Joe Raedle/Getty Images News

Introduction

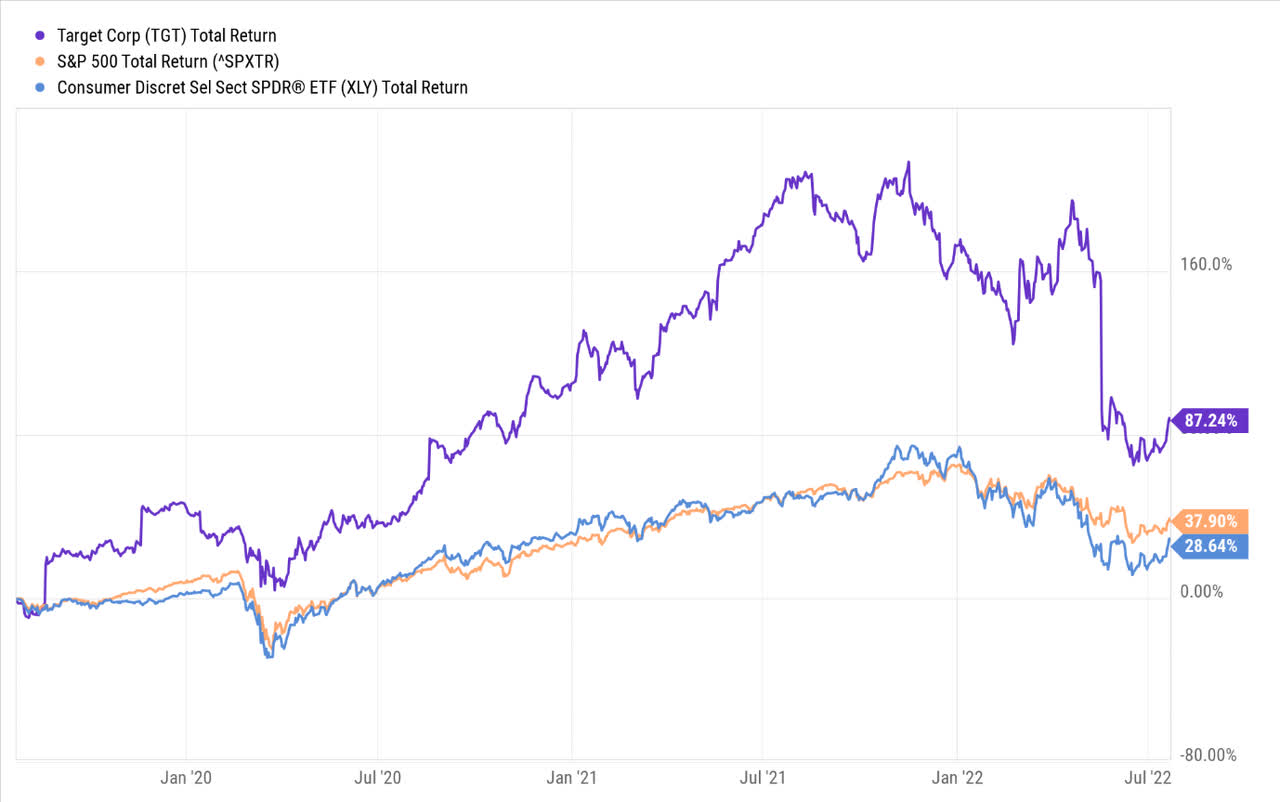

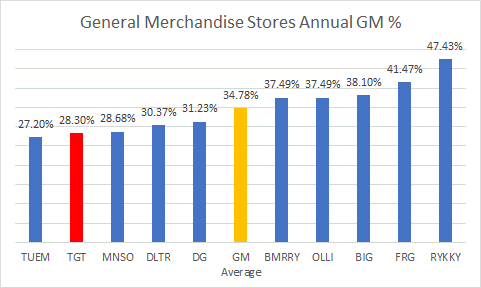

Notwithstanding the recent sell-off, over the last three years, the Target Corporation stock (NYSE:TGT) has proven to be a very lucrative source of returns, comfortably outperforming not only its peers from the consumer discretionary space (by 3x) but the broader markets as well (by 2.3x).

YCharts

After a disastrous Q1, where the stock had gapped down and earned the infamy of nearly topping the list of post-earnings losers (large-caps that experienced 10% or more declines on a single day, post earnings), questions are now being asked if there’s further weakness in store, or if this is perhaps a good opportunity to own a long-term wealth compounder at cheaper levels. In this article, I will seek to address some of these questions.

Is Target Predicted To Go Back Up?

Well, large parts of the sell-side analyst community certainly believe that the stock could bounce back from current levels; this is reflected in the texture of the analyst ratings, and the average target price.

For further clarity, consider that out of the 33 analysts that cover the stock, 58% of them have assigned a ‘Buy’ or ‘Outperform’ rating, with the remaining 42% comprising only ‘Hold’ ratings, with no ‘Sell’ ratings whatsoever. Besides, the average price target works out to $180, implying around 14% upside from the current price levels. With a price target standard deviation of nearly 19%, the implicit potential upside could even stretch to the $214 levels. If TGT’s stock were to hit those levels, it would also mean that the current gap (at $209) had been closed. The market is rife with gap traders who will be looking to position themselves ahead of a potential gap close, but if the stock were to trade beyond those levels, one would need to see a “significant” improvement in Target’s operations, which I feel is unrealistic, given a potential recessionary backdrop.

Investing

What’s Our Read On Target Corporation, And What’s The Outlook For The Rest of 2022?

Whilst one can spot a few green shoots in the macro data and it appears that the market is beginning to feel a little better about Target Corporation, I still believe it would be prudent to not get carried away. Here are some thoughts for your consideration.

Target’s long-term ambition is to be a mid-single-digit revenue growth business, but even though one would hope that things can only improve from Q1, do note that by the end of this year, the annual growth is still likely to be below the company’s long-term target; consensus estimates currently point to Jan-23 annual sales growth of only 3.85%, and to me, that does feel rather underwhelming when you consider what’s in store.

Firstly, consider that over the last few quarters, Target has had to deal with a very strong base effect where annual sales growth had been growing at 20% levels (in the recently concluded Q1, the base effect was 23% growth witnessed a year ago). Delivering a 4% growth over that high base was no mean feat. Fortunately for TGT, this strong base effect will ease off substantially in the upcoming Q2, as last year, the topline growth was closer to 9%. Given the drastic drop-off in the base effect you would hope for an improvement in Q2, but consensus expectations for the quarter point to an even lower annual growth percentage of only 3.8%.

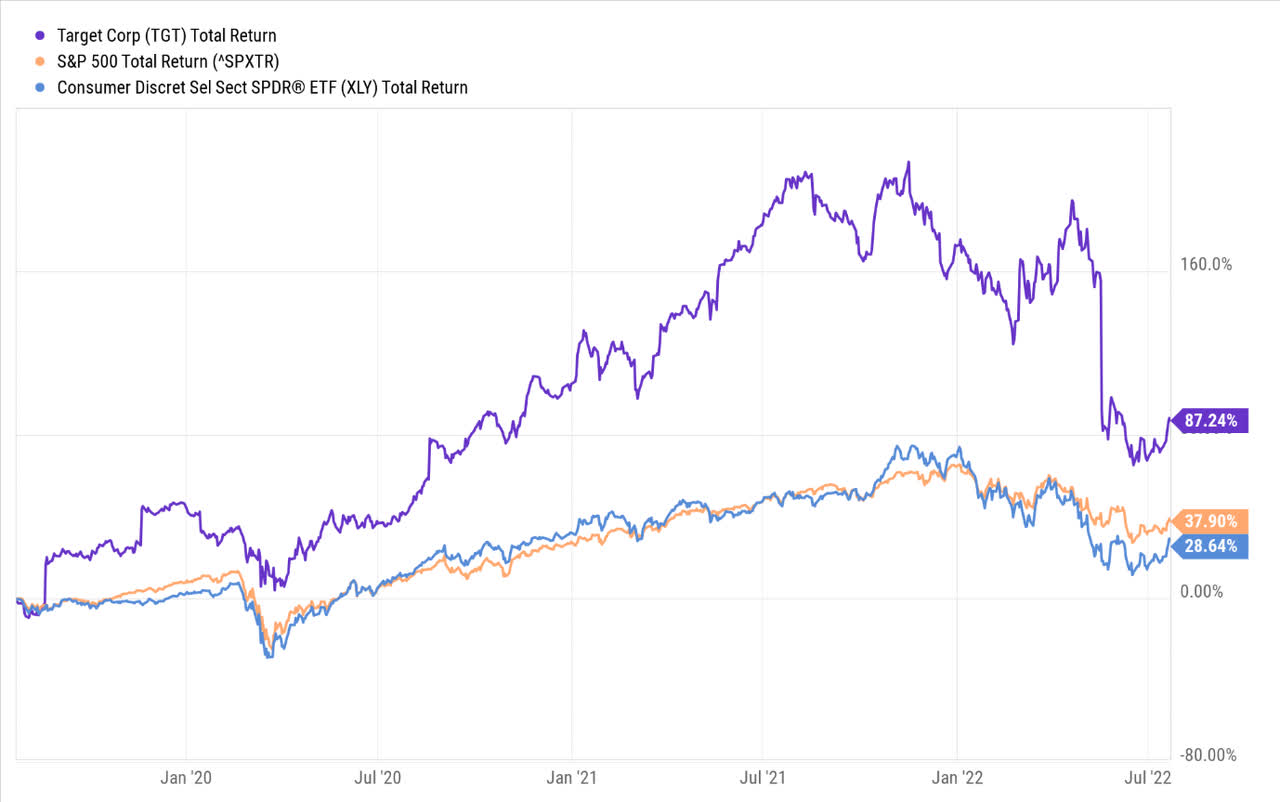

The back-to-school/college dynamics and the holiday season dynamics of Q3/Q4 should abet the topline in Q3 and Q4 but in an increasingly recessionary environment, you do wonder if appetite will be as resilient as in recent years. Target’s largest-selling products come from the beauty and personal care space, and you’d imagine these are avenues where consumers would be prepared to compromise when things become tight. There’s already some evidence of consumers curtailing their spending during each visit; in Q1, the growth in average transactions across Target stores was lower by 0.6%.

TGT Annual & Quarterly Reports

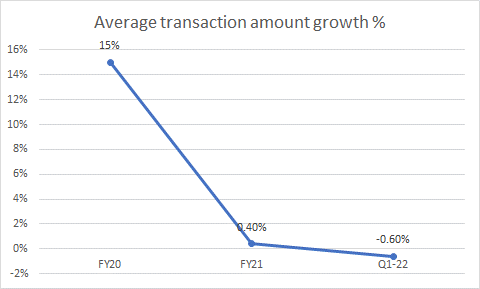

Then consider the dynamics with margins. Even before the disappointing Q1 results, TGT’s annual gross margins of 28.3% were below average and one of the lowest in the general merchandising space. Incidentally, the company’s GMs have been on a downward slide for three straight years now (FY19: 28.9%, FY20: 28.4%)

Seeking Alpha

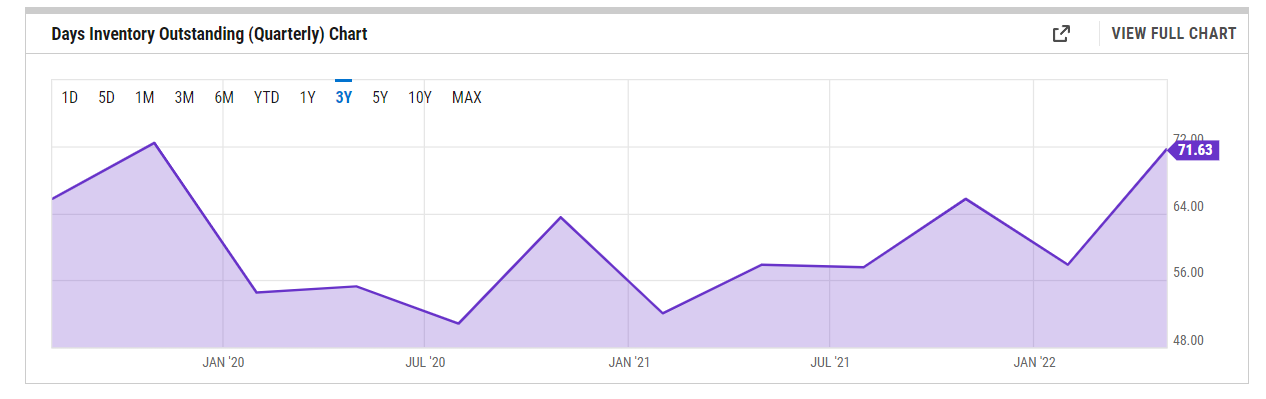

In Q1 gross margins ended up declining by a whopping 430bps (25.7%), with much of the pressure coming from merchandising-related challenges and transportation and supply chain-related issues. Merchandizing pressure came on account of TGT’s inability to understand market dynamics where they ended up building more inventory than required. Converting this inventory into revenue has proven to be a chore, with TGT’s inventory turnover ratio currently at its lowest level since the Oct-2018 quarter, nearly 15 quarters ago. In effect, typically whilst they’ve held inventory for a little over two months, they’re now holding it for 72 days!

