Alena Kravchenko/iStock Editorial via Getty Images

Introduction

Alphabet (NASDAQ:GOOG) and Meta Platforms (NASDAQ:FB) are digital advertising behemoths with strong market shares in the estimated $571 online ad spend in 2022 (per eMarketer). While the two giants will likely dominate the competition in the near future (Google in search and Meta in social media), I believe Google is the better choice for investors who wish to capitalize on increasing ad budget allocation to digital. In this article, I will discuss why Alphabet investors will sleep better than their Meta counterparts.

Social media platforms come and go, but Google will likely remain relevant in the future

Like many social media platforms such as Six Degrees, Blogger, Friendster, MySpace, Yahoo, Pinterest (PINS), and Twitter (TWTR), Meta is facing stalling user growth as the company reported the first QoQ decline in DAUs in 4Q21. While Facebook has been a durable growth story since 2004, it is not immune to the risk of obsolescence as the app is having an issue staying relevant with younger generations.

In fact, internal documents released in October 2021 by former Facebook employee turned whistleblower Frances Haugen show the following:

- Facebook teen acquisition is low and continues to see lower levels of engagement vs. older cohorts.

- Users born before 2000 are fully saturated when they reached 19-20 years of age, while those born after 2000 are seeing delayed saturation as migration of IG teens to FB is extremely modest.

- US young adult engagement is flat to negative vs. pre-Covid levels.

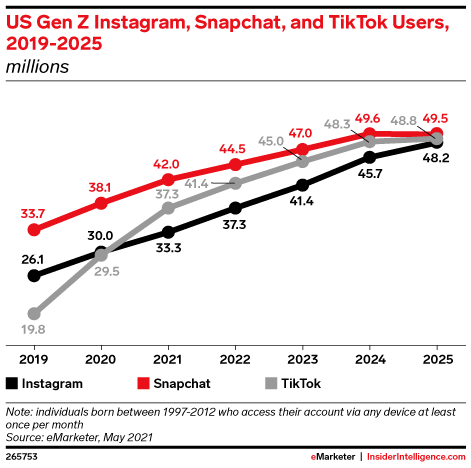

To keep users engaged, Meta plans on investing aggressively in Facebook Reels. However, adding short-form videos may not be enough to address the underlying issue that teenagers simply do not want to be on the same platform as their parents and older siblings. This is why both Snapchat and TikTok are the most popular apps amongst US Gen Z users, and that 25% of US Tik Tok users are 10 to 19-year-olds.

eMarketer

While Facebook’s aging user base has become a challenge, Google is likely to stay in a relatively stable/dominant position as search is less sensitive to changing consumer preferences. From a user’s standpoint, the value of a social media platform is determined by whether his/her friends (or Kylie Jenner) will be on the same platform, whereas the value of a search engine is based on the usefulness and accuracy of the information being provided in response to a search query.

PS: In case you’re considering buying Meta as a value stock, here are 5 reasons why I think it’s a value trap.

Why does Google have a wider moat in search than Meta in social media?

The short answer is that Google has built a massive search index (library) containing hundreds of billions of web pages, which makes it virtually impossible for a new competitor to gain traction as users simply cannot find the results they want with a smaller index.

Take Danish startup FindX, for example, which started in 2015 as an alternative to Google by building its own index and algorithm to provide personalized results. The company quickly found itself struggling because large websites like LinkedIn and the Wall Street Journal would usually identify non-Google/Bing crawlers as security threats to their sites, thereby blocking new search engines from indexing their content. FindX shut down in 2018.

When software engineer Zack Maril researched how websites treated Google’s crawlers by studying 17 million robots.txt files (instructions telling search engine robots which web pages they can or cannot access), he found that only Google’s crawler can have access to links that contain PDF documents on ScienceDirect (a popular site for research papers) and that Alibaba.com will only permit Google’s crawler to access its product pages.

Then there’s DuckDuckGo, the privacy-centric search engine that does not collect user data to avoid the “filter bubble” where results are modified by search history and location. This means whatever sites you visit via DuckDuckGo will not know where you came from and what keywords you used to find them. While DDG has gained popularity thanks to higher awareness for user privacy, the privacy-oriented search engine sports a meager 0.68% market share, significantly lagging Bing’s 2.96% and Yahoo’s 1.51%.

Therefore, competing successfully with Google has become more of a chicken-and-egg problem where one cannot get traffic without content and content without traffic. This is why Google owns 92% of search market share while others (Bing, Baidu, Yahoo, Yandex, and DuckDuckGo) account for just 7.38%. In the foreseeable future, I believe this will continue to be the case.

Bottom line

Search engine is a winner-take-all space and whoever owns the biggest index and traffic today will likely remain dominant going forward. This is very different from social media where the popular choice today may not always be the popular choice tomorrow as younger generations may not share the same preferences as the older generations. As a result, I believe Alphabet investors will sleep better than their Meta counterparts.

Alphabet stock has recently experienced another round of selloff thanks to a more aggressive Fed that sent the 10-year yield up from 2.3% in the beginning of the month to 2.7%, which is obviously a downer on tech valuations. For a forward P/E of 23x, I believe the risk/reward of Alphabet remains favorable and the stock should have no problem reaching the consensus price target of $3,400 given Alphabet’s industry-leading position and solid margin profile in a rising interest rate environment where most profitless tech stocks will struggle.

Be the first to comment