TrongNguyen/iStock via Getty Images

Tattooed Chef’s (NASDAQ:TTCF) cumulative year-to-date net loss reached $86.7 million when it released earnings for its fiscal 2022 third quarter. The period saw a material decline in profitability as gross margin maintained its inversion into negative territory. The Los Angeles-based company is now going on defence after years of strong demand for its plant-based frozen food range turned anaemic. This defensive pivot was critical and forced by cash and equivalents that had declined to just $14.2 million as of the end of its last reported quarter against cash burn from operations at $17.2 million in the same period.

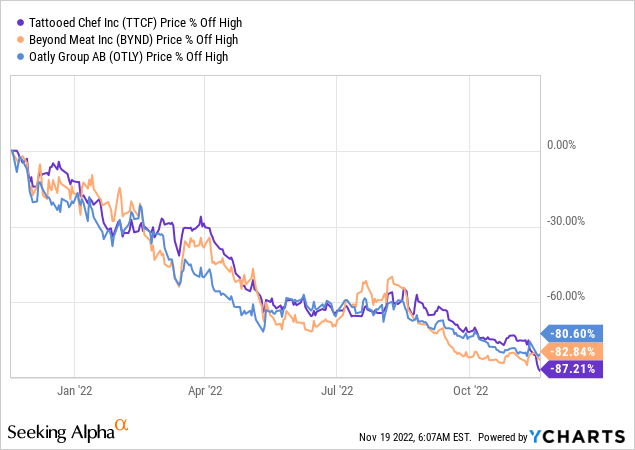

With the common shares down nearly 87% over the last year, current investor sentiment is now coming in at a marked change from the pandemic years when the company was recording strong growth from its pre-pandemic comps and was fast expanding into new products and more grocery stores. Some of this growth still exists with branded SKU count tripling from when they went public and with products now available in 18,000 locations. Further, most of the revenue this year has been entirely unit driven.

The collapse of some of the best-known plant-based food names this year has come as a stark surprise to pandemic-era guidance for growth on the back of secular demand factors. Tattooed Chef along with Beyond Meat (BYND) and Oatly (OTLY) are all now down more than 80% year-to-date as hope and hype around a plant-based diet future met difficult capital market conditions for the loss-making firms.

How The Plant-Based Dream Morphed Into A Financial Nightmare

Tattooed Chef’s last reported earnings for its fiscal 2022 third quarter saw revenue come in at $54.1 million, a decline of 8% over the year-ago quarter and a miss by $18.73 million on consensus estimates. This fall in branded product sales was partially driven by a $6.2 million increase in contra revenue-related expenses and drove gross profit margins to come in negative at $3.9 million. This was a marked deterioration from a positive gross profit of $5 million in the year-ago quarter but was an improvement from the second quarter where a negative gross profit margin of $4.9 million was realized.

The company’s net loss during the quarter expanded to $38.5 million, up 4.7x from a loss of $8.2 million in the year-ago quarter. This drove cash burn from operations of $17.2 million, an increase from $8.8 million in the year-ago comp.

Tattooed Chef is now going on the defence with a series of cost-cutting initiatives to be implemented over the 2023 fiscal year. This will include a reduction in marketing expenses of around $15 million and savings from greater automation of around $6 million. Overall, management expects the defensive pivot to be able to save around $30 million by the end of 2023 and for the more streamlined company to be able to achieve positive EBITDA and cash flow by the middle of fiscal 2024.

The fourth quarter should be marginally better than the third with Tattooed Chef set to institute its first-ever price increases across its product portfolio and with an expanded SKU range in Walmart (WMT) stores. Hence, if the company was to adequately buff up a currently insufficient liquidity position and returns to double-digit revenue growth its 0.75x price-to-forward sales ratio might prove to be cheap.

Was It All Just A Fad?

The collapse of Tattooed Chef’s profitability and common shares have left its shareholders asking whether plant-based eating was just all a fad. This diet was meant to be driven by secular factors that would at minimum support revenue growth for the next few years. Indeed, Gen Z and Millennials largely formed Tattooed Chef’s customer base with concerns around the environment and animal welfare driving the overall viscosity of demand.

Indeed, the sentiment then was clear. About 35% Of Gen Z wanted to be meat-free by the end of 2021 with emissions from plant-based foods 10 to 50 times smaller than those from animals. Further, it became an established consensus that if countries were to meet emission reduction targets, then radical shifts away from animal-based diets would be critical. This broader macro story formed on the back of the growing class of environmentally conscious consumers continues to be a core part of Tattooed Chef’s investment proposition.

But the company’s financial performance has been incredibly poor with sales of its broad product range that includes frozen cauliflower mac and cheese bowls, cauliflower crust pizza, and riced cauliflower stir fry underperforming expectations. It’s not quite fully clear why revenue growth is now negative against heightened unprofitability at a gross margin level. The bears would be right to flag the intensely competitive and low-margin space the company operated in before inflation eroded consumer discretionary income and made households more selective with food purchasing decisions. But the third quarter performance also highlights a potential absence of a moat or a still not expansive enough SKU range.

Tattooed Chef’s core objective is now to stem its revenue decline, return itself to a positive gross margin, and reduce cash burn. Hence, the next question is whether the company has enough liquidity for a runway that would allow them to realize these objectives. I’m not a buyer even at this valuation.

Be the first to comment