gorodenkoff

Thesis

The software framework created by Schrödinger (NASDAQ:SDGR) has revolutionised the process of discovering new treatments and materials. The company licences its computational platform to universities, pharmaceutical and biotechnology companies, and government agencies worldwide to aid in the development of new materials and therapies. The company’s computational platform accelerates the discovery of high-quality pharmaceutical and material molecules. Machine learning improves the speed and accuracy with which these chemicals can be identified, thereby accelerating the process of identifying new drugs and reducing costs. The resulting platform is highly scalable and possesses significant network effects due to these competitive advantages. For SDGR, the company lacks the operating leverage to facilitate any profitability. The hopes of profitability that were once management’s advocation in 2021 are now far gone, with the company struggling to transform a successful product into shareholder value.

Company Background

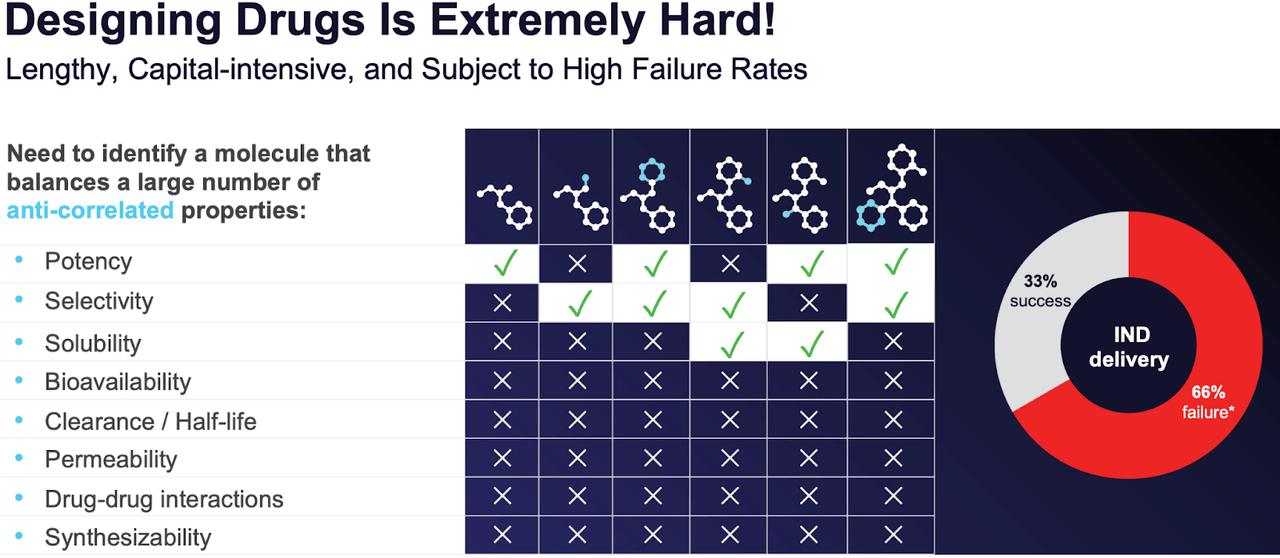

The company argues that its computational process enables researchers to discover new opportunities at a lesser cost and with a higher success rate than with conventional methods. Schrödinger’s computer algorithms have been advanced to the point that they can now exactly map the essential characteristics of molecules.

Company Presentation

The usual approach to medication development is inefficient and time-consuming. The standard medicine approval process takes an average of five to seven years, and over two-thirds of drug research studies fail.

Company Presentation

Standard technique involves screening existing chemicals for “hit molecules,” or those with detectable action. Once discovered, these hit molecules would be subjected to intensive testing to maximise their activity, with the goal that one of these tests would yield a new drug. Due to the manual nature of this process, it is not only time-consuming and prone to error, but also expensive. When something is excessively expensive, it typically results in a number of challenges.

