JHVEPhoto

Intro

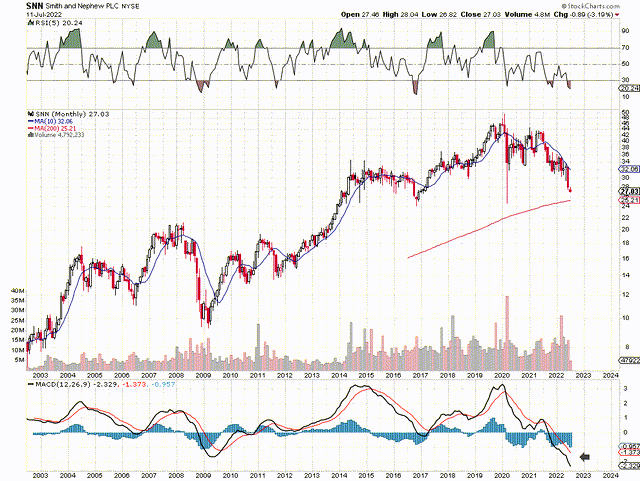

If we look at a long-term chart of Smith & Nephew (NYSE:SNN) (medical device firm), we can see that shares have been undergoing an aggressive decline since early 2020. If indeed the present decline continues in earnest, it will be interesting to see if the stock’s 2016 lows (which correspond more or less with the 200-month moving average of just over $25 a share) can stop this present decline in its tracks. As we can see now from the monthly MACD technical indicator, shares have not been this oversold for well over two decades so strong potential definitely exists here if indeed a bottom can be printed over the near term.

SNN came across our desk from a value screen we ran where valuations and profitability trends were the main themes of the screen. Therefore, we know from the outset that Smith & Nephew remains profitable and continues to generate positive cash flow. Suffice it to say, if the company has the wherewithal to keep on generating positive cash flow throughout this present downcycle, then sooner or later shares simply have to force a bottom to reflect the value SNN is providing to the marketplace.

SNN Technical Chart (Stockcharts.com)

Growth Issues

As we can see from the chart above, SNN’s share price has now reached the levels that the stock witnessed at the tail end of fiscal 2013. Although the net income of $524 million over a trailing twelve-month average is actually down approximately $30 million compared to fiscal 2013, we maintain that the company is in a far better position today than it was close to nine years ago. For one, the annual dividend of $0.75 per share has increased by $0.23 per share since fiscal 2013. However, as we can see confirmed from the chart above, it has been SNN’s poor growth rates in both its sales and earnings since fiscal 2019 which has led the stock lower in recent years.

Earnings growth though is only one facet of evaluating a company. Why? Because when one is dealing with a high-margin stock (such as SNN), the company simply does not need to keep on growing its earnings aggressively every year to generate solid cash flow. Let me explain.

Return On Capital

If we crunch some numbers by stating that SNN generated $524 million in net profit over the past four quarters and the current market cap of the company is $11.79 billion, we can say that the stock is trading with a price-to-earnings multiple of roughly 22.5. Now with 4% bottom-line growth expected this year, we can use the following formula to estimate a forward-looking rate of return for the stock.

Rate of Return = G + D/M where

G = Expected annual earnings growth rate

D = % Of Earnings Paid Out As Dividends

M = Price To Earnings Ratio

Plugging the following into the formula, we get an expected annual rate of return for SNN to be equal to 4% + 62/22.5 = approximately 6.76%.

Suffice it to say, given SNN’s payout ratio and current earnings multiple, we can see that the stock’s expected annual return has almost increased to 7% which is noteworthy for the following reason. Essentially what we are getting at here is deciphering the amount of capital needed to produce SNN´s 4% bottom-line growth rate in fiscal 2022.

Therefore, if we state that SNN’s 4% earnings growth in fiscal 2022 comes from 38% of its total earnings (62% are paid out in dividends), we can say that the company’s return on incremental capital comes in at 10.53% (0.04 / 0.38). Why is this important? Well, companies can actually mask how inefficient they are by strong earnings growth rates but yet have very poor return on capital numbers. This means these companies need to constantly use the lion’s share of their earnings to keep earnings growth rates elevated. The problem is then when spending stops, earnings growth comes to a firm standstill.

SNN on the contrary where the stock´s gross margin comes in 28% higher than the sector, has increased its equity by roughly 38% since fiscal 2013 and presently comes in at $5.56 billion. By consistently being able to build the business through asset accumulation, the company is in a far healthier position at present to now grow its earnings off its increased capital. This means the company’s valuation from an assets standpoint for example is far cheaper than in fiscal 2013.

Conclusion

Therefore, to sum up, although growth issues have contributed to an aggressive slide in shares of SNN over the past 30+ months or so, the company is expected to return to growth this year. We await a convincing swing low in the technicals and maintain the stock is in a better position at present over yesteryear. We look forward to continued coverage.

Be the first to comment