sturti/E+ via Getty Images

Nobody really belongs in purgatory. It’s not a destination point, it’s a waiting room.”― A.D. Aliwat

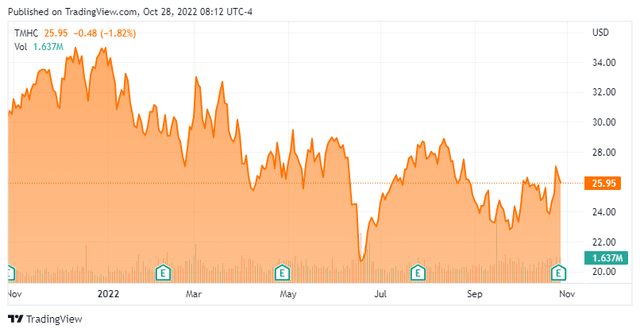

Today, we put Taylor Morrison Homes (NYSE:TMHC) in the spotlight. As 30-Year mortgage rates have risen to seven percent for the first time since 2002 after beginning the year just north of three percent, the housing market has found itself under extreme pressure.

It is likely to be a rocky few quarters for home builders as sales slow and the market finds an equilibrium. The sector should benefit from lower price around key input costs such as lumber and copper. With the stock of Taylor Morrison selling for less than three times this year’s projected EPS, how much of these coming months in purgatory for the sector priced into the shares? An analysis follows below.

Company Overview:

