jmalov/iStock via Getty Images

Tupperware Brands (NYSE:TUP) had a terrible week plunging about 50% and their future does not look much better. Management warned that they may be in violation of covenants under their loan agreement in 4Q or early next year, but I am not sure if they will actually end up in bankruptcy court. I am expecting a significant issuance of new shares that would provide enough cash needed to get lenders’ approval of less restrictive loan terms. Issuing new stock would be 180 degrees turnaround from earlier this year when they repurchased $75 million of their stock. Lockdowns in China, soaring inflation, and turmoil in Europe have killed their recent results. In addition, their change in business model of selling Tupperware products in retail stores instead of via Tupperware parties may not work.

Going Concern Warning

Tupperware investors were spooked last week when their 10-Q included “there is substantial doubt about its ability to continue as a going concern for the twelve-month period following the date of this filing“. Some clarification of this statement is needed. First, this is not the same as when an auditor includes a “going concern” statement in an audited annual report. Second, this required statement is a relatively new FASB Accounting Standard (ASU 2014-15) that started after December 15, 2016, and some investors are still not familiar with it. Sears Holdings (formerly SHLDQ) was one of the first companies to file this going concern statement back in early 2017 and their stock plunged because, as I wrote about it in a SHLDQ article, investors seemed completely unaware of ASU 14-15. (Sears Holdings had their bankruptcy plan declared effective last week after four years in Ch.11 and shareholders received no recovery/stock cancelled.)

One of reasons for ASU 14-15 is that it is a timelier indication of potential going concern problems instead of just having an annual statement by the auditor. These going concern statements by management could be included in quarterly 10-Q reports or in a 10-K. In addition, management is expected to state why there could be going concern issues by giving specific details and they are also expected to state how they are trying to alleviate these issues. Tupperware asserted it is trying to execute its “turnaround plan” as way to deal with the ASU 14-15 statement. Part of that plan, however, will result in cash payments, such as severance pay, of up to $100 million over the next few years as they restructure their business model according to management during their conference call.

Tupperware agreed to an amended credit agreement effective August 1 that allowed “for a temporary higher maximum total Net Leverage Ratio of 4.5x in the third quarter of 2022, 4.25x in the fourth quarter of 2022 and first quarter of 2023, and 3.75x in the second quarter of 2023 and thereafter…” While Tupperware had a net leverage ratio of 4.17x as of September 24 that is under the current 4.5x covenant, it is unlikely, in my opinion, they will be compliant with the 4.25x and 3.75x covenants going forward. (It is interesting to note that their net leverage ratio at the end of 2021 was a respectable 2.11x.) Management even stated in the 10-Q:

Due to the volatility in the Company’s earnings and progressive tightening of the financial covenants in the First Amendment to the Credit Agreement, it is probable that the Company will not be able to maintain compliance with the covenants in its Credit Agreement, including the existing Consolidated Net Leverage Ratio covenant, for the next twelve months.

If the world economy slides into a recession, even renegotiated covenants at a much more favorable level might be very difficult to avoid breaching. Management claims they are in the process of negotiating, but the reality is lenders often become stricter with their requirements as the economy contracts and risk of default by all distressed borrowers increases. I would expect the interest rate terms will be significantly changed under any new amendments. They currently pay Secured Overnight Financing Rate-SOFR+275 (4.39% as of September 24, but SOFR has increased about 60 basis points since then.)

There is also an interest coverage covenant of 3.0x for the last four consecutive quarters. As of 3Q, they had a 5.93x coverage so that is currently not a problem but given the outlook for their operations this could also become a serious issue.

As reports of Tupperware’s financial problems are spread by various media sources, vendors might become much stricter with their terms because they don’t want to get stuck shipping supplies to them and then not getting paid, especially if Tupperware eventually does file for bankruptcy. Vendors may only deal under COD terms or with very large cash deposits with orders and/or before deliveries. These stricter terms would require Tupperware to borrow more cash to finance their inventories, which makes it even more likely they will not be able to comply with covenants in the future. (I covered the vendor bankruptcy issues in great detail in a BBBY article.)

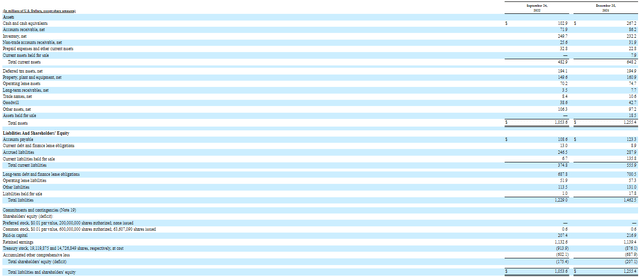

Currently there is $13.44 net long-term debt per common share, which compares to a current stock price of $4.02 or about 3.3x times as much net debt compared to current stock price. This clearly indicates Tupperware currently has way too much financial leverage.

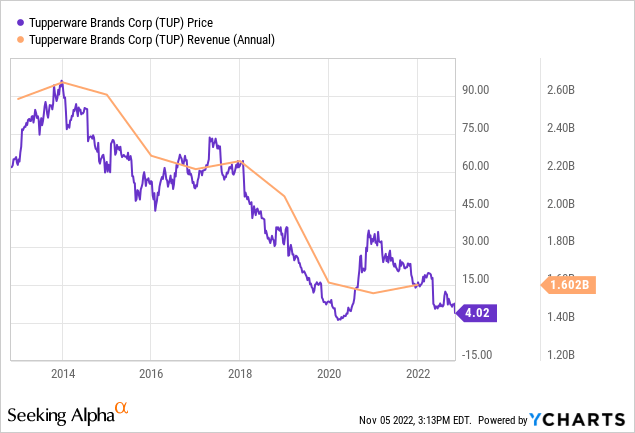

Stock Price and Annual Revenue 10 Years

Change from Repurchasing Stock to Issuing New Stock

Given their weak current financial, it seems unbelievable that less than nine months ago they negotiated a $75 million repurchase of their shares, which resulted in a repurchase of 4,876,589 shares at a price of $15.38 per share. This compares to a current TUP price of $4.02. One wonders what in the world was the board of directors thinking, especially since Tupperware was in terrible shape during the start of the pandemic in 2020 and the stock price traded as low as $1.20. Prudent management should have used that $75 million to reduce debt instead. This same completely irrational, in my opinion, management of cash by the board is just like Bed Bath & Beyond (BBBY) that had massive stock repurchases earlier this year and now has to issue new BBBY stock at much lower prices than they repurchased the stock for to stay afloat.

As I expected, management did not say anything about issuing new stock to raise cash during their conference call because any mention of it may have pushed TUP stock even lower as investors worry about dilution. Often the first indication of selling additional shares is when an actual SEC prospectus filing is made and not before. In my opinion, they need to raise at least $100 million via a new stock issue. The $100 million would be enough to cover future restructuring cash expenses without the need to borrow that money. This $100 million would imply 25 million additional shares based on their latest stock price of $4.02. This compares to 44,478,026 shares outstanding as of October 31. Therefore, there would be a significant amount of dilution for current TUP shareholders. It does, however, seem that shareholder approval will not be needed to issue new shares because according to their balance sheet they have 600 million shares authorized already.

Brief Overview of 3Q Results

The results for 3Q were weak as expected because of higher raw material costs, quarantines again in parts of China, and high inflation. Many consumers have become much more selective in their buying habits with soaring prices world-wide. Tupperware products are not a necessity, and some consumers are trading down to cheaper/poorer quality containers.

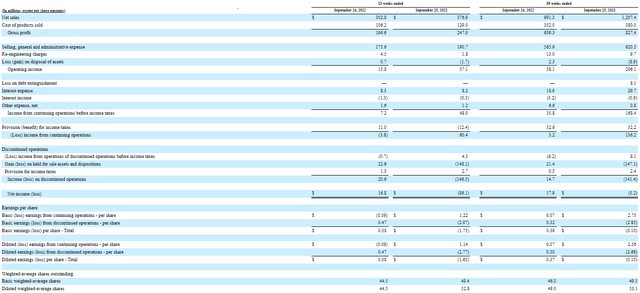

3Q and 9 Months GAAP Income Statements 2022 and 2021

3Q and 9 Months GAAP Income Statements 2022 and 2021 (sec.gov)

3Q 2022 and Year-End 2021 Balance Sheets

3Q and Year End 2021 Balance Sheets (sec.gov)

Now in Target Stores

Tupperware is partially changing their standard business model of direct sales via Tupperware parties to selling in Target stores. Their active sales force numbers already dropped 12% in 3Q from the same period last year to 305,605 from 345,340. The revenue per salesperson also dropped to $991 from $1,092 in 3Q based on my calculations.

There are a few problems selling in Target stores. First, I always thought that selling in retail stores had a much lower profit margin than direct to consumer sales. Second, there is price/quality risk by selling in a store. Selling via a Tupperware party a potential buyer can’t do direct comparisons of products whereas in a store a consumer can directly compare the quality/price to other similar products in a Target store. Tupperware products are not cheap, and it is questionable, in my opinion, if they are really worth the higher prices. Their products are somewhat better than other plastic containers, but they are still really generic and may not be worth the higher price. Third, they tried selling in Target stores years ago and it did not go as hoped, so that program was discontinued. Finally, there are only limited varieties of Tupperware products in Target stores, and I question if consumers will go to either Tupperware’s or Target’s websites to view/buy the larger variety.

While I think they will transition to much more sales via traditional retail stores, I expect their direct sales operation in South America will continue because that region still has a very strong direct sales operation with a 141,091 current sales force (46% of the total company sales force).

Conclusion

Tupperware’s long historic business model of selling plastic containers via Tupperware parties has become outdated and it is uncertain if they can transition over to selling in stores and on-line. They have had declining revenue for a long time, and it may continue in the wrong direction.

The “going concern” warning killed the stock last week. Unless they can get very positive results from selling in Target stores and negotiate new amendments to their credit loan, it is unlikely they can stay out of bankruptcy. I am expecting that the lenders will require additional cash is needed before they will agree to significant changes in the covenants and that cash will most likely come via a major new stock issue, which will cause dilution for current shareholders. It is better for TUP shareholders to get diluted than cancel under a Ch.11 reorganization plan. I rate TUP stock a hold because issuing new stock may keep them out of bankruptcy court and give them some time to execute a turnaround plan.

Be the first to comment