JHVEPhoto

We covered Morningstar (NASDAQ:MORN) last year and came to the conclusion that despite its quality its valuation was too high. We are analyzing the company again to see if it has grown into its valuation, or if it is better to continue waiting for a better entry point. Morningstar is a company we would like to be able to eventually add to the portfolio given its superb financials and attractive economics, we believe this is a wealth compounder of a stock, but there is a limit as to how much we are willing to pay for it.

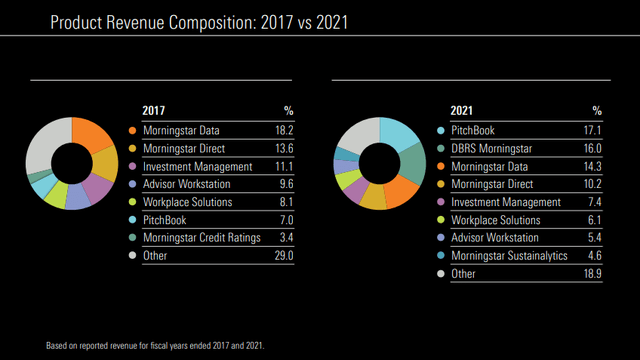

One of the big surprises from analyzing Morningstar again is just how important its two recent acquisitions have become, PitchBook and DBRS have become the number one and number two sources of revenue for the company. PitchBook is the data platform for startups, and DBRS is the world’s fourth largest credit ratings agency. Everything points to both of these acquisitions being great successes, and major sources of growth for Morningstar going forward.

Financials

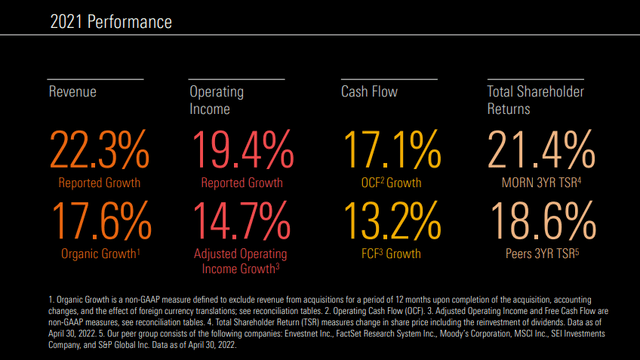

Morningstar grew at a good rate most of its key metrics during 2021, with revenue, operating income, and cash flow all up nicely. While growing at 15-20% is very decent growth, the problem that we saw last year is that the company was priced to deliver hyper growth, not just be a nice 15-20% grower.

Morningstar Investor Presentation

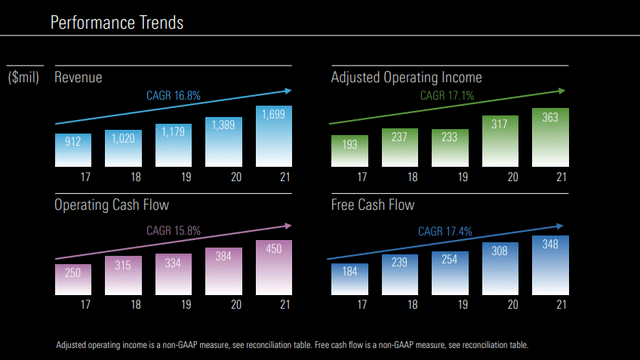

One thing we can give Morningstar credit for is that it has been a very consistent grower. Over the last five years Morningstar has delivered 16-17% growth for all its key metrics. At this level of growth most key indicators have almost doubled in the last five years. For example. growing at 17.4%, free cash flow has nearly doubled from $184 million in 2017 to $348 million in 2021. We believe this consistency is one of the reasons investors like the shares so much.

Morningstar Investor Presentation

Growth

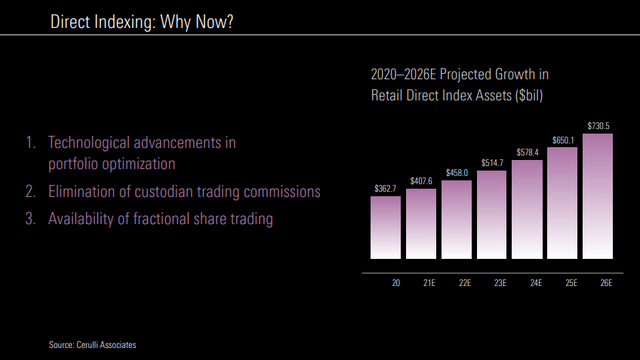

One of the more exciting growth waves that Morningstar is riding is that of direct indexing. Direct indexing technology enables the building of a portfolio that track an index by purchasing a subset of the holdings. It allows to express individual preferences, like ESG, through security level customization. It also offers tax advantages, including loss harvesting, which are unavailable from a fund. In other words, it has some advantages compared to both ETFs and individual security selection. Due to these advantages it is one of the fastest growing trends in wealth management.

Morningstar Investor Presentation

Balance Sheet

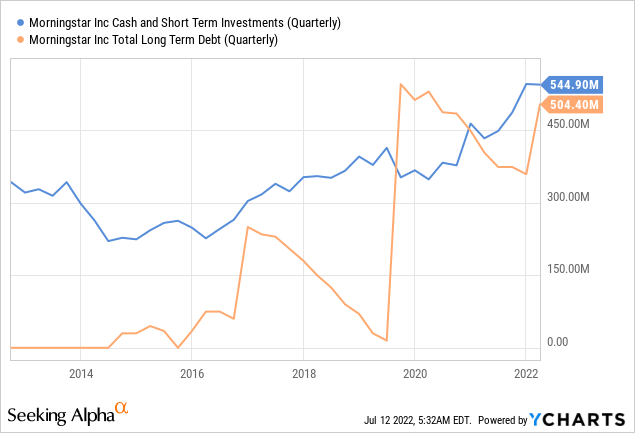

Morningstar’s balance sheet remains quite strong with almost as much cash and short-term investments and total long-term debt. Although this still does not reflect the impact of the acquisition of Leveraged Commentary & Data for ~$650 million in cash.

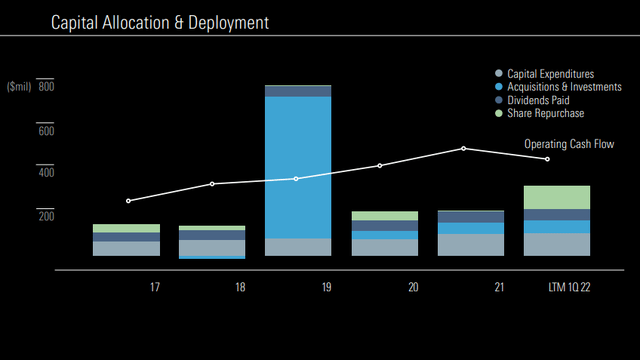

Capital Allocation

Morningstar has been balancing very well its different capital allocation options, with some resources destined for M&A, some for capital expenditures, and rewarding shareholders through dividends and share repurchases. In particular M&A has been very successful so far, with blockbuster acquisitions like DBRS and PitchBook performing very well.

Morningstar Investor Presentation

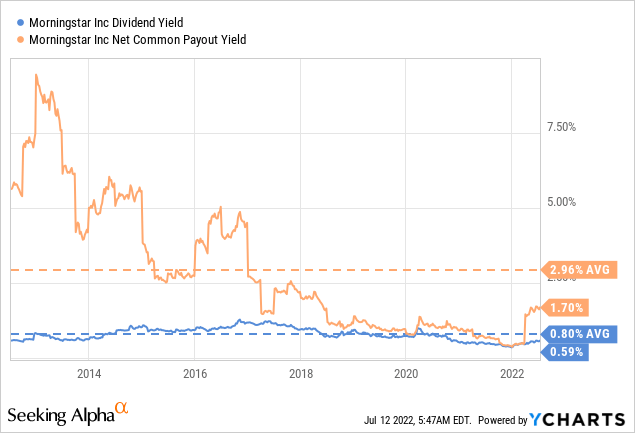

The dividend yield is currently quite low at ~0.59%, below its ten year average of 0.8%. Things look a little more attractive when looking at the net common payout yield which considers both the dividend yield and net share repurchases.

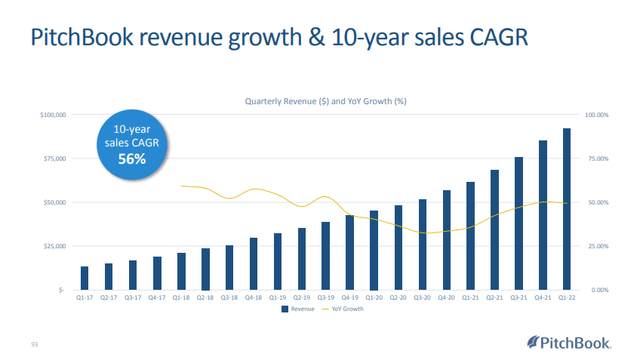

The Crown-Jewel: PitchBook

PitchBook has turned out to be a brilliant acquisition, and it has gone from representing ~7% of Morningstar’s revenue in 2017 to ~17.1% in 2021. More than 80,000 private market professionals use its suite of products to get an edge. Customer use the platform for things like startup deal sourcing, comps & valuations, etc.

Morningstar Investor Presentation

The ten years sales CAGR PitchBook has delivered is a breathtaking 56%, and its recent growth rates remain strong. We believe PitchBook will only become more important for Morningstar in the next few years. In 2021 PitchBook added 3,143 new logos, and delivered a 127% net renewal rate.

Morningstar Investor Presentation

New Acquisitions

Morningstar is trying to recreate the magic it achieved with its two major acquisitions DBRS and PitchBook with the recent purchase of Leveraged Commentary & Data.

LCD will complement PitchBook’s robust product and research capabilities by covering every metric of the leveraged loan market. The purchase price is up to $650 million in cash. LCD generates approximately $56 million in revenue, the purchase price is therefore more than a 10x multiple on sales. Our first impression is that this looks like an expensive acquisition, but maybe the growth and strategic value justify it. Time will tell if it turns to be another home run for Morningstar.

Valuation

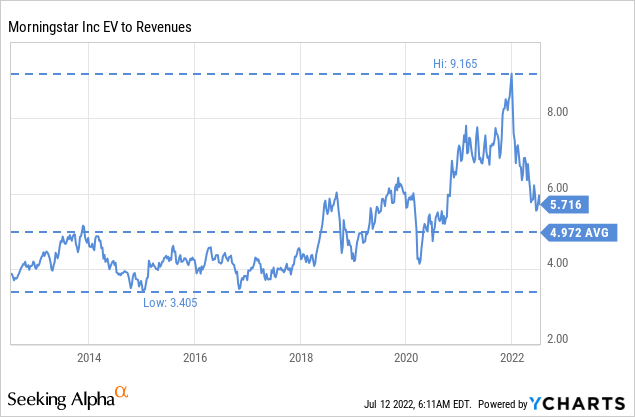

In recent years Morningstar has been trading as a software SaaS company, with high multiples to revenues. While we appreciate the quality of the company, and the long runway that some of its growth engines still have, such as direct indexing and PitchBook, we are not convinced such multiples are appropriate for Morningstar as a whole.

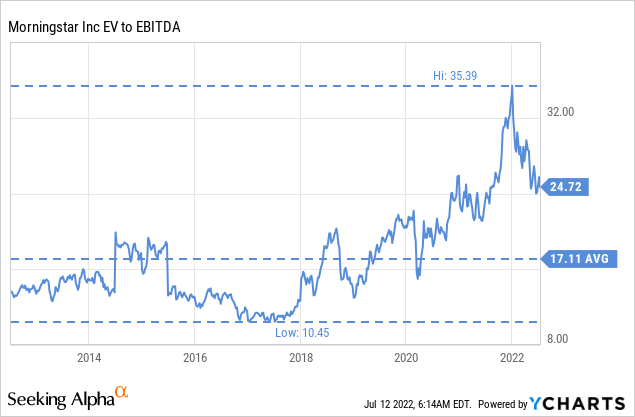

Morningstar is trading significantly above its average ten year EV/EBITDA multiple, and much of the gains in recent years have come from multiple expansion.

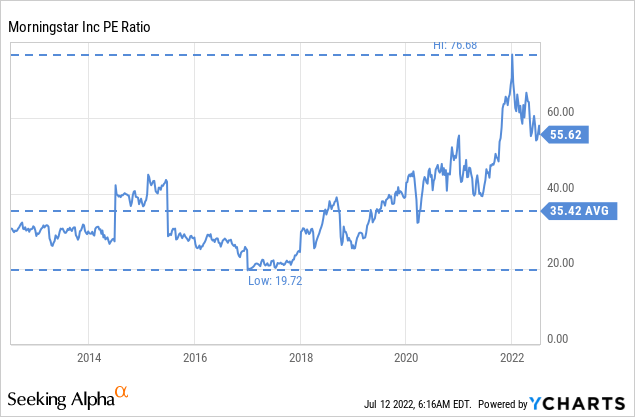

Similarly its price/earnings ratio is considerably above its ten year average, and we don’t believe that a company growing its earnings at ~20% deserves to trade with a p/e of 55x.

Risks

Morningstar has solid profitability and a strong balance sheet, so we are not overly concerned about the company’s ability to continue as a going concern. We believe the biggest risk for shareholders is the high valuation with which shares are currently trading. Shares could fall considerably should growth slow down a little bit, given that they are arguably priced for perfection.

Conclusion

Morningstar still has significant growth opportunities in front of it, from direct indexing to continuing growth at PitchBook and DBRS. This is a company we would love to add to the portfolio, but we cannot justify paying a ~55x p/e ratio for a company growing at ~20%. We are therefore maintaining our ‘Sell’ rating for the time being, and will continue following the company hoping that we can justify a purchase in the future.

Be the first to comment