gorodenkoff

Investment Thesis

The current state of the macro-environment is filled with bodeful vocabularies: stagflation, recession, and trade deficits. During the stage of macro uncertainties, it is advisable to diversify the portfolio into different asset classes and to combine it with a long/short strategy. iM DBi Managed Futures Strategy ETF (NYSEARCA:DBMF) utilizes the futures contract-based strategy to hedge the portfolio to limit the downside.

DBMF is an excellent complement to the existing portfolio since it has a minimum correlation with other asset classes. I believe DBMF did everything right related to the macro-environment’s direction; its current positions will navigate investors through 2022.

ETF Overview

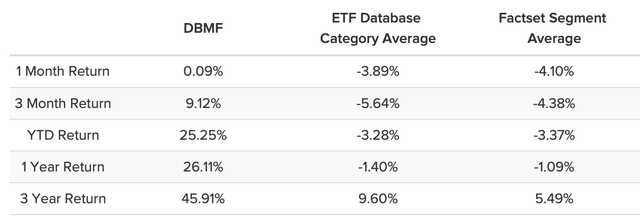

DBMF is an active-managed liquid alts ETF run by Andrew Beer and Mathias Mamou-Mani from DBI Investments. Andrew was a Baker Scholar from Harvard Business School with over two decades of experience in the hedge fund industry. Andrew is an expert in the commodity futures and emerging market industry, and his expertise helped DBMF to outperform the market by 44.11% YTD. Even compared to other hedge fund-like ETFs, DBMF surpassed the category average by 28.53% YTD.

DBMF is one of the few high-quality liquid alts ETFs on the market. The main goal of DBMF is to operate like a hedge fund with long/short positions, various financial instruments such as future-based contracts, and allocations across different asset classes.

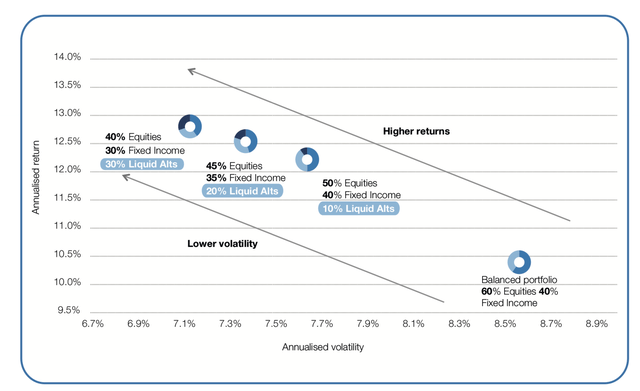

Liquid alts gain increasing popularity because of their diversification, decorrelation, and hedge elements. At the same time, liquid alts offer liquidity, allowing investors to buy and sell as conveniently as other ETFs. Liquid alts are often used as a component of institutional asset allocation. The bond market experienced a sell-off over the past years, and the equity market has had high volatility since 2020, which makes the traditional 60/40 asset allocation method less efficient. According to Schroders, if the institutions blend in 30% liquid alts positions and lower the equity and fixed income allocation to 40/30, the portfolio will achieve a higher annualized return and less annualized volatility. The demand for liquid alts also surged this year. For instance, Fidelity Investments rolled out alternative solutions recently to meet retail channel needs.

60/40 with Liquid Alts (Schroders)

Strategy

After reading through DBMF’s Website, I found that DBMF’s investment philosophy is macro-focused and will adjust over time. Central bank policies such as quantitative tightening, inflation, and geopolitical tensions are the three main themes within DBMF’s asset allocation now.

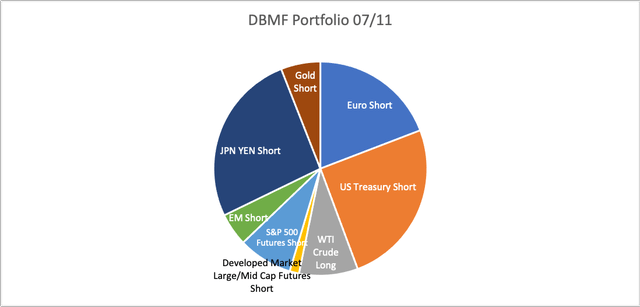

All of DBMF’s positions are contracts based, which is time-sensitive. The portfolio requires extensive monitoring, including rollover. In addition, DBMF rebalances weekly based on NAV which causes the portfolio breakdown to be hard to track. As of July 11th, DBMF has a -41% short position in the Japanese Yen, which is the most significant position. It has a -40% short position US 2-yr to 30-yr Treasury and -30% short in Euro short position. The fund also has moderate short positions in S&P 500 futures, Emerging Market futures, Gold futures, and Developed Market Large/Mid Cap Equity futures. The only long position it has is 14% long in WTI Crude Oil futures. Thus, the current portfolio has a gross exposure of 158% and net exposure of -130%.

DBMF Portfolio as of 07/11 (Data from DBi Website, Consolidate by Author)

Is DBMF a Good Investment Vehicle?

DBMF aims to achieve a low correlation movement from the broad market by diversifying into different asset classes, as shown above. Portfolio construction requires professional knowledge and heavy trading expenses. Historically, Global Macro Hedge Funds were common to park the money. However, Global Macro Hedge Funds do not provide access for retail channels, RIAs, or even small institutions. And the average cost is a 2% annual management fee+performance fee. DBMF provides the investment and redemption option to all types of investors with only 80 bps of annual expense. From the product standpoint, DBMF is accessible and can be an excellent vehicle.

I believe the current macro themes will run through 2022, and DBMF’s portfolio is well-suited to the current macro environment.

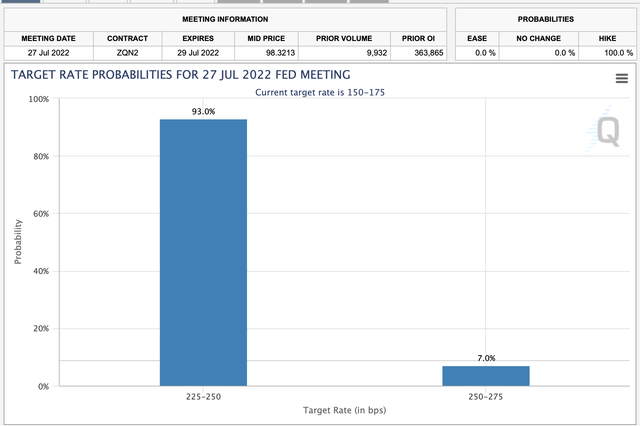

DBMF has -40% of net exposure in US Treasury futures short position range from 2-yr to 30-yr. The most concentrated position is in the 2-yr Treasury with 14%; it’s a bet on the 2-yr us Treasury yield hike continues. In the first quarter of 2022, the market believed that inflation would peak in April/May and consequently normalized by the end of 2022. However, the May CPI rose 8.6% YoY, the highest since 1981. This result forced Federal Reserve to hike the fed funds rate by 75 bps in the June FOMC meeting. Wall Street also raised the June CPI estimate to 8.8%. The persistent inflation will trigger Fed to become more hawkish. From CME, the market participants started to price in only two scenarios in the July FOMC meeting, 75 bps and 100 bps rates hike. The 50 bps is no longer an option. This shows the Federal Reserve’s determination to solve the inflation, even with the consequence of a hard landing. Increasing the federal funds rate has the most direct connection with the 2-yr Treasury yield; as the rates rise, the 2-yr yield will rise.

July FOMC Target Rate Survey (CME)

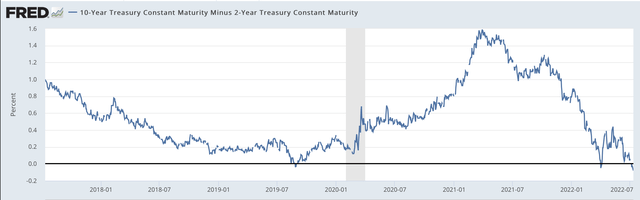

Federal Reserve’s actions have more impact on the 2-yr Treasury yield, whereas the market has more effect on the 10-yr Treasury yield. DBMF bets Fed will sacrifice the yield curve control, thus shorting 2-yr Treasury notes until we see inflation peaks. The bet on a 2-yr Treasury yield rise also highlights the thesis on near-term recession. On July 12th, 10-2 yr us Treasury spread is -11 bps, making the yield curve most inverted since 2007. Inversion happens when the 2-yr Treasury yield becomes higher than the 10-yr Treasury yield. It’s a leading indicator of recession. When the yield curve becomes inverted, the economy will likely reach recession over the next 6-24 months.

10-2 US Treasury Yield Spread (Fred)

The overall us treasuries short also makes sense, as the Fed announced shrinking its balance sheet from the May FOMC minutes. It shows that Fed will unload US Treasury by $60 billion monthly from June. The unloading from Fed will intensify the sell-off of the bonds as the market acts ahead of Fed.

