Erikona/E+ via Getty Images

Global business conditions worsened once again in the manufacturing sector in November, with the JPMorgan Global Manufacturing Purchasing Managers’ Index™ (PMI™), compiled by S&P Global, falling further into contraction territory amid a further steep downturn in global trade flows.

The survey’s sub-indices showed export orders falling steeply, down for a ninth successive month, with the rate of decline continuing to run at one of the fastest recorded since the global financial crisis, despite signs of fewer shipping delays and logistics constraints.

Global goods exports fall for ninth straight month

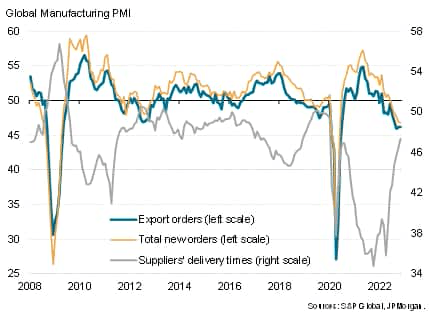

Global manufacturing orders and supplier delivery times

An accelerating production downturn among the world’s factories was fueled in November by a fifth successive monthly drop in new order inflows, the rate of decline of which accelerated to one of the highest seen over the past 13 years. Leading the order book downturn was a continued steep retrenchment of world trade flows, with new export orders falling especially sharply again in November, thus signalling one of the steepest deteriorations in global trade since 2009. If early pandemic lockdowns are excluded, recent months have seen the steepest falls in worldwide export orders and total inflows of new work received by manufacturers since the global financial crisis.

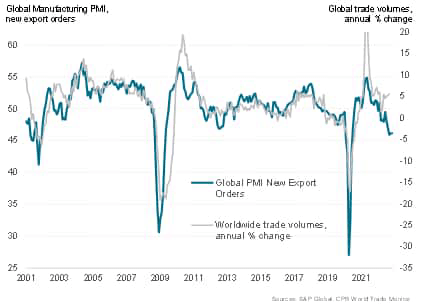

Note that the worsening global trade picture from the PMI survey comes despite signs of supplier delivery times easing, a result of fewer global supply chain delays. While these improvements in supply conditions appear to have helped temporarily lift global shipping volumes, the PMI survey warns that new orders placed for exports around the world are falling sharply, which is expected to translate into lower shipping volumes in coming months.

Global PMI new exports orders and global shipping volumes

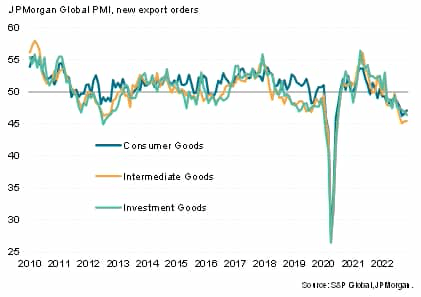

Broad-based export slump across various product types

The decline in exports worldwide was broad-based across product types, though led by slumping demand for intermediate goods which comprised components typically purchased by other manufacturers. This reflected a growing sign of reduced buying activity and destocking.

However, export orders for investment goods, such as plant and machinery, are also falling sharply, pointing to a reduction in international capex spending on a scale not seen prior to the pandemic since 2012.

Exports of consumer goods are likewise sliding at a marked pace, dropping at a rate in recent months which – barring initial pandemic months – looked to be the steepest since the global financial crisis as households around the world adjust to higher prices and reduced spending power.

Global PMI export orders

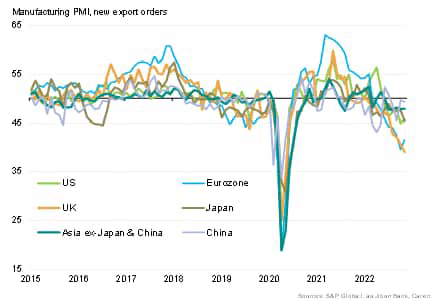

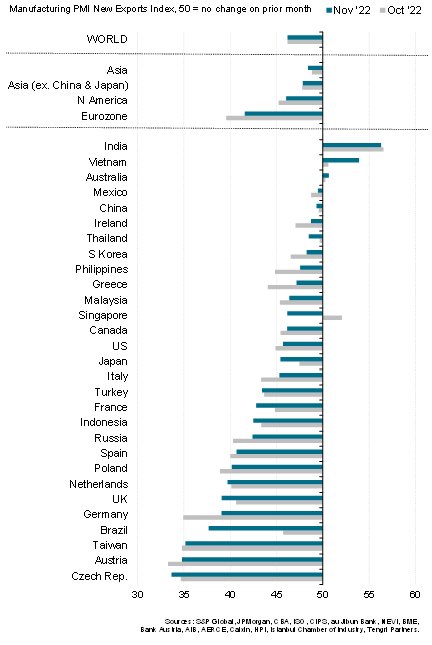

Of 29 economies, only India and Vietnam report any significant export gains

The global trade downturn also grew more widespread geographically in November. Only three of the 29 economies for which November PMI data on exports are available reported rising export orders in November, with only India and Vietnam reported any significant gains. Australia eked out a marginal increase. However, even with these gains, Asia continued to report export losses on average, albeit suffering considerably less severe losses than that seen in Europe and North America.

The steepest export declines were observed in the Czech Republic and Austria, followed by Taiwan, Brazil, Germany, and the UK.

Manufacturing PMI export orders

Export rankings

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment