DNY59

As of June 30, 2022, U.S. cannabis equities have fallen 81.9% over the past 505 days. [1] While negative performance of this degree can seem like a once-in-a-lifetime event, this is not the case in the cannabis sector. The depth of the decline is knocking on the door of the previous cannabis market shakeout in 2019/2020 when stocks fell 83.8%. The current drawdown is particularly frustrating as there has been significant improvement in company fundamentals and impressive industry growth over the past two years.

As we have been investors during these last two cannabis bear markets, we believe it is valuable to discuss the circumstances surrounding these drawdowns and highlight how the sector has changed since. These developments, along with all-time low valuations, make us even more confident this time about the sector’s future performance, especially for experienced firms like Green Thumb Industries (OTCQX:GTBIF), Cresco Labs (OTCQX:CRLBF), and Curaleaf Holdings (OTCPK:CURLF).

Two bear markets in the past three years have been a learning experience for cannabis companies and investors alike

The last major drawdown in the U.S. cannabis sector lasted 331 days, between April 22, 2019 until March 18, 2020, as stocks fell 83.8%. The long-term future of the industry was no less robust then, but there were a few incidents that contributed to the poor equity performance. These included:

- A national vaping crisis where over a thousand Americans were sickened and many died due to inhalation of illicit cannabis vaping products that contained vitamin E acetate. While products manufactured and sold by legal operators were deemed safe, it cast a pall over the sector as “vaping epidemic” headlines were prominently featured in major news outlets.

- The collapse of Canntrust Holdings (OTC:CNTTQ), a Canadian cannabis operator, which found itself in trouble with Canadian regulators after the Company was accused of growing cannabis in unlicensed grow rooms. The Company ultimately filed for bankruptcy, and the incident led to speculation that illegal activity would be found elsewhere in the industry, with devastating consequences for equity holders. Since then, there have been zero major legal debacles for publicly-listed cannabis firms.

- The lackluster opening of the Canadian cannabis market in October 2018. Limited form factors and a woeful undersupply of retail stores led to obsolete inventory, and significant losses, for Canadian operators. Between September 2018 and March 18, 2020, the share prices of the two largest Canadian cannabis companies, Tilray (TLRY) and Canopy Growth (CGC), returned -96.2% and -78.7%, respectively. The Canadian cannabis market continues to have its issues, and as the “face” of the global cannabis industry, it has cast a shadow on its U.S. peers.

- A lack of capital markets access. The issues above, in combination with poor equity performance, led to a drought of capital which put stress on many operators. Some of which never recovered, including erstwhile industry stalwart iAnthus (OTCPK:ITHUF), which was taken over by its creditors. Capital market access has improved over the past two years but is limited by cannabis’s Federal illegality.

While 2019 can seem like a lifetime ago, we remember the period well. The drawdown, while painful, was a tremendous learning experience for investors and operators. Unlike investing in other nascent industries where historically revenue growth has been paramount amidst a backdrop of frothy valuations and readily available cash, cannabis investors learned to prioritize management quality, balance sheet health, profitability, and market exposure. Fallow periods can occur unexpectedly in this industry, and the best operators know that they should be prepared for any environment that comes their way. The result has been stronger companies that are far more capable of funding their operations than they were during the last drawdown.

Still, no matter how well prepared, tough times are no picnic. The current drawdown we find ourselves in today is no less crushing than the last. As of the close on June 30, 2022, the sector is down 81.9% from its February 10, 2021 high, and has lasted nearly six months longer than the 2018/2019 drawdown. This bear market has its own culprits to blame. These include:

- A significant reduction in trading venues for U.S. cannabis stocks. Over the past year, multiple banks and custodians have disallowed trading in U.S. cannabis equities. In November 2021, JPMorgan sent notice to its clients that it would no longer allow trading in U.S. cannabis securities. This followed a similar decision by Credit Suisse in May 2021. More recently, in April 2022, Vanguard restricted OTC trading, which is the primary trading venue for U.S. cannabis stocks. Restrictions like these led to forced selling and limited the pool of potential buyers.

- Regulatory delays which stalled growth in multiple markets. In New Jersey, voters passed a ballot initiative to legalize adult-use cannabis in November 2020. It was not until April 21, 2022, however, that retail sales officially launched. In Illinois, 185 social equity licenses were held up in the courts due to lawsuits which has limited the state to 110 dispensaries and slowed the market’s growth. These licenses are now finally expected to lead to new dispensaries opening in late-2022/early-2023. Delays such as these hamper industry growth.

- A lack of movement on Federal legislation. While Democrats control the House, Senate and White House, there has yet to be any serious progression of cannabis reform legislation in Washington. Senate Majority Leader Chuck Schumer has squashed all bills that have passed the House as he remains focused on his comprehensive legalization bill, which does not have the necessary votes to pass. While there is still time before the 117th Congress closes, the path to passing meaningful legislation narrows by the day.

- Reopening/recessionary concerns for share of the consumer wallet. Inflation has arguably become the number one global economic issue. With gas prices at all-time highs and higher-priced consumer staples, the cannabis sector is facing similar headwinds like the consumer discretionary industry. To that end, year-to-date through June 30, consumer discretionary stocks (XLY) have returned -32.5% vs. -55.2% for cannabis stocks, both significantly underperforming the broader market.

Awareness of the issues above does not make us feel any better about the current drawdown but does at least provide context as to why the sector has performed poorly. Unfortunately, we cannot pinpoint when the current drawdown will end, but we are significantly more confident about the underlying fundamentals of the sector than we were during the last trough.

U.S. cannabis multi-state operators (“MSOs”) are fundamentally sounder and cheaper than they were during the 2019/2020 cannabis bear market

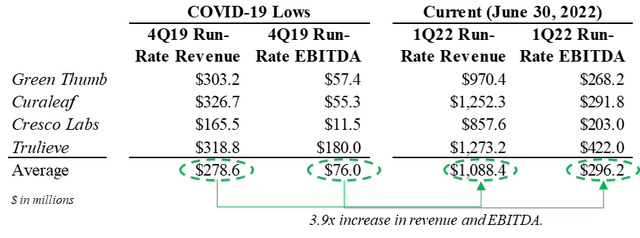

The sector’s performance during the 2019/2020 drawdown may be similar to today, but the underlying fundamental story has significantly improved. At the end of 2019, only a few U.S. MSOs were reporting material revenues let alone positive EBITDA. Fast forward to today and the improved strength of these businesses is readily apparent. For example, the four largest public MSOs in 2019 have grown their revenues and EBITDA by 3.9 times on average over the past nine quarters.

This performance has been due to a combination of industry growth and expansion of operations. Since the Covid-19 lows, these four MSOs have increased their footprints by four states on average and more than doubled their dispensary counts. The result has been a reduction in dependence on any one market and increased brand recognition with deeper market penetration.

| March 2020 | Current (June 30, 2022) | |||||

| # of Markets | # of Dispensaries | # of Markets | # of Dispensaries | |||

| Green Thumb | 12 | 42 | 15 | 77 | ||

| Curaleaf | 17 | 54 | 22 | 134 | ||

| Cresco Labs | 9 | 21 | 10 | 50 | ||

| Trulieve (OTCQX:TCNNF) | 4 | 44 | 11 | 167 | ||

| Average | 11 | 40 | 15 | 107 | ||

Source: Company Filings

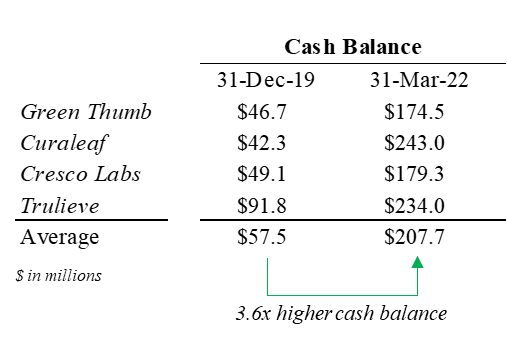

MSOs have also strengthened their cash positions over the past two years. On average, these four MSOs have increased their cash balances by 3.6 times which helps them maneuver through a period of limited capital market access. These larger cash balances support our view that the previous downturn was instructive to the management teams that survived it. For example, GTBIF raised over $150 million in equity financing in February 2021 and closed on $217 million of debt financing in April 2021, which partially retired existing debt at a lower interest rate and extended the maturity by two years. These transactions were prescient and positioned the Company to manage through this downturn.

Company Filings

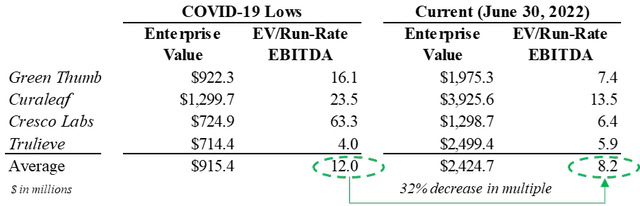

Despite the improvement in their financial and operational performance, investors have not rewarded the sector with higher trading multiples. The enterprise values of these companies have only increased by 2.6 times on average since March 2020, resulting in EV/EBITDA multiples that are 32% cheaper on average than they were at the Covid-19 lows.[2]

We understand that the macroeconomic picture today is cloudy, with high inflation, the war in Ukraine, and still unresolved supply chain issues. However, in March 2020 the global economy had effectively shut down and the world was facing a deadly virus which we knew very little about. It is hard to argue that today’s situation is worse than it was then, yet U.S. cannabis stocks are priced as if that were the case.

The U.S. cannabis market has grown substantially since March 2020 as more markets open and develop

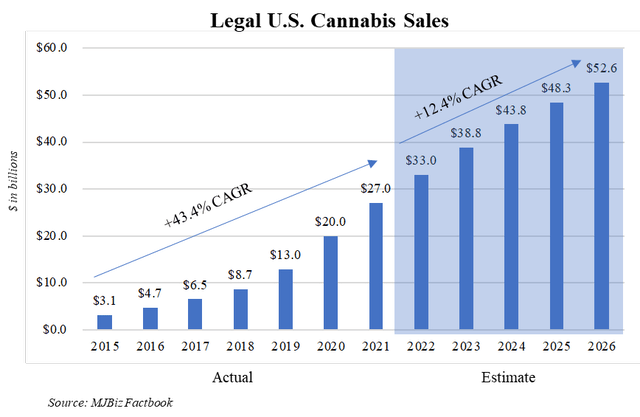

Unlike some sectors which have seen demand slow in a post-Covid-19 world, the cannabis industry continues to grow at a steady pace, with the opening of new markets and a growing consumer base. In 2021, the legal cannabis market grew +35% over 2020’s figures to $27 billion in total sales and shows no signs of slowing. Nine states have legalized adult-use cannabis since 2019, but half of them have yet to launch recreational sales, including large markets like New York and Virginia. Once they come online, these new markets will help grow the legal sales market for a number of years.

When we consider the recent launch of adult-use in New Jersey, the upcoming start of adult-use sales in Connecticut and New York, the doubling of dispensaries in Illinois, and the opening of other new markets over the next few years, there is substantial runway of market growth ahead. The legal U.S. cannabis market is still in the early innings, but like any nascent industry, short-term headwinds can create bumps along the road. Still, while a recession may cause lower revenues for traditional retailers and consumer discretionary businesses, the cannabis sector is likely to avoid this fate given the massive tailwind.

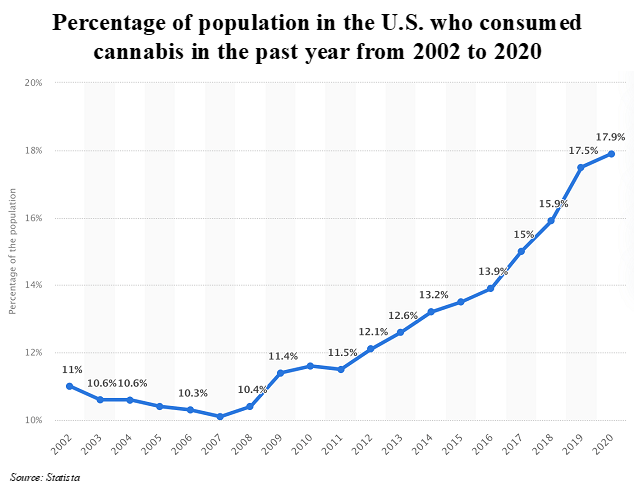

Contributing to the industry’s growth is the continued increase in cannabis usage nationally. As of 2020, 18% of the U.S. population consumed cannabis in the past year, an increase of 6% over the past decade.

Statista

These levels are significantly below the percentage of Americans who consumed alcohol in the past year, which was 69.5% as of 2019. While it will take years before cannabis matches alcohol in terms of consumption levels, the normalization of cannabis use will likely bring a significant number of new consumers into the fold in the years ahead.

Concluding thoughts

We are as frustrated as any cannabis investor by this current drawdown but we are in the early innings of the cannabis investment opportunity. The industry has seen this type of drawdown before and recovered, and we see little reason the same outcome cannot be achieved again. The issues facing the industry are real but primarily technical, and will not last forever. Uplisting to major exchanges, involvement of institutional investors, removal of punitive Section 280E taxes, and better access to capital markets will eventually be solved with the stroke of a pen in Washington.

In the interim, U.S. cannabis operators like GTBIF, CURLF, TCNNF and CRLBF have built a solid foundation on which to grow their businesses and generate even larger revenues and profits. At the same time, valuations are at all-time lows, providing investors with a margin of safety. The short-term price action can be discouraging, but we still view the long-term opportunity as attractive as ever.

[1] US Marijuana Companies Index (UMMAR Index) used for cannabis market returns.

[2] We are not the only ones who have noticed the combination of depressed valuation and strong fundamentals. Executives at Ascend Wellness (OTCQX:AAWH) and TerrAscend (OTCQX:TRSSF) have recently made open market stock purchases and Ascend’s CEO Abner Kurtin elected to take his 2022 compensation in the form of common stock.

Be the first to comment