nespix/iStock via Getty Images

A Quick Take On SAFG Retirement Services

SAFG Retirement Services (CRBG) has filed to raise an undisclosed amount, which could be as high as $3 billion in an IPO of its common stock, according to an S-1 registration statement.

The firm provides retirement services and life insurance products to consumers.

With the ‘baby boomer’ generation retiring in large numbers, CRBG is well positioned to grow for years to come.

I’ll provide an update when we learn more about the IPO from management.

Company

Houston, Texas-based SAFG was founded as part of insurance giant AIG to provide consumers with retirement solutions and insurance products.

The company will be rebranded as Corebridge before the completion of the public offering.

Management is headed by Chief Executive Officer Kevin Hogan, who has been with the firm since December 2014 and previously held a variety of positions at AIG or Zurich Insurance Group since 1984.

The company’s primary offerings include:

-

Individual Retirement

-

Group Retirement

-

Life Insurance

-

Institutional Markets

SAFG has booked fair market value investment of $8 billion as of December 31, 2021 from parent firm AIG.

SAFG – Customer Acquisition

The company provides various annuity and other retirement products through distribution relationships with financial advisors, insurance plan sponsors, insurance agents, both externally and through its direct-to-consumer platform.

Recently, the firm has announced a strategic partnership with Blackstone to manage a portion of its investable assets.

General Operating expenses as a percentage of total revenue have fallen as revenues have increased, as the figures below indicate:

|

General Operating |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

9.0% |

|

2020 |

13.5% |

(Source)

The General Operating efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of General Operating spend, was 4.0x in the most recent reporting period. (Source)

SAFG’s Market & Competition

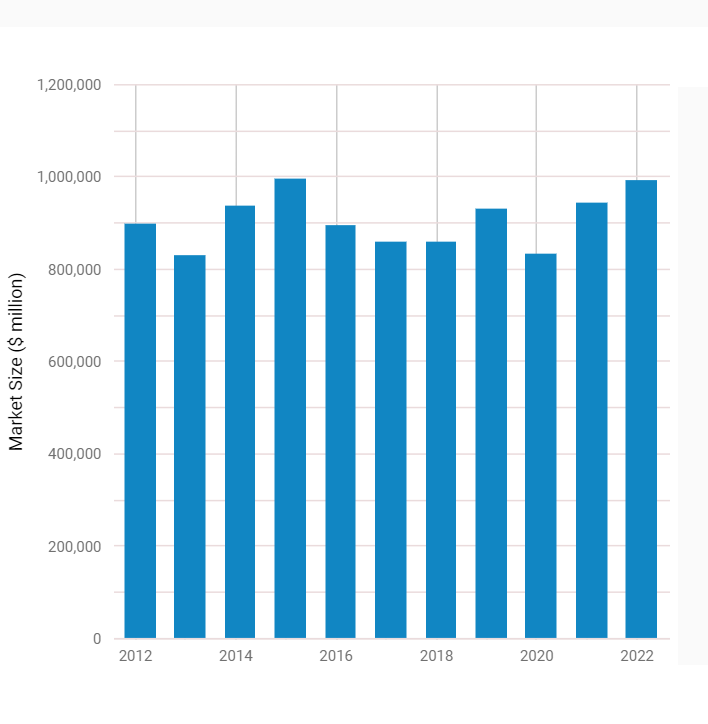

According to a 2022 market research report by IBISWorld, the U.S. market for life insurance and annuities is expected to reach $995 billion in 2022.

This represents an annual growth of 5.1% from 2022.

The average annual five-year growth rate is an estimated 2.9% from 2017 to 2022.

Also, below is a chart showing the historical and projected growth trajectory of the U.S. life insurance and annuity market:

U.S. Life Insurance And Annuity Market (IBISWorld)

Major competitive or other industry participants include:

-

John Hancock

-

Lincoln Financial Group

-

MetLife

-

Nationwide

-

New York Life

-

Prudential

-

TIAA-CREF

SAFG Retirement Services Financial Performance

The company’s recent financial results can be summarized as follows:

-

Sharp growth in topline revenue

-

Much higher revenue net of policyholder benefits and interest

-

High operating and net profits

-

Reduced cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 23,390,000,000 |

55.3% |

|

2020 |

$ 15,062,000,000 |

|

|

Revenue Less Policyholder Benefits And Interest |

||

|

Period |

Revenue Less Policyholder Benefits And Interest |

% Variance vs. Prior |

|

2021 |

$ 11,791,000,000 |

139.1% |

|

2020 |

$ 4,932,000,000 |

|

|

Revenue Less Policyholder Benefits And Interest Margin |

||

|

Period |

Revenue Less Policyholder Benefits And Interest Margin |

|

|

2021 |

50.41% |

|

|

2020 |

32.74% |

|

|

Profit (Loss) Before Income Taxes |

||

|

Period |

Profit (Loss) Before Income Taxes |

Operating Margin |

|

2021 |

$ 10,127,000,000 |

43.3% |

|

2020 |

$ 851,000,000 |

5.6% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

2021 |

$ 7,355,000,000 |

31.4% |

|

2020 |

$ 642,000,000 |

2.7% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

$ 2,461,000,000 |

|

|

2020 |

$ 3,327,000,000 |

|

(Source)

As of December 31, 2021, SAFG had $537 million in cash and $387 billion in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was $2.5 billion.

SAFG Retirement Services IPO Details

SAFG intends to raise an undisclosed amount, which could be as high as $3 billion in gross proceeds from an IPO of its common stock.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says that all IPO proceeds will go to the parent firm and SAFG will receive no proceeds from the offering. (Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm is subject to various financial guarantees and indemnity commitments and is ‘unable to develop a reasonable estimate of the maximum potential payout under certain of these arrangements. Overall, we believe that it is unlikely we will have to make any material payments related to completed sales under these arrangements, and no material liabilities related to these arrangements have been recorded in the Consolidated Balance Sheets.’

The listed bookrunners of the IPO are J.P. Morgan, Morgan Stanley and Piper Sandler.

Commentary About SAFG’s IPO

CRBG is seeking to go public as it spins out of parent firm AIG.

The company’s financials have shown sharp growth in topline revenue, increasing revenue net of policyholder benefits and interest, substantial operating and net profits but lowered cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021, was $2.5 billion.

General Operating expenses as a percentage of total revenue have dropped as revenue has increased markedly; its General Operating efficiency multiple was 4.0x in 2021.

The firm currently plans to pay quarterly dividends on its shares in the range of $400 million to $600 million, although the final amounts will depend on a variety of factors such as the firm’s performance and regulatory constraints.

The market opportunity for providing life insurance and annuities in the United States is extremely large and expected to grow at a moderate rate of growth.

The number of retirees in the U.S. is growing rapidly, so demand for retirement services will continue to be strong, so the firm enjoys excellent growth prospects in its favor.

J.P. Morgan is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (34.2%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is quickly rising interest rates or changes to credit spreads which may impact the valuation of its long-dated investments.

It could be argued that we are currently in such a volatile interest rate environment.

When we learn management’s pricing and valuation expectations, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment