Brandon Bell

Introduction

Every crisis creates an opportunity. In Europe, the main crisis right now is not the war in Ukraine but the fallout of that war causing major issues in the energy supply chain. Natural gas flows to Europe have fallen off a cliff and it is of course wishful thinking that a reliable supply chain can be set up before the winter hits. Sure, LNG imports are increasing but there obviously are limits and there is a zero percent chance LNG will cover the shortfall from lower Russian gas imports this winter. This will create a binary scenario: either a solution will be found with Russia opening the valves, or Europe is in for a rude awakening for relying on cheap Russian natural gas for so long. Natural gas will be available, but the question will be at what price. In just the last month, the natural gas price in Europe has doubled, likely in anticipation for the Nord Stream pipeline going offline for maintenance and the uncertainty related to the reopening of that pipeline. It’s not unthinkable there will be ‘sudden technical issues’ that cannot immediately be fixed ‘because the Western sanctions against Russia result in the latter not having the technical capabilities to solve the issues’.

Enter the scene, North European Oil Royalty Trust (NYSE:NRT). Despite the trust’s name, there’s virtually no exposure to oil. The natural gas sales provide in excess of 90% of the revenue with sulfur making up pretty much the rest of the consolidated revenue. The sulfur is a by-product from treating the sour gas at the desulfurization plant.

The Trust’s model is very simple and straightforward

Philip MacKellar has done a good job in explaining what NRT is all about in his April article. I’d strongly recommend his article to learn about the background of North European Oil Royalty Trust and what the royalty is all about.

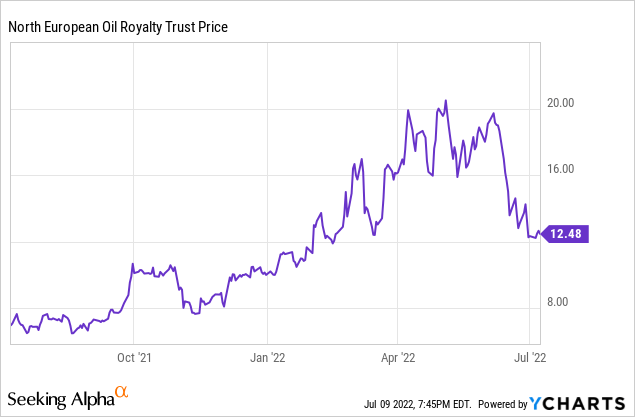

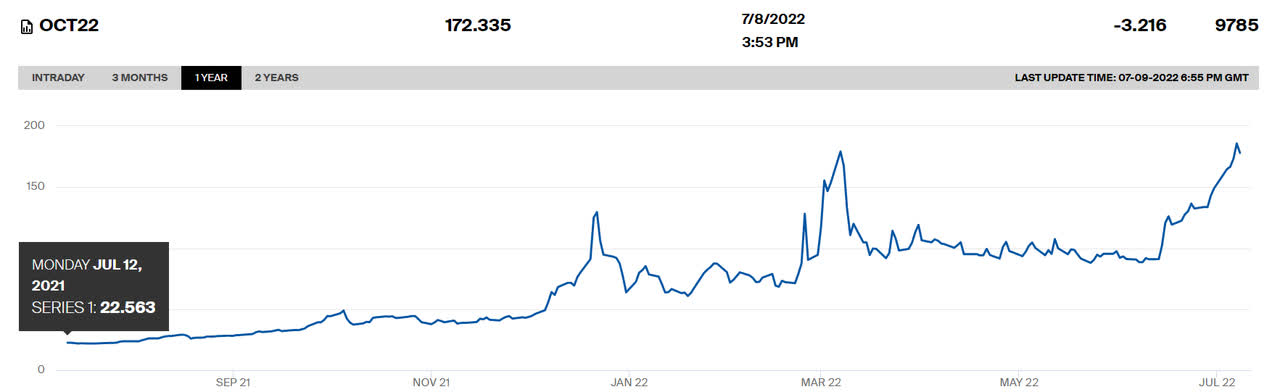

Philip considered NRT as an excellent hedge against inflation. While that may be right, I see in NRT an excellent vehicle to take advantage of the very strong European natural gas prices. Let’s have a look at the one year chart for TTF Natural gas for delivery in October 2022. Note: European gas prices are expressed in EUR per MWh.

