Elena Bionysheva-Abramova/iStock via Getty Images

Investment Thesis

The market sentiment is getting flustered as we observe the warning signs of a recession coming to fruition. These signs are cropping up in almost every sector, from commodities to the stock market & real estate. Prices for the metal market hit 16-month lows on the 1st of July after dropping more than 11% in two weeks. Let’s see what’s happening at one of Canada’s leading mining companies Teck Resources Limited (NYSE:TECK).

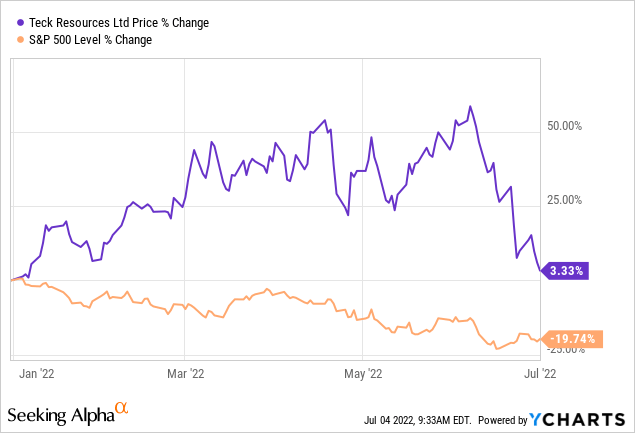

Teck Resources stock gained 3.33% YTD, outpacing the S&P 500’s 19.74% loss. With a superb stock performance by Teck in 2021, a downward trend has been observed more recently as the prices dove down by 23% in June ’22, directly correlating with copper prices which are also down by 16% this month. Copper had enjoyed a commodity super cycle with an 81% gain last year. Now analysts predict that with recent heavy dips, this super cycle might see its end.

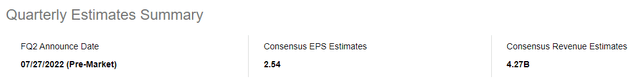

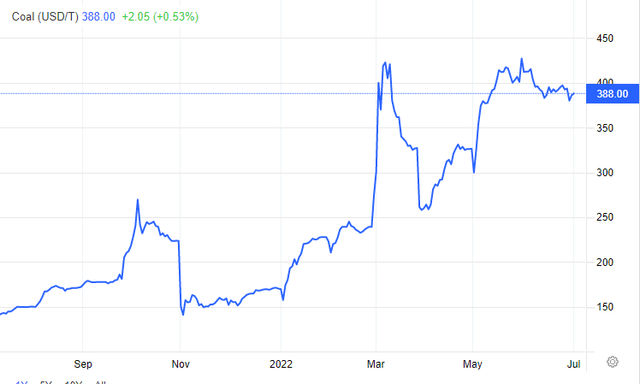

Analysts are looking positively at Teck’s upcoming earnings report, expected to be published on July 26th, with an expected EPS of $2.54, a staggering leap of 407% from the prior-year quarter. This is most likely backed by a strong jump in coal prices which form the company’s biggest revenue-generating and gross margin segment.

Seeking Alpha

The stock experienced a substantial upward movement until June, backed by bullish commodity pricing. With the prevailing market conditions, I rate the stock as a “Buy” due to high coal pricing, which will amplify its Q2 earnings reports, likely resulting in a buying frenzy, hiking the share price.

Company Overview

Headquartered in Vancouver, Teck Resources is one of Canada’s leading mining companies working in the mining and mineral development sector. It is one of the oldest players in the industry, sporting a diversified product line.

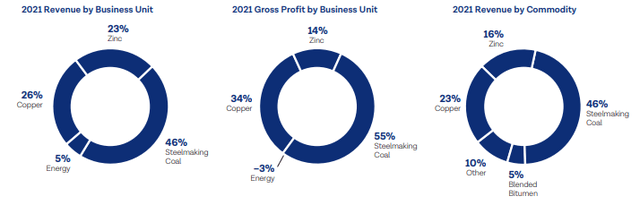

Its core business focuses on steel-making coal, accounting for almost 55% of the company’s total revenue and 69.2% of gross profit; zinc, accounting for 18.2% of total revenue and 9.6% of gross profit; copper, accounting for almost 18.5% of total revenue and 17.7% of gross profit; and investments in energy assets, accounting for almost 8.3% of total revenue and 3.5% of gross profit in the MRQ.

Teck Resources 2021 Annual Report

The company has been inclining towards expanding its copper mining operations recently, with already four operating mines mining copper and several big development projects underway in Canada and South America. TECK is also known for being the world’s second-largest seaborne exporter of steelmaking coal.

