killerbayer/iStock Editorial via Getty Images

Investment Thesis

The A1 Telekom Austria Group (OTCPK:TKAGY), or Telekom Austria, is one of the largest Austrian and Central East European telecom service and equipment provider. Having most of its business in Austria, since its restructuring in 2016, Telekom Austria has expanded through CEE regions. This expansion deliberately targeted less developed European countries with a hope that they would outpace the growth of the rest of the developed Europe and also require lower relative investments for the expected returns. In the same time, this expansion policy meant that new risks were brought into its business model. One of those has significantly higher probability of being materialized in a form of the forced abandonment of its Belarus operations, which has also been reflected in Telekom Austria’s market price. However, Telekom Austria was a technological pioneer in this part of Europe in expanding 5G network and also building its tower infrastructure. The latter being its hidden asset, which might be of more value than one could assume.

Business Overview

Telekom Austria is now a far cry from the image and results it was achieving only 7 years ago. Since early 2000s, predecessors of current Telekom Austria made a series of corporate blunders in an attempt to restructure themselves from once state owned company to the current publicly listed private entity. Failed rebranding as Jet2Web, separation and later again merging of their mobile and fixed telephony business, this period was crowned with a so called “Telekom Affäre” where, among other fraudulent behaviors, Telekom Austria’s share prices were manipulated in order to meet the bonus targets of the highest level management.

As of April 2014, the situation had changed. In agreement between America Movil (AMX) and ÖBAG (Austrian State Wealth Fund), majority ownership of Telekom Austria was sold to America Movil (51% stake). Remaining shares were distributed between the public and ÖBAG (28.42% stake).

“Since then, Telekom Austria, with its primary listing on the Vienna Stock Exchange, became a leading provider of digital services and communication solutions in the CEE region, with approximately 25 million customers in seven core markets (Austria, Bulgaria, Croatia, Belarus, Slovenia, Serbia and North Macedonia). In addition, Telekom Austria has established itself as a digitization partner in Switzerland and Germany in segments such as IoT, cloud and security solutions. The group now offers mobile and fixed line telecommunications, broadband internet, integrated ICT and business solutions, payment, multimedia and entertainment services, as well as wholesale and payment solutions.” – Source

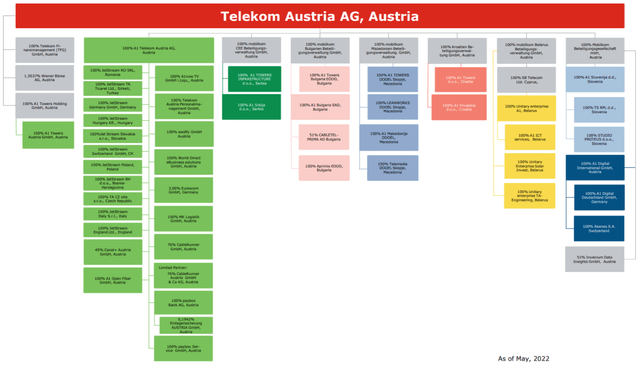

In light of the current crisis and potential risk of being forced to leave Belorussia, it’s important to note the legal background of the Telekom Austria corporate structure. Namely, presence in each of the seven core markets is executed through limited liability entities, effectively limiting the potential losses from each of the entities up to the limit of the invested equity from an accounting point of view, and future expected cash flows from a valuation point of view.

Telekom Austria Group Structure (Company Website)

Telekom Austria business generates most of its revenue through telecommunication services, either towards mobile or fixed line clients. A minor portion is generated through equipment sales and thought other activities which currently include rental income, solar energy production and lease of its tower assets to third parties.

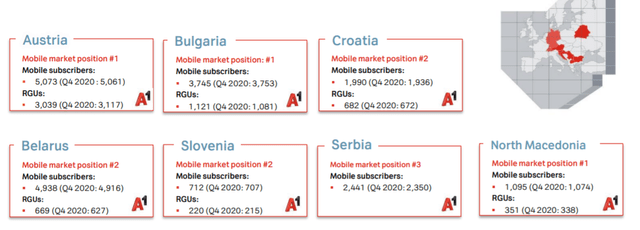

Telekom Austria is the largest or second-largest telecom company in all the countries it operates.

Telekom Austria Market Share (Q1 2022 results presentation)

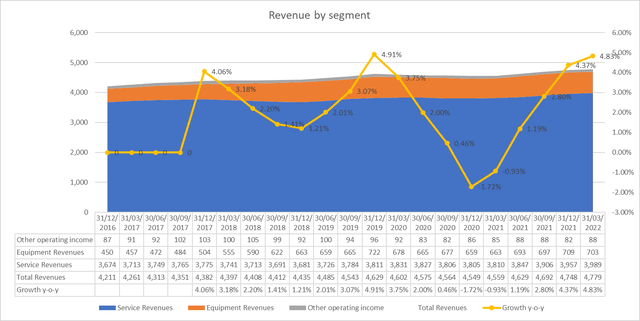

Since 2016, revenue has grown constantly, averaging just above 2%. The biggest impact on revenues so far came with lockdowns of 2020 which drastically reduced the number of tourists in Austria and Croatia, and thus reduced roaming charges.

Trailing 12 month revenue development (Author’s Calculations)

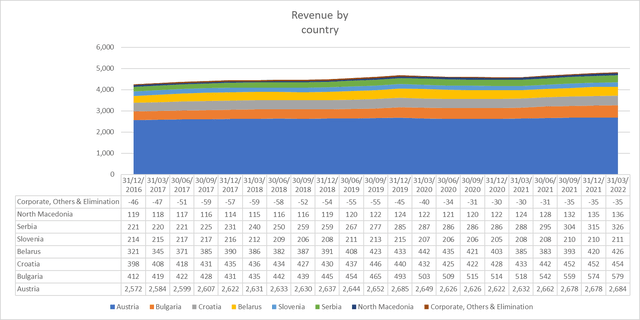

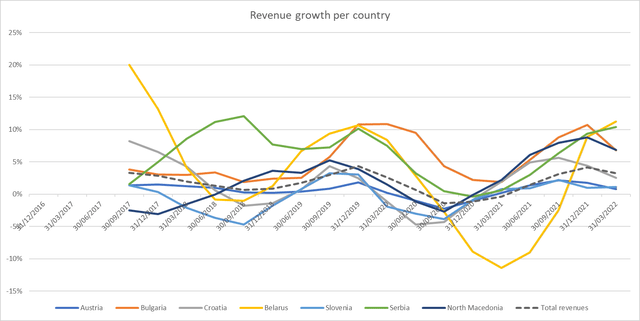

As for the revenue development per countries in which it operates, the impact of 2020 lockdowns is visible in the figures below (both on absolute and relative growth rate levels).

Trailing 12 month revenue per country of operation (Author’s Calculations)

Trailing 12 month year on year growth (Author’s Calculations)

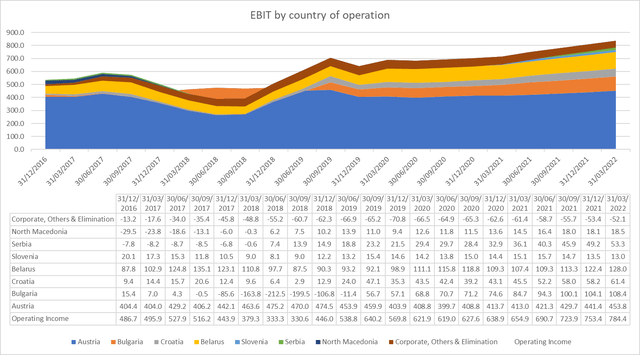

The remarkable achievement in Telekom Austria development since 2016 came in a form of increase in overall efficiency, and rapid expansion of its operating income in all countries.

Trailing 12 month operating income by country of operation (Author’s Calculations)

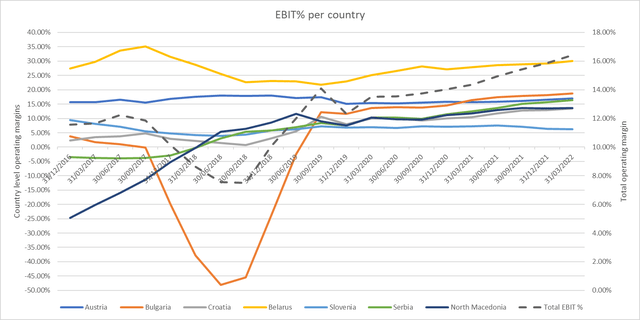

Results in operating margins show how Telekom Austria has steadily grown into mid-teens margin business over time. Noting that Belarus is a unit with the highest operating margin (please note that the consolidated Group EBIT margin is plotted on secondary axis on a figure below).

Operating margin per country of operation (Author’s Calculation)

Debt levels and capital expenditure are mentioned in the next section.

Peer Comparison

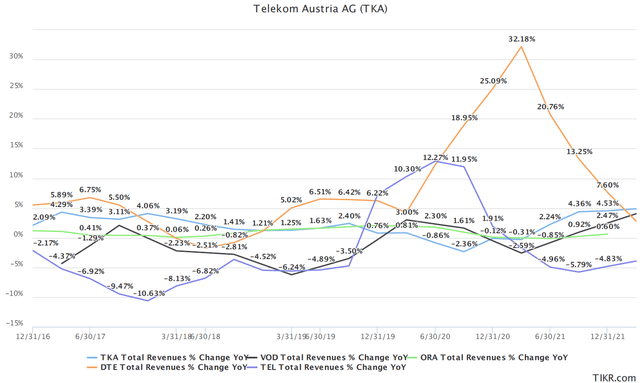

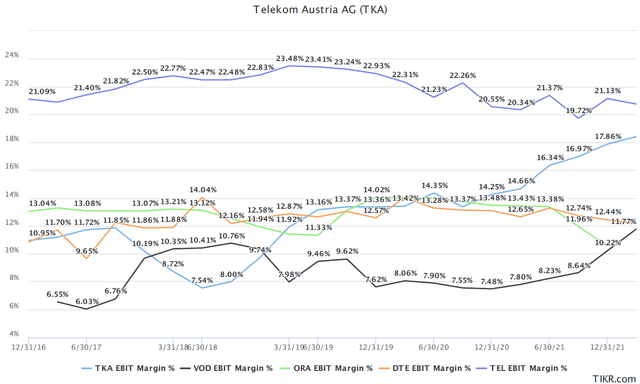

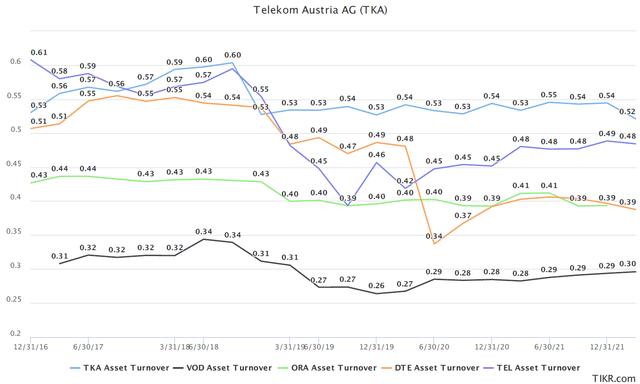

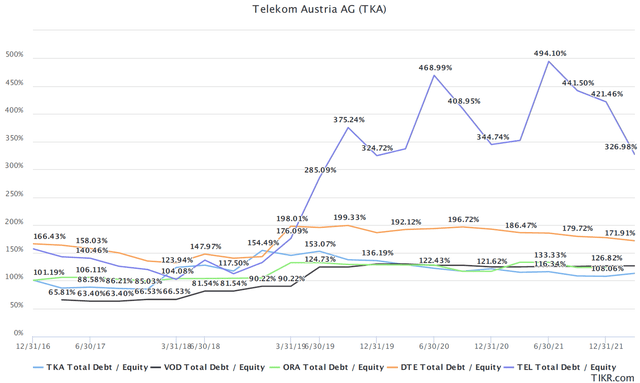

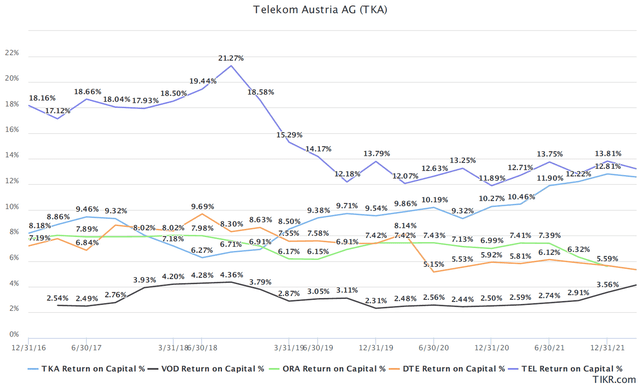

I used Orange (ORAN), Deutsche Telekom (OTCQX:DTEGY), Vodafone (VOD) and Telenor (OTCPK:TELNF) (OTCPK:TELNY) as relevant peers to better understand Telekom Austria history.

Unsurprisingly, the majority of telecoms show similar revenue development paths over the last six years. Outlier being Deutsche Telekom and their USA operation. As shown in business overview, part of Telekom Austria revenue volatility is caused by its Belarus branch and volatility of local currency.

Revenue growth rates peer comparison (tikr.com)

From a point of view of the operating margins, Telekom Austria slightly outperforms its peers, especially in later period. As we have seen before, it is Belarus again being the most income efficient part of the group. But even excluding it, it would decrease Telekom Austria’s operating margin to slightly above 15%.

Operating margins peer comparison (tikr.com)

Asset turnover, or sales to capital ratio, is surprisingly high relative to its peers. One way to look at this number is as how much of capital (debt and equity) need to be invested in order to maintain current level of revenues. One of the ways Telekom Austria has profited from expansion in Central and Easter Europe is that due to the relative faster development of its focus region compared to already developed economies. Its capital expenditures tend to produce higher returns over their lifetime, as the level of standard of living in those countries grows slightly faster than in developed economies.

Sales to capital peer comparison (tikr.com)

Same as for other telecom companies, infrastructure investments needed for the rollout of 5G networks required significant increase in financial leverage, making them inherently riskier business. Worse still, benefits from 5G are still to be seen in the income statements of the telecom companies. As things stand now, once again investment cost in infrastructure was borne by telecoms, but rewards will be collected by others.

Financing structure peer comparison (tikr.com)

The former point, on operating and capital allocation efficiency, has also reflected on the achieved returns on capital. For the same level of financial leverage, Telekom Austria is able to achieve much better results than its peers.

ROIC peer comparison (tikr.com)

As visible, its transformation since 2014 has created value.

Recent Developments

The latest release of Telekom Austria results provided some assurances for the future, while also leaving the most important question unanswered.

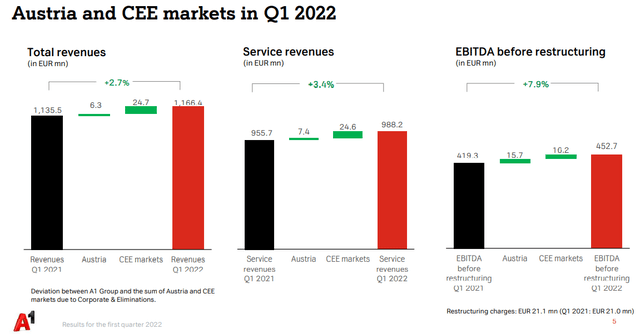

On a positive note, service revenues (roughly 85% of their revenue) have grown more than usually historically, but this was expected due to depressed values of 2021 and missing roaming revenue.

Q1 2022 results (Q1 2022 results presentation)

Operating income grew in all regions except North Macedonia, which is the smallest of their operating regions.

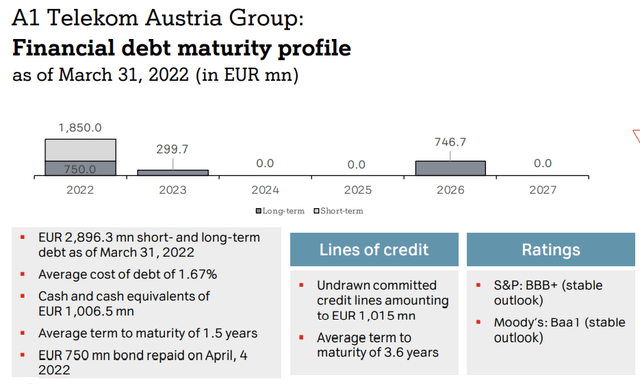

This has led to the highest cash reserves Telekom Austria had in its history. As of Q1 2022, Telekom Austria had over EUR 1.1 billion in cash and cash equivalents and short term investments. To put this into perspective, its market capitalization is EUR 4.8 billion, while enterprise value is EUR 6.8 billion.

In addition, EUR 750 million of debt through bond (25% of outstanding debt) yielding 4% was repaid through cash and bank loans, securing cheaper financing and greater flexibility for the uncertain future. The exact amount of own cash to retire this debt is unknown.

Financial debt maturity profile (Q1 2022 results presentation)

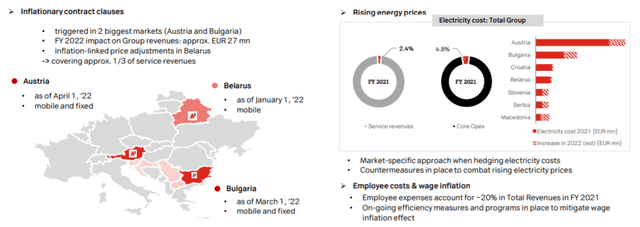

Still, on a positive side, steps were taken to adjust the pricing to the inflation. Although I will talk about their exposure in Belarus as a source of risk, it now seems to have been also a good training ground for hedging against inflation and currency risks (average inflation in Belarus up to 2020 was close to 10% per annum).

Inflation adjustments (Q1 2022 Results Presentation)

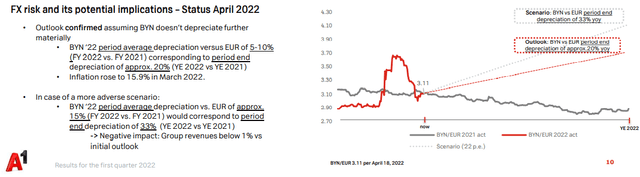

Belarus ruble exposure is actively managed and hedged, thus limiting the most adverse impact on Group revenues to -1%.

FX hedging of Belarussian RUB (Q1 2022 results presentation)

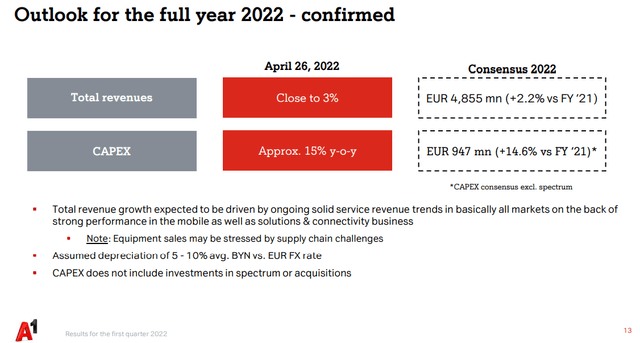

Since 2021 saw a decrease in CapEx, plans are set in place to increase it again to the levels before Covid-19 crisis. These immediate forecasts will also be included in my DCF.

Outlook for 2022 (Q1 2022 results presentation)

Risks

For any other telecom companies, the biggest risk in current global environment would whether intensive capital investments in 5G network deployment would lead to returns in line with their historical averages. However, the geopolitical situation has converted Telekom Austria from a predictable business to an almost speculative investment.

Telekom Austria is the largest telecom service provider in Belarus and currently there is a high global and local pressure in Austria to leave this market. Although orderly exit from the market sounds like a feasible option, possibilities to leave this country are limited. Finding a local buyer for its operations is not an easy task, simply due to the size of Telekom Austria in Belarus (second in size only to state owned Beltelecom).

In the same time, risk of potential nationalization of Telecom Austria infrastructure and operations is real in case that the conflict further escalates and Belarus takes more active role in war against Ukraine.

From an accounting point of view, total loss of the business in Belarus would result in a loss up to the level of equity invested in the limited liability entity operating there. In absolute amount, this would be close to EUR 1.45 billion (against current trailing 12 month net income of EUR 476 million).

Group Equity Holdings (2021 Annual Report)

The more important effect would come from loss of future cash flows, which I will analyze in the valuation section.

Hidden Asset

Before turning to the DCF, it is important to consider one more element which could affect the value proposition of Telekom Austria. Like many telecoms in Europe, it too has taken steps to increase monetization of its tower assets (masts and antennas) which have so far been mostly used in limited capacity to service its own needs. Unlike its USA counterparts, European telecom companies have only just recently started to either spin off or sell their tower assets.

Telekom Austria announced at the end of 2020 that it started to search for the alternative organization approach that would allow reaping more benefits from its tower assets through a targeted management focus on internal efficiencies and higher tenancy ratios. In 2021, the Group established an organization for its towers business, and carved-out the towers in Bulgaria and Croatia (with no impact on the segments).

Based on what is communicated in the local media, a strategic alternative is being searched for all tower assets except those located in Belarus. Put in numbers, a total of some 7,900 masts are located in Austria and 7,100 in other regions (based on some estimates, 1,100 transmission mast are located in Belarus).

Although not openly communicated in media, pressure to monetize the assets must be coming from America Movil, as it has done the same with its own Latin American towers. However, there is a strong political opposition arguing that this critical infrastructure was built by Telekom Austria before America Movil took majority ownership and that the sale of the critical infrastructure would not be in the best interest of ÖBAG and Austrian state.

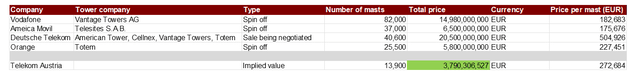

Nevertheless, it is worthwhile exploring what this value could be. Although the appropriate approach would be to discount future cash flow of the tower assets, I took a shortcut here out of convenience and I focused on the public information available on similar transactions. A similar topic was already written about on Seeking Alpha. The table below shows the outcomes.

Pricing of tower assets (Author’s Calculation)

If one would to calculate the potential value based on simple average of negotiated and available values of spun off business and number of masts operated by each, a price of close to EUR 3.8 billion would be implied.

Whether this will still be an entity owned by Telekom Austria as a majority stakeholder or completely sold and removed from the books remains to be seen. In long term, this should at least decrease capital investments of Telekom Austria below the level that would have to be paid for utilizing the infrastructure sold.

In case that this option is truly considered in the future, I would revisit my valuation. For now, I would rather take it as a significant cushion against potential loss of Belarus unit.

Intrinsic Valuation Assumptions And Considerations

To calculate the fair value of Telekom Austria, I used a three-stage discounted free cash flow model, assuming the following stages of development:

- Higher than historical growth in revenue due to increased inflationary adjustments followed with more intensive capital investment period.

- Revenue growth slowdown to the level of inflation in services sector and normalization of capital investments.

- Stable growth in line with the long term inflation expectation.

The company’s operating cash flows were valued as a going concern and discounted back at an estimated cost of capital. Cash and cash equivalents were added back, minority interest, and the market value of debt and leased properties were taken out to arrive at a total value of equity. Total equity value was then divided by the current total number of shares outstanding to obtain an initial value per share.

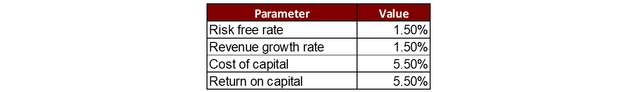

The following are the assumptions I used in the intrinsic value calculation for them:

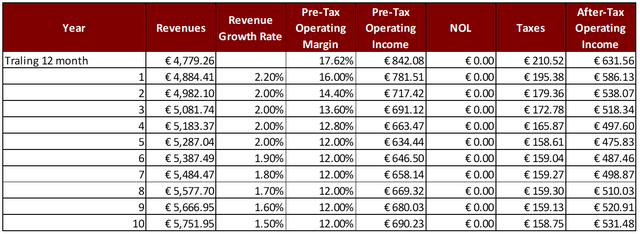

Revenue Growth

For next year, I will use the expectations of 2.2% growth provided by the management. However, in my Belarus exit scenario, revenues would decrease by -8.91%. In midterm, I would then expect the revenues to grow by 2% each year, converging to my long term expectation of the inflation rate in Europe of 1.5%.

Target Operating Margins

As shown, Telekom Austria operates with high margins, however out of caution I would expect the margins to converge to the industry average of 12%. Loss of Belarus would also impact the Group consolidated operating margin by roughly -1%, although I would assume that the convergence to 12% would hold in this scenario also.

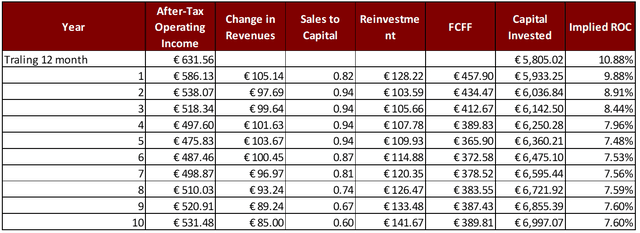

Reinvestment Assumptions

Measured through the sales to capital ratio, where capital is equal to the sum of total equity and interest bearing debt, I started from the current state of Telekom Austria and then assumed that 15% increase in capital expenditure would be required in midterm for a successful rollout of 5G. This translates to 0.94 sales to capital ratio. In the long term though, after this capital investment cycle is over, I would expect that the ratio will fall back to its long run average of 0.6.

Cost Of Capital

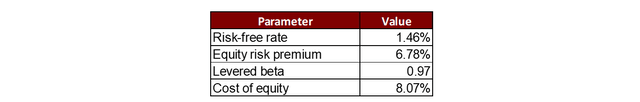

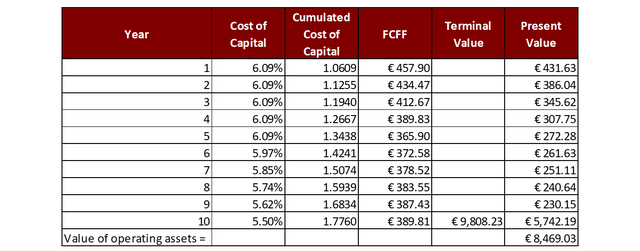

For cost of capital, I estimated cost of equity from the market-implied equity risk premium and I added a regional risk spread (largely based on CDS spreads) based on where revenues were earned. I used an average bottom-up business beta from telecom services and equipment companies and then levered the beta to Telekom Austria’s own adjusted debt/equity ratio. Equity risk premium was calculated as revenue weighted average of risk premium for each of the countries in which Telekom Austria operates. Multiplying the equity risk premium by the computed beta and adding it to the risk-free rate sums to a total cost of equity. The estimation was performed using June 24, 2022 values.

Cost of equity (Author’s Calculation)

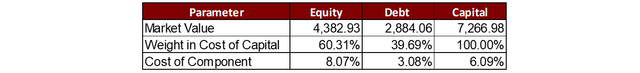

Cost of capital is then derived as the weighted average of cost of equity and cost of borrowing net of tax, based on ‘BBB+’ credit rating (note that I subtracted EUR 750 million of debt repaid after Q1 2022 assuming cash repayment):

Cost of capital (Author’s Calculation)

Terminal Cash Flow Value

For value of the terminal cash flow, the following assumptions were used:

Terminal Value Assumptions (Author’s Calculations)

In case of Telekom Austria terminal value, my only expectation is that it will be a value neutral business. It will grow with the risk-free rate and earn its cost of capital.

Valuation Results

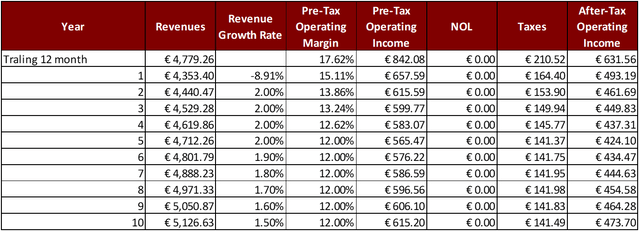

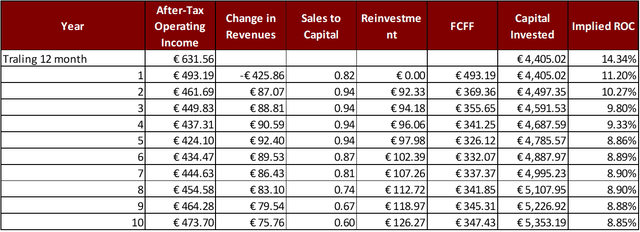

Values projected and discounted by these assumptions are the following:

In my base case, I assumed that revenues will grow slowly, but consistently over the next ten years and beyond. In the same time, I would expect for operating margin to contract to the industry level, since there is no strong argument or competitive advantage that Telekom Austria possesses to similar relative size telecom operators.

After Tax Operating Income Forecast – Baseline Scenario (After Tax Author’s Calculation)

Over the same period, I assumed that additional EUR 1 billion will have to be invested to fund this modest growth. Note that since I am creating my forecasts of cash flows from operating income, I implicitly assume that depreciation is a cash expense. In the case of Telekom Austria, this amounts to roughly EUR 850 million per year. As a result, some EUR 10 billion in total are assumed to be invested over the next 10 years to maintain its business.

Free Cash Flow to the Firm Forecast – Baseline Scenario (Author’s Calculation)

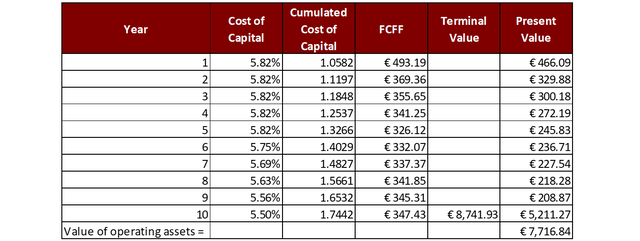

With my assumptions for cost of capital (decreasing as economies in which Telekom Austria operates develop), total value of its operating assets is EUR 8,469 million.

Discounted Cash Flows – Baseline Scenario (Author’s Calculation)

From this value, I then subtract the present value of its remaining debt of EUR 2,853 million, minority interest of EUR 2.2 million, and I add back the cash and cash equivalents (after April 2022 debt repayment) of EUR 256 million. Resulting is the value of equity of EUR 5,870.11. Using the current share count of 664.08 million, this implies a fair value per share of EUR 8.84. The stock was trading at EUR 6.46 at the time of this analysis. To put it in relative terms, if you agree with my assumptions of future cash flows and risks, current price would imply an internal rate of return of 8.03%.

However, the story of Telekom Austria does not end there. In case of the scenario of disorderly exit from Belarus (nationalization and total loss to the level of equity), following results are obtained for the value of the operating assets.

As I mentioned, some 9% of revenue will be lost and operating margin will contract also.

After Tax Operating Income Forecast – Exit Scenario (Author’s Calculation)

In the same time, exit would decrease the reinvestment amount and total invested capital.

Free Cash Flow to the Firm Forecast – Exit Scenario (Author’s Calculation)

More importantly, exit from the troubled and risky country would also reduce the average cost of capital of the remained of the Group, having positive impact on the value of the cash flows.

Discounted Cash Flows – Exit Scenario (Author’s Calculation)

As a result, value of the operating asset would decrease to EUR 7,716 million. Subtracting the debt, minority interest and adding back the cash would result in the fair value of remaining equity of EUR 5,117.92 million. Again this translates to EUR 7.71 per share or internal rate of return of 6.68%.

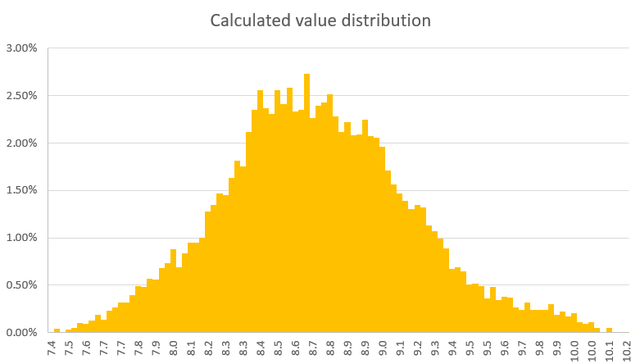

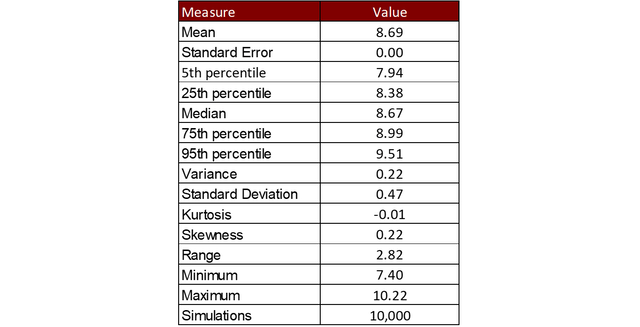

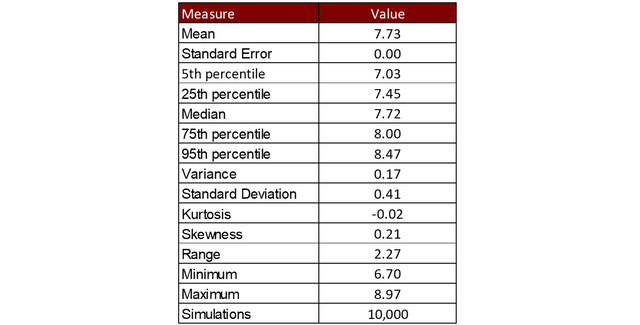

For both scenarios, baseline and disorderly exit, I also ran simulations. With slightly different assumptions. In baseline scenario I would make the result of the whole group more volatile as Belarus is a constant source of the variability in bottom line.

In case of baseline scenario, I would assume that in midterm revenue growth can vary between -1% and 3% using triangular distribution around 2% and allowing for higher likelihood of adverse developments due to the Ukrainian conflict. In a disorderly exit scenario, volatility in revenue of the remaining business would decrease, and it would vary around 2% with a standard deviation of 0.25%, normally distributed. Also in both scenarios I would allow my terminal risk-free rate to vary around 1.5% using normal distribution with 0.30% standard deviation. It is worth noting that both terminal growth rate and cost of capital are a function of my expected terminal risk-free rate, so they vary together.

Simulation Results – Baseline scenario (Author’s Calculation) Simulation Summary – Baseline scenario (Author’s Calculation)

In case of disorderly exit scenario, outcomes are the following.

Simulation Summary – Disorderly Exit Scenario (Author’s Calculations)

Summary

I own Telekom Austria, and I am deeply biased whenever I approach its valuation, since I purchased it initially so that it would provide a stable and growing dividend stream in my portfolio. It was supposed to be a boring element of my portfolio I would need to revisit only sporadically. However, its narrative has changed, although business of telecom companies remains robust as always. Whether you forecast a recession or soft landing, or something third a year from now, you will most likely be reading about it using either a mobile network or broadband internet connection, and you, like almost everyone else, will be paying your bills. I will not be increasing my position in Telekom Austria, and hence I can only recommend to hold it if you have it. I acquired Telekom Austria at EUR 5.4 a few years ago. On one side, I am aware that a lot more can go wrong with current Belarus exposure. On the other side, hidden assets it holds could add close to EUR 2 or EUR 3 per share if monetized to full extent. I fear the former, and hope for the latter.

Call For Comments

What is your view on the future development of Telekom Austria? Do you think that potential spin-off of the tower asset business can help Telekom Austria in the long term, and how? What other cost you see in staying or leaving Belarus market? Express your opinion, provide alternative assumptions and different opinions in the comment section below, and I will happily rerun my analysis using your inputs.

Be the first to comment