metamorworks

Investment Thesis

TELUS International (NYSE:TIXT) is a customer experience (CX) and digital IT service provider. The company has a solid track record of delivering outsized growth vs. its peers along with industry leading profit margins. While the customer base, which is largely focused on global tech and ecommerce/fintech clients, has led to slower growth in recent quarters owing to the macro environment, the long-term potential of the company remains intact. This has created an attractive entry point for long horizon investors looking for a business with sound fundamentals. Led by an experienced management team, the company has made meaningful progress on adding a higher mix of digital capabilities to its portfolio via M&A and is poised to benefit from the tailwinds in areas such as digital transformation, AI and content moderation. We discuss several catalysts which could present meaningful upside and move valuation closer to a true end-to-end digital service provider over the long term

Company Overview

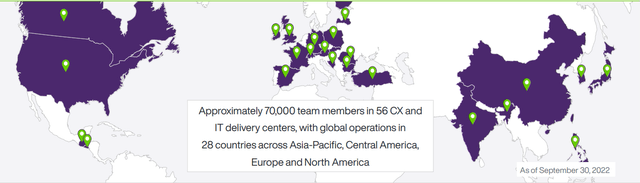

TIXT is a spin off from the large Canadian telecom company TELUS Corp (TU). The company has a global presence in 28 countries and employs ~70,000 people along with a large community of AI gig workers.

TIXT locations (Company materials)

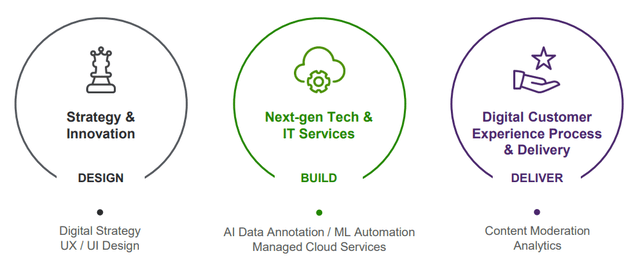

TIXT delivers its services under 3 broad categories: 1) Design, 2) Build and 3)Deliver. These categories represent the end-to-end value chain of services in the B2B service space. By way of example, let’s say a business is experiencing lower customer satisfaction metrics and wants to improve this trend. They may engage a vendor such as TIXT to first determine the root cause of the problem and then DESIGN a solution (e.g., customers are dissatisfied given the amount of time it takes to get support and want a more streamlined solution such as the ability to self-serve). Once a solution has been identified, the business may further engage TIXT to BUILD the required solution (e.g., a web portal where customers can log in and provision services). Finally, TIXT can be engaged to manage and DELIVER on-going service on the solutions it has built (e.g., maintenance of the online portal along with call center agents who can provide support for more complex issues which can’t be handled via the online portal). For a more detailed listing of services, see investor presentation pg 9-11.

TIXT Services Overview (Company materials)

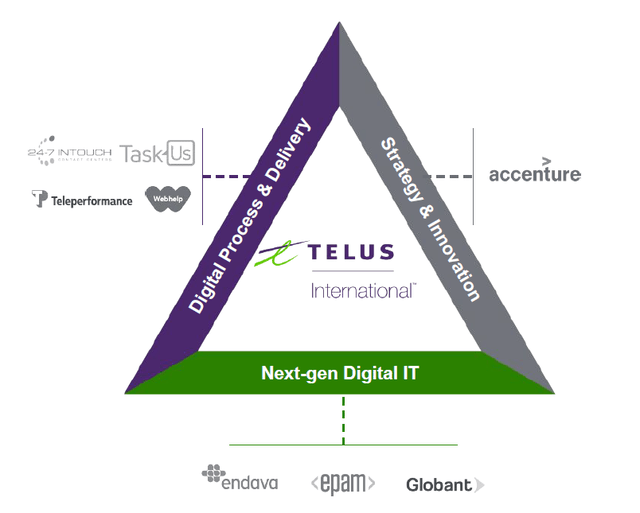

It is critical to understand the importance of being an end-to-end provider in this space. Generally, the clients that engage companies like TIXT are large enterprises who prefer to deal with a single provider who can deliver more services vs. working with many vendors. This allows these clients to get “bundle deals” which in turn minimize costs. Furthermore, the value of Design and Build services is generally perceived to be higher as these represent higher growth areas. Finally, clients prefer to work with large, well-capitalized vendors who can minimize continuity risk. These trends have led to consolidation in the service industry with competitors looking to position themselves as true end-to-end providers. We believe TIXT is further ahead of its peers in these areas which gives it a competitive advantage.

