35007/E+ via Getty Images

Banco Latinoamericano de Comercio Exterior (NYSE:BLX) or the Foreign Trade Bank of Latin America, is a multinational Panamanian bank formed by Latin American Central Banks to hold their deposits and promote foreign trade in the region.

The bank operates under conservative guidelines, is rated investment grade by all rating agencies, and has shown resilience despite a bad decade for Latin America.

With Latin America growing faster thanks to more expensive commodities, BLX is expanding its portfolio and spreads. These improvements have only recently become noticeable, but the market has not reacted. Today, BLX is trading well below a P/E ratio of 10, and if the trend continues, it may very well trade at a P/E ratio of 5 compared to FY23E earnings. All of this, again, for a bank with very conservative lending practices.

I am usually not extra bullish on any stock but can affirm that BLX is the most undervalued stock I have ever covered for Seeking Alpha.

Note: Unless otherwise stated, all information has been obtained from BLX’s filings with the SEC.

Company overview: a bank of banks

BLX is a private bank whose principal shareholders are Latin American Central Banks, followed by some of the region’s most important commercial banks. The company also trades publicly in the US as an ADR.

The company is domiciled and has its headquarters in Panama. BLX was created in the 1970s with the objective of using the reserves of Central Banks to promote foreign trade in the region.

50% of the Bank’s total deposits come from central banks or their designees (i.e., the Bank’s Class A shareholders), 25% from private sector commercial banks and financial institutions, 15% from state-owned and private corporations and international organizations, and 10% from state-owned banks.

BLX’s portfolio and lending policies

BLX’s portfolio can be characterized using four concepts: conservative, short, dollar-denominated and concentrated.

Starting with conservative, BLX has a history of well-performing loans even under the Great Financial Crisis. For the four years ending in 2021, the company only recorded loan write-offs for $110 million, against lending activity surpassing $40 billion, according to the company’s 20-F for FY21. As of 3Q22, the company has only 0.1% of its portfolio in non-performing status.

The company can record small losses because it has a short-term-oriented portfolio. As of 3Q22, 70% of the company’s portfolio had maturities shorter than 1 year. Short-term lending also provides protection against rate increases because the portfolio can be repriced often.

In terms of currency, BLX is protected from devaluation too. As of December 2021, when the last information was published, more than 95% of the company’s book was dollar-denominated.

Finally, BLX’s portfolio is concentrated in terms of industries and countries. As of 3Q22, 43% of the company’s loan portfolio was concentrated in financial institutions, followed by 10% in O&G, and 7% in utilities. Brazil concentrates 15% of the book, followed by Mexico and Colombia with 12% and 10% respectively. These percentages change quickly, and the company recognizes that it makes strategic allocations.

Operational efficiency

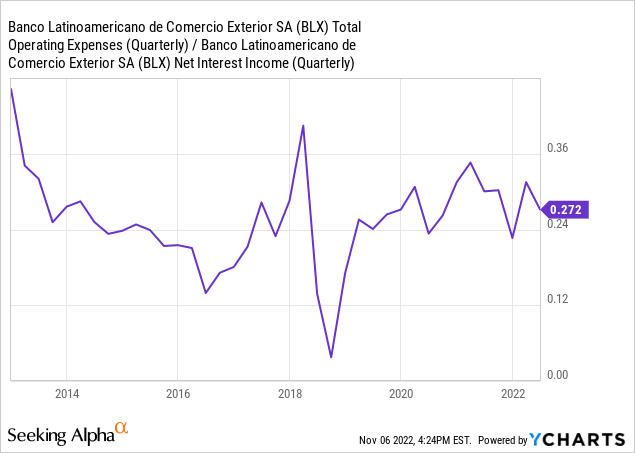

Another interesting aspect is BLX’s fantastic operational efficiency. The company’s expenses over net interest income (the efficiency ratio) have consistently been close to or below 30%. Again, this provides protection because the bank has low operational leverage.

Funding

BLX is financed by deposits and short-term borrowing.

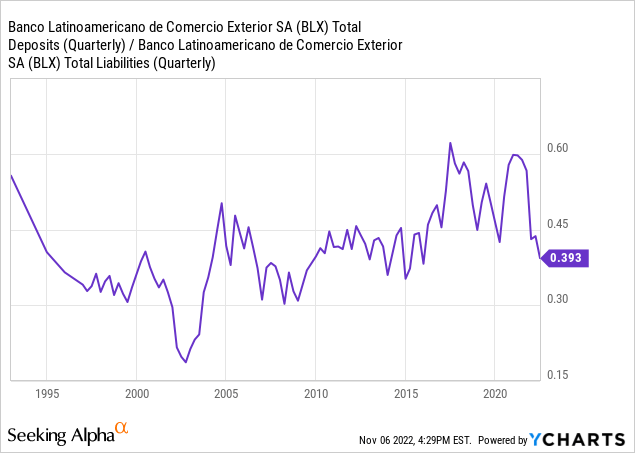

As the chart below shows, historically, less than 40% of the company’s liabilities were financed by deposits. These deposits pay competitive rates and adjust fast, in contrast with retail-based deposits. They are definitely safer in terms of liquidity risks but do not provide a significant cost advantage against other forms of financing.

BLX also funds itself through short-term borrowing. As of 3Q22, approximately 25% of the bank’s liabilities were composed of repo transactions and a remaining 25% of “long-term loans” that have relatively short maturities (two years and a half on average as of December 2021, the latest info available).

Growth and dividends in a complicated context

The past decade was not great for Latin America. Most economies in the region either stagnated or decreased. The main reason behind this trend was the secular bear market of commodities, given that both market-oriented and social-oriented economies, leftist and rightist government countries, all suffered (albeit definitely some more than others).

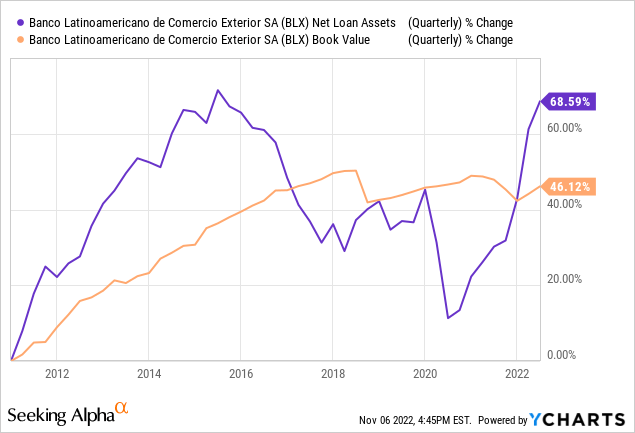

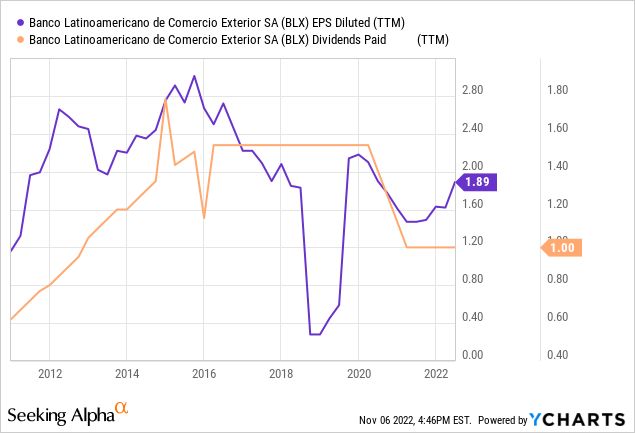

Even under this context, BLX was able to grow and then sustain its book value despite paying dividends consistently. In terms of risk appetite, the company significantly decreased its book after 2016, when many of the regions’ biggest economies decisively shrunk (particularly Brazil, Argentina and Venezuela). The company’s earnings suffered, albeit not to an extreme, and the dividend was reduced.

Investment grade ratings

Finally, BLX has been rated as investment grade (Fitch BBB) for the past 13 years by the main raters, according to the company’s FY21 20-F. This provides another reassurance. The company’s outlooks remain stable under Fitch and S&P, and negative under Moody’s.

Recent developments

As the chart for net loan assets showed, BLX has been rapidly increasing its loan book since the second quarter of 2021. The book has not only reached but surpassed pre-pandemic levels. Most of that increase was financed by additional borrowing rather than deposits, as can be observed in the deposit rate over liabilities in the above sections.

According to BLX’s management, this policy responds to the belief that Latin American countries will benefit from the current bull market in commodities, and that therefore more trade financing is justified.

Margins and spreads have also widened, despite the fall in deposits as a percentage of total assets. BLX’s NIS stood at 1.43% for 3Q22, against 1.17% one year ago and 1.11% for the 9M21 period.

The increase in loans and spreads was unnoticed for most of 2021 and the beginning of 2022 because the company had to record additional loan losses for its bigger book. But since 2Q22, BLX has been posting record quarterly earnings, at least in terms of what was prevalent for the past 5 years. BLX posted net income of $0.63 per share for 2Q22, and $0.73 for 3Q22, against $0.41 for 3Q21 and an average of $0.36 for the 9M21 period.

Risks and valuation

Are these record earnings sustainable? That depends substantially on commodities and the effect they have on foreign trade in Latin America. If commodities remain elevated, increasing trade in Latin America, BLX will be able to sustain an expanded portfolio. Otherwise, it will have to shrink it again.

I am not an expert in commodities, and I am not recommending BLX on the basis of a macro forecast. Rather, I believe BLX’s current share price more than offsets negative developments, while leaving an open opportunity for neutral or positive developments.

First, considering the bank can sustain the same portfolio and spread, it can easily generate $0.85 EPS per quarter. The reason is that the latest quarters have carried increases in loan loss provisions that only occur if the book is growing, but not if the book is stagnant. This scenario could imply yearly earnings of between $2.8 and $3.4 per ADR, against a current price of $15.8 per ADR. With these ratios, it is unnecessary to consider an increase in the loan book or the spreads earned.

On the opposite hand, which negative developments would justify a current price of $15.8? With a loan portfolio that was 22% smaller and a spread that was 26 basis points lower, BLX was generating earnings of $0.41 per share in 3Q21. Annualized, that comes to a current P/E ratio below 10. This means the current price accommodates a significant book and spread reduction.

Catastrophic scenarios are extremely improbable. As I commented, the company has suffered negligible real loan losses and has a short-term, dollar-denominated portfolio. If funding was removed (particularly repos) then the company could simply wind up its loan book. Even considering that all repos are repaid ($2.4 billion as of 3Q22), the company’s loan book would be similar to the one in 3Q21, with the scenario contemplated above.

BLX seems like a classic “heads I win, tails I don’t lose” situation. The stock price seems so disconnected with the business that I tend to fear I am missing something. After significant study, I have not found what that something could be.

Several developments could become catalysts: consistent earnings per quarter above $0.6 per ADR; a dividend increase, currently at $0.25 quarterly; and positive economic or political catalysts in Latin America that increase the market’s interest in the region.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment