klmax/iStock via Getty Images

Following Tenable’s (TENB) solid results and revenue guidance, we reiterate our buy rating on the stock. We expect Tenable to continue to report beat and raise quarters during 2022, driven by the broadening platform. Tenable is the best vulnerability management (VM) asset to own. Tenable is gaining share at the expense of two of its best-known competitors – Qualys (QLYS) and Rapid7 (RPD). Tenable now is the market leader, having gained share at the expense of QLYS and RPD during 2021. Both Rapid7 and Qualys had decent products until they pivoted to adjacent market spaces. However, Tenable doubled down on the core Vulnerability Management, and this focus is now paying off. Vulnerability management now encompasses OT (operation technologies), Web applications, Active Directory, Infrastructure as code deployments, in addition to Desktops, Laptops, Servers, Storage, and Networking equipment. Tenable software is known to be more accurate in finding vulnerabilities. It has fewer false positives and false negatives, a well-known problem affecting other VM vendors.

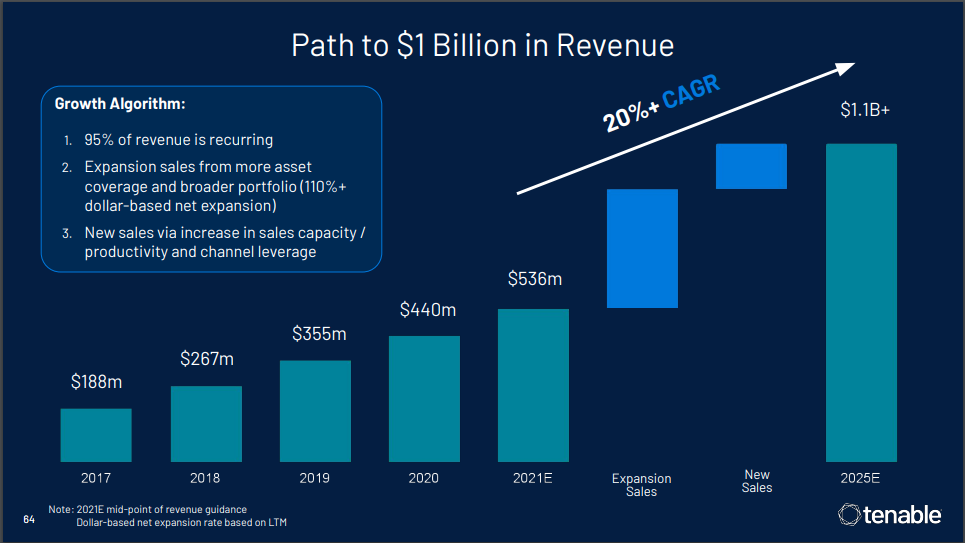

As Tenable laid out at its analyst day, we expect the company to grow at least 20%+ for the next three years, exiting FY2025 with revenue north of $1.1 billion and an operating margin of at least 25%. Tenable is trading at a discount to both RPD and QLYS, providing investors the opportunity to own a quality stock at a reasonable price.

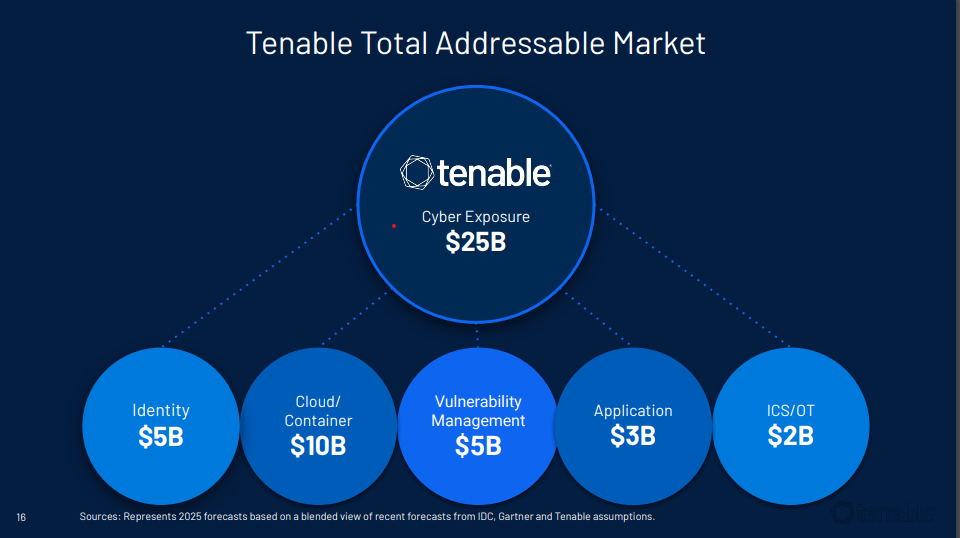

Expanding and fast-growing TAM

The TAM for Tenable is much larger than before. The TAM is now about $25billion. The newer segments of the TAM (Identity, OT, Cloud/Container, and SaaS) are growing faster than the corporate growth rate of about 20%, while the core VM is only growing at about 10%. Tenable expects to grow at least 20% until 2025 to reach $1.1 billion in revenue. Cloud/container VM security and Identity (Active Directory) are the most promising segments of Tenable’s business. In addition, following the Colonial Pipeline attack, many companies are looking for ways to protect their operational infrastructure. We believe Tenable has one of the best platforms to manage IT and OT assets through a single solution. Therefore, we are highly confident Tenable will continue to outgrow its two primary competitors – RPD and QLYS. The following chart illustrates Tenable TAM.

Tenable Investor Presentation

On its analyst day in December 2021, Tenable laid a path toward $1.1 billion in revenue exiting F2025. The company expects to grow at least 20%+ for the next three years to reach $1.1 billion in revenue. More importantly, the company also expects to operate at a rule of 50, exiting FY2025 with a Free Cash flow margin of 30%+. The following chart illustrates the path to $1billion in revenue.

Tenable Investor Presentation

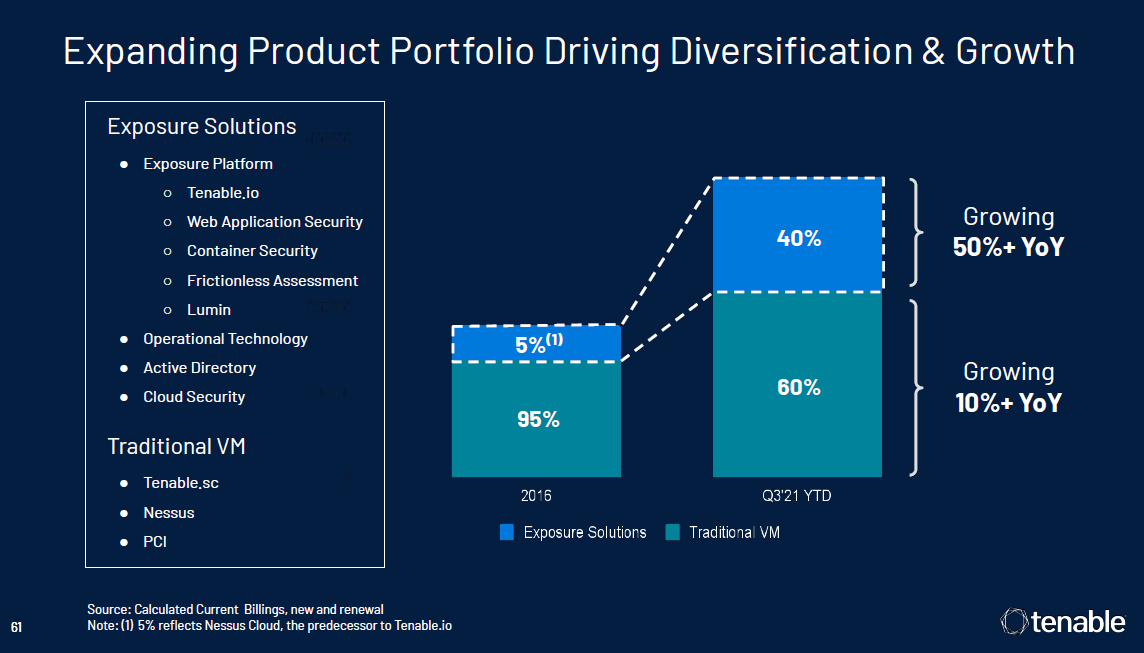

We believe the $1billion revenue target is achievable given the newer product categories such as “Exposure Solutions” are growing at 50%+. We believe Exposure solutions made up about 40% of revenue during F4Q21. We expect “Exposure Solutions” to become a sizable portion of revenue exiting 2025. The following chart illustrates the contribution of newer products and their growth rates.

Tenable Investor Presentation

Solid results

Tenable reported another solid quarter with revenue and EPS ahead of estimates. Revenue was $149 million ahead of the $144.5 million consensus estimate. Revenue grew 26% Y/Y. Current Calculated Billings (CCB) was $194 million and grew 29%. CCB accelerated from 25% in 3Q, 23% in 2Q and 20% in 1Q. The company also generated $22 million in operating cash flow for the quarter and about $97 million operating cash for fiscal 2021. Tenable has about $512 million in cash and investments at the end of the year. The cash balance includes about $366 million in proceeds from its credit facility. The company continues to make tuck-in acquisitions to round out its product portfolio and augment its platform for newer growth areas. We believe this is a prudent growth strategy and will likely pay dividends for the company.

EPS was $0.05 and was 2 pennies better than the consensus of $0.03. EPS beat was driven by higher than expected revenue and lower than expected operating expenses, offset by lower gross margin. The company added 562 new enterprise platform customers and 100 new six-figure customers during 4Q.

Outlook – Revenue better but EPS below

Tenable provided mixed guidance with revenue above estimates but EPS below. For F1Q22, revenue is expected to be in the range of $152-154 million, versus the prior consensus of $148 million. EPS is expected to be in the range of 4-5 cents versus the previous consensus of 6 cents. For F2022, revenue is expected to be in the range of $662-670 million versus a consensus of about $640 million. EPS is expected to be in the range of 15-to-19 cents, versus the prior consensus of 35 cents. The company noted that it needs to invest in R&D to integrate the products into its platform and roll out additional features. In addition, the company is also planning to expand its sales into selling the products in various markets. Needless to say, many investors view the results and the outlook as strong. The stock was trading up aftermarket.

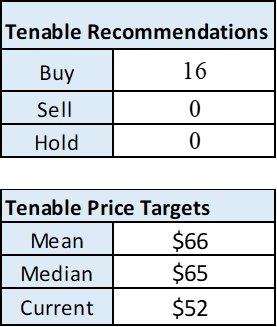

Valuation

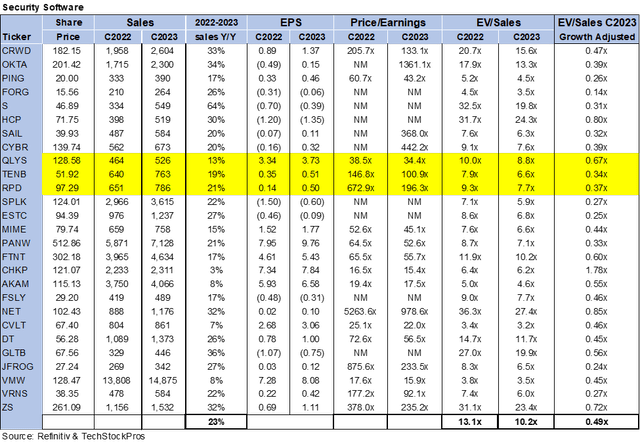

Tenable stock trades at 6.6x EV/C2023 sales versus the peer group average of 10.2x. While the peer group is expected to grow at 23%, Tenable is expected to grow at 19%. Even accounting for slowing growth, Tenable is cheaper than the peer group. On a growth-adjusted basis, Tenable is trading at 0.34x versus the peer group average of 0.49x. Tenable is also cheaper despite growing faster and taking shares from both QLYS and RPD. Tenable continues to foreclose opportunities to Qualys/Rapid7 in some large enterprise accounts. An overwhelming number of Wall Street analysts are bullish on the stock with “buy” ratings. The following chart illustrates Tenable’s valuation regarding its security peer group and Wall Street analyst ratings, and mean and median price targets.

Refinitiv & Techstockpros Refinitiv and Techstockpros

What to do with the stock

Tenable is the VM asset to own. Tenable has twice the number of customers as Qualys and is executing well on the core VM-focused products such as PC, Servers, Networking Equipment, and Storage devices. Tenable is investing to cover newer asset classes such as Active directory, Containers, Microservices, Web and SAAS applications, and operational technologies. Tenable is also investing to protect “Infrastructure as a Code” offerings. The entire VM solution is deployed as a single platform, making the offering very compelling for users. The stock is also relatively cheap when compared to many growth assets. With Log4J vulnerability likely to drive demand for the rest of 2022, we expect many security stocks to do well. We expect Tenable to perform well. Therefore, we recommend investors buy shares here, albeit in small increments.

Be the first to comment