Editor’s note: Seeking Alpha is proud to welcome Mario Silva as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan/Getty Images News

There is a very good opportunity to buy Amadeus IT Group (OTCPK:AMADF)(OTCPK:AMADY) at the current price. The stock fits well with the “buy and hold” strategy used by Warren Buffett when he bought Coca-Cola (KO), Apple (AAPL), and American Express (AXP). He did that when these companies faced a “temporary setback” that pushed their stock prices down temporarily. Amadeus could be a similar situation for long-term investors, and I’ve used the different rules established by the “Oracle of Omaha” to see if the odds are in our favor. Let’s see why this stock is a long-term opportunity.

Background

Amadeus, with headquarters in Madrid, Spain, was founded in 1987 by Air France, Iberia, and Scandinavian Airlines Systems. It is the biggest player worldwide that has a huge network that connects travel agencies and tour operators with airline companies, rental cars, hotels, and cruise lines. The company has developed other technological services that have a greater amount of digitalization and more efficiency within the travel and tourism sector. Amadeus is a leader in terms of its two business lines: distribution and IT solutions. As of 2022, the company has more than 40% market share of the world market in distribution, an increase from 36.7% in 2010. The company’s other competitors are Sabre (SABR) and Travelport, with the latter having more exposure to the U.S., and Sabre being the second largest airline distributor in the industry after Amadeus.

First Buffett rule – industry recovering gradually (a “temporary setback”)

Before COVID, according to the International Air Transport Association (IATA), the number of air travelers was expected to double in 20 years across the world, reaching 8.2 billion people traveling. That’s an increase of 3.5% compound annual growth rate (CAGR) since 2019. During COVID, the industry was significantly impacted and, as such, new estimates for the short term were required, although the long-term estimates should not change materially. IATA estimates that the number of travelers could reach 4 billion in 2024, surpassing pre-COVID levels and rising to 103% of the 2019 levels.

In February 2022, the IATA provided a new update for the next five years:

-

In 2021, overall traveler numbers were 47% of 2019 levels; this is expected to improve to 83% in 2022, 94% in 2023, 103% in 2024, and 111% in 2025.

-

In 2021, international traveler numbers were 27% of 2019; this is expected to improve to 69% in 2022, 82% in 2023, 92% in 2024, and 101% in 2025.

In other words, most of the travel and tourism sector is expected to recover its pre-COVID levels in 2024.

Again, as per IATA:

The biggest and most immediate drivers of passenger numbers are the restrictions that governments place on travel. Fortunately, more governments have understood that travel restrictions have little to no long-term impact on the spread of a virus. And the economic and social hardship caused for very limited benefit is simply no longer acceptable in a growing number of markets. As a result, the progressive removal of restrictions is giving a much-needed boost to the prospects for travel.

Business Model

Among its main services the company offers technological services and platforms for distribution for travel agencies and tour operators, connecting them with travel providers such as airline companies, hotel chains, cruise lines, and rental cars. To fulfill this goal, and as part of the distribution business line, Amadeus offers the Global Distribution System (GDS). That is a platform of networks containing travel-related information such as schedules, fares, and related services that also enables automated travel-related transactions between travel providers and travel agents.

Another type of distribution offered by Amadeus is the New Distribution Capability (NDC), which enables the airline companies to share information and sell their own products and services directly to the travel agencies, corporations, and passengers without the need of the GDS services. Using the NDC, the airline companies have much better flexibility to launch more personalized promotions to differentiate its services from those of the competitors, marketing products more quickly than traditional distribution channels, like the GDS, and responding faster to the possible shifts in consumer trends.

Amadeus has another business line: IT solutions. The company offers a wide range of technological services to its different customers. One example of these kind of services is the supply of technological management systems for airlines companies to manage their prices according to the season, helping them in maximizing their efficiency and profits. There are other value-added services such as the customer experience enhancement, data integration, consulting services, support for passenger processing, and so on.

Taking both business lines together, the company is providing solutions to 474 airline companies, 132 airline operators, 29 cruise and ferry lines, 133 ground handlers, more than 1 million hospitality providers and hotels, 21 insurance provider groups, and 90 rail operators, as well as corporations, travelers, business travel agencies, online travel agencies, and retail travel agencies.

