muhammet sager

TC Energy Corporation (NYSE:TRP) is one of the leading energy infrastructure companies in North America. TRP has significantly underperformed its peers due to a number of recent operational hiccups, including a massive cost overrun at the Coastal GasLink project. TRP currently trades at a depressed 12.8x Fwd P/E multiple with a 6.6% dividend yield.

If TRP can quantify the remaining cost overruns at Coastal GasLink, as well as identify assets that can be divested to fund the financing gap, I believe there is a re-rating opportunity in TRP shares. I currently rate TRP a speculative buy, pending more information on the outstanding risks.

(All figures quoted in this article are in Canadian dollars, unless otherwise specified.)

Company Overview

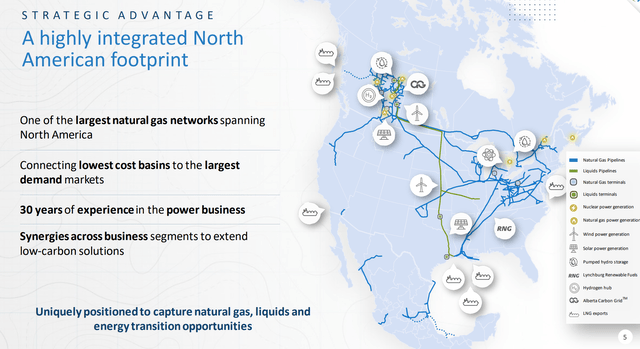

TC Energy Inc is one of the largest energy infrastructure companies in North America. TRP owns one of the largest natural gas networks in North America that transports fuel from low cost production basins like the Western Canadian Sedimentary Basin (“WCSB”) in Canada and the Marcellus in the U.S. to the largest demand markets, whether it is cities on the East Coast like New York or to the U.S. Gulf Coast for export (Figure 1).

Figure 1 – TRP network (TRP investor presentation)

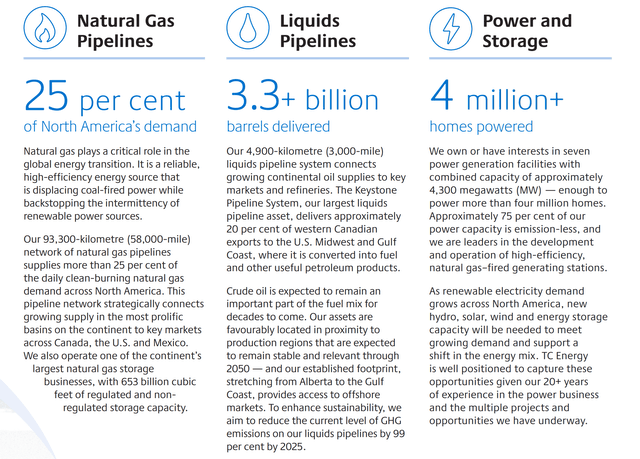

TRP’s operations are split into 3 main segments: natural gas pipelines, liquids pipelines, and power and storage.

Figure 2 – TRP overview (TRP investor presentation)

A Natural Gas Pipeline Giant

TRP is primarily known for its natural gas pipeline network, which spans over 93,000 km and supplies more than 25% of the natural gas demand across North America. The natural gas pipeline business is further segmented geographically into Canadian, the U.S., and Mexico.

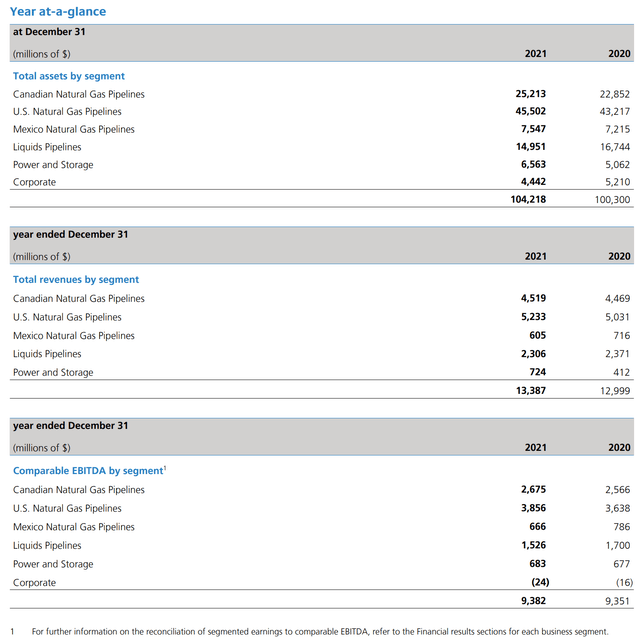

The natural pipeline segment accounted for $78.2 billion (75%) of the company’s $104.2 billion in assets as of December 31, 2021, and $10.3 billion (77%) of 2021 revenues of $13.4 billion and $7.2 billion (77%) of EBITDA (Figure 3).