YCharts

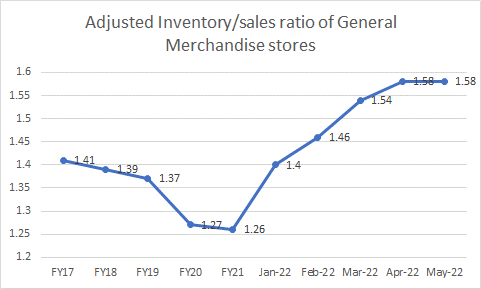

Unwinding this inventory will prove to be a lingering headache of sorts, both with regards to the timing and the pressure it will put on the gross margin by way of greater promotions and markdowns. In fact, based on the data sourced from US Census, it appears that this is an issue for all general merchandisers (GM) and the situation has only continued to worsen as per the most recently available data for May (rather than improve). Typically, the inventory/sales ratio for US GM stores has averaged around 1.34x over the last five years, but currently, it is closer to the 1.58x levels, so you can get a sense of the excess inventory that is still prevalent in the system.

US Census

Whilst inventory re-sizing pressures could linger, TGT may see some respite from transportation and supply chain costs in the quarter ahead (Just for some context, at the end of Q1, Target’s management stated that they expect to see incremental freight and transportation costs of $1bn for the rest of 2022). Fuel costs have come off quite a bit from elevated levels whilst crucially, it appears as though congestion in the West Coast ports has come down significantly (the backlog of vessels waiting to berth is now down by 75% from the start of the year). For the uninitiated, Target is heavily reliant on this port for sourcing goods from China. Besides these developments, there are also some suggestions that the Biden administration could lower China-related tariffs, which could serve as another useful catalyst for TGT’s cost base going forward. Nonetheless, at the operating level, TGT plans to only hit EBIT margins of 6% for FY22, below its long-term target of 8%+.

Aside from the P&L-related narratives, Target’s balance sheet is also not in the best of shape (notwithstanding the excess inventory), and I don’t see this improving a great deal in 2022. Just for some perspective, the total debt of over $17bn is at its highest point since February 2013 (implying a net debt/EBITDA of 1.51x), and the cash on books has collapsed to an inordinately low figure of just $1.1bn (one needs to go back a good 7-8 years to see a lower figure than that).

I believe TGT will continue to be highly levered for the foreseeable future as it plans to ramp up both its upstream and downstream supply chain. As far as upstream is concerned it plans to add five distribution centers over the next two years, and with regards to downstream, it plans to open three new sortation centers before the end of this year. TGT will also be indulging in additional remodeling spend of 200 of its stores this year. In effect, TGT plans to spend another $4-$5bn on CAPEX this year, which will no doubt put pressure on the company’s leverage position.

With steep CAPEX spend of this sort and pressures on the operating front, investors should also not expect the same level of share repurchase intensity that we saw last year (last year’s share repurchase spend was over $7.3bn).

If there’s one aspect of the TGT story that remains resplendent, it is the dividend profile of the firm. The firm has a remarkable record of paying and growing its dividends for well over half a century now, and those who own the share as of August 17th will benefit from a 20% hike in the quarterly dividend (0.90 to 1.08). That would put the forward yield at 2.74%, which is better than the stock’s long-term dividend yield average of 2.46%; so certainly something to think about there.

Closing Thoughts- Is TGT Stock A Buy, Sell, or Hold?

As you may have inferred from what’s broadly covered in the previous section, I’m not prepared to be bullish on Target’s stock as yet, and my neutral view is also augmented by the valuation picture and the relative picture vs other discretionary stocks. On a forward P/E basis, the stock currently trades at 18.3x, more or less in line with its 5-year average of 18.9x

YCharts

Then, if you compare TGT stock to its peers from the consumer discretionary space, as represented by the SPDR Consumer Discretionary ETF (XLY), we can see that the ratio is now at fair levels, trading close to the mid-point of its long-term range, implying no real edge in pursuing TGT (relative to other CD stocks) at this juncture. Besides, even if you want to try and play for a gap trade (see technical chart in the second part of the article), I don’t think it’s the best time to stage an entry as we’ve just seen seven straight days where the high of the day has been higher than the previous day’s high or close (it would be preferable to wait for a pullback if you’re thinking of going long).

Stockcharts

To conclude, I rate TGT stock as a HOLD.

Be the first to comment