Revenue Breakdown

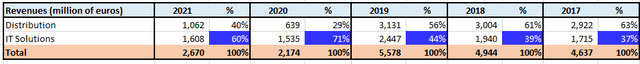

The evolution of the different business lines in the last five years indicates that the IT solutions business line is opening up new possibilities for future growth, offering more value-added technological services with higher margins. Revenues from the IT solutions business have been increasing in the last few years:

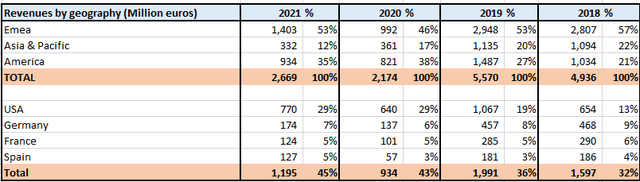

In terms of geographical diversification, Amadeus is well-diversified and is seeing increasing participation in America post-COVID in 2020. On the other hand, the U.S. is the country with the highest participation individually in the total revenues of the company. In the following table, we see the participation by geography and the participation of the top four countries with the largest portion of the pie:

Second Buffett rule – excellent, shareholder-oriented management

Luis Maroto, CEO of Amadeus, has been working at the company for more than 20 years. Maroto has successfully led all of the acquisitions made by the company in the last 10 years. One example is the acquisition in 2018 of Travelclick, which is a hotel technology company that offers business intelligence and operational services. This acquisition enabled Amadeus to reinforce its hospitality solutions business, which has been another source of cash generation for the company in the last years. Amadeus paid $1.52 billion, a price that was only three times Travelclick’s revenues in 2017 of $373 million, and 17 times its EBITDA in the same year.

To put things in perspective, Adobe Systems (ADBE) recently paid more than 50 times sales for FIGMA, a subsidiary that is expected to have revenues of $400 million in 2022. The multiples paid for Travelclick shows that Amadeus’ management doesn’t like to overpay for acquisitions.

Also, Maroto has been responsible for the launch of the NDC as a response to a challenge issued by the IATA. In 2015, the IATA decided to launch its NDC to support airline companies with respect to avoiding a total reliance on the Amadeus GDS platform. In response to that challenge, Amadeus launched its own NDC platform to offer another alternative to the airline companies. As of 2021, Amadeus has signed up more than 20 airline companies for its NDC platform; in this way, Amadeus offers a wider range of services with its GDS and NDC. Maroto turned a threat into an advantage, since the NDC was launched by the IATA as a potential substitute for the Amadeus GDS, and now Amadeus offers interesting complementary services with both its GDS and NDC.

Maroto seems to have prepared Amadeus for the very long term given that he wanted to protect the business from the entrance of the big U.S. tech companies into the industry. In this way, Amadeus has signed very long-term contracts with airline companies and other players within the travel and tourism sector to reinforce its long-term relationship with them. Integrating Amadeus’ systems with those from its clients makes it very difficult for potential powerful competitors to disrupt Amadeus’ technological services.

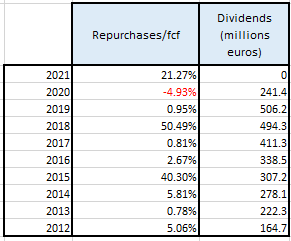

In regard to capital deployment, management has not been consistent in its repurchases of its own shares since it prioritizes its investments in growing organically and through acquisitions, without taking on much debt. Furthermore, management has shown a higher ratio of repurchases/FCF when the stock dropped significantly in 2018 due to the trade war between U.S. and China, and in 2021 due to COVID. This indicates that management does not like to overpay for its repurchases, unlike many other companies.