Company Presentation

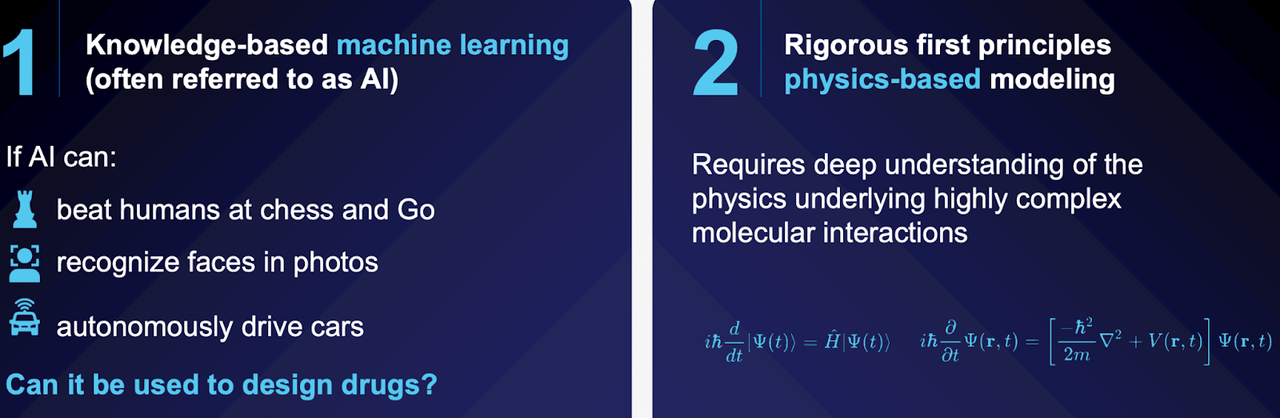

As a result of machine learning and physics-based platforms, pharmaceutical companies can discover more effective molecules in significantly less time than in the past. Programmers can utilise Schrödinger’s platform to anticipate fundamental molecular properties and their effects. With this automated system, locating the correct hit molecule in a development project is far faster, cheaper, and more reliable.

Company Presentation

Schrödinger is able to accomplish more in less time and on a greater scale than conventional discovery methods. Without a doubt, this provides a big benefit to the clientele. When utilising Schrödinger, users have access to a significantly larger library of compounds than when using standard methods. Schrödinger may give developers a molecule that is optimal for their targeted profile significantly faster than standard discovery methods.

This is because fewer pharmaceuticals will be involved. When a product’s price increases, buyers tend to purchase less of it. No accommodations should be granted for drug testing. It stands to reason that as the cost of drug discovery grows, fewer new treatments will be introduced. Instead of experimenting with brand-new substances, researchers will just seek the most promising opportunities. As a result, fewer molecules will be available for screening, which will impede the identification of innovative therapies.

Growth Prospects

Given the company’s computational and machine-learning roots, it is not unexpected that Schrödinger is able to rapidly expand the platform. The implementation of machine learning has directly led to reduced search and evaluation times for molecules in Schrödinger. This is essential since the marginal cost of obtaining new customers is minimal.

It is not unexpected that the top 20 pharmaceutical companies are all Schrödinger clients, given the aforementioned advantages of their products. A further benefit of Schrödinger over its competitors is the platform’s longevity and credibility. Investors can see how potent their competitive advantages are since they have secured the business of the major manufacturers.

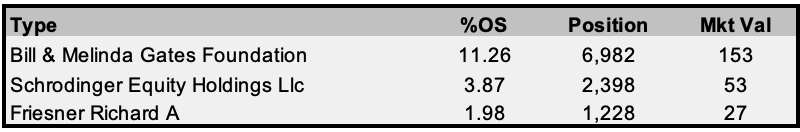

Further to much of the credibility that the companies customers infer on the software, significant investments from renowned philanthropists such as Bill Gates further exemplifies the reach and demand for the product in further enhancing the medical field.

FactSet, Author’s Work

Financial State of the Company

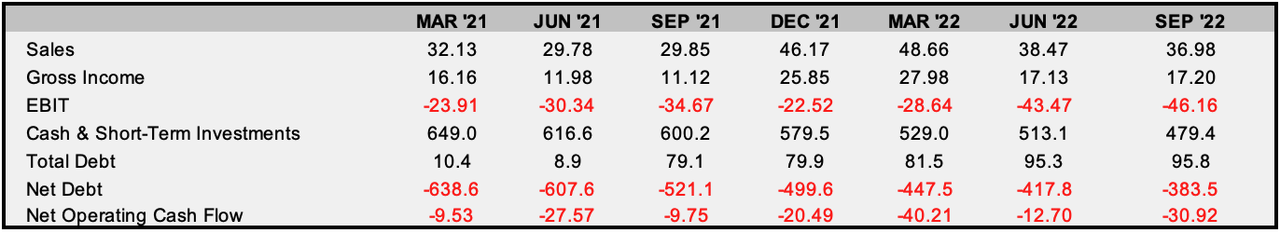

Clearly, the company’s product has the potential to transform a trillion-dollar industry. The product is widely used and accepted on a conceptual level, but as investors we must look beyond this. The fundamental story depicts a company that has continued to penetrate the industry, whereas the profitability score card depicts a company that cannot scale its operations. The transformation of R&D into free cash flow that can be effectively returned to shareholders appears to be in the distant future as profitability continues to decrease. The company has continued to demonstrate its inability to reduce operating costs in inflationary environments, with R&D and ‘other SGA’ costs increasing by 100 percent during the same time period that sales have increased by 65 percent. The absence of operational leverage has played a significant role in the 2021 and 2022 share price decline.

