Kumer

Investment Thesis

I, last updated on Veru Inc. (NASDAQ:VERU) for Seeking Alpha back in November last year. I was cautiously optimistic that the company was undervalued as a result of its thriving commercial stage Sexual Health division, its Phase 3 clinical trial stage drug Enobosarm, indicated for metastatic breast cancer, both as a monotherapy and in combo with Eli Lilly’s (LLY) Verzenio, and its second lead asset Sabizabulin, being evaluated in a late stage study in prostate cancer patients, and most importantly, targeting an Emergency Use Authorisation (“EUA”) to treat hospitalized COVID-19 patients at high risk for Acute Respiratory Distress Syndrome (“ARDS”).

In late November, Veru stock traded at $7.7, but its shares have well and truly bucked the biotech bear market, having risen in value by 90%, to trade at $14.6 at the time of writing.

That’s primarily due to the potential use of Sabizabulin as a COVID therapy for high-risk, hospitalized patients. In early April, Veru announced positive results from a planned interim analysis of its double-blind, randomized, placebo-controlled Phase 3 COVID-19 clinical trial evaluating oral sabizabulin 9 mg versus placebo in 150 hospitalized COVID-19 patients at high risk for ARDS.

The Independent Data Safety Monitoring Committee recommended the trial be halted early thanks to the data, which Veru reported as follows:

The prespecified primary endpoint was death at or before day 60. Sabizabulin treatment resulted in a clinically and statistically meaningful 55% relative reduction in deaths (p=0.0029) in the intent to treat population. Placebo group (n=52) had a 45% mortality rate compared to the sabizabulin-treated group (n=98) which had a 20% mortality rate.

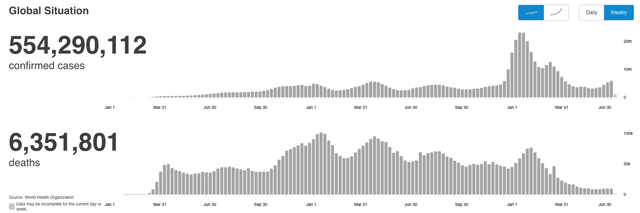

Although many people might think of the pandemic as being in their rearview mirror today, the reality is that cases remain high, and have been spiking recently, while in July alone, according to data from the World Health Organization (“WHO”) there have been 9.9k deaths globally, close to exceeding the total number of deaths in June.

COVID cases and deaths tracked by World Health Organisation. (WHO)

The market’s response to Veru’s data was a surge in its (fast declining) share price to ~$15, and although stock quickly fell back to $8, it surged again as the FDA confirmed the Phase 3 interim data would be sufficient for an EUA filing. The filing has been submitted, and the likelihood appears to be that the FDA will approve an EUA imminently, meaning there’s an exciting short-term upside opportunity in play for Veru investors.

In a recent Corporate Presentation, Veru says it’s planning to treat nearly 50k COVID patients per month in the US alone with Sabizabulin, and quotes data from the Washington Post suggesting there could be as many as 100m new cases this fall and winter, implying a risk of 1.2m deaths, 660k of which may be prevented with Sabizabulin, Veru claims.

Sabizabulin, if approved, certainly has an opportunity to thrive as a therapy for hospitalized patients. Both Merck’s (MRK) molnupiravir and Pfizer’s (PFE) Paxlovid are indicated for non-hospitalized COVID patients, and therefore if Sabizabulin, which is orally available like Paxlovid, can establish itself as superior to Gilead’s Remdesivir / Veklury – which generated sales of >$5.5bn in FY21, then blockbuster (>$1bn per annum) sales seems a potential outcome.

Given Veru’s current market cap remains below $1.2bn (at the time of writing), that is an exciting prospect for investors – the best commercial stage companies typically have a price to sales ratio of at least 2.5-3x.

In summary, the Sabizabulin COVID opportunity has arrested a slide in Verus’ share price, sending it soaring, but there’s more than a suspicion that there is plenty more upside to be realized if an EUA is awarded for hospitalized COVID patients, and Veru can meet its manufacturing, distribution, reimbursement and commercial goals.

On the negative side, the poor performance of the share price before the Sabizabulin COVID data was announced suggests that the market has reservations about the other areas of Veru’s business. In the rest of this post, I will briefly discuss each opportunity in turn, and conclude with a brief discussion of where I see Veru – and its share price – in 12-18 months’ time.

Enobosarm – An AR Targeting Therapy Without The Negative Side Effect Profile

Enobosarm is a type of drug that targets the androgen receptor (“AR”), which is a proven effective way to stop tumor growth in breast cancer, however targeting AR is usually associated with unwanted side effects such as a deep voice, facial hair, acne, and also liver toxicity, and not all types of breast cancer have a high enough expression of AR for this type of drug to be effective.

