Marko Geber/DigitalVision via Getty Images

Introduction and Thesis

Once beloved by Mr. Market, Teladoc Health, Inc. (NYSE:TDOC) used to be one of the favorites during the pandemic. However, in the past few months, Mr. Market has heavily punished Teladoc in anticipation of decreasing growth as pandemic restrictions end. The recent decline has caused the company’s valuation multiples to fall to reasonable levels.

Thus, in a previous article, I was bullish on Teladoc as valuations, financials, and fundamentals were favorable. Since then, the company has released its quarterly earnings and a full year update reporting a continuation of financial and fundamental strength increasing. Teladoc’s operations are getting more efficient while sustaining growth as the company nears profitability.

Therefore, considering the improving valuations, financials, and fundamental strength of the company, I believe Teladoc is a strong buy.

Teladoc’s Position in a Growing Market

Telehealth is becoming more prominent as consumers and employers realize the value of telehealth fueled by the pandemic. Further, the massive shift in the age demographics of the developed world, including the United States, provides a long-term and growing demand for flexible healthcare systems. Therefore, I continue to believe that the market in which Teladoc operates is growing.

Changing Age Demographic

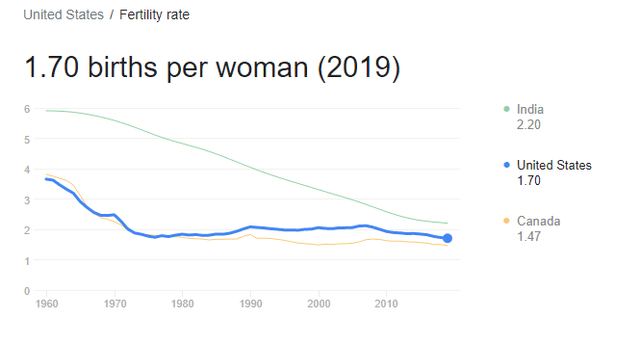

The physician shortage is expected to worsen until 2034, when the shortage is expected to be about 100,000 physicians. The primary cause of this phenomenon is the aging population. To maintain a population level, a birth rate of 2.1 per woman needs to be maintained. However, as the chart below shows, the U.S. birth rate has been consistently below 2.1. In fact, the U.S. birth rate has fallen below 1.7 levels. This creates problems, since average U.S. life expectancy continues to increase.

As a result of a lower birth rate and a higher life expectancy, the population will naturally get older, creating more demand for healthcare services. With a population of fewer potential physicians, the healthcare worker shortage will likely get worse.

I believe this trend will be favorable for Teladoc as the company is the leader in providing telehealth services ranging from primary care, chronic care, and mental health care. The company provides whole-person healthcare as Teladoc strives to become the first doorstep to the healthcare industry. For an aging population familiar with the use of technologies, it may be easier to use Teladoc’s services first before visiting a physical doctor since telehealth is more accessible and require no wait times and traveling.

Telehealth

I believe the pandemic has fueled the adoption of telehealth, creating a permanent trend. This is because it is most logical for most patients to use Teladoc’s services.

In the case of mental health patients, a significant amount of therapy can be done online in the privacy of the patient’s home. The patient will not need to wait or travel before his or her reservation time.

Further, in the case of chronic care, the patient will be able to update physicians on his or her ongoing conditions possibly aided by at-home technologies including remote vital monitoring, thermometer, digital otoscope, virtual stethoscope, and more before receiving the patients’ prescription. If the patient can not receive proper care online, then the telehealth physician can simply refer the patient to his or her local hospital.

For all patients, especially older patients, this model, in my opinion, creates an easier and more accessible form of health care. Therefore, I believe that telehealth becoming the first pathway for consumer healthcare may be a possibility in the near future.

Financials

Before talking about the improvements the company has shown during the past quarter, I will quickly discuss the company’s earnings results.

On top of its strong earnings report, the company made meaningful progress to achieve net profits in the coming quarters. First, the interest expense relative to the revenue dropped sequentially from 3.6% in 2021Q3 to 3.4% in 2021Q4 while the adjusted gross margins increased to 68.4% from 67.6%. These improvements were the result of operational efficiencies and continual cross-selling improvements. The management team during the earnings call said that “the percentage of chronic care members enrolled in more than one program has doubled over the prior year,” showing strong cross-selling momentum.

Further, the company’s stock-based compensation showed a significant sequential decrease from $71.701 million to $61.615 million, which decreased the SBC as a percent of revenue from 13.8% to 11.33%. Overall, Teladoc is becoming more efficient and now operates at a near break-even level, setting up a strong foundation as the company eyes profitability in the coming quarters.

Achieving higher margins while reducing interest, expenses, and SBC shows the improving strength of Teladoc and the improving operational efficiencies. Teladoc reported a net loss of about $10 million, which was a massive improvement from about $394 million loss in 2020Q4. Therefore, given this data and proof of improvements, I believe Teladoc is nearing profitability in the coming few quarters.

In its balance sheet, Teladoc has about $893 million in cash with total assets of $17.7 billion. The company has very low debt and liabilities levels; total liabilities are about $1.7 billion, making the total liability to asset ratio (L/A) extremely low at about 9.6%. Given that the company’s operations are growing more efficient as Teladoc nears profitability, I believe the company’s financial health is in great shape.

Risks

Teladoc is a telehealth company operating in the healthcare industry, which is an extremely fragmented industry. Clinics, hospitals, equipment, and other factors are not all controlled by a single conglomerate. One explanation for this may be that consumers are not loyal to certain hospitals or medical products as long as they do their job. Similarly, if a strong telehealth competitor arises with competitive pricing, customers will most likely not be loyal to Teladoc, affecting the company’s prospects. Thus, despite Teladoc’s industry leadership today, competition risks remain.

Further, the adoption of telehealth may pose its own risks. Consumers may not feel confident that they will receive the optimal healthcare service online, leading to a fairly small percentage of the population utilizing telehealth, contrary to bullish predictions.

Summary

Teladoc is becoming more and more attractive over time. As per my last article, the company’s valuation is favorable. After the earnings report, Teladoc showed that the company’s operations are becoming far more efficient while continuing growth nearing profitability. Finally, the fundamental strength of Teladoc’s telehealth service continues as the age demographic shift has been and is occurring, which will have positive ripple effects for Teladoc for years to come. Therefore, I believe Teladoc is a buy.

Be the first to comment