Since 2013, the company has made very important acquisitions that have reinforced its leadership position in the industry – including Travelclick in 2018, Premier Inn in 2017, Itesso in 2015, IHG in 2014, etc. On the other hand, the company stopped paying dividends in 2020 and 2021 in order to accumulate more liquidity due to COVID. However, the company has announced that it will pay dividends again in 2023. In the last 10 years, before COVID, the dividend yield was between 1% and 2% and grew year-on-year from 2012 to 2019:

Amadeus Annual Report

Third Buffett rule – strong competitive advantages relative to its main competitor

Amadeus’ long-term contracts are around 15 years with airline companies for distribution services, and three to 20 years with different players within the travel and tourism sector for IT solutions services. Furthermore, most clients have incentives to renew their contracts because Amadeus fully integrates its systems, software, and IT solutions with those of its clients. This increases their “switching costs” and gives Amadeus the opportunity to fully understand the clients’ needs in terms of delivering more IT solutions in the future.

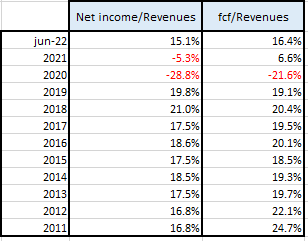

To reinforce customer loyalty, Amadeus has innovated significantly. The company spent 8%-9% from its gross margins in R&D expenses. In this regard, Amadeus brings cutting-edge technology to its ecosystem, delivering significant value to its clients and strengthening the competitive position of the company. Given this high level of integration with its clients’ systems and the supply of value-added services, Amadeus has fortified its competitive advantages and its power to set higher prices. That is reflected by its high net margins and high free cash flow margins pre-COVID:

Amadeus Annual Report

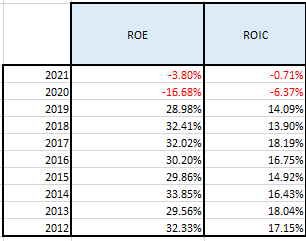

In the table above, the net margins and free cash flow margins were impacted by the COVID situation in 2020 and 2021. However, these margins are improving as part of the recovery of the sector. These high margins drive up its ROE and ROIC, which means that Amadeus can reinvest into its core business and earn higher returns on its capital. Although these returns were negative during COVID, they were really good in the pre-COVID years. In 2022, as the sector is recovering and the company’s performance is improving, these two important metrics are expected to return to their pre-COVID levels:

Amadeus Annual Report

The wide diversification of its revenues from several technological services contributes with more recurrent cash flows. When a passenger makes a reservation through a travel agency for the services of airlines, hotels, cruises, or rental cars through online platforms or using apps, Amadeus is generating cash from different sources. The company connects more than 1.5 billion people with travel agencies in more than 190 countries. Its revenues are not concentrated in Spain, which represents barely 5% of its total revenues.

Excellent Performance Pre-COVID

According to the financial statements audited in 2019, Amadeus’ revenues were 5,570 million euros, which represented an increase of 12.87% compared to 2018. Looking at the last nine years before 2019, revenues have increased in 7.84% CAGR. Gross margin was 74.33% and its net margin was 19.76% in 2019, and an average net margin of 18.77% in the last nine years shows its strong position in the industry. In 2019, the long-term debt of 2,328 million euros can be paid back in less than 2.5 years with the net income of 2019. And free cash flow was 1,066 million euros in 2019 compared to 1,008 million euros in 2018, which represents an increase of 5.76%. From 2011 to 2019, free cash flow was growing at 5.33% CAGR. And ROE was 28.98% in 2019, averaging 31.67% in the last nine years.

Performance Post-COVID

Given its exposure to the travel and tourism sector, the company experienced a decline in revenues of 60% because of COVID in 2020, while net income dropped from 1,100 million euros in 2019 to -626 million euros in 2020, and free cash flow dropped from 1,066 million euros in 2019 to -469 million euros in 2020. In 2020, the company needed to increase its financial leverage given the disruption of COVID in the sector, so its total debt increased to 5,663 million euros from 3,573 million euros in 2019.

In 2021, Amadeus’ revenues grew 22% from 2,174 million euros to 2,670 million euros; the net income also improved from -626 million euros in 2020 to -142 million euros in 2021. Free cash flow increased from -469 million euros in 2020 to 176 million euros in 2021, showing a good recovery to positive numbers. Total debt decreased from 5,663 million euros in 2020 to 4,979 million euros in 2021.