FactSet, Author’s Work

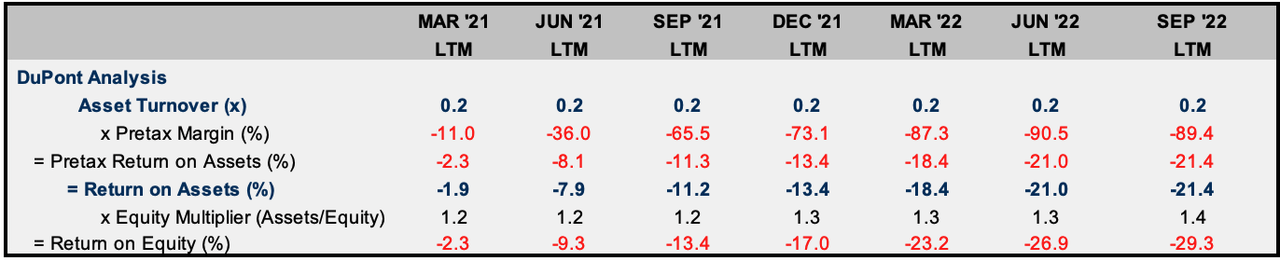

In light of declining profits, the company’s return on equity has continued to deteriorate. Pre-tax margins have deteriorated to levels markedly different from the -11% margins observed in March of 2021. This deterioration, coupled with the 17% increase in the leverage ratio, has widened the return on equity discount. Important to note, shareholders will continue to realise no value until management is able to facilitate growth or as long as operations cannot be scaled.

FactSet, Author’s Work

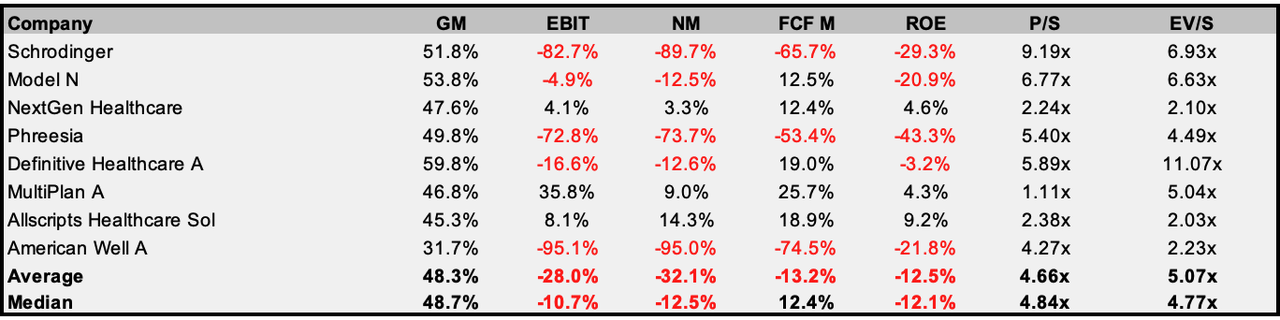

The unusual case of Schrödinger in comparison to many of its peers, some of whom have been public for the same length of time as Schrödinger, indicates the possibility of a significant downside return distribution. A visual examination of the companies’ profitability indicators reveals that their operating profits are among the lowest-performing in their respective peer group. This, along with the highest valuation in the group, indicates a disconnect between the fundamentals and the market price that cannot continue to persist.

FactSet, Author’s Work

Final Thoughts

Schrödinger has developed software that will continue to support the expansion of the medical R&D sector for many years. The world’s largest pharmaceutical companies use the software, which is backed by an all-star team. This is the point at which the concept of scalability and the management’s ability to transform this product into a formidable cash flow-generating enterprise are essential. The unfortunate reality is that the company’s management has continued to struggle significantly to effect material changes in the income statement’s fundamental factors. As a result, I do not consider this a viable investment.

Be the first to comment