bombermoon

Introduction to Renewed Thesis

I am a shareholder of Infrastructure and Energy Alternatives (NASDAQ:IEA), and have written an article discussing how current profit weakness is an opportunity for value expansion upon improvement. Well, it seems that I am not the only one looking for a turnaround play, as another EPC MasTec (NYSE:MTZ) has acquired IEA. The current 30% premium, or 50% above my prior article, is certainly a strong return, and came far sooner than expected. However, the share price has been weak for at least a year and a half, as the current buyout price is only a mild premium over my first coverage of IEA. I am thankful that I have recently added more shares on the weakness, an important way to trade cyclical companies.

The questions now are: to sell IEA prior to the completion of the acquisition, or to hold on to the coming MasTec shares. It is an interesting thought experiment, and I see a few pros and cons to both sides of the coin. Unfortunately, MasTec does not have a strong balance sheet, and this acquisition is both draining all cash on hand, and is dilutive ($14 total share price, $10.50 funded in cash and $3.50 in shares/dilution). At the same time, we remain in a weak cycle for EPCs, especially as the effects of the infrastructure bill remain unseen. If investor sentiment changes over the next few quarters thanks to out-performance, MasTec’s similarly low valuation allows for shares to gain at a rapid clip.

MasTec Acquisition Presentation

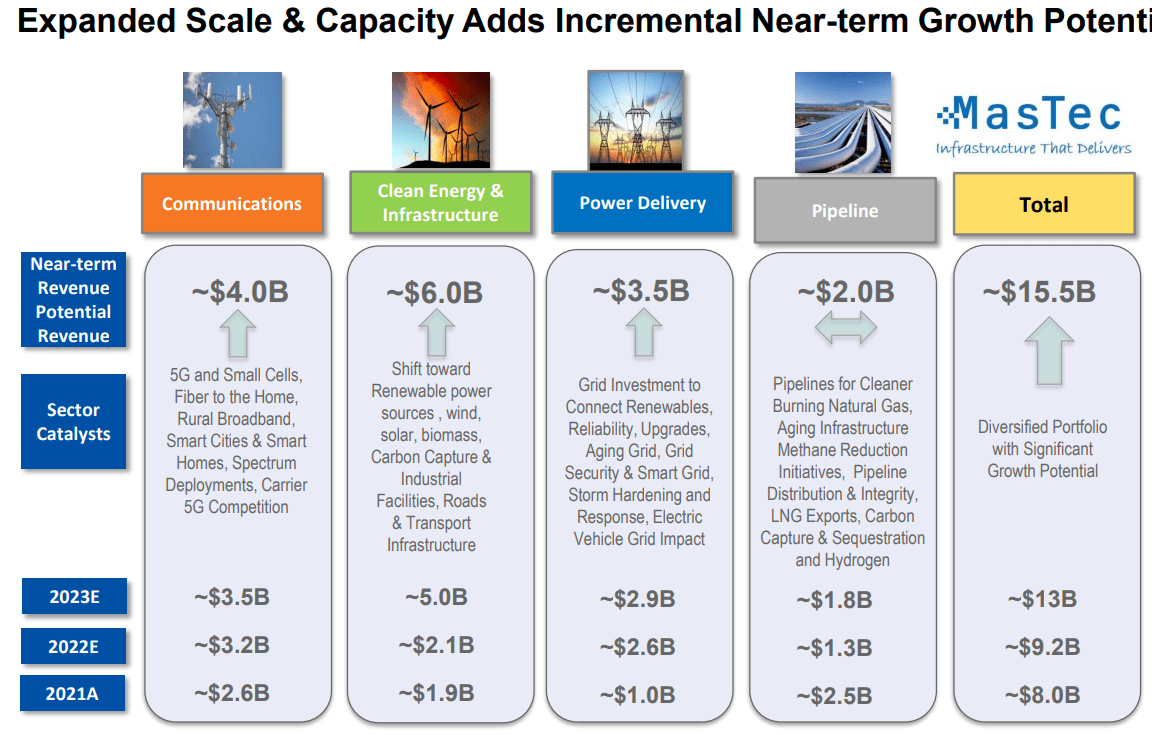

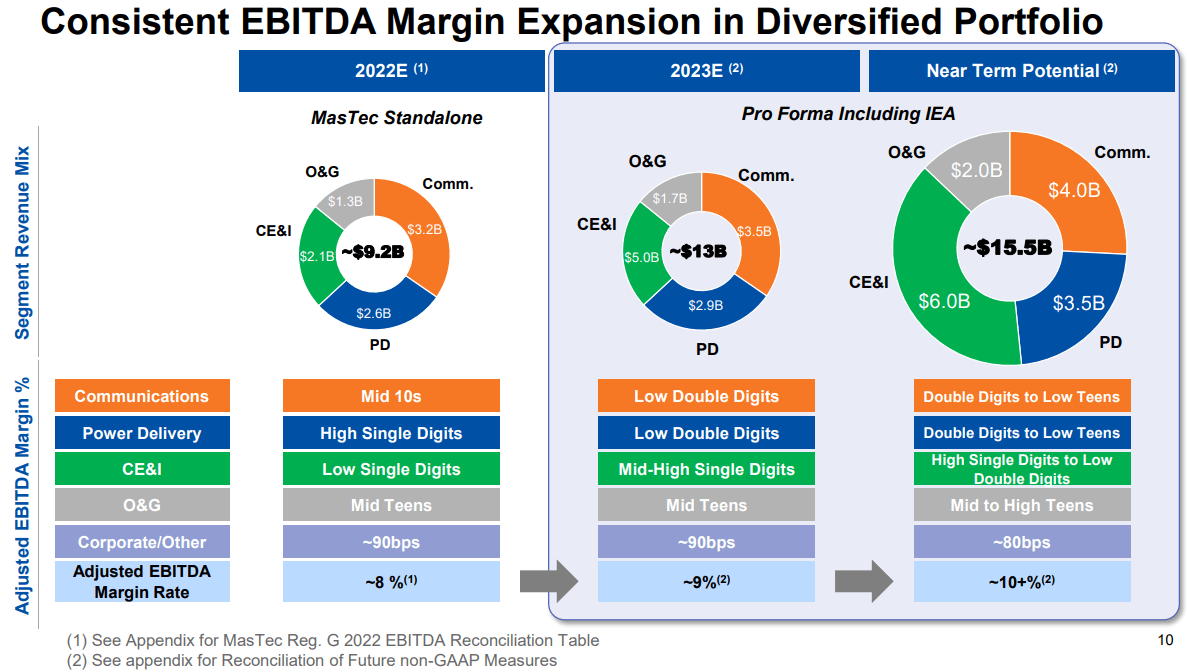

MasTec’s new pro forma outlook has been presented, shown in the image below, and I believe that the new company will gain necessary diversification. MTZ has traditionally relied on communications and power delivery revenues, while IEA has seen far more growth from renewable energy projects. Now, the company will have more growth segments to rely on even if governmental negligence prevents full stimulus (while one bill has been passed, effects have yet to be seen but renewable projects may be at the fore). I believe that stimulus will be necessary to allow for a bullish outlook on MasTec due to financial weakness.

MasTec

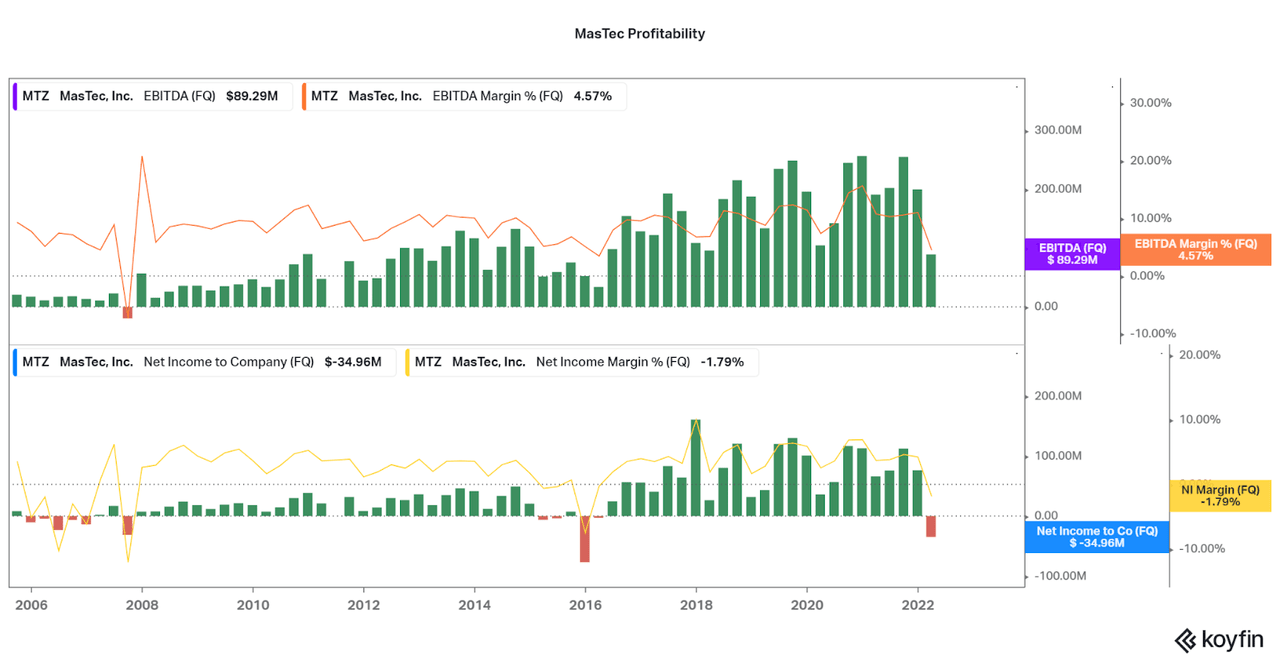

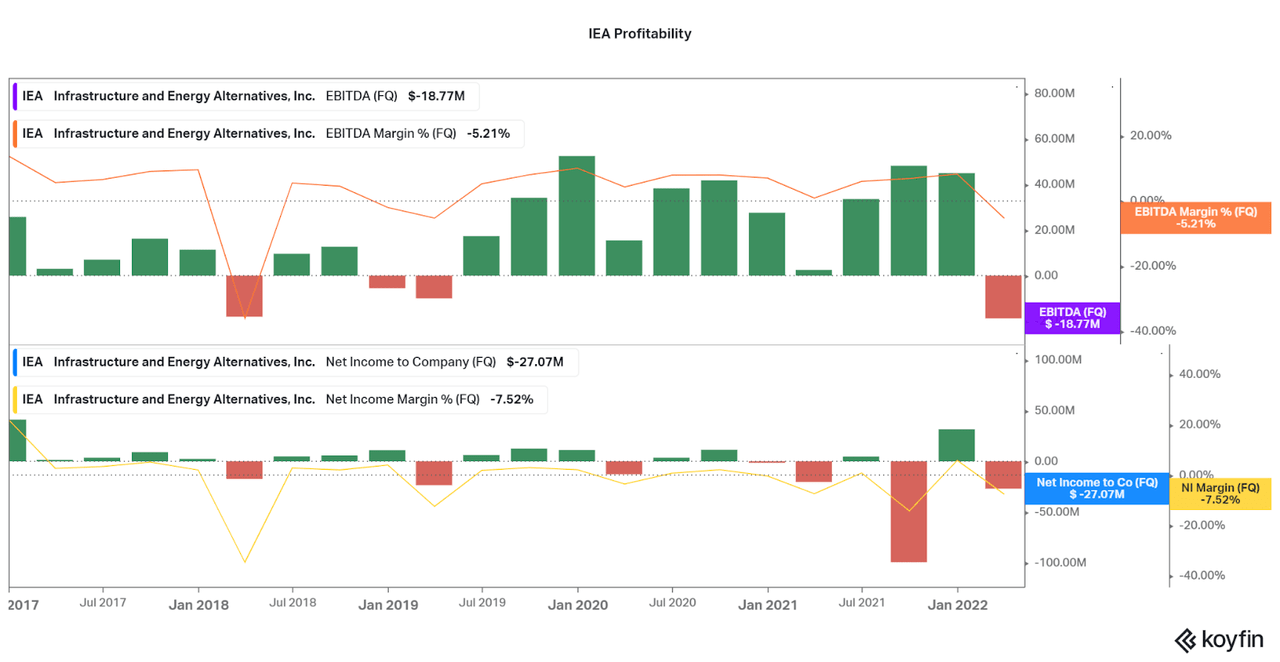