Intercontinental Exchange Web Page

As you can see above, the natural gas price has eightfolded (!) in just one year time. This automatically means a royalty owner on natural gas concessions should do very well as they are immediately exposed to the revenue side of the equation and don’t have to deal with operating expenses.

There are two caveats here in NRT’s case. The natural gas price used by Exxon Mobil (XOM) and Shell (SHEL) as operators of the concessions is not the TTF gas price but the German Border Import Price. It is not easy to exactly find that price but I am assuming the variation on the widely used TTF price will be relatively low. And as Germany sourced a very large portion of its natural gas needs from Russia that now all of a sudden has to be replaced, I don’t expect the German natural gas price to be substantially lower than the TTF benchmark price. As such, while not 100% correct, I think using the TTF benchmark price to calculate the future royalty cash flows is realistic.

The second issue is the lag between spot prices and realized prices. While the operators of the natural gas field are making monthly royalty payments, the price used is based on a three-month rolling average. So there will be a small delay between spot prices and NRT actually receiving the higher prices. I don’t see this as a major factor either as it is NRT that will eventually see the benefit of the higher prices.

North European Royalty Trust’s year runs from November 1 to October 31st so the most recent financial results take the months of February-March-April into consideration while the next quarterly report, due at the end of August, will provide the details on the quarter from May to July.

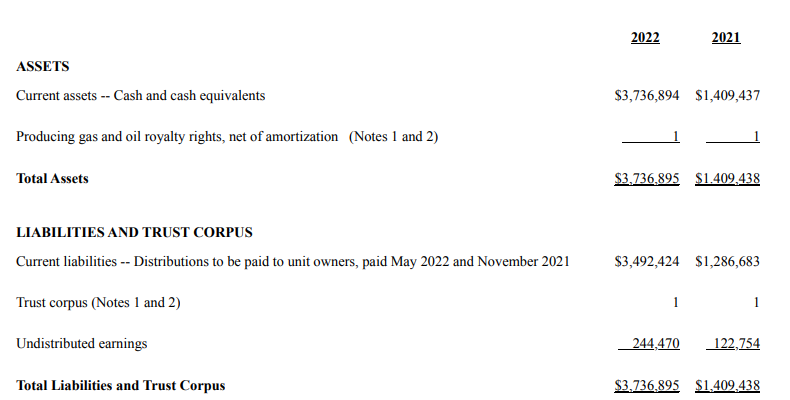

As NRT is a Trust distributing its royalty income, its balance sheet looks very clean. There are no assets other than the cash temporarily parked on the balance sheet ahead of a distribution payment. There’s no debt either, which means NRT has one of the simplest balance sheets I have ever seen. This is the balance sheet situation as of the end of April.

NRT Investor Relations

So it’s a very straightforward model. The cash comes in, the cash goes out. That’s it. And the incoming cash flow is obviously depending on a number of reasons: the natural gas production rate, the natural gas price and the exchange rate (as the natural gas gets sold in EUR but NRT reports its earnings and its distributions in USD).

Extrapolating the Q2 results to what we may expect from the current quarter

Based on the Q1 and Q2 performance, we can make some very educated guesses on what the distribution for the next few quarters will be. We know the natural gas price and we know the exchange rate. The only unknown right now is the production rate, but to keep things simple I will assume the Q2 production rate as steady state output.

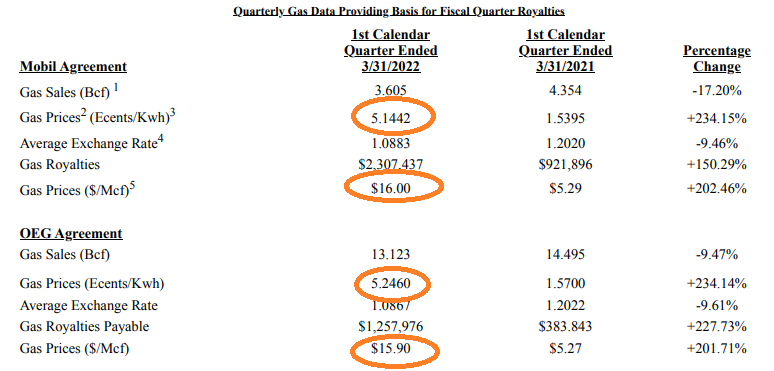

NRT Investor Relations

So in the second quarter we see the trust generated $3.77M in royalty revenue and had just under $215,000 in operating expenses to end up with a distributable income of $3.56M. In the same quarterly report, we see the gas price was around $16/Mcf during the first quarter of the calendar year. But equally important is the gas price in eurocents per kilowatt hour of 5.144 and 5.246.

NRT Investor Relations

That makes it easier to compare apples to apples as we just need to multiply the price per kWh by 1,000 to get the MWh price. So at an average price of 52 EUR per MWh, the distributable income was $3.56M.

Let’s now see what would happen if we use a price of 105 EUR per MWh, twice the average natural gas price from the previous quarter. The revenue would increase to $7.45M (the sulfur revenue wouldn’t double) and even if I would increase the overhead expenses by about 15% to $0.25M, the distributable income would jump to $7.2M. Divided over the 9.2M units outstanding, the distributable income would be $0.78/share. The exchange rate is still fluctuating and we don’t know the exact production rate so a margin of error should be applied here, perhaps 5-10% on either side.

Applying the current spot price of 170 EUR per MWh would result in a quarterly dividend of approximately $1.30 for an annual dividend of in excess of $5. This means that at the current spot prices, NRT would have a yield of in excess of 40%.

The proved producing reserves underpin a useful life of about 7 years but the main ‘issue’ is that Niedersachsen, the area where the Oldenburg concession is located, hasn’t allowed new onshore drilling in a while. This means Exxon and Shell can only rework the existing wells to maximize the performance and hopefully the urgent requirement to secure a natural gas supply in Germany will help the permitting of new wells. Earlier this year, offshore drilling and the development of an offshore gas field in Niedersachsen were approved, so hopefully this means Niedersachsen will consider permitting onshore gas well development as well. If that does not happen, then we should expect a gradual decline of the annual natural gas production.

Investment thesis

The only unknown at this point is the tax treatment on the distributions for Europeans. I will only find out in August when the distributions are hitting my accounts. But considering the likely massive payouts for the next few quarters, I would not be deterred by a high withholding tax, similar to the LPs. Of course, when the natural gas price decreases again the total tax pressure does come into play but I expect to have sold the position before then.

At this point my strategy is to use NRT as a hedge against the natural gas bill as there will be a direct correlation between the natural gas bill for households in Europe and the distributions paid by North European Oil Royalty Trust.

One of the commenters on Philip’s article stated, ‘all trusts eventually go to zero and a 4% yield is not good enough’. That’s correct. But given the natural gas prices in the past quarter and how the natural gas prices are behaving in the current quarter, I think it is not unrealistic to expect a total distribution of $1.75 for the next two announcements. I hope this will cause the stock to re-rate as that would allow me to lock in a capital gain as I see NRT as a vehicle to take advantage of the European natural gas prices. I think the market is misled by the word ‘oil’ in the trust’s name and perhaps the next few distribution announcements will be an eye opener.

I have a long position in NRT and will be looking to further increase this position on weakness (of course on the condition the European natural gas price doesn’t suddenly collapse).

Be the first to comment