As of June 2022, Amadeus registered a significant growth in revenues of 82% YoY and a very good improvement in its net income from -144 million euros to 318 million YoY. In addition, free cash flow improved from -88 million euros to 344 million euros, while total debt decreased from 4,979 million euros in 2021 to 4,681 million euros as of June 2022. This is a clear sign that the sector keeps recovering in 2022.

Competition

Amadeus has a strong presence in Europe, the Middle East, and Africa (EMEA) and the Asia Pacific, with less presence in the Americas. Sabre, a U.S. GDS provider and the second largest in the industry after Amadeus, has a stronger presence in North America.

According to Sabre’s 2019 10-K, pre-COVID, 55% of its direct billable booking came from North America, and only 16% from EMEA, 20% from Asia-Pacific, and 9% from Latin America. Before COVID, Sabre had revenues of $3,974 million in 2019, an increase of 2.79% compared to 2018. Net income was $162 million in 2019, which was a decline of 52% compared to 2018. The net margin was only 4.08% in 2019, while it was 8.8% in 2018 – both substantially lower than the net margins of Amadeus, which were 19.8% and 21%, respectively.

In 2019, Sabre’s long-term debt was $3,261 million, which means that it would take 20 years to pay back that debt with its net income of 2019 compared to only 2.5 years for Amadeus in the same period. Sabre’s ROE was 17%, whereas Amadeus’ was 28.98% in 2019. With regard to free cash flow margins, Amadeus averages 20% while Sabre averages only 11%.

The beginning of the pandemic in 2020 was difficult for Sabre as its revenues dropped 66%, almost like Amadeus; net income declined from $158 million in 2019 to -$1,280 million in 2020. Sabre’s total debt increased from $3,342 million in 2019 to $4,665 million in 2021 as part of its higher liquidity requirements during COVID.

In 2021, Sabre’s revenues grew 24% compared to 2020, similar to Amadeus with a revenue growth of 22% in the same period. But Sabre’s net income is still negative with -$950 million and -$1,280 million in the previous year. Free cash flow also improved from -$835 million in 2020 to -$464 million in 2021, but is still negative, whereas Amadeus had already earned positive free cash flows in 2021.

As of June 2022, Sabre registered a growth in revenues of 66% YoY compared to 82% for Amadeus in the same period. Sabre’s net income improved from -$517 million to -$150 million – still negative. Sabre’s free cash flow improved from -$355 million to -$245 million in the same period, but still remain negative. The total debt of the company has not changed materially from $4,752 million to $4,748 million in the same period.

These results indicate that Amadeus is recovering faster from COVID than Sabre. Thanks to its much better net margins and free cash flow margins, Amadeus is already delivering positive numbers while reducing its total debt. Looking at these numbers, Amadeus is superior to its main competitor Sabre in financial performance, profitability, free cash flow generation, and lower financial leverage, as it has a stronger business model and is more sustainable as a long-term investment.

Fourth Buffett rule – undervaluation

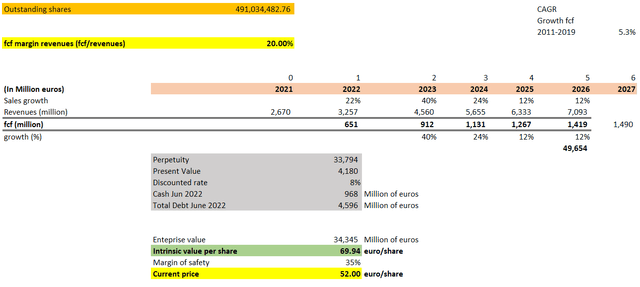

Using DCF methodology, I made the following assumptions to calculate the intrinsic value:

- In 2024, Amadeus would reach the same revenues as its pre-COVID levels in 2019 as estimated by the consensus.

- Free cash flow margins of 20% on average for the following years; this has been the average in the last 10 years before COVID.

- Growth in revenues in 2025 and 2026 will be 12%.

- Growth in free cash flow in perpetuity of 5% CAGR; this has been the average CAGR in the last 10 years pre-COVID.

- Outstanding number of shares of 491,034,482, as it was in 2021.

- To calculate the enterprise value, the total debt as of June 2022 is subtracted from the present value of all the future free cash flows, adding the cash of the balance sheet as of June 2022.

- The discounted rate used was 8%.

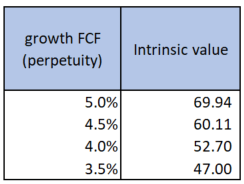

With these assumptions, my intrinsic value is 69.94 euros per share:

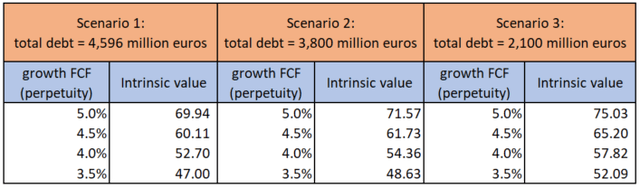

Now, remember that the higher the margin of safety, the better the long-term returns. Considering the high volatility in the stock market right now, shares of Amadeus could reach lower levels. On the other hand, it’s very important to create a sensitivity analysis changing some of the assumptions; for example, we might see how the intrinsic value changes as the growth in free cash flow in perpetuity (FCFP) changes:

Prepared by the author

I take the 3.5% as the lowest growth projected in FCFP, since I estimate that this growth should match at least the number of passengers projected by IATA in 2018 of 3.5% CAGR to the year 2037. The growth in FCFP assumed in my calculation is 5% given its past CAGR during 2011-19 that was 5.3%. According to the table above, and given the current stock price fluctuating between 47 and 52 euros per share, the market is assuming indirectly only 3.5% and 4% of growth in FCFP.

In my particular view, I assumed 5% of growth in FCFP since Amadeus is a company with a strong market position with a higher pricing power and strong free cash flow generation. This is supported by the fact that in the last two years the company has strengthened its partnerships with more airline companies and its business model, taking a leading role in the digitalization of the industry.

Although the travel and tourism sector is recovering gradually from the COVID situation as people have not lost their desire to travel after two years of severe restrictions, an economic recession and the effects of the war between Ukraine and Russia could slow down that recovery. Therefore, the question is how long this kind of scenario might last. This question isn’t as important if our strategy for this stock is oriented to the long term.

In the meantime, Amadeus will reduce its level of debt as the sector is recovering in the middle of an uncertain macroeconomic scenario. In this sense, we did some sensitivity analysis considering the reduction of the total debt to pre-COVID levels and taking the different scenarios in the growth of FCFP assumed previously. This reduction of debt could be another factor that might boost the valuation of the company:

As per the table above, we would expect a convergence of the current total debt of the company toward pre-COVID levels, like scenarios two and three, as the travel and tourism sector recovers gradually, reducing the need for more debt as those requirements will be satisfied from its own cash flow generation. It is important to notice the different intrinsic values improving as the total debt is reduced in scenarios 2 and 3.

In regard to the sensitivity related to the discounted rate and given the assumptions presented at the beginning, I use 8% in the valuation of a high-quality company. If the discounted rate is increased to 9%, keeping all other factors unchanged, the intrinsic value would drop from 69.94 to 50.17 euros per share. I apply 8% when I feel comfortable with the company. It would be reasonable that a higher discounted rate is used since the inflation rates might push that rate up, so our intrinsic value would be close to 50.17 euros under those conditions. However, a strong company like Amadeus might increase fees to counteract the pressure from the inflation rates, and that situation could mitigate the risk of higher discounted rates. Also, as inflation rates show a downward trend, the pressure on the discounted rate will recede as well.

Risks and Challenges

I have identified a few items that could challenge my investment thesis. First, if the travel and tourism industry’s recovery takes longer than expected, Amadeus’ financial performance will be negatively impacted, creating a more bearish sentiment for its stock.

A mitigation this risk would be that the company has good enough liquidity since the beginning of the pandemic in 2020, being conservative in its cash management. In the worst-case scenario, the company might raise more capital through bond issues or more credit lines as it enjoys strong confidence among institutional investors and the banking system. However, a scenario like 2020 is unlikely since vaccines solved a great part of the problem and restrictions in airports are being lifted gradually.