Substantial Returns in 2021 Backed by Rising Prices

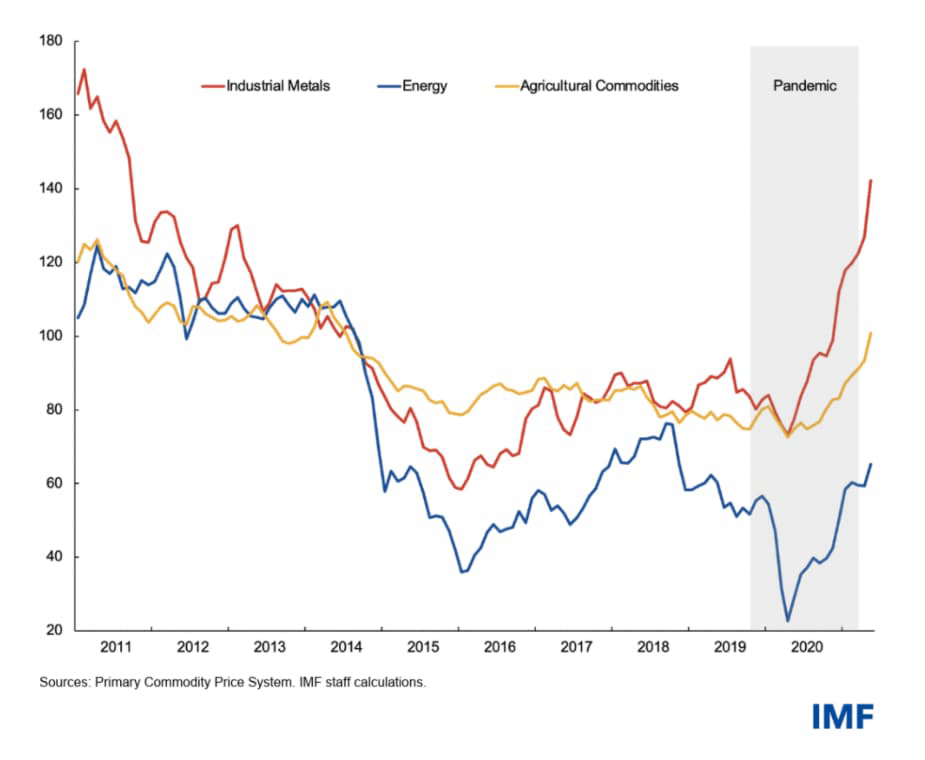

Commodities have always acted as an inflation hedge during tougher times. Consider the COVID-19 pandemic, which badly affected most the industries and businesses around the world, but industries directly correlating with commodities weathered the pandemic storm pretty well.

One of the reasons why the mining and metal industry thrived during the pandemic with healthier balance sheets and a good amount of excess liquidity was due to the substantially higher commodity price, as the average prices for copper, zinc, steelmaking coal, and blended bitumen were 51%, 32%, 85%, and 108% higher in 2021 than in 2020 respectively.

IMF

Source: CNBC

Sustainability & Net Zero Aim

Carbon Capture Project Initiation

According to a PWC report, companies with higher ESG ratings show better market performance and outperform the broader market, delivering shareholder returns that averaged 10% higher than the general market index.

A recently published McKinsey report states that as the world moves towards cleaner technologies, the metals, and mining sector will be tested; it will need to provide the vast quantities of raw materials required for the energy transition. For many mining companies worldwide, these climate commitments would result in mine closure and decommissioning facilities.

Looking at the fundamentals, TECK is in a healthy position to expand its operations and sustainability efforts. To achieve net-zero emissions by 2050, TECK has announced its Carbon Capture Utilization and Storage (CCUS) pilot project at its Trail Operations metallurgical complex in southern British Columbia, helping the company align with its Climate Change Strategy and reduce its carbon emissions by 33% by 2030.

TECK has a reputation for practicing sustainability as it was previously named in the S&P Dow Jones Sustainability World Index for the 12th consecutive year and recognized as the number 1 company in the Metals and Mining sector.

Teck’s Heavy Investment in Copper

According to Donald, CEO of TECK

We significantly advanced our strategy to rebalance our portfolio towards copper by progressing Teck’s flagship QB2 project — a long-life, low-cost operation that will double its consolidated copper production and position Teck as a major global supplier.

Update On QB2 Project

The shortage of key metals will make it harder and challenging for metal & mining companies to transition towards net-zero by 2050. Decarbonizing society will require critical resources to move the industry toward a greener economy. Let’s take the example of copper, which is critical for low-carbon transition, as it is one of the essential industrial metals used in integrated renewable energy systems such as solar, wind hydro, etc. The world will need significant copper, with demand expected to double by 2050.

TECK’s QB2 Project is one of the world’s largest undeveloped copper resources. QB2 is expected to have low operating costs, an initial mine life of 28 years, and significant potential for further growth. QB2 project is in its completion stage, where almost 77% of the construction work has been completed in Chile, with its first production expected in the second half of 2022.

Valuation

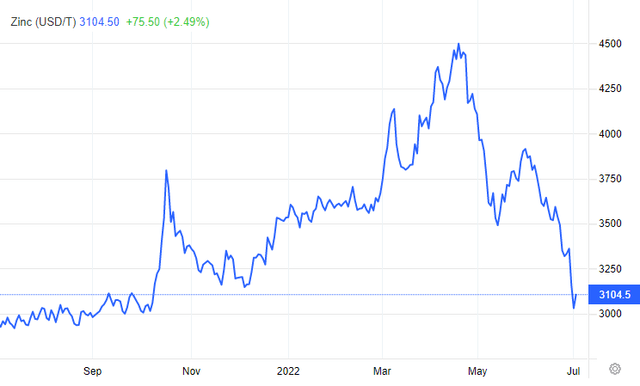

One of the key criteria while selecting a mining stock is to look at the underlying commodity prices. The correlation between commodity price and mining stock price will give a greater understanding to the investors of how the changes in commodity prices affect the prices of mining stock and eventually decide whether to buy, hold or sell the stock. More often, the spot and forward prices correlate more strongly with the commodities than the long-term prices.

TECK, one of the beneficiaries of the rising commodity prices, had an excellent year with a 58.78% upward price movement in 2021. Such catalysts, along with prudential capital management, helped TECK deliver superior results.

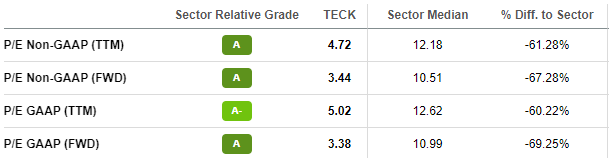

TECK is currently trading at a significantly lower forward P/E multiple of 3.44x, and a trailing P/E multiple of 4.72x, compared to a multiple of 10.51x and 12.18x of its peers, exposing traits of a value stock.

Seeking Alpha

Similarly, it is trading at lower forward and trailing P/CF and P/B ratios than the industry median as well as its 5-year averages. On average, the stock is trading at a 43% discount to the industry medians and a 37% discount to its 5-year averages, indicating a fair value price tag ranging between $47 and $52 per share, which is on spot against analyst consensus price targets.

In contrast, dividend yield remains low at 0.92% compared to the industry average of 2.17%, which indicates that there is still room for future growth in dividend payments, especially considering the trailing FCF yield of over 8%. In terms of shareholder returns, the company has also recently announced a share buyback program amounting to $500 million, which will be considered regularly according to the market conditions.

Financial Performance

Even though Teck’s levered FCF margin of 1.97% was low, its financial statements show a healthy cash position with liquidity remaining strong at $6.1 billion as of April 26, 2022, including $1.9 billion of cash reserves, leading to a current and quick ratio of 1.92x and 1.19x, ample enough to cover its short-term obligation.

Revenue of $ 12.7 billion was up 19.8% in the MRQ compared to $10.6 billion last year. Similarly, gross profit is at its highest level, amounting to $5.5 billion, at the end of Q1 2022, with the gross margin almost doubling YoY, backed by appreciating metal prices. These numbers are unlikely to be sustainable, especially given that the commodity prices recently continued to drop.

Trading Economics

TECK’s Highland Valley Copper Operations had a gross profit of $721 million in 2021, compared to $331 million in 2020 and $196 million in 2019. The increase was primarily the result of substantially higher copper prices, partially offset by the strengthening of the Canadian dollar and higher unit operating costs. These higher unit operating costs were mainly due to inflationary pressures such as higher diesel costs for operations and transportation.

In 2021, the substantial increase in gross profit from the copper business unit was driven by copper’s super cycle, which averaged its price at around $4.27 per pound for the year; this price currently stands at almost $3.6 per pound, a decline of almost 17%.

Similarly, the zinc business unit gross profit increased by 32% compared to 2020, supported by an average realized zinc price of $1.39 per pound for the year.

The biggest chunk of all came through realized steelmaking coal prices of $209 per ton, which drove a $2.5 billion increase in the gross profit in its steelmaking coal business unit. Favorably, these prices have hit new highs in the current year as coal prices surged to over $430 by May end.

Trading Economics

These numbers concur that the high commodity prices predominantly dictated the YoY gain. Since the revenue growth is not organic, the company risks losing its recent financial gains if the commodity prices nosedive due to any reason.

However, the substantial leaps in the coal prices have driven the estimated EPS of the company to $2.54 in the upcoming reports, which will be an over 4 times YoY EPS growth.

Conclusion

TECK has performed exceptionally well compared to other similar companies, with over 75% YoY revenue growth. The recent decline in the metal prices, especially in Teck’s copper business unit, may offset the short-term pricing advantage acquired through coal, but the overall sentiment remains positive.

The company’s long-term prognosis also remains optimistic because of its aggressive project initiations and endeavors. Teck’s capital expenditures for 2022 are expected to be approximately $785 million for capital growth and sustainability.

Investors, in general, have been fearsome due to commodity prices going down much faster than estimated as we move towards a recessionary environment. Similarly, CPI numbers are about to come in July and are anticipated to be hiked up.

Times are tough ahead, and investors have also become cynical about the overall situation of the stock market. Until now, Teck has been impressive with its price movements until June, but the systemic risks have turned the overall market sentiment to a bearish one, which has also affected Teck.

Commodity and commodity-related companies can act as a hedge against inflation if they can sustain themselves during a commodity bust. Accordingly, I expect Teck to see some selling pressure in the near term, which is more related to the overall market conditions rather than the company’s performance. However, investors looking for a long-term commodity company security can reliably bet on Teck.

Be the first to comment