Figure 3 – TRP financial summary (TRP 2021 annual report)

Liquids Pipeline Beset By ESG Concerns

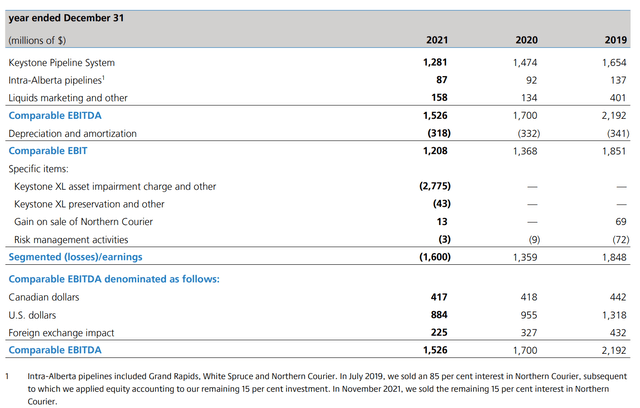

TRP’s liquids pipeline segment primarily involves the transportation of Alberta heavy crude oil to the U.S. Gulf Coast via the much-maligned Keystone pipeline. TRP originally planned to expand the capacity of the Keystone pipeline with the Keystone XL pipeline project, but due to President Biden’s revocation of the existing Presidential Permit, the Keystone XL project was terminated and TRP took a $2.8 billion impairment charge in 2021 (Figure 4).

Figure 4 – Financial summary of Liquids Pipeline financial summary (TRP 2021 annual report)

Power & Storage Small But Meaningful

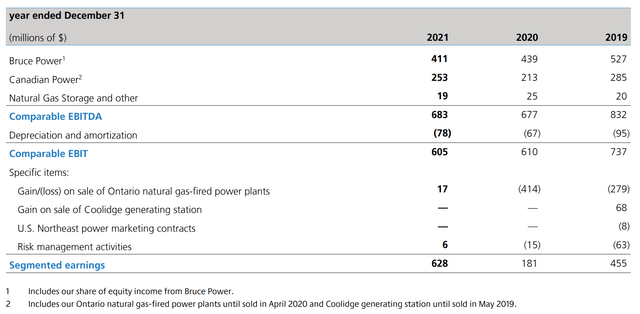

TRP’s Power & Storage segment encompasses the company’s 4,300 MW of power generation capacity spread from 1 nuclear power plant and 6 natural gas power plants and 118 Bcf of non-regulated natural gas storage capacity.

Although TRP’s Power & Storage business is small, it is still quite meaningful, contributing $0.7 billion in segmented EBITDA in 2021 (Figure 5).

Figure 5 – TRP Power & Storage financial summary (TRP 2021 annual report)

Importantly, these projects are mostly regulated utilities and help underpin TRP’s valuation.

Utility-Like Business Operations But Cyclical Valuations

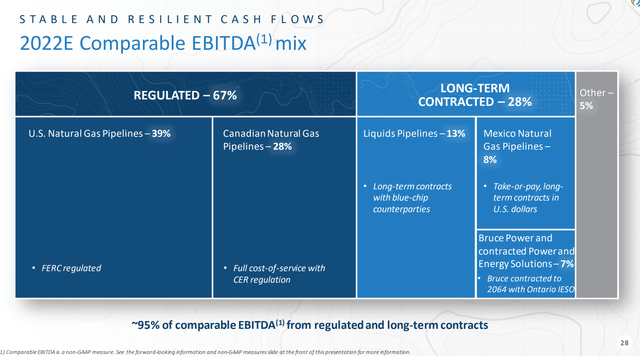

The most interesting aspect of TC Energy is that 95% of its business is regulated or under long-term contracts, meaning there is a high degree of visibility on revenues and cash flows, much like a utility company (Figure 6).

Figure 6 – 95% of TRP EBITDA is regulated or under long-term contracts (TRP investor presentation)

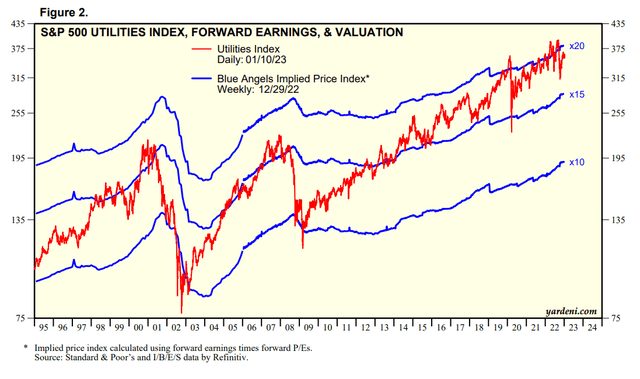

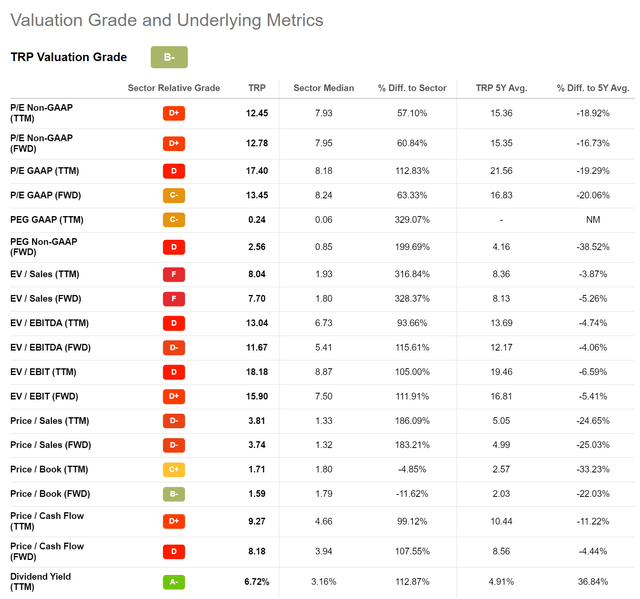

However, compared to utility companies, which trade at forward P/E multiples of ~19x (figure 7), TRP actually trades at cyclical energy sector multiples of 12.8x Fwd P/E, or a 30-35% discount (figure 8).

Figure 7 – Utility sector valuations (yardeni.com)

Figure 8 – TRP valuations (Seeking Alpha)

2022 Was A Tough Year For TRP

2022 was a tough year for TC Energy, as the company suffered a number of operational hiccups, causing the company to underperform its Canadian energy peers as represented by the iShares S&P/TSX Capped Energy Index ETF (XEG:CA), especially its closest competitor, Enbridge Inc. (ENB:CA) (Figure 9).

Figure 9 – TRP significantly underperformed XEG and ENB in 2022 (Seeking Alpha)

First, TRP’s Coastal GasLink project was vandalized in February, causing millions in damages and significant construction delay. Then its Keystone pipeline suffered a force majeure incident in July, causing a week-long service outage. This was subsequently followed by news of a major cost blowout at the Coastal GasLink project, with construction costs surging to $11.2 billion, from an initial $6.6 billion estimate.

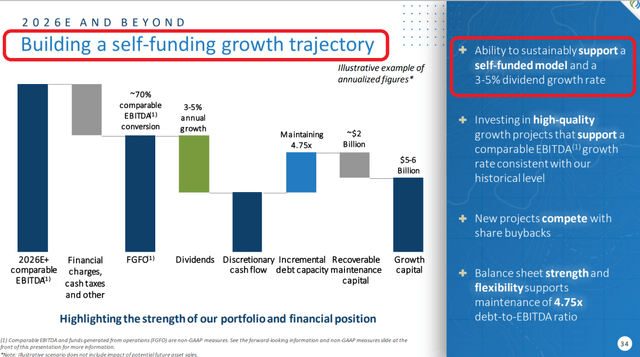

The surging costs at Coastal Gaslink forced TRP to tap equity markets for a $2 billion equity raise to fund its Mexico natural gas pipeline project. This was a surprise to many investors, as TC Energy had been marketing its growth program as “self-funded” (Figure 10).

Figure 10 – TRP had been marketing itself as self-funded growth (TRP investor presentation)

Investor confidence was shaken further at TRP’s November Investor Day, with management once again hiking the cost estimates for the Coastal GasLink project, citing cost pressures. Worryingly, the company did not provide a definitive cost estimate, only saying any cost overruns will be funded by a $5 billion divestiture program.

Finally, in December, TC Energy’s Keystone pipeline was shut once again after more than 14,000 barrels of oil was spilled into a creek in Kansas. Although the pipeline was subsequently approved to reopen at the end of December, no in-service date has been approved and the company does not have an estimate for the cleanup costs for the oil spill.

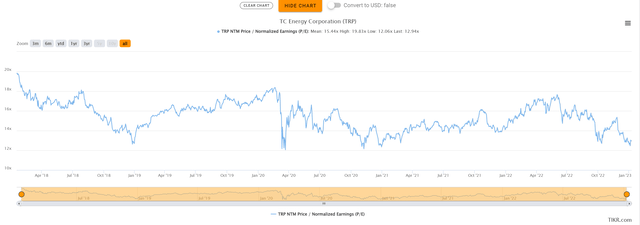

Valuation In The Dumps; Upcoming Earnings Call Will Be Key

As we mentioned above, TRP’s valuation is currently in the dumps, trading at a forward P/E multiple of only 12.8x. This valuation multiple is similar to the company’s valuation multiple at the depths of the COVID pandemic, when the world seemed literally about to end (Figure 11).

Figure 11 – TRP trading at COVID valuations (tikr.com)

Importantly, while TRP’s valuation scrapes the bottom, its peers like ENB have seen their valuation multiples recover to pre-COVID levels of 18.2x Fwd P/E (Figure 12).

Figure 12 – ENB’s valuation has recovered to pre-COVID levels (tikr.com)

This opens an interesting valuation gap between TRP and its peers, provided the company can assuage some of investors’ fears regarding its recent operational missteps. I believe the upcoming earnings call for TRP will be a key catalyst for TRP.

For example, if TRP can definitively quantify the remaining cost overruns at Coastal GasLink, and keep it within $2-3 billion, that should help lift investor sentiment. At the end of 2022, the pipeline was approximately 80% complete, so containing cost overruns to an additional $2-3 billion should be achievable.

What Assets Will Be Sold To Close The Funding Gap?

Furthermore, if TC Energy can identify the specific divestitures the company will use to fund the cost overruns, then that will allay investors’ concerns regarding the funding gap and possible further equity issuances.

Unfortunately, the Keystone pipeline, one of the assets that TC Energy was rumored to be looking to sell, appears to be unsaleable at the moment due the recent oil spill and open-ended cleanup costs.

Looking through TRP’s portfolio, it appears the assets most likely to be divested may be a non-operating stake in the Canadian NGTL System (“NGTL”) that connects the WCSB to the Canadian Mainline, or a non-operating stake in the Mainline itself.

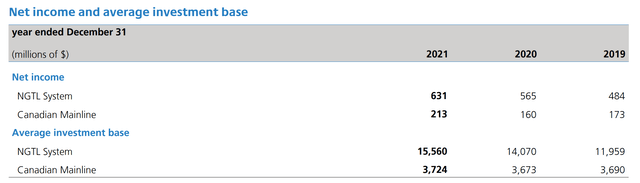

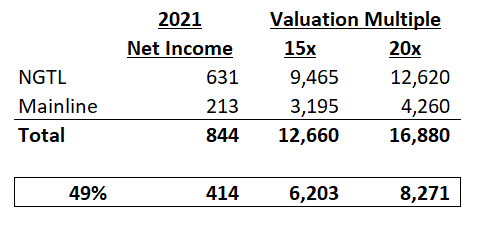

Financially, the NGTL generated $631 million in earnings in 2021 while the Canadian Mainline generated $213 million (Figure 13).

Figure 13 – Canadian pipeline earnings (TRP 2021 annual report)

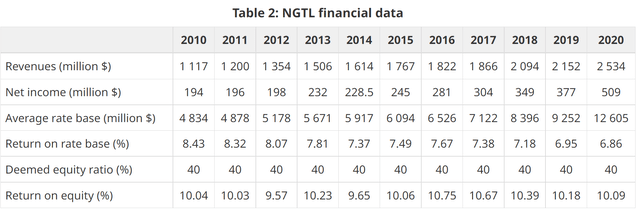

Both assets are tolling pipelines with regulated returns determined by the Canada Energy Regulator (“CER”). For example, the NGTL system has a regulated 10% ROE (Figure 14). Regulated assets like the NGTL should fetch utility-like multiples, given the defensive nature of their cashflows.

Figure 14 – NGTL is a regulated pipeline (cer-rec.gc.ca)

Therefore, a 49% sale of NGTL and the Mainline could fetch $6 to $8 billion dollars for TC Energy, at the expense of a ~$400 million decline in net income (Figure 15).

Figure 15 – Potential sell down of Canadian pipeline assets (Author created)

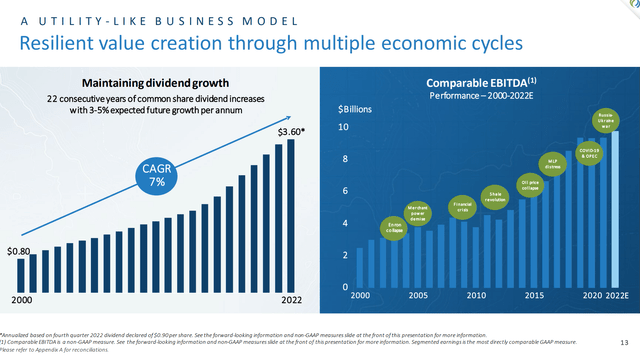

TC Energy Has Been A Long-Term Value Creator

Provided TC Energy can navigate the next couple of quarters without any more operational hiccups, investors could be richly rewarded, as TRP has a history of value creation. In the past 2 decades, the company has grown its dividend at a 7% CAGR, and the company’s EBITDA has increased 5-fold (Figure 16).

Figure 16 – TRP has a history of value creation (TRP investor presentation)

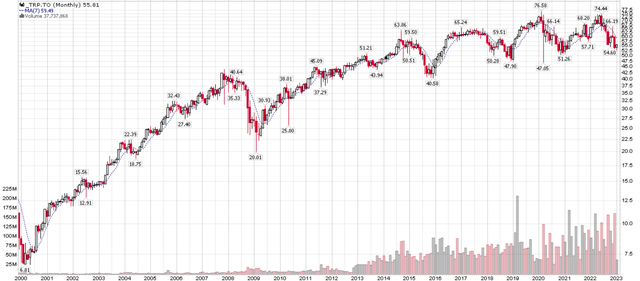

Since early 2000, TRP’s stock price has increased ~8x, in addition to paying its hefty dividend yield (Figure 17).

Figure 17 – TRP stock price has increased ~8x since 2000 (stockcharts.com)

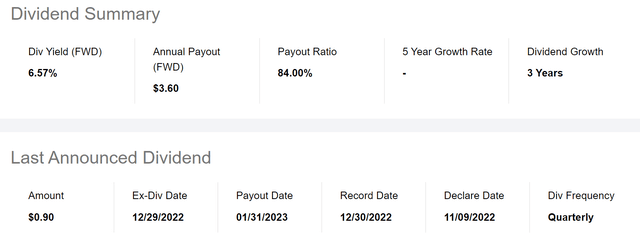

Currently, TC Energy has a 6.6% dividend yield, based on the forward rate of $3.60 / year. TRP’s dividend appears comfortably funded, with an 84% payout ratio (Figure 18).

Figure 18 – TRP dividend yield is 6.6% (Seeking Alpha)

Risk To TC Energy

As we touched on briefly above, there are significant risks with the TC Energy story. First, construction costs at Coastal GasLink has blown out twice, with the ultimate bill still unknown. However, mitigating this risk is the fact that ~80% of the project is completed to date.

Second, the recent Keystone oil spill still has an open-ended cleanup bill. Historically, onshore oil spills have cost tens of millions in cleanup costs. TRP’s latest oil spill of ~14,000 barrels of oil is on par with historical spills, although every cleanup effort varies depending on the location and local fauna contaminated. Furthermore, with ESG being top of mind in 2023, the cleanup costs could easily double or triple historical levels.

Finally, with TRP being capital constrained in the short-term due to cost overruns at Coastal GasLink, TC Energy may be challenged to grow its dividend at the targeted 3-5% rate.

Conclusion

TC Energy Corporation is one of the leading energy infrastructure companies in North America. The company has significantly underperformed its sector and peers due to a number of recent operational hiccups, with its valuation multiple trading at depressed 12.8x Fwd P/E. If TRP can quantify the remaining cost overruns at Coastal GasLink, as well as identify assets that can be divested to fund the financing gap, I believe there is a re-rating opportunity in TRP shares. I currently rate TC Energy Corporation a speculative buy, pending the upcoming Q4 earnings call.

Be the first to comment