tawatchaiprakobkit

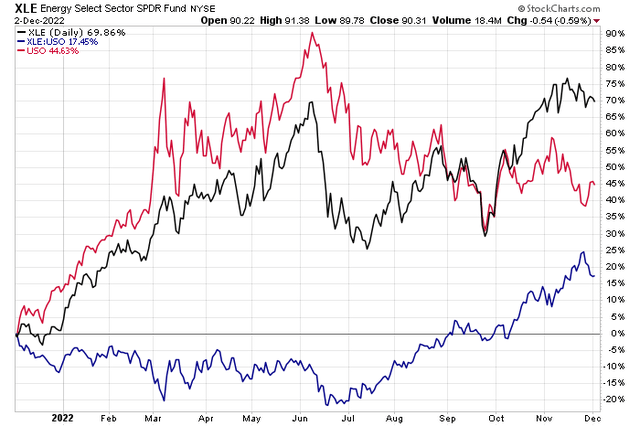

Energy stocks have recently consolidated big gains from late September. It could be just another pause in a broader uptrend all while oil prices struggle. That relative equity price strength is a bullish signal for the sector’s stocks, in my view.

One small name, not directly in the oil & gas space, but within the Energy sector, recently notched a 52-week high with positive technicals. Let’s navigate the risks and upsides of Teekay Shipping.

Energy Stocks Beating Oil Prices

According to Bank of America Global Research, Teekay (NYSE:TK) is one of the world’s largest tanker owners and operators. It owns 47 mid-sized tanker vessels and is a 50% joint-owner of one VLCC, charters-in 6, for an operational fleet of 51 tankers (the 51 includes 2 STS support vessels). The company owns a combination of Suezmax, Aframax, Product Tankers, support ships, and a 50% JV stake in one VLCC tanker.

The Bermuda-based $446 million market cap Oil, Gas, & Consumable Fuels industry company within the Energy sector trades at a 21.8 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Teekay recently reported non-GAAP earnings per share of $0.15 on revenue of $303 million, more than double the sales from the same period a year ago. Its management team noted that the tanker market continues to improve with spot rates at robust day rates versus late 2021. The generally positive Q3 report came after the firm launched a $30 million stock buyback plan in August.

Teekay is also working to reduce its debt burden as market fundamentals improve. Still, there’s the risk that a decline in shipping rates materially hurts the company since it is quite leveraged to how its industry trends go. Other risks to the stock price include a global recession which would reduce shipping demand. OPEC+ oil production cuts and/or a drop in oil prices would also be problematic. The upside potential stems from a recovery in spot shipping rates, an improved company balance sheet, and industry M&A boosting valuations.

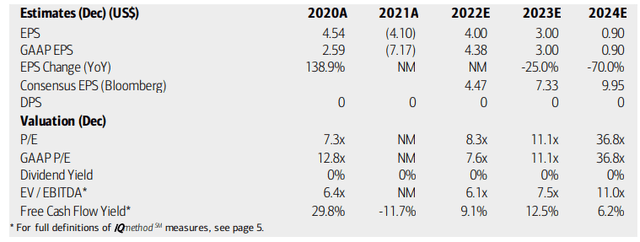

On valuation, analysts at BofA see earnings having turned sharply positive in 2022 after a tough 2021. Next year, per-share profits are seen as dropping with an even steeper decline in 2024. The Bloomberg consensus, however, is much more bullish. Still, no dividends are expected, but shareholder accretive activities come by way of the noted share repurchase program. TK trades at a low EV/EBITDA multiple and produces impressive free cash flow. Overall, I like the valuation here despite the earnings uncertainty.

Teekay: Earnings, Valuation, Free Cash Flow Forecasts

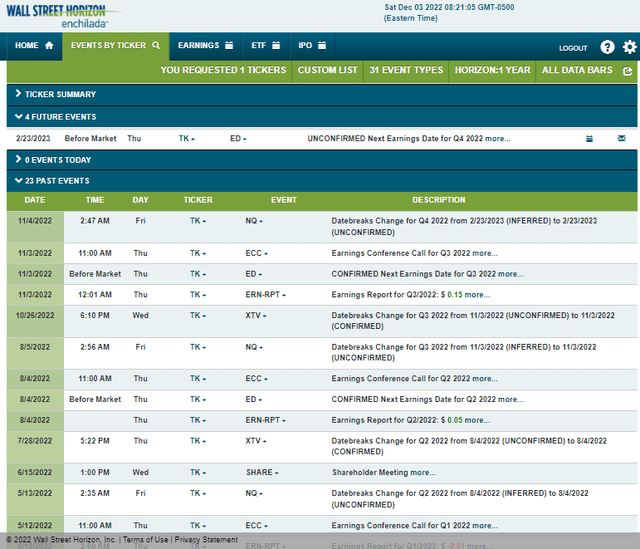

Looking ahead, data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 23 BMO. The event calendar is light until then, however.

Corporate Event Calendar

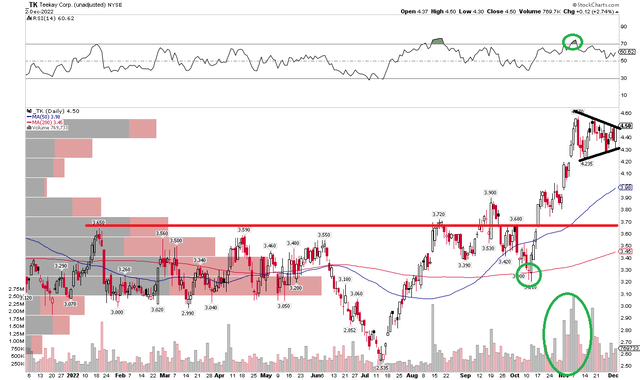

The Technical Take

TK closed last week with a bullish engulfing candlestick within a broad bullish triangle pattern. That bullish setup has a measured move price objective to near $6 based on the $1.36 length of the upward move added on top of the breakout, which would be near $4.50.

Also notice how there was big volume during the early November climb – a telltale sign of embedded strength in the upside thrust. Moreover, the 52-week high a few weeks ago was confirmed by a new high in RSI, and the current consolidation comes on lower volume. With shares breaking free from the prior $3 to $3.65 range, I see more upside potential ahead.

TK: Bullish Triangle Pattern, Good Volume & RSI

The Bottom Line

While a global recession looms, Teekay’s valuation using forward numbers looks good. Also, a strong technical chart should excite the bulls. I see more positives than negatives with this small-cap shipping stock exposed to the Energy sector.

Be the first to comment