Endocrine therapy targeting the estrogen receptor (“ER”) is the more usual treatment for breast cancer patients, but the FDA has granted Enobosarm a Fast Track designation for three main reasons.

Firstly, due to the fact that patients can build up resistance to drugs that target ER. Secondly, because Enobosarm does not have the masculinizing side effects of other AR targeting drugs. And thirdly, because studies have shown that AR agonists can enhance the effects of ER targeting therapies, such as Pfizer’s (PFE) Ibrance, or Eli Lilly’s (LLY) Verzenio, two drugs which respectively generated $5.4bn and $1.3bn of sales in FY21.

In a Phase 2 open label study, in patients with metastatic AR-positive, ER-positive breast cancer, a clinically meaningful clinical benefit rate of 32% was observed in the 9 mg group at six months, compared with 29% in the 18 mg group. When the study was terminated, the median duration of clinical benefit was not reached in the 9 mg group and was 14.1 months in the 18 mg group.

Additionally, it was noted that patients who had >40% AR staining achieved a clinical benefit rate (“CBR”) of 52%, while those who had <40% achieved a CBR of just 14%.

That has informed the structure of the Phase 3 study, which will enroll ~210 patients with >40% AR nuclei staining who have failed the prior lines of therapy nonsteroidal aromatase inhibitor, fulvestrant and CDK4/6 inhibitor therapy, with a primary endpoint of median radiographic progression free survival (“rPFS”).

A second pivotal trial also is underway, ENABLAR-2, which targets the 2nd line metastatic breast cancer setting, in combo with Lilly’s Verzenio. The target enrollment is 180 patients, and the primary endpoint again rPFS. Data from the monotherapy study is expected in 2023, with an NDA submission planned by management for early 2024, whilst data from the combo study is expected early in 2024.

That may seem a long way off, but based on the evidence to date, Enobosarm appears to have a reasonable chance of success in both trials. I would rate the Verzenio combo as perhaps the more exciting opportunity, as the 2nd line market would be larger and Veru would benefit from Eli Lilly’s sales and marketing infrastructure.

There has not been much discussion (that I can find) relating to a peak sales opportunity for Enobosarm – a drug in-licensed from Oncternal Therapeutics (ONCT) in December 2020, after it had failed studies in stress urinary incontinence. I will stick my neck out and suggest a ballpark figure of ~$350m in peak sales, although this figure could be higher if Pfizer were interested in using Enobosarm in combo with Ibrance, perhaps.

The pivotal trials may uncover issues with negative side effects that smaller prior studies have masked, or some more serious safety concerns, but the drug has been tested in multiple studies and generally presented a satisfactory profile, so it may come down to efficacy. That being the case, and based on the pre-screening of patients for AR staining, there appears to be a good chance that endpoints will be met and an approval forthcoming.

Sabizabulin In Prostate Cancer

Sabizabulin is expected to enter a Phase 2 study as a monotherapy in 3rd line breast cancer, and in combo with Enobosarm in patients who have failed to respond to chemotherapy, but these studies have not yet been initiated, according to Veru’s latest Corporate Presentation.

Of more immediate interest is Sabizabulin in Prostate cancer. During the Q122 earnings call, Veru CEO Mitchell Steiner updated analysts as follows:

We are actively enrolling an open label randomized two to one multicenter Phase III VERACITY clinical study evaluating Sabizabulin 32 milligrams vs. an alternative antigen receptor targeted agent for the treatment of chemotherapy naive men with metastatic castrate-resistant prostate cancer who had tumor progression after previously receiving at least one antigen receptor targeted agent.

The primary endpoint is radiographic progression-free survival, enrollment for the Phase III VERACITY clinical study is on track and we expect to enroll approximately 245 patients from 45 clinical centers in the US.

In its Phase 1b/2 study an Objective Response Rate (“ORR”) of 21% was achieved, with 1 Complete Response (“CR”) in the intent to treat population, while the median rPFS in all patients treated with a 63mg dose was 11.4 months. The drug was well tolerated, with no reports of clinically relevant neutropenia or neurotoxicity.

Veru seems confident that Sabizabulin can achieve a median rPFS of ~7.4 months, while an alternative antigen receptor – likely to be AstraZeneca’s (AZN) Lynparza – is only expected to achieve ~3.7 months.

Obviously, if that’s proven in the Phase 3 study – although it should be noted the dose used will also be half that used in the successful Phase 1b/2 – the case for approval in Prostate will be hard to ignore, although the indication may be niche. Sabizabulin would target patients who have become resistant to AR targeting drugs like Johnson & Johnson’s (JNJ) Zytiga or Pfizer’s (PFE) Xtandi – both multi-billion selling drugs – before they begin chemotherapy.