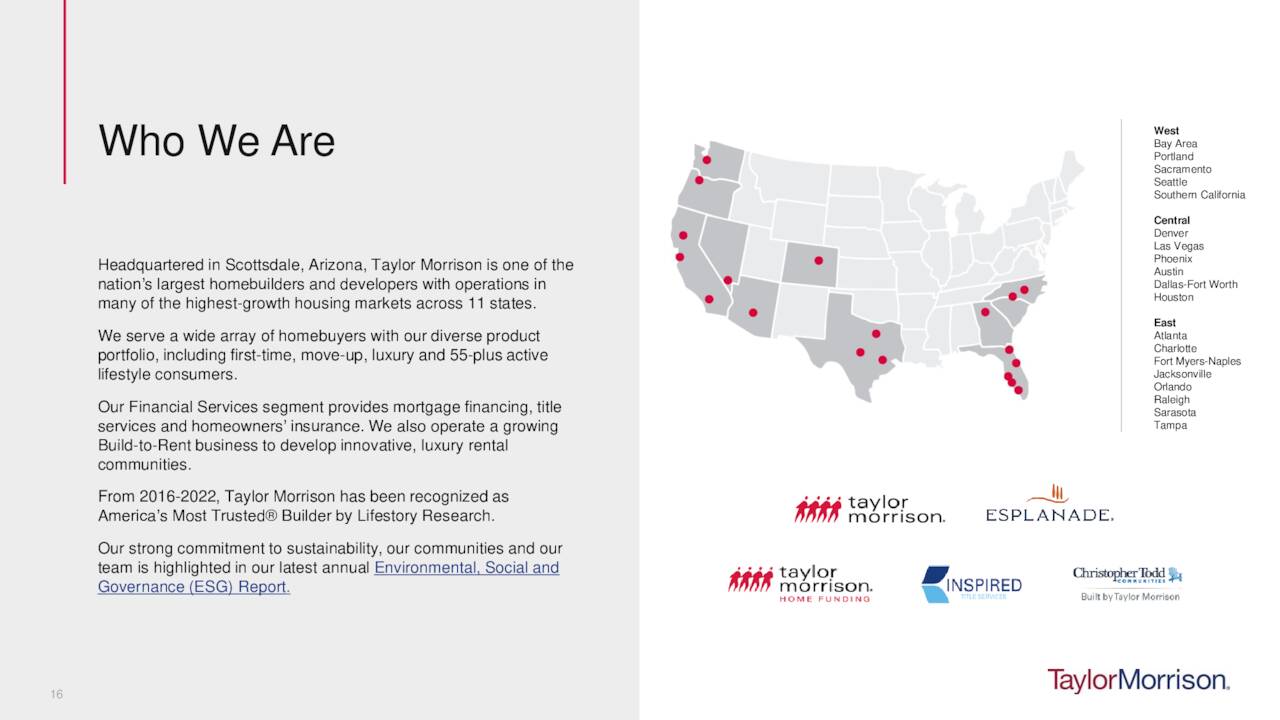

This Scottsdale-based company operates under the Taylor Morrison, William Lyon Signature, and Darling Homes brands. Its primary area of operations includes Arizona, California, Colorado, Florida, Georgia, Nevada, North and South Carolina, Oregon, Texas, and Washington. The company has approximately 80,000 owned and controlled homesites. The stock currently trades at around $26.00 a share and sports an approximate market capitalization of $2.85 billion.

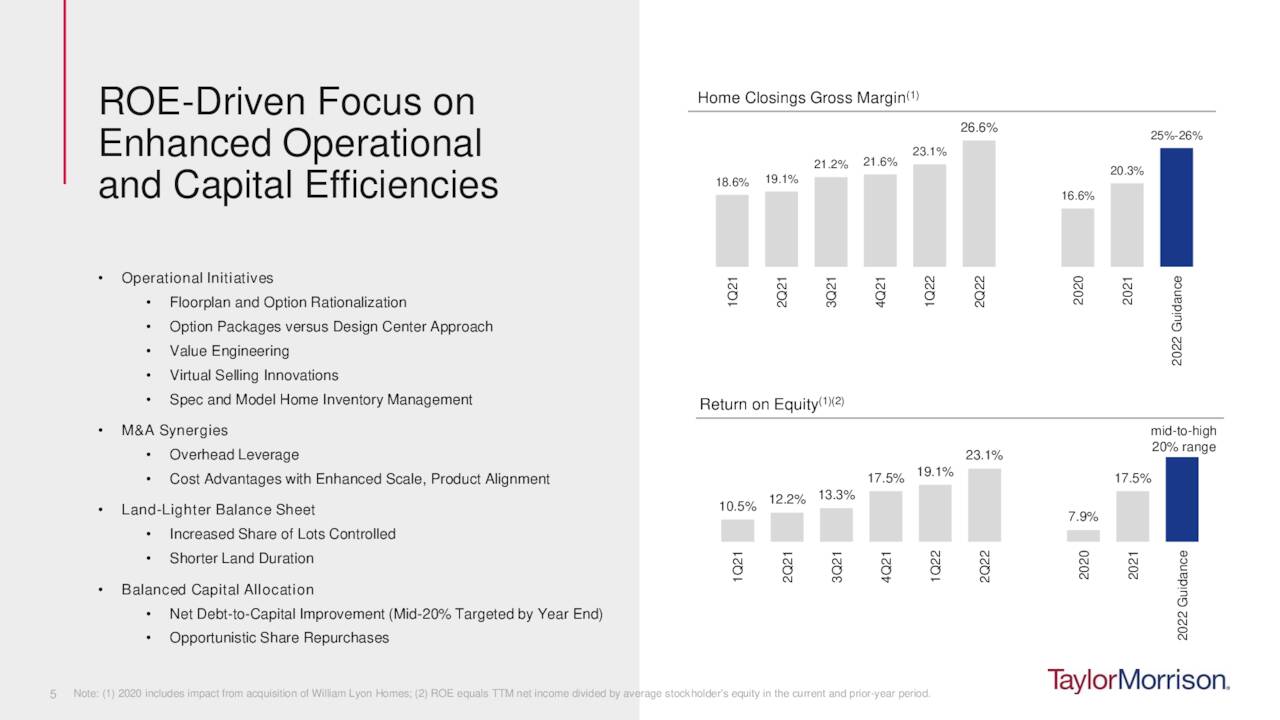

July Company Presentation

Third Quarter Results:

The company posted third quarter numbers earlier this week. The company delivered non-GAAP earnings of $2.72 a share, approximately 20 cents a share above the consensus. Net income was up 84% from the same period a year ago to $310 million. Revenues rose just over nine percent on a year-over-year basis to $2.03 billion. This was $170 million in light of expectations.

Home closings fell eight percent compared to 3Q2021. However, the company saw a 22 percent increase in average closing price to $650,000 during the quarter. Earnings were bolstered as SG&A costs as a percentage of revenue fell to an all-time low of 7.4%, an improvement of 210 basis points from the same period a year ago. Gross margins improved 630 basis points to 27.5% as well.

As with the rest of the sector, Taylor Morrison is seeing the impacts of average mortgage rates more than doubling since the beginning of 2022. New orders during the quarter fell 39% to 2,069 compared to the same period a year ago. In addition, as a percentage of gross orders, cancellations increased to 15.6% from 10.8% in the second quarter of this year and 6.7% a year ago. The average home price for new orders also fell three percent to $619,000. Finally, ending backlog for the quarter was 7,941 sold homes. This was down 23 percent from 3Q2021, with a sales value of $5.4 billion, down 12 percent.

Analyst Commentary & Balance Sheet:

Since third quarter results were posted Wednesday, four analyst firms, including Barclays and BTIG, have reiterated or downgraded TMHC to Hold ratings. Two of these contained slight downward price target revisions. Price targets proffered range from $25 to $30 a share.

Just less than five percent of the outstanding shares of the stock are currently held short. In the first quarter of this year, three insiders sold just under $250,000 of stock in aggregate. In mid-September, the company’s CFO added just over $250,000 worth of equity to his holdings. That is the only insider activity in the shares so far in 2022.

July Company Presentation

The company repurchased $105 million worth of shares in the third quarter and return on equity improved 1,300 basis points to 25.8 percent during the quarter as well. This continued an impressive trend for the company over the past two years.

The company ended the third quarter with approximately $1.4 billion worth of liquidity which includes credit facility capacity of $1.1 billion as well as unrestricted cash of $329 million. More importantly, Taylor Morrison remains on track to reduce its net debt-to-capitalization ratio to the mid-20 percent range by year-end.

Verdict:

The current analyst firm consensus has Taylor Morrison earning around $9.50 a share in FY2022 as revenues rise some 13% to just over $8.1 billion. They see profits falling to just under six bucks a share in FY2023 as sales fall some 20%.

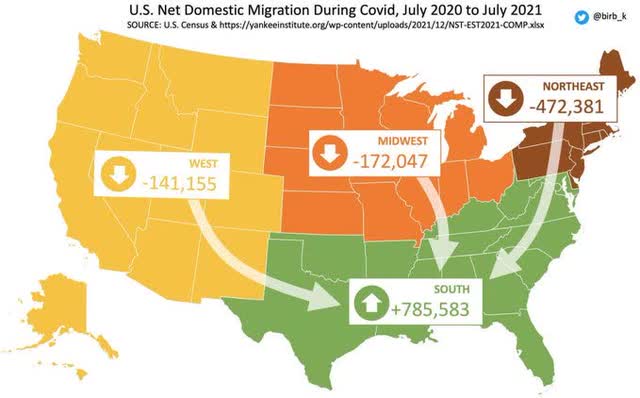

One thing I like about Taylor Morrison is most of its operations are in states like Florida and Texas which have seen significant intrastate migration over the year and this migration has accelerated since the pandemic. The company has solid return on equity metrics, low leverage, is buying back stock, and has seen net insider buying in 2022. Even if EPS falls to five bucks a share in FY2023, an investor is paying just over five times earnings for TMHC.

July Company Presentation

That said, headwinds for home builders are going to be challenging for the next few quarters and probably will not start to dissipate until the Federal Reserve ‘pivots‘ on monetary policy. Therefore, TMHC is a stock I plan to slowly scale into via covered call positions in the coming months as I incrementally build a position in this well-run and well-positioned home builder.

Purgatory is hell with hope.”― Philip José Farmer

Be the first to comment