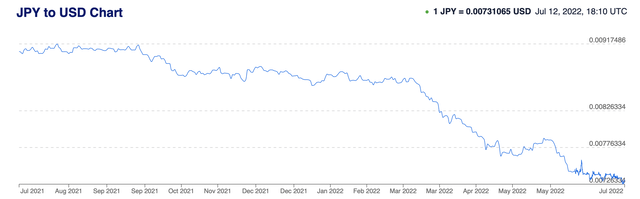

DBMF’s short position on JPY illustrates the Bank of Japan’s attitude of insisting on the QE despite the hyperinflation. And this central bank policy will cause JPY to depreciate against the USD. Especially when the Federal Reserve starts to raise the rate and cause the dollar repatriation, the contra policy will further depreciate JPY.

Bank of Japan’s QE isn’t sustainable; Hedge Funds are betting against Japanese Government Bond for the logic of BOJ will eventually give up yield curve control and raise the rate. If that logic holds, JPY will likely rebound from its all-time low. And I saw that DBMF started taking profits from its JPY short position; its short position decreased from the first quarter -80% to the current -41%.

JPY/USD (XE)

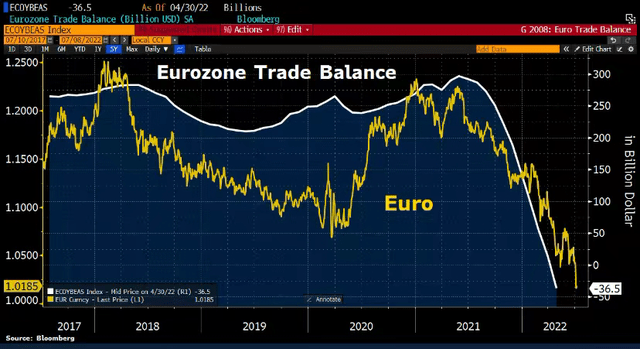

DBMF’s -30% net short position in Euro is based on the assumption of negative sentiment related to the recession, inflation, and trade deficit. On July 11th, Euro reached a near 1-1 exchange ratio against the dollar, the first time since Euro was created. As shown from the chart below, Euro’s movement is closely tied to the Eurozone trade balance. Due to the Russian invasion of Ukraine, the energy crisis in Europe required more imports than expected, and it’s currently in deficit. Even the global manufacturing magnate Germany reports the first deficit in 30 years. The Euro will have more downside if ECB’s intervention on inflation isn’t effective and Russia cuts more gas supply. From technical analysis, if Euro break the 1.00 support zone, the next target price will be 0.80.

Eurozone Trade Balance/Euro (Holger Zschaepitz, Bloomberg Terminal)

As mentioned before, the QT from Fed will trigger the dollar repatriation. It’s an ominous sign for an emerging market, as they might default on their dollar-dominated national debt. Sri Lanka officially announced bankruptcy last week, as its central bank ran out of dollars. If we look at the 1997 Asia Financial Crisis, Sri Lanka’s Bankruptcy may cause a domino effect on other emerging markets. DBMF’s -8% net short position in MSCI Emerging Market Futures is a good strategy during the US QT period.

Risk

DBMF has heavy short positions in betting the Federal Reserve to keep being hawkish. If the CPI data reports a sudden drop and the macro environment starts to recover, then the entire portfolio of DBMF will be at risk.

Mitigating geopolitical tension will impact the thesis of Euro depreciation and energy price hike. DBMF needs to be flexible and adjust the strategies promptly if we see the overall macro environment shifts.

DBMF is an active-managed ETF with a higher management fee than passive funds. Investors need to understand the expenses associated with the fund before pooling the capital.

Historically, top-performing funds tend to perform worse than average in the next year. That’s due to the inertial thinking of the fund managers who believe the same strategy will work every year. DBMF has a seasoned management team, but investors should monitor the positions to check if the management team is doing its job of adjusting strategy.

Key Takeaways

From the analysis above, DBMF has an all-weather strategy well-suited to the current macro environment. The YTD return proves the fund management team’s expertise in adjusting the strategy promptly and delivering alphas to investors. Its existing us Treasury, Euro, JPY, and Emerging Market short positions will likely lead to outperformance of the market in the second half of 2022. I think DBMF is one step ahead of the market, and its contract-based portfolio offers more flexibility in implementing its investment strategy. Thus, I believe DBMF is an add-on to the existing portfolio during a time of uncertainty.

Be the first to comment