Editor’s note: Seeking Alpha is proud to welcome Thomas Prescott as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

TchnipFMC Pipelay Vessel “Deep Energy” kateafter/iStock Editorial via Getty Images

Introduction

I’m going to break with tradition and start with several disclosures; I’m a long-term investor in TechnipFMC (NYSE:FTI), I have decided to continue holding FTI, and I plan to add to my position. I’m also a fool for big, beautiful boats like the specialized pipe laying vessel shown above; I love em like a bee loves honey!

I originally bought FTI near the bottom of the pandemic dip on my belief that, at below $6, it was a deep value. At that time, oilfield service (OFS) stocks, including FTI, were very low due to severe revenue contraction. I expected FTI (a quality OFS with crucial technology, equipment, and expertise in offshore oil and gas) to rebound with a recovering post covid global oil and gas sector resulting in fabulous gains.

So far, my investment thesis has not played as anticipated; FTI has underperformed since late March of 2020. FTI has not been a fabulous investment and might continue a similar trend. I am generally a long-term investor, but that does not mean that I cross my fingers and hope that my investments will produce gains one day. I am convinced that resolving to continue holding a long-term position demands the same deliberation as initiating a new position.

In the following paragraphs, I will revisit my original investment thesis and reconsider FTI as a value OFS within a recovering energy Market. I will begin with a macro view of oil and gas (O&G) markets. Notably, within the broader O&G sector, FTI is focused on offshore oilfield services. I will then consider FTI with relation to recent price, valuation, revenue and EPS, recent news, and momentum. I will then discuss risks and present conclusions.

A Macro View of O&G Markets

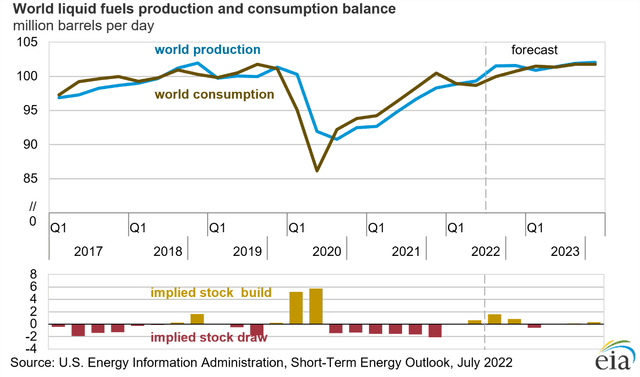

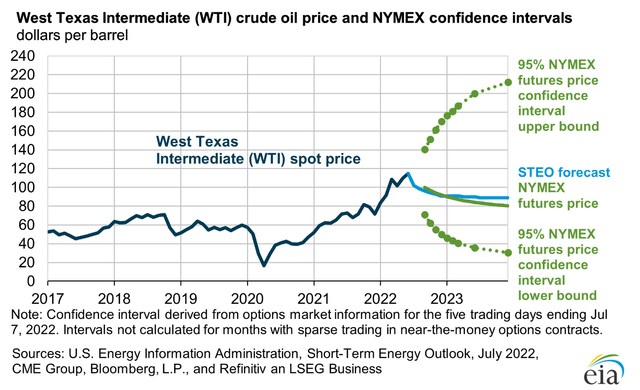

In the last two years, energy markets have made a volatile recovery with supply and demand in precarious balance and prices currently near 10-year highs. On July 12th, the U.S. Energy Information Agency (EIA) released its most recent Short Term Energy Outlook.

These data illustrate a tightening balance between production and supply with a forecast of elevated WTI spot price. The natural gas market is in a similar position according to other data included in this report.

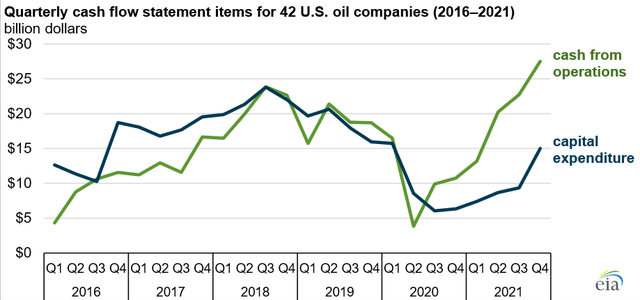

Elevated prices in O&G markets have resulted in increased cash from operations and rebounding CapEx among E&P’s according to further recent EIA data.

These data are based on published financial reports of 42 U.S. E&P’s and illustrate large increases in both cash from operations and CapEx. Quarterly cash from operations in 4Q21 were the highest reported since late 2014 with CapEx increasing 60% from 3Q21 to 4Q21. Notably WTI averaged just $77 per barrel in 4Q21. More recently, WTI has oscillated around $100 indicating possible further expansion of cash from operations and additional cash to fund CapEx. Given that E&P CapEx equates to revenue for OFS, the market is rapidly improving for FTI.

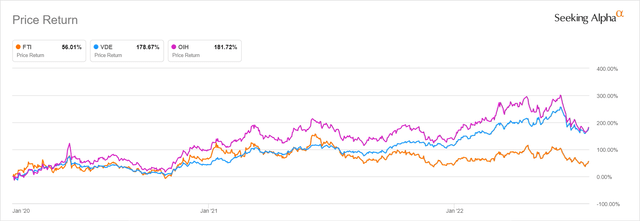

FTI: Recent Price Return

My original investment thesis was that FTI, a quality OFS, would rebound in a post pandemic recovery. Ironically, the energy sector has been the best performing sector this year, but FTI has lagged the broader recovery. The following chart plots FTI price return with that of Vanguard Energy ETF (VDE) and VanEck Oil Services ETF (OIH) since late March of 2020.

VDE is an ETF whose holdings are mostly major E&P’s including the top three: XOM: 22%, CVX: 17%, and COP: 7% while OIH is comprised of OFS companies including FTI. Since late March of 2020, VDE and OIH have rebounded about 180% including recent declines. Compared to OIH, FTI has underperformed oilfield services through the subsector’s recovery indicating possible unrecognized value.

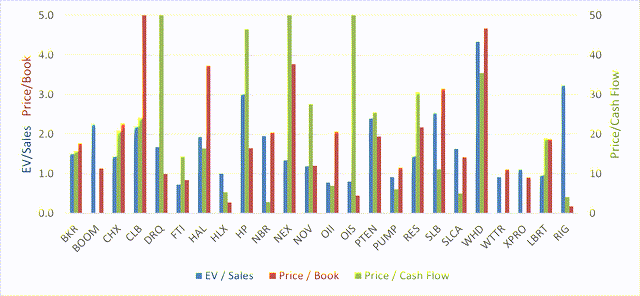

Valuation

The data above were sourced from Seeking Alpha and illustrate valuation metrics across OIH’s oilfield service holdings. FTI valuation metrics compare favorably with other OFS’s with the lowest EV/Sales. FTI Price/Book and Price/Cash Flow are amongst the lowest in the sector. Notably, offshore OFS peers Helix Energy Solutions (HLX) and Oceaneering International (OII), also exhibit relatively low valuation. Historically, E&P offshore CapEx has often lagged land recovery in an upward trending O&G cycle. Given the low valuation of FTI and its offshore focus, FTI appears poised for asymmetric returns as offshore joins the broader recovery of oil field services.

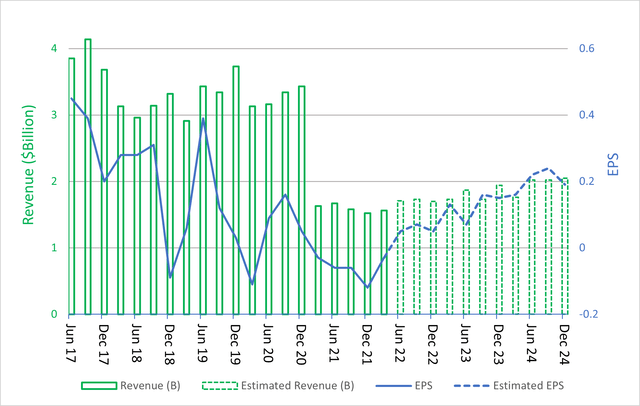

FTI Revenue and EPS

These data were sourced from Seeking Alpha and represent historic and consensus estimates of FTI revenue and EPS. Revenue and EPS both declined sharply in early 2021 as E&P’s cut back on CapEx. So far FTI revenue and EPS have not recovered to pre-pandemic levels. However, consensus estimates indicate recovering revenue and EPS forward to late 2024. These forward estimates are reinforced with recent news.

Recent News

On Friday the 15th of July, BofA upgraded FTI and ChampionX (CHX) to buy while downgrading Patterson-UTI Energy (PTEN), NexTier Oilfield Solutions (NEX), and ProFrac (PFHC) to hold. With relation to FTI, BofA forecasts accelerated growth in the international subsea market FTI serves, reiterates FTI’s market leading position in subsea services, highlights an improved balance sheet, and calls out increased free cash flow. I’ll admit that my first reaction is relief that someone agrees with me and perhaps soon the market will realize that I have been right along! Of course, my first reaction falls grossly short of careful deliberation.

Digging further into recent news, FTI has added to its backlog with large new contract awards from international E&P’s including Equinor, Total Energies, Exxon, and Petrobras. Recent quarterly results indicate recovering earnings. The latest investor slideshow reveals new orders totaling 2.2 billion; highlights total backlog of 8.9 billion; and describes a fortress like balance sheet with 1.2 billion in cash equivalents and 802 million in net debt. Further, per the slideshow, FTI occupies a market leading position within subsea services providing integrated field architecture and design; equipment including subsea production trees, manifolds, and umbilicals; and comprehensive engineering, procurement, and installation using specialized fleet. In short FTI is the biggest, best provider of subsea services with an impressive moat made up of unique capabilities, expertise, and equipment.

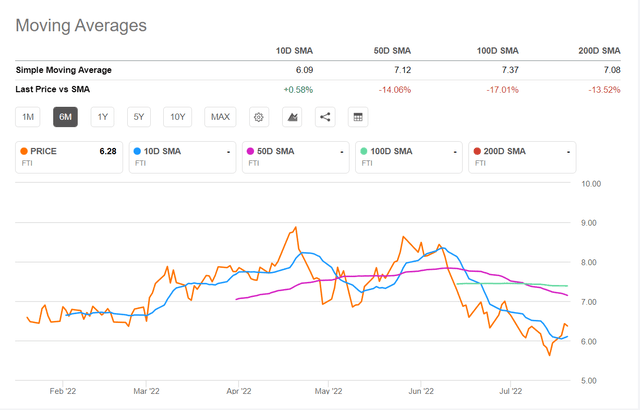

Momentum

Moving averages can often be a powerful trend-spotting tool. Currently FTI is well below its 50D, 100D, and 200D moving averages. With current price well below longer term averages, FTI is cheap. Currently, FTI is 45% below its 52 week high. A recent break above 10D SMA may indicate positive forward momentum.

Broader Observations

Offshore oil and gas operations involve all the challenges of onshore operations with additional hurdles. These include increased oversight and regulation, unique risk to the environment, negative societal perception, technical and engineering challenges, higher initial investment, longer cycle, and generally greater risk. Therefore, E&P’s have focused their reduced CapEx on short cycle production onshore and in established fields. These observations may explain why FTI has lagged the broader energy recovery and that of other OFS companies.

Many analysts are predicting a tight market for oil and gas with depleted volumes in storage and future demand balancing or exceeding production. Further, there has been historic under investment in new of oil and gas capacity. This reduced CapEx proceeded the pandemic and actually began in late 2016. Recent analysis by a Seeking Alpha author report there is very little spare capacity in energy supply. To meet future oil and gas demand globally, increased CapEx will be required to build production capacity including additional investment in offshore oil and gas.

Risks

The volatility in the oil and gas industry is scary. The energy sector is subject to unnerving volatility with frequent spikes and dips. The current cycle began with the dramatic pandemic induced dip in April of 2020, and it is uncertain if the peak has been reached or how long oil and gas prices will remain elevated. Demand destruction and recession are both risks across the entire oil and gas sector.

FTI is a very specific investment in offshore oil field services. According to recent full-year guidance, FTI derives about 80% of its revenue from subsea services. E&P’s could choose to further delay longer term offshore investments and focus CapEx on short-cycle onshore projects.

Market chatter is abundant. Some analysts predict energy prices heading higher while others forecast a falling market. Analysis often attempts to retrospectively explain short term energy volatility via the news of the day. Or conversely, market chatter predicts how energy prices will react to short term news. Ultimately, our hard earned capital is at stake and we need to make good decisions. I’ve found that those of us who make mostly good decisions are often lucky.

Conclusions

The current energy market is strong and current data indicate historically high cash from operations and growing CapEx amongst E&P’s. FTI’s recovering revenue, EPS growth, new contracts, and increased backlog suggest that offshore CapEx is already increasing with still more planned. The BofA upgrade of FTI includes a 12-month price target of $8.00 which indicates a potential return of almost 50% over the next year.

Right now, FTI stock is exceptionally low with limited downside risk making it a safe investment with considerable upside. Short term momentum indicates a possible sharp upward trend in valuation. I predict offshore oil and gas services will soon join the broader recovery in the energy sector. I recommend investors who are comfortable in the energy sector buy FTI at current prices. More cautious investors may want to wait for further evidence of recovering offshore CapEx.

Be the first to comment