On the other hand, signing new deals for new services with the same clients and new ones was not only a way for Amadeus to reinforce its business model during the pandemic, but also a way to support the different players of the industry to recover faster from COVID. So, even in the worst-case scenario where a recession hit the industry, people will need to travel. This would enable Amadeus to raise fees for more value-added services, developing new technological solutions that support airline companies or hotels to be more efficient in their operations and better promote their services, given the budget constrains from passengers in that scenario.

Second, Amadeus might not be an easy-to-understand company, breaking one of the most famous Buffett rules. However, one of the main reasons why Buffett wants companies that are easy to understand is because he likes to hold these businesses for many years; in this sense, it’s very important to understand and anticipate future risks associated with those business models. A company without much complexity enables Buffett to anticipate those risks and feel comfortable, incorporating those factors in the calculation of the intrinsic value. That’s a reason why he avoids, for example, tech companies because of their unpredictability in the long term – with that “unpredictability” associated more to their complexity.

Amadeus is a tech company, but that doesn’t mean it has a complex business model; its software and platforms to sell reservations globally are well known by travel agencies and tour operators. Management has put in a great effort to make Amadeus more predictable for the long term, signing very long-term contracts with its clients, generating more stickiness with its services and technology, and delivering more value-added services that make it very difficult for clients to change to other providers. Management has been strengthening the company’s business model, creating strong barriers to entry for any potential new entrant in the industry, making Amadeus more predictable as a business model for the long term.

Third, shares of Amadeus might not experience a significant appreciation in the short or midterm, so investors might feel disappointed about the stock performance in the short term. However, the strategy for Amadeus should be “buy and hold,” so we do not need to be worried about its short-term or even midterm performance. You might think that there would be an “opportunity cost.” But if we’re looking at a very long-term horizon, that “opportunity cost” is diluted over time as the industry gradually recovers its pre-COVID levels, while the market recognizes the company’s privileged position in the industry and its high-quality business model.

There is high demand for the company’s services and technology, particularly in a scenario where players in the travel and tourism sector need to be more competitive, more efficient and more digitalized. There are very few suppliers of these requirements globally in this sector, Amadeus being the leader among those “few providers.” All of these factors might boost Amadeus’ valuation in the long term.

A Strategy for Shares of Amadeus

Buying this stock at a price between 47 and 52 euros is best as the company is expected to improve its performance given the gradual recovery of the sector. The consensus is that the sector will recover to its pre-COVID levels of 2019 in 2024. However, it is feasible that a company like Amadeus could recover those levels before 2024. Either way, the strategy should be “buy and hold.”

If you were to suppose that we’re heading into a recession and it lasts for two to three years, I would buy at the current price of 47-52 euros per share, holding that position for the long term. If the stock price dropped to a price lower than 40 euros, I would add more shares to my portfolio to reduce my average cost. The strategy for this stock is to hold for the very long term, at least 10 years, to take advantage of the compounding effect given its long-term secular growth and its high returns on equity and capital invested. Compounders like Amadeus drive up their intrinsic value over time, a good anchor to boost the long-term stock market price.

Conclusion

Something that I learned from Warren Buffett is to look at outstanding companies that are facing a “temporary setback,” since during those periods these companies can be found at a discount. Usually, in those scenarios these outstanding companies are dismissed by investors because they don’t know if those difficult periods are temporary or permanent. I believe that Amadeus is facing just a brief problem related to its industry.

Amadeus fulfills all of Warren Buffett’s rules to be a very good long-term investment; thus, any investor oriented to the long term should consider Amadeus one of the most interesting bets within the travel and tourism sector. On the other hand, a factor that might cast doubt on the company’s growth potential in the short term is the possibility of a recession. Nevertheless, I believe the company’s business model is very resilient and is particularly reinforced by its strong competitive advantages, which are reflected by its high margins, low financial leverage, and excellent management.

The secret sauce for a successful long-term investment is to buy outstanding companies when they are facing a negative situation, as their business models are very resilient and can surpass those issues without much difficulty. This is what Warren Buffett has done with Coca-Cola, Apple, American Express, etc. – holding those stocks for several years to take advantage of their compounding effect. Amadeus seems to be a similar situation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment