Charif Souki, Tellurian Executive Chairman Anthony Harvey/Getty Images Entertainment

Background

Almost 2 weeks ago, I analyzed Tellurian (NYSE:TELL) and rated it a sell on valuation, lack of financing for Driftwood LNG, growing domestic LNG capacity, and international competition. Since then, TELL has declined more than 35% and I feel like it is worth revisiting.

The negatives and risk were sufficiently covered in my previous analysis. However, I feel like TELL’s chairman Charif Souki might have a couple aces in the hole that even the most optimistic analysts have not fully explored.

This discussion will focus on TELL’s high insider ownership; existing permitting; and net present value of the Driftwood project compared to an equal, but unpermitted LNG export project.

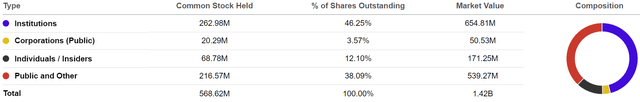

Notable TELL Shareholders

TELL Ownership

Notable TELL shareholders include Vanguard Group, State Street Global Advisors, and Blackrock and each hold about 6% of outstanding shares. International E&P, TotalEnergies SE (TTE), owns almost 4% of outstanding shares while insiders own over 12% of TELL shares.

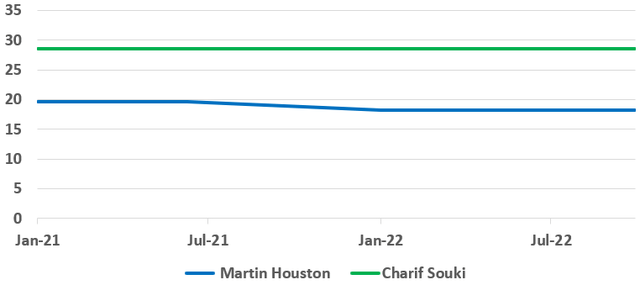

TELL Co-founders: Share Holdings

SEC filings from January 1st of 2021 to present were reviewed and tabulated in a downloadable Excel file. TELL executive chairman, Charif Souki, owns over 28 million TELL shares and according to SEC filings, he did not sell a single share in 2021 or 2022. Tell co-founder and vice chairman, Martin Houston, owns over 18 million shares according to the latest SEC filings and, according to SEC filings, has not sold any shares in 2022.

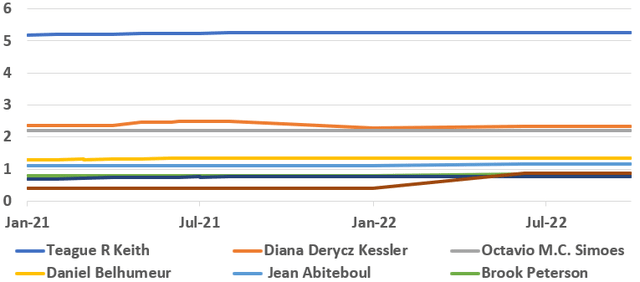

TELL Insiders: Share Holdings

COO Robert Teague currently holds over 5.2 million shares while board member Diana Kessler holds over 2.3 million shares. TELL’s president and CEO, Octavio Simoes, holds 2.2 million shares. Additionally, Daniel Belhumer (general counsel), Jean Abiteboul (board member), and Brook Peterson (board member) hold 1.35, 1.16, and 0.84 million shares respectively.

After completing my bearish analysis of TELL, I would have expected to see a pattern of selling. However, after reviewing SEC filing going back to January 1st of 2021, I found the opposite. TELL insiders are, without exception, not selling and further have generally accumulated shares since January of 2021.

Generally speaking TELL insiders are experienced energy industry professionals and I would not suggest that any one of them is a fool. Therefore, one must ask: why are they holding and even continuing to accumulate TELL shares?

Driftwood LNG Project is Fully Permitted

TELL’s Driftwood LNG export facility is fully permitted after a process that took about 3 years.

Federal Energy Regulatory Commission (FERC) Permit:

- In May of 2016, TELL requested to initiate pre-filing review process.

- In March of 2017, after receiving approval to file, TELL filed its FERC Application

- In April of 2019, TELL received FERC approval after some back and forth on environmental impact statements.

DEPARTMENT OF ENERGY Authorization:

- In September of 2016, TELL applied for an authorization to export LNG.

- In February of 2017, DOE granted TELL a long-term authorization to export LNG to free trade agreement nations.

- In May of 2019, DOE granted TELL a long-term, authorization to export LNG to non free trade agreement nations.

In addition to permitting, TELL has completed front end engineering & design (FEED), awarded an engineering, procurement, and construction (EPC) contract to Bechtel Energy, and issued limited notice to begin construction with FID targeted for 2022.

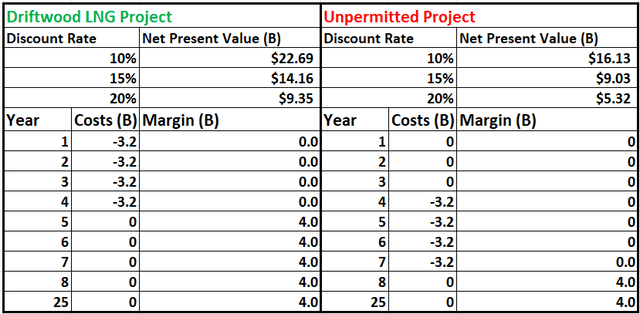

Net Present Value of Fully Permitted Driftwood Project

The fully permitted Driftwood LNG export project is the key to unlocking TELL value and price return. Even without financing, the fully permitted project may hold value for an international energy company interested in a head start on LNG exports or an energy poor country seeking to guarantee natural gas supplies. Since permitting took about 3 years, I would argue that TELL’s permits can be valued with a straight forward net present value calculation based on some simple assumptions.

Assumptions:

- The calculation is based on 25 years.

- Driftwood revenue begins in year 5.

- Unpermitted project revenue begins in year 8.

- Each project will take 4 years to complete at a cost of $3.2B in each year.

- After completion, each project will generate margin of $4B/Yr.

- Discount rates of 10%, 15%, and 20%

Net Present Value: Driftwood vs Unpermitted

With discount rates of 10%, 15%, and 20% the net present value Driftwood was $6.6B, $5.2B, and $4B greater than the unpermitted project. The complete calculation is available in a downloadable Excel file.

Risks

The risks surrounding TELL were painfully discussed in my previous analysis. However, some investors may need to be reminded that the bottom for any share price is always zero. Although Vanguard Group, State Street Global Advisors, Blackrock, and Total Energies all hold 4-6% of outstanding TELL shares, TELL remains high risk.

TELL has a long history of missing deadlines for both securing financing and beginning construction. So far, TELL has missed perhaps the most profitable period in which to export LNG. Without financing, the Driftwood project will remain unbuilt and TELL will remain a severely overvalued, small natural gas producer.

Conclusions and Recommendations

On September 20th (in a YouTube video), TELL CEO Charif Souki said the company will continue to seek equity partners to help finance the Driftwood LNG project. Given the time required to permit a similar project, the unbuilt, but fully permitted Driftwood could be worth as be worth $4B to $6.6B to a potential equity investor or roughly 3 to 5X TELL’s current market cap of $1.36B.

Although TELL remains high risk, Charif Souki and other insiders are not liquidating their shares. I believe that Driftwood’s permits are their aces in the hole and that the project could attract investors who are willing and able to provide financing.

Since my last analysis, TELL shares have declined almost 40% and I believe their risk has been substantially reduced. Some investors may have a place in their portfolio for a high risk investment like TELL. I recommend those investors buy TELL at current market prices.

Be the first to comment