AsiaVision/E+ via Getty Images

Teladoc Health, Inc. (NYSE:TDOC) is experiencing a significant slowdown in its operations, which may cause the company to lower its 2022 guidance by a notch or two when it releases earnings for 2Q-22.

The video-conferencing firm, whose stock price and valuation skyrocketed during the Covid-19 outbreak, has faced severe reality checks this year as member growth has slowed and the health-care pioneer has been forced to remove its sales guidance due to a widespread worsening in key metrics.

Teladoc’s stock is still overvalued in relation to its ability to generate earnings.

Teladoc Health’s Core Problem

Teladoc is dealing with several issues at once. Teladoc, which pioneered a business model that allowed patients to consult doctors via technology such as video-conferencing platforms and mobile apps, is experiencing a significant slowing of its platform metrics. The slowing of platform metrics has already resulted in a new forecast for 2022.

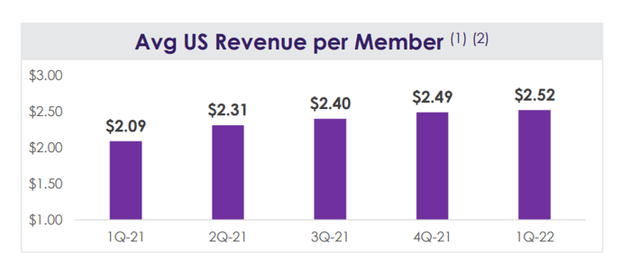

Consider revenue per member in the United States market. Revenue growth has slowed significantly over the last year. Despite the company’s 11% QoQ revenue growth per member in the United States from 1Q-21 to 2Q-21, monetization has slowed this year, which can be attributed to the conclusion of the pandemic.

From 4Q-21 to 1Q-22, average U.S. revenues for members climbed at a dismal 1%, implying that easing concern over Covid-19 infections is driving a general slowdown in Teladoc’s growth.

Average U.S. Revenue Per Member (Teladoc Health Inc)

During the epidemic, Teladoc’s business model worked flawlessly. With social isolation and travel limitations limiting people’s freedoms, the ability to consult with doctors via video-conferencing technology made perfect sense. Teladoc benefited from the epidemic as online counseling of health-care professionals became more popular and customers began to pay significant sums for so-called “access fees.”

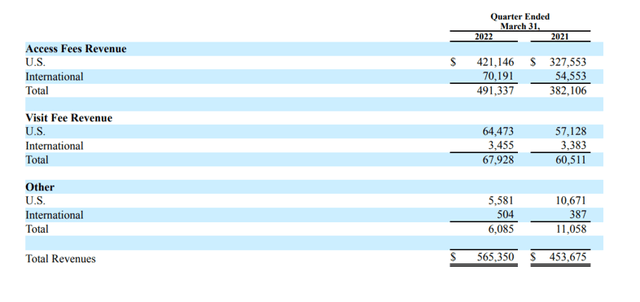

Employers, hospitals, health systems, and individual members pay access fees when they use Teladoc’s provider network or online consultation platform. The majority of Teladoc’s income increase has come from access revenues. Customers paid Teladoc $491.3 million in access fees in 1Q-22, a 29% increase YoY. Teladoc’s access fees accounted for 87% of its income and are critical to the company’s long-term performance in the health-care industry.

However, the rate of rise in access fee income has dropped sharply in the last year, in large part because people are less fearful of Covid-19 and have already readjusted to life after Covid-19, which includes coming to doctor’s offices in person. Access fee revenue growth fell to 29% YoY in 1Q-22, down from 183% in 1Q-21.

Total Revenues (Teladoc Health Inc)

Consistently Unprofitable

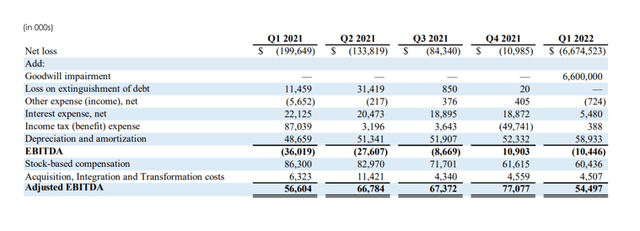

While important revenue segments are seeing slower sales growth, it is also a concern that Teladoc only generates profits on an adjusted EBITDA basis. On a GAAP basis, the company has routinely created losses, which is not a good way to sell your brand.

Teladoc’s net loss increased dramatically in 1Q-22, owing mostly to a $6.6 billion non-cash goodwill impairment charge. Teladoc would not have been profitable even if the impairment charge had not been taken.

This worries me because Teladoc benefited from large and beneficial business tailwinds during an unprecedented global pandemic in 2020 and 2021, which fueled the company’s member and sales growth. Nonetheless, Teladoc has been unable to generate a profit from its operations.

Adjusted EBITDA (Teladoc Health Inc)

Valuation Still Seems High

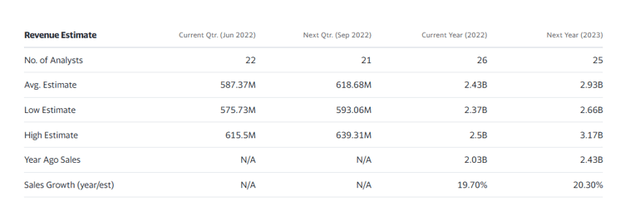

Moving forward, the market anticipates a significant decline in the company’s revenue growth rate. Teladoc’s overall revenues in 2021 were $2.0 billion, representing an 86% increase YoY. The current year’s sales are expected to be $2.43 billion, implying a growth rate of less than 20%.

Next year’s growth rate is similarly set at 20%, implying that Teladoc’s sales would remain stable in the future. Furthermore, if Teladoc’s key KPIs (revenue per average U.S. member, increase in access fees revenues) continue to slow in the second quarter, management may retract its 2022 guidance.

Revenue Estimates (Teladoc Health Inc)

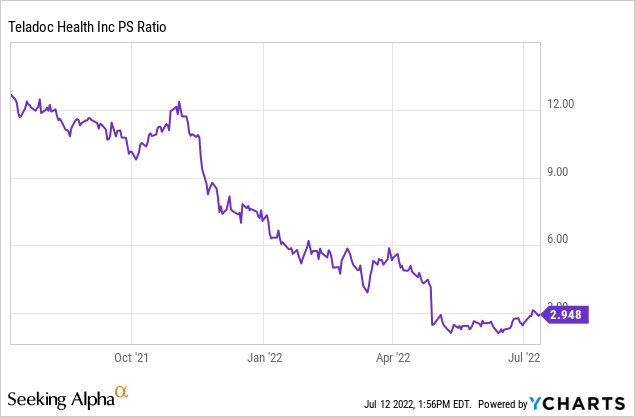

Based on sales, I believe Teladoc has greater potential for correction. Despite the fact that the company has no real earnings, the stock has a 2.9x sales multiple. The stock is still expensive at 2.9x sales, and if management lowers its sales projection for 2022 again, investors could suffer significant losses.

Can Teladoc Health See A Higher Stock Price?

Everything is possible, and if Teladoc reports a blow-out quarter on July 26, 2022, with stronger-than-expected revenue growth in the second quarter, investors may reconsider giving the health-care pioneer another chance. However, as things now stand, I am not hopeful that this will be a realistic outcome for Teladoc’s investors.

My Conclusion

A fool and his money are soon parted. Teladoc cut their sales target by $150 million last quarter, and if sales trends continue in the second quarter as they did before 2Q-22, TDOC could be in big danger.

For investors who have persisted with the health-care company this long, the 2Q-22 will be a brutal reality check: A slowdown in key platform measures such as member growth, access fee growth, and overall revenue growth would be negative to the stock’s near-term outlook, forcing management to lower its guidance once more.

With that said, I believe the risks outweigh the potential upside for TDOC, especially given the company’s stock’s high sales multiple of 2.9x.

Be the first to comment