TIXT market positioning (Company materials)

Recent Performance

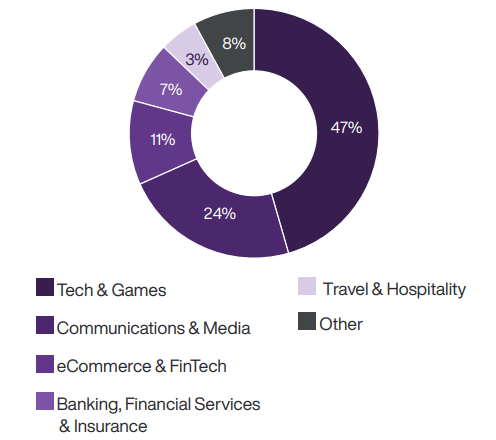

While the business is well diversified, it has historically grown via a tech focused customer base. Given the recent macro impact on the tech industry, TIXT has experienced somewhat of a slowdown in its growth in 2022 and will likely by impacted in 2023 as well. The company’s recent Q3 release showed a slight miss on revenue however this was compensated by a beat on EPS. TIXT also slightly called down its guidance for 2022. It is important to note that the business is still poised to deliver low to mid-teens revenue growth which we believe has further upside (to be discussed later in the Potential Catalysts section).

TIXT Revenue by Customer Verticals (Company materials)

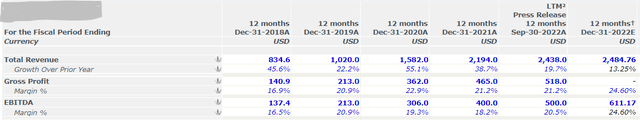

The overall historical financial performance of the company has been top notch with perhaps the most attractive feature being the focus on profitable growth (vs. growth at all costs) which the company management frequently talks about on investor calls. Given the experienced management team and the company’s history of being a spinoff from a large telecom provider (which are very fixated on EBITDA margins and growth), investors potentially get the best of both worlds (growth and profitability).

TIXT historical financial performance (CapIQ)

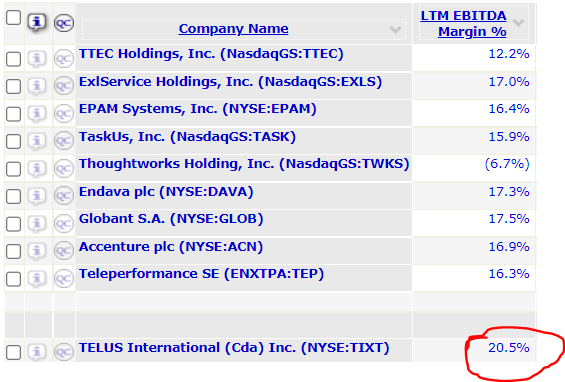

One of the reasons we believe TIXT warrants a premium valuation is due to its strong track record of profitability. In fact, TIXT has one of the highest margins in the industry which should allow it to better withstand the current macro environment.

TIXT margin comparison (CapIQ)

Potential Catalysts

Digital Progression

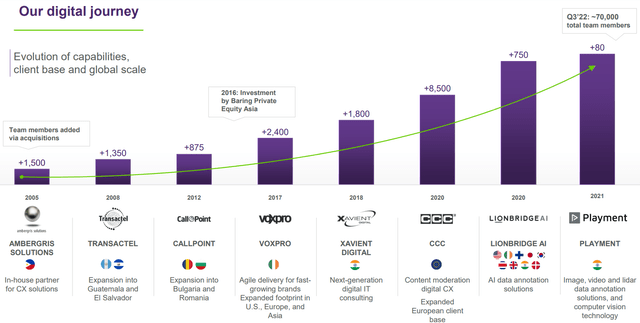

The company currently trades as a traditional call center/BPO provider however we believe that the market is not giving full credit for the broad array of digital services which the company has added to its portfolio over the recent years which have positioned it as a true end-to-end provider. Below is an overview of the service capabilities which the company has added to its portfolio in recent years:

Digital IT Services

This is a very large serviceable market as companies look to digitally transform their back-end processes to increase automation and efficiencies. The focus on digital transformation has been increasing as companies face wage pressures and rising costs. Digital transformation services are estimated by IDC to have been a $147 billion market in 2019 and estimated to grow at a four-year compound annual growth rate of 21% through 2023.

TIXT has also recently announced a transformative acquisition of WillowTree which provides it with further Design and Build capabilities. These capabilities seem to be geared towards front-end development which are highly complementary to the digital transformation work which is usually focused on back-end. While TIXT seems to have paid a premium for this asset, the price seems justified given the company’s superior growth rate (~50% in 2021 and on track for 35-40% in 2022) and high profit margins.

Content Moderation

Content moderation has garnered a lot of attention recently with the emergence of “fake news” and “misinformation” scrutiny. Anyone following the news has seen the extreme negative PR for Twitter as there are indications of toning back its content moderation practice. Given that content moderation isn’t a core service for big tech companies, they usually outsource these services to reputable vendors such as TI. In fact, based on our estimation, TI is likely a top 5 provider of this service globally. Everest Group estimates the content moderation market to have been approximately $1.5 billion to $2.0 billion in recent years, and expects it to experience estimated growth of 40%-50%.

AI Data Annotation

I have written about data annotation in my recent article on Appen (OTCPK:APPEF) which is the largest and only major competitor to TIXT for AI data annotation services at scale. In short, all advancement in AI is highly predicated on the quality of data which is used to “train” the machine. In order for this data to be useful, it needs to be annotated/labelled by humans. The AI data annotation market is expected to be $5.3B by 2030 with a growth rate of more than 26%.

Increased Outsourcing during Recessionary Environment

While in the early stages of a recession, decision making in large organizations is delayed and sales cycles for outsourcing services are elongated however as experienced in past down turns, one of the most effective ways for enterprises to cut costs while maintaining operations/planning for future growth is to leverage outsourcing services particularly in offshore locations. Note that while TIXT has only been public since early 2021, the business has been around for over 15 years and has experience operating in challenging macro environments.

Recent M&A and potential for future acquisitions

One of the differentiating factors for TIXT is its enviable M&A track record which is lauded by equity analysts. The company started with the acquisition of a small call center in the Philippines with 1,500 employees and is today operating with 70,000 employees. Consolidation via M&A is a key growth strategy for companies in this sector given the vendor consolidation trend described earlier in this article and TIXT’s track record and reputation positions it favorably in this regard.

TIXT acquisitions (Company materials)

Valuation

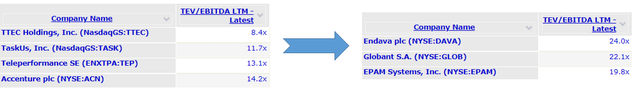

Based on comparable stock valuations presented below, it’s clear that TIXT is trading as a traditional BPO provider however given the additions to its service portfolio and especially after the recent WillowTree acquisition, we believe that the market will begin to see TIXT closer to its digital peers. Note that TIXT currently trades at ~13x.

An additional overhang on TIXT’s valuation is tied to its ownership structure. As mentioned previously, TIXT is a spin off from the large Canadian Telco, TELUS Corp. TELUS retains ~55% ownership in TIXT given its strategic importance (TELUS is a customer of TIXT as well). Additionally, Baring Private Equity Asia, which invested in the company pre-IPO, still retains ~19% ownership. This leaves behind a smaller portion for other investors, many of whom are large funds with a long-term horizon. We believe that the lack of public float potentially inhibits these larger funds from buying in bigger quantities. This issue may however be resolved in the near term as Baring may look to sell down its stake given its time horizon of investment in TIXT (PE firms eventually look to divest from assets they invest in and rotate proceeds to new funds). TIXT did a secondary offering in September 2021 where it appears that Baring has already started selling its stake.

Key Risks

- Customer Concentration: Top 10 clients represent ~60% of TIXT’s revenue. This however is a fairly standard metric in this industry given large enterprises preference to work with end-to-end providers.

- Impact from Macro environment: A slowdown in the overall macro environment will have an impact on TIXT and this industry in general. However as discussed, this may actually lead to more business in the medium term as companies look to outsource

- M&A Integration: TIXT has undertaken significant M&A in recent years and plans to continue down this path going forward. This leads to risk that various parts of the organization won’t be fully integrated.

Conclusion

Economic downturns are known to present attractive value creation opportunities as good assets are discounted along with the entire market and we believe TIXT falls within this categories. The company has one of the highest profitability in the industry which should allow it to fare the macro environment better than its competitors. Also, given the execution on its digital progression, we believe the stock is mispriced and it’s only a matter of time until the market classifies it closer to its digital peers. The increasing public float will further help drive the valuation as more long-term institutional investors afford this opportunity to take long positions in the stock. Our overall price target is $40 compared to the current trading price of $23.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment