imaginima

Planet Labs (NYSE:PL), which we’ve covered before here, just reported third quarter results for fiscal 2023. While we were pleasantly surprised by the strong revenue growth the company delivered, we continue to be very concerned about its profitability. This is a company that we believe does have a lot of potential and that we expect will continue delivering strong revenue growth, but we are not seeing the type of operating leverage necessary to feel confident that profitability is in sight.

We are still rooting for the company to succeed, as we appreciate its mission “to image the whole world every day and make global change visible, accessible, and actionable.” One piece of information shared at its recent investor day that we found particularly interesting is that on average more than one scientific paper with Planet’s data is published every day. The company is well on its way to becoming ‘the Bloomberg Terminal’ for earth data.

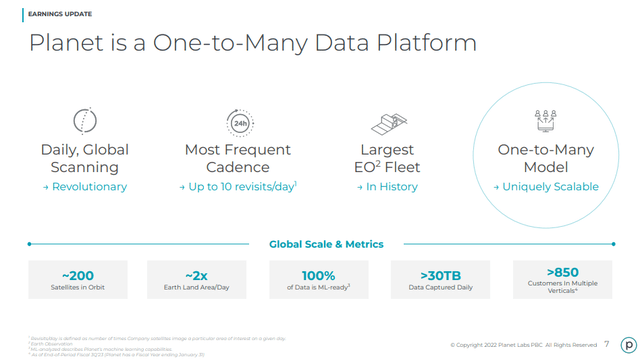

Another thing we like is the evolving business model that is quite scalable, and in particular we like the business transformation the company is making. It has gone from being a satellite company originally, to later being a data company, and it is now becoming a platform company. This means the company can monetize not only the data, but also the algorithms and the insights generation. As it develops more tailored solutions for specific industries, we believe the company will continue to become more relevant and gain new customers, especially as it makes its platform easier to use for customers.

Planet Labs Investor Presentation

Q3 2023 Results

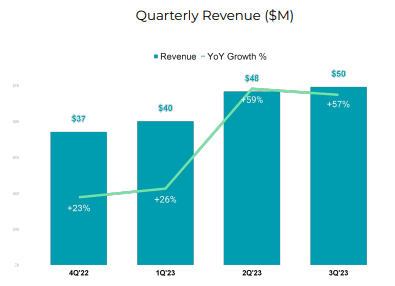

In Q3 the company generated $49.7 million in revenue, representing a 57% y/y growth. Non-GAAP gross margins expanded to 54%, up from 35% a year-ago. Planet Labs ended the quarter with 864 unique customers in many different industries.

Planet Labs Investor Presentation

The Adjusted EBITDA loss was $12.4 million, and the company ended the quarter with $425 million in cash, cash equivalents and short-term investments. The company also announced that it signed an acquisition agreement with Salo Sciences, Inc. This is a company that provides analytic solutions for the digital measurement, reporting and verification of above ground forest carbon.

Target Addressable Market Expansion

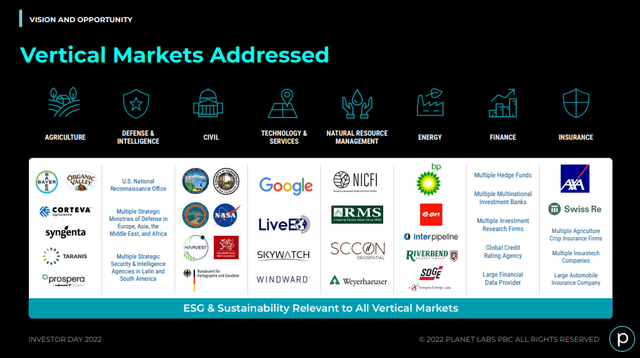

One of the reasons we believe Planet Labs can continue to grow at a rapid pace for some time is that it continues to add potential use cases across industries for its services. The slide below was shared during the company’s investor day, and it is impressive how many vertical markets the company serves.

Planet Labs Investor Presentation

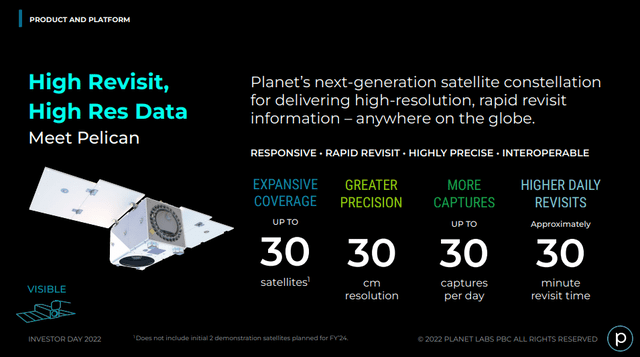

As the company further improves its offering, we believe the market will expand even more. For example, the company is already working on next generation satellite constellations. One that we find particularly promising is named ‘Pelican’, and it is planned to be a satellite constellation offering high resolution, rapid revisit, and high precision information. This should enable new use cases and further increase revenue for the company, although it will require significant investment as well.

Planet Labs Investor Presentation

Financials

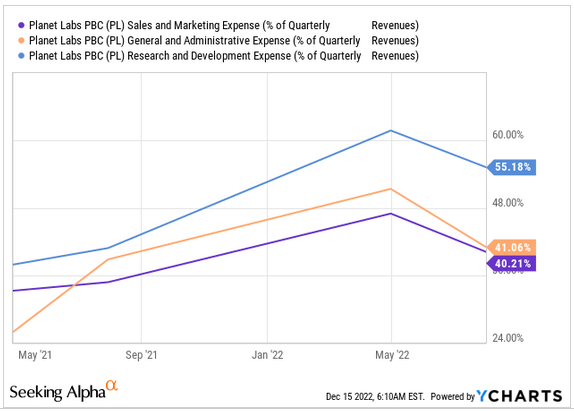

As we’ve mentioned already, our big concern with Planet Labs is the complicated path to profitability. Most cost categories remain extremely elevated, and we are seeing very little in the form of operating leverage as revenues increase. We can understand R&D costs still being very substantial for a young technology company, but we are more concerned with G&A and S&M.

YCharts

During the earnings call there was a question from an analyst related to the high sales and marketing expense levels. CFO Ashley Fieglein Johnson replied the following, which sounds like it will take some years before there is meaningful operating leverage.

Thanks for the question. And yes, as you point out, we’ve been investing significantly in our sales infrastructure. We talked about before we went public that a large reason for raising the capital was wanting to have more feet on the street, because there were a number of geographies where we weren’t even vertically aligned in our sales organization, because we just didn’t have enough AEs on the ground to do so.

So we’ve been adding on that front, and with that comes a support infrastructure that you need to make a lot successful. So everything from our sales ops teams to our SDRs and sales engineers. And we’ve also been investing in customer success, making sure when we sign these customers, we’re getting them the value as early in that on ramping process as possible.

The goal now is to make that scalable and there are multiple ways to scale the sales infrastructure. One of them is through the continued automation that we’re building into the product to make it easier for customers to on-ramp and to make it lighter touch for the customer success teams. So they can cover a broader customer base. The other way is through partnership programs.

So right now, I would say, most – if not, well the vast majority of our partners still have a Planet wrap involved in the sales process. Ultimately as the products become more advanced again on the customer onboarding et cetera, we can be lighter touch with our rep involvement in the sales process. So we’ve been scaling rapidly over the last year, we’ll obviously be focusing on making sure we get operational scale over the coming years.

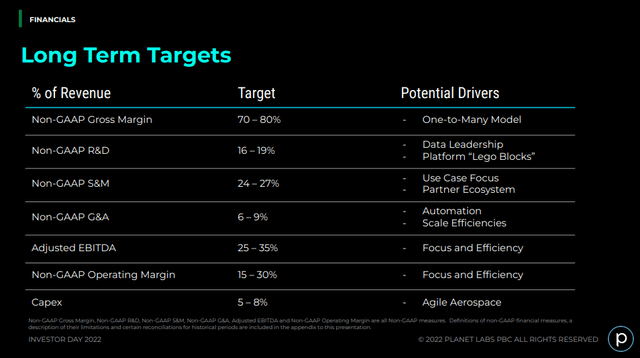

The long-term financial targets for the company look quite decent, if it finds a way to get there. Its non-GAAP operating margin target is 15-30%. Of course, how much this translates into real GAAP earnings will depend on how aggressive the company continued to be with its stock-based compensation.

Planet Labs Investor Presentation

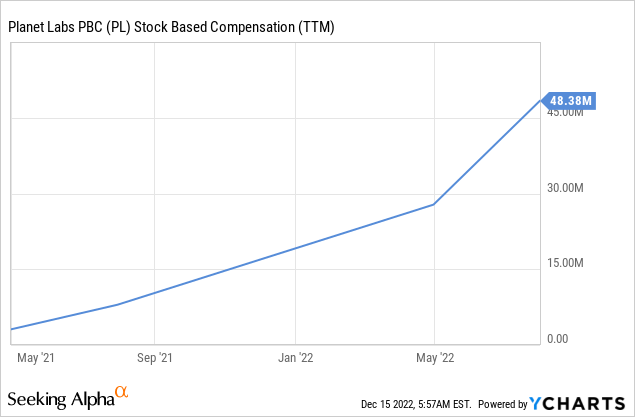

Right now we believe the company is being excessive with SBC, given that its trailing twelve months stock-compensation expense is ~$50 million. For a company with a current revenue run-rate of ~$200 million, we believe this is too much. In other words, the company is giving out ~25% of its revenue as SBC.

Guidance

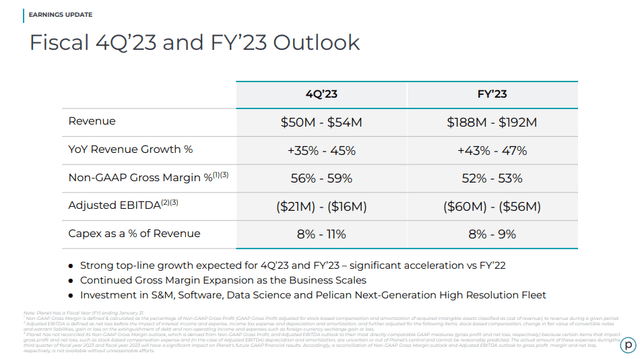

With respect to guidance shared during the earnings update, we believe the company is being conservative with the YoY Revenue Growth expectation of +43% – 47%. Given that the last two quarters the company has delivered growth almost reaching 60%. What we find extremely disappointing is that the company still expects to have a very negative Adjusted EBITDA. This reaffirms our belief that the path to profitability is nowhere in sight.

Planet Labs Investor Presentation

Valuation

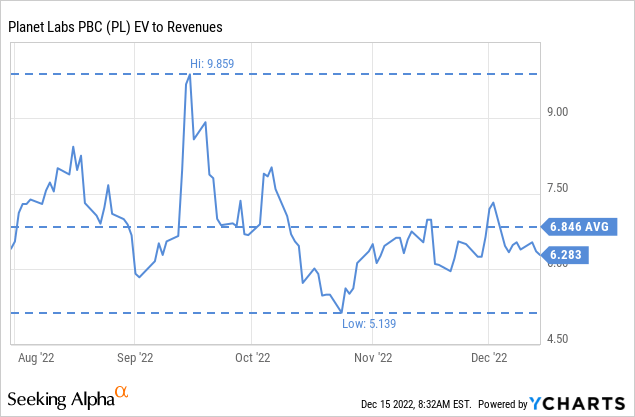

As a company with negative EBITDA, it is very difficult to value the shares. The most reasonable multiple to reference is therefore EV/Revenues. At ~6.8x it is clear that investors are betting that revenue growth will be very high for a very long time, and that the company will eventually show enough operating leverage to turn profitable. We are more convinced about the company being able to grow for several more years at a decent rate, than we are about it improving its profit margins substantially. There is also the question about SBC, and if the company will eventually moderate this expense.

Risks

The main risk we see with Planet Labs is that its path to profitability is very uncertain. It has to keep growing rapidly, but it also has to deliver meaningful operating leverage. We therefore consider the shares to be highly speculative.

Conclusion

We believe Planet Labs is a very promising company with incredible technology, and a worthwhile mission. We would like to see the company succeed, but we are worried that its path to profitability looks very complicated. We do believe there is potential for positive returns, but it comes with very high risk. Complicating things further is a valuation that already assumes high revenue growth for many years, and significant stock-based compensation that will make GAAP profitability very difficult. For all these reasons, we are maintaining our previous ‘Hold’ opinion in the shares despite the strong revenue growth.

Be the first to comment