Based on my review of Sabizabulin in Prostate cancer, it seems that management has mapped out a path to approval and that it could be successful based on earlier studies, while Sabizabulin’s safety profile has been reasonably well established. But the peak sales opportunity seems unclear, and it does not seem certain that physicians would flock to prescribe Sabizabulin ahead of chemotherapy.

Prostate is a very tricky disease and Veru is already working on a newer therapy, dubbed VERU-100 – a long acting agonist based on a three-month slow release subcutaneous injection. A Phase 2 trial is underway, with a 100-patients Phase 3 planned for this year.

Overall, as in breast cancer, it seems as though Veru may successfully guide 2 drugs through the pivotal trial process, with a reasonable chance of success, particularly with Sabizabulin. The market opportunity may not exceed the low triple-digit millions, due to the potentially niche indications, however. The overall opportunity is typical of many mid-to-late stage biotechs, and generally speaking, would likely not support a market cap valuation >$500m on its own.

The Sexual Health Division

Veru’s Sexual Health division is known as UREV, and comprises its FC2 female condom that provides dual protection against unintended pregnancy and the transmission of STIs, and recently approved (in December last year) Entadfi, indicated for Benign Prostatic Hyperplasia.

Sales in this division in FY21 were $61.3m – up 44% year-on-year, which is primarily driven by FC2, although management has earmarked Entadfi for peak sales of $200m per annum.

In fiscal Q222, Veru reported $23.2m of FC2 revenue, although overall revenues of $27.2m were down 3% year-on-year. Entadfi will soon launch however, and management will be hoping that allows them to reverse a net loss of $20.6m in Q222, and become profitable again, which is quite an achievement for a small biotech that is funding several late stage studies.

Conclusion – Sabizabulin’s EUA Is The Major Catalyst Here, Despite Promise Elsewhere

I would be a little worried for Veru if the FDA opts against handing Sabizabulin an EUA.

While Veru is a biotech with a diversified pipeline and opportunities in breast and prostate cancer, with a sexual health division that could double or even triple its income over the coming years, the market does not seem willing to attach too much value to these opportunities, given the company’s share price had been in steep decline until the positive Sabizabulin/COVID data arrived.

Although there may be (by my ballpark reckoning) up to $500m in potential revenue on the table in Prostate and Breast cancer markets, and a further $250m in sexual health, the risk of trial failure in the former is clear and present until the Phase 3 data proves otherwise, and therefore Veru’s current market cap valuation of $1.2bn is arguably marginally too high. The UREV revenues clearly help, but it seems there’s skepticism over peak sales of Entadfi also.

If there’s potentially $750m of peak revenues on the table, but we discount that by 50% due to the risks involved, to $375m, and multiply by 3 for a good P/S ratio, we’re looking at a market cap target of $1.1bn max – considerably higher than the low of ~$200m assigned by the market when Veru shares hit a low of $2.4 in November last year.

Without the COVID opportunity, to the market it seems Veru is a strong looking biotech that practically pays for its own research thanks to a profitable sexual health division, but whose capacity for growth that would justify a >$1bn market valuation is questionable. I would actually disagree that Veru is worth <$1bn, due to my estimations around peak sales opportunities and progress, but I would still be concerned for Veru shareholders should it not receive the EUA.

Throw in the COVID opportunity, however, which is within touching distance of being cleared by the FDA, and there’s suddenly a blockbuster sales opportunity that would make the current valuation of the business look much too low!

We won’t have to wait long therefore to find out whether Veru stock soars, or retreats, but it’s highly unlikely to remain the same after the FDA makes its EUA decision. Veru management sounds very confident of success, and given the limited treatment options for patients hospitalized with COVID, and the high mortality rates, the signs point towards good news for Veru shareholders.

Personally, I can see Veru stock experiencing significant volatility if the EUA is approved, owing to factors such as marketing Sabizabulin, reduction in COVID hospitalizations, rival drugs, newly developed therapies and limited funds for marketing – Veru only has ~$112m cash, although it would likely raise more if Sabizabulin is handed and EUA.

As such, in 12-28 months time, if its EUA approved, I would speculate that Veru’s market cap valuation could be above $2bn – it should perhaps be >$3bn based on a P/S ratio of 3x, but I factor in the risks mentioned above.

That results in a share price target for me of ~$25. Although the downside risk is substantial, I also believe the ex-COVID opportunities are worth more than the market believes, so to conclude, I think Veru stock remains a buy with a 12-18 month investment horizon in mind, with some longer-term downside protection in place.

Be the first to comment