juliannafunk

Investment Thesis

Carvana Co (NYSE:CVNA) remains a speculative stock, since it is unlikely to report profitability during the potential recession ahead. Therefore, retaining its current cash burn and share dilution strategies ahead, while further relying on long-term debts for its highly unsustainable operating expenses. The recent ADESA acquisition was also ill-timed, given the elevated rates of auto-loan delinquencies and auto repos in the auto bubble ahead.

Therefore, anyone looking for a quick rally or moderate stock recovery would be sorely disappointed, since we do not expect any positive catalysts in its upcoming FQ2’22 earnings call. Anyone looking for bottom-fishing stocks should look elsewhere too, since there are other stocks out there with better long-term price returns for your capital.

Carvana Has Not Reported Profitability Despite The Hyper Auto Sales In FY2021

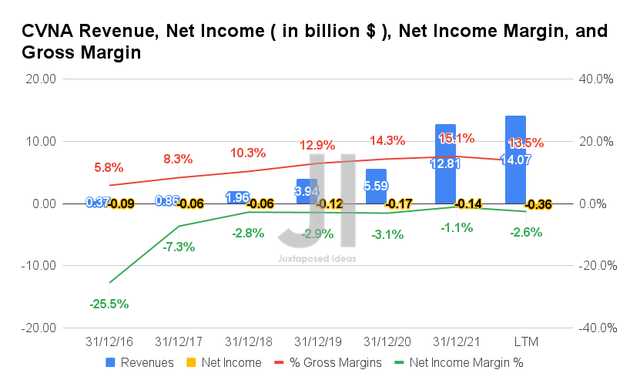

CVNA has definitely benefited from the hyper-demand and hyper-elevated auto prices post-reopening cadence, which boosted its revenue growth at an impressive CAGR of 80.1% since FY2019. By the LTM, the company reported revenues of $14.07B and gross margins of 13.5%, representing a massive increase of 357.1% and 0.6 percentage points from FY2019 levels, respectively. In contrast, CVNA still struggles with profitability, with deepening net losses of -$0.36B and net income margins of -2.6% in the LTM, a decline of 300% though broadly in line with FY2019 levels, respectively.

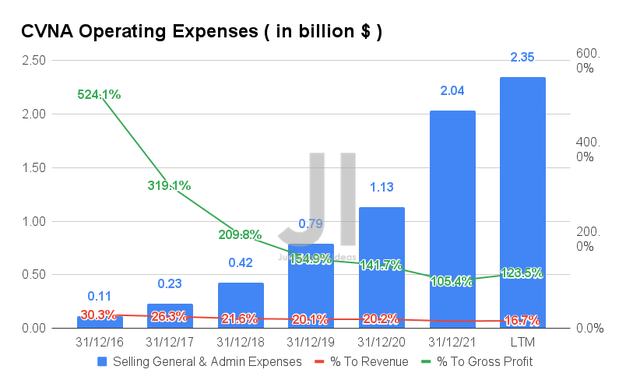

The reason why CVNA has yet to report profitability is due to its elevated operating expenses. By the LTM, the company reported expenses of $2.35B, which represents a massive increase of 297.4% from FY2019 levels. It is also apparent that the ratio to its growing gross profits and revenues remains unsustainable, since these operating expenses still account for 123.5% of its gross profits though a more moderated 16.7% of its revenues by the LTM.

CVNA has reportedly commenced on a rightsizing of its existing workforce by 12% and optimization of its compensation, advertising, logistics, and logistics spending. Nonetheless, we do not expect much improvement in its operating expenses and profitability moving forward, given the notable deceleration of its revenues during the potential economic downturn ahead, further worsened by its recent acquisition of ADESA‘s US physical auction business from KAR Global (KAR).

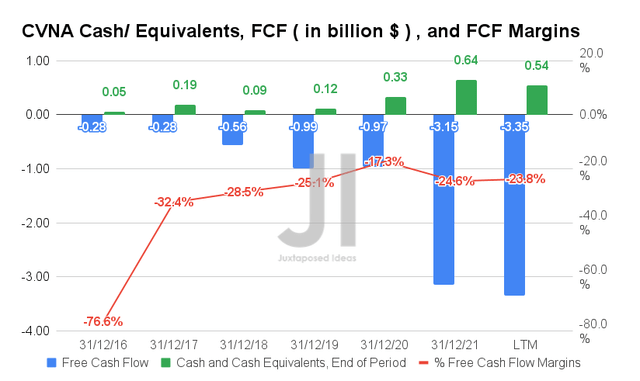

Therefore, it is not hard to see why CVNA has yet to report positive Free Cash Flow (FCF) generation as well. By the LTM, the company reported an FCF of -$3.35B and an FCF margin of -23.8%, representing an enormous decline of -338.3% though a slight improvement of 1.3 percentage points from FY2019 levels, respectively. Though CVNA reported relatively modest cash and equivalents of $0.54B on its balance sheet, it is essential to note that these were boosted by its massive long-term debts.

CVNA Remains A Massive Cash-Burn & Share-Dilution Machine Ahead

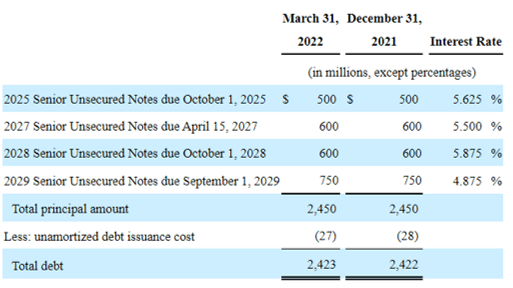

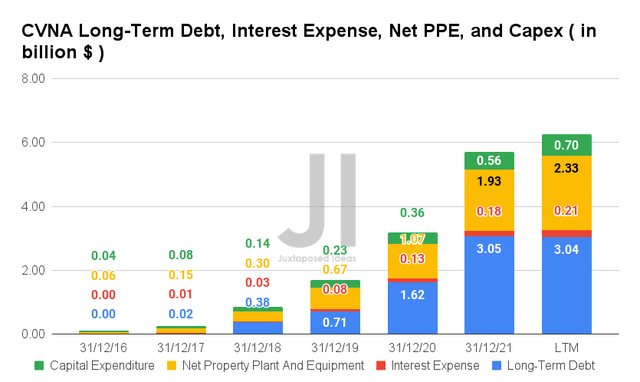

By the LTM, CVNA reported long-term debts of $3.04B and interest expenses of $0.21B, representing massive increases of 423.9% and 262.5% from FY2019 levels, respectively. In contrast, the company also grew its net PPE assets to $2.33B and capital expenditure to $0.7B in the LTM, representing a notable growth of 347.7% and 304.3% from FY2019 levels, respectively.

For FQ2’22, we expect to see up to $6.34B in debt burden, with $3.3B attributed to the ADESA acquisition. Though CVNA has reiterated the deal as a pivotal inflection point to its goal of “becoming the nation’s largest and most profitable automotive retailer,” we are not convinced since the company remains speculatively unprofitable for the next three years, while raising its total debt/ EBITDA ratio to an eye-watering level of 181.34x by FQ2’22.

CVNA Debt Maturity

Seeking Alpha

Nonetheless, if we were to study CVNA’s debt maturities, we are still not overly worried, since these would only take effect from FY2025 onwards. We expect the same for its debt burden for the ADESA acquisition. In the meantime, the company would likely take on more debt ahead, due to its aggressively expanding operating costs and lack of profitability in a normalized auto sales environment in H2’22 and FY2023.

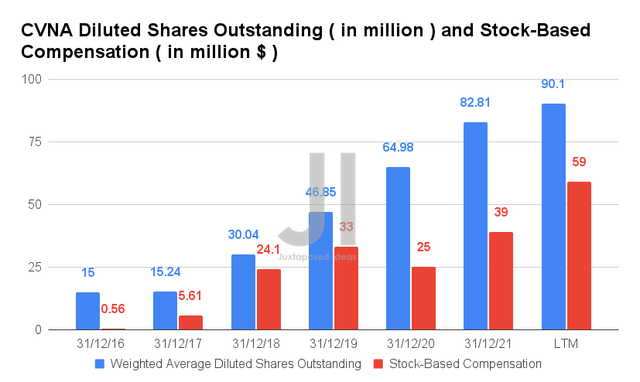

Therefore, CVNA would also rely on more share dilution ahead, with a total of $59B Share-Based Compensation (SBC) expenses reported in the LTM. This has directly contributed to its growing diluted shares outstanding of 90.1M simultaneously, indicating a massive dilution of 92.3% since FY2019 and a gargantuan 591.2% since its IPO in FY2017. Therefore, assuming a similar rate ahead, we may expect to see CVNA reports up to $230 in annual SBC expenses and 215M of diluted shares outstanding in FY2025, due to its lack of profitability for the next three years. Therefore, representing a massive share dilution of 1410.7% from its IPO levels. Long-term (and interested) investors beware of this cash-burn and share-dilution machine.

Analysts Remain Unconvinced Of CVNA’s Profitability Ahead

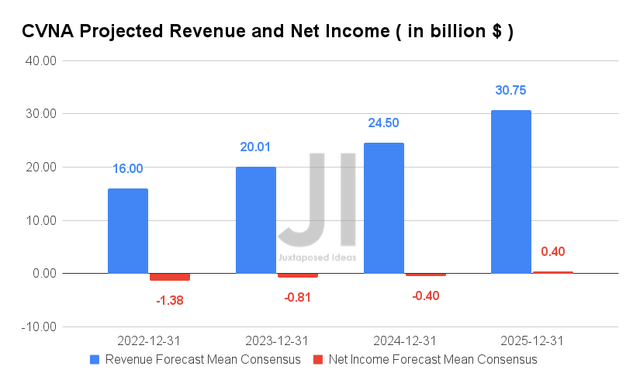

Over the next four years, CNVA is expected to report revenue growth at a CAGR of 24.5%, while potentially reporting net income profitability of $0.4B by FY2025. For FY2022, consensus estimates that the company will report revenues of $16B and net incomes of -$1.38B, representing YoY growth of 24.9% and in line, respectively.

In the meantime, analysts will be closely watching its FQ2’22 performance, with consensus revenue estimates of $3.98B and EPS of -$1.89, representing YoY growth of 19.31% though a decline of -87%, respectively. Nonetheless, we are not hopeful, given CVNA’s poorer EPS performance in the past three consecutive quarters.

So, Is CVNA Stock A Buy, Sell, or Hold?

CVNA 5Y EV/Revenue and P/E Valuations

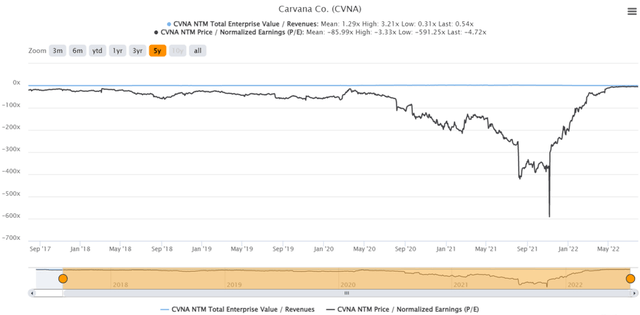

CVNA is currently trading at an EV/NTM Revenue of 0.54x and NTM P/E of -4.72x, lower than its 5Y mean of 3.21x and -85.99x, respectively. The stock is also trading at $29.15, down 92.2% from its 52 weeks high of $376.83, though at a 49.8% premium from its 52 weeks low of $19.45. Based on its historical stock price action for the past two months, we could potentially surmise that CVNA has hit a bottom at current prices, after the continuous plunge since August 2021.

CVNA 5Y Stock Price

Nonetheless, despite the consensus estimates’ attractive buy rating for CVNA at a price target of $61, we are not convinced of its 109.26% upside. If the company could not report profitability during the hyper-demand for used cars in the past two years, we doubt it would do well in the potential recession. In addition, with the elevated rates of auto-loan delinquencies and auto repos climbing in the past month as the stimulus programs end, we expect further headwinds to CVNA as consumers shun away from expensive purchases in the intermediate term.

In the meantime, we do not expect CVNA stock to recover anytime soon during this season of bearish market sentiments. Therefore, existing investors with excess capital should simply hold their stock, since there is no point in selling at current prices, especially if one had bought in at highs. It goes without saying that there are better investments out there with higher returns for your capital. Prospective investors, do not waste your time with CVNA.

Therefore, we rate CVNA stock as a Hold for now.

Be the first to comment