 ratio was 16.4% as of the end of September, and the 15.5% mentioned above already takes the proposed special dividends into account which were paid out earlier this year. The CET1 ratio fell to 15.3% as of the end of Q1.

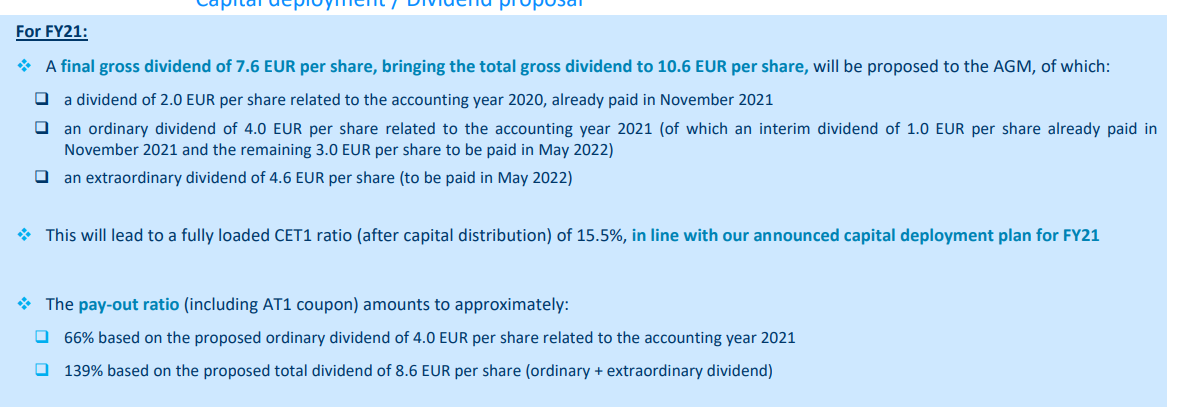

So what did KBC do earlier this year? It announced a 10.6 EUR dividend of which 3 EUR has already been distributed in 2021. The remaining dividend of 7.6 EUR per share was payable in May and consisted of a final dividend of 3 EUR/share related to the FY 2021 results (which brings the full-year dividend attributable to 2021 at 4 EUR/share) and a special dividend of 4.6 EUR per share. So long story short, a total of 7.6 EUR was paid out in May. The shareholders were quite happy with this unexpected bonus, but it also looks like some of them called it a day and sold after the stock went ex-dividend.

KBC Group Investor Relations

2022 was not expected to be a special year for any of the banks in the Eurozone. 2020 was a bad year due to the loan loss provisions and subsequently 2021 was an exceptionally good year because most banks were able to take back some of those provisions. 2022 was expected to be a ‘normal’ year, the first normal year since 2019 really.

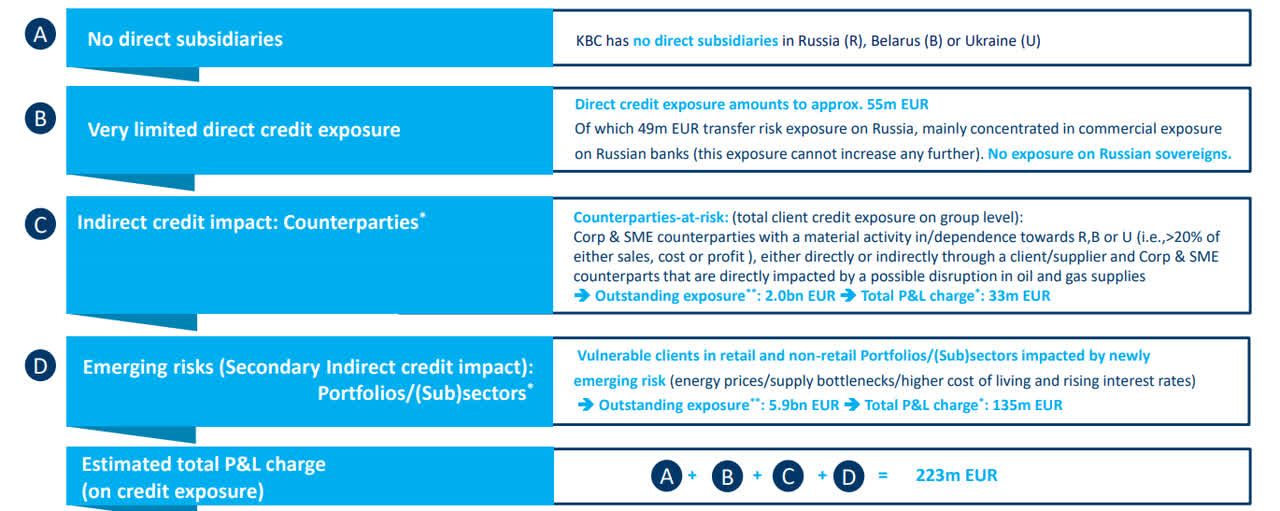

Unfortunately, the Russian-Ukrainian war has decided otherwise. Suddenly European banks need to rethink their exposure to certain countries and sectors as the upcoming recession will have a nasty impact. And although KBC does not have any activities in Ukraine or Russia and despite the bank confirming its total exposure to Russia, Ukraine and Belarus combined is just 55M EUR (which is 0.015% of the balance sheet total, so the exposure is completely negligible), it has been thrown on the pile of ‘riskier’ banks despite its superior CET1 ratio (15.3% as of the end of March).

The main exposure of the bank to Ukraine and Russia is an indirect exposure: KBC has lent money to clients that do have exposure to Russia. Although the absolute numbers of the indirect exposure appears to be high, KBC thinks it can keep the P&L charge limited to 223M EUR.

KBC Group Investor Relations

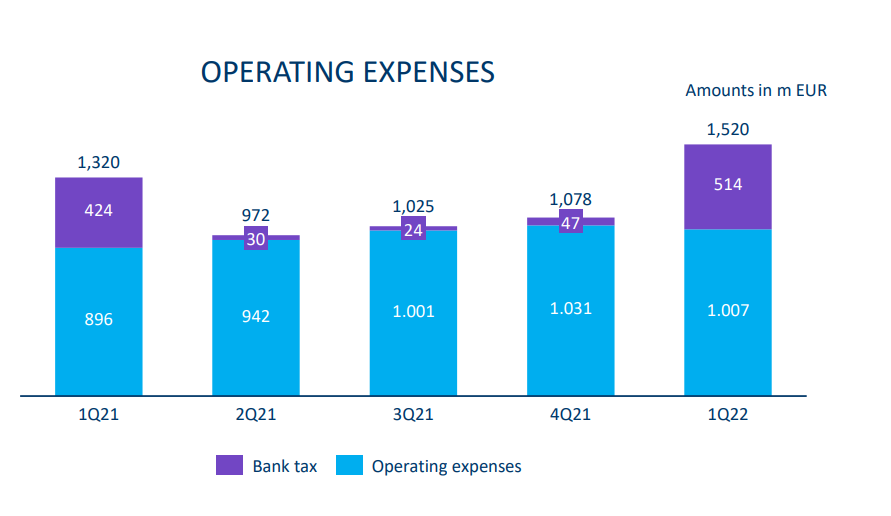

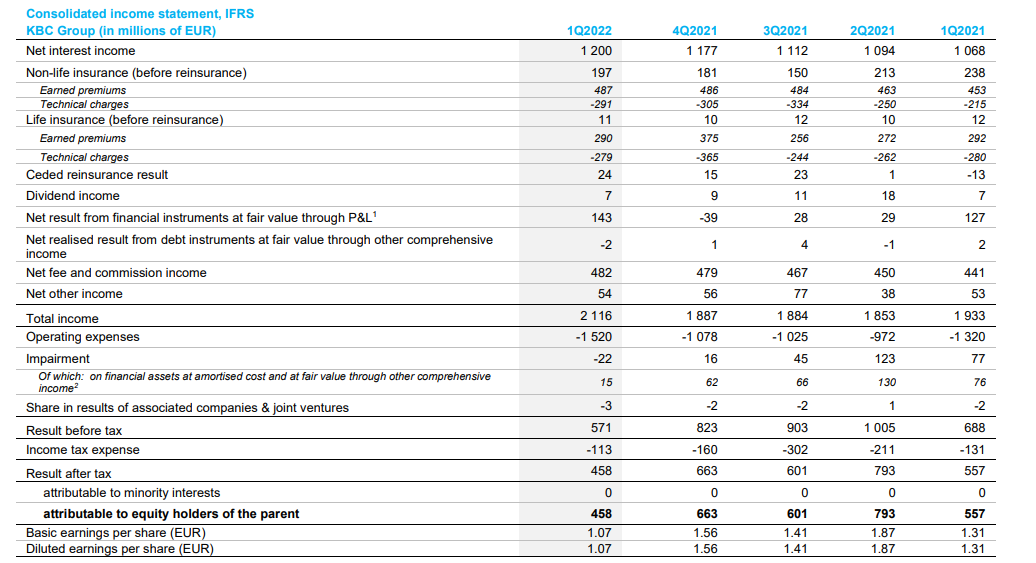

The Q1 income result was also strong. That’s remarkable considering the first quarter of the year is always the weakest. Not because of ‘seasonal’ effects, but because European countries are still punishing banks for the 2008 Global Financial Crisis by levying a high ‘bank tax’. As you can see below, the bank tax is payable in Q1 and this year, KBC had to pay 514M EUR in additional taxes.

KBC Group Investor Relations

The bank records these taxes as an operating expense and that’s why the first quarter has a high total amount of operating expenses and a relatively low net income.

KBC Group Investor Relations

Despite this tax, the net income was still 458M EUR thanks to a very low loan loss provision of 22M EUR. That loan loss provision will likely continue to increase in the next few quarters but that’s fine as KBC will save half a billion euros in operating expenses considering it paid the majority of the bank tax in Q1.

Investment thesis

While we will see an increasing cost of risk resulting in higher loan loss provisions, the bank’s ‘earnings engine’ is very solid. The LTM pre-tax and pre loan loss provision earnings of KBC was approximately 3.75B EUR, which means the bank has a very solid earnings profile that should be able to weather most storms. This doesn’t mean 2022 will be a painless experience for the bank, but KBC should be able to get through it without compromising its strong capital ratios.

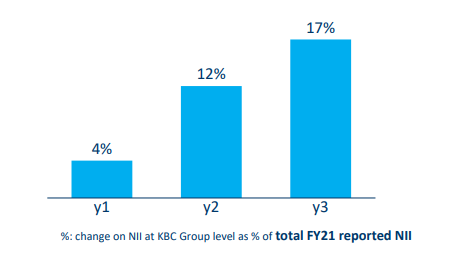

I’m also intrigued by the bank’s projections of what an increasing interest rate could mean. The image below shows the impact of a 100 bp parallel rate hike across the portfolio on the net interest income. The impact will remain somewhat limited in the first year but by the end of Y3, KBC should see its NII expand by 17%.

KBC Group Investor Relations

Based on the LTM NII of approximately 4.6B EUR, the positive impact of a 100 bp rate hike would be 782M EUR (representing about 575M EUR after tax) by the end of Y3. A 150 bp rate hike would increase the net income by almost 900M EUR per year or in excess of 2 EUR per share. Combine this with the 15.3% CET1 ratio and the average LTV value of just around 55% across the entire mortgage portfolio on the balance sheet, and I think KBC is well-armed to navigate through these difficult times.

I currently have no direct position in KBC Group but I have an indirect long position. I have also written out of the money put options on KBC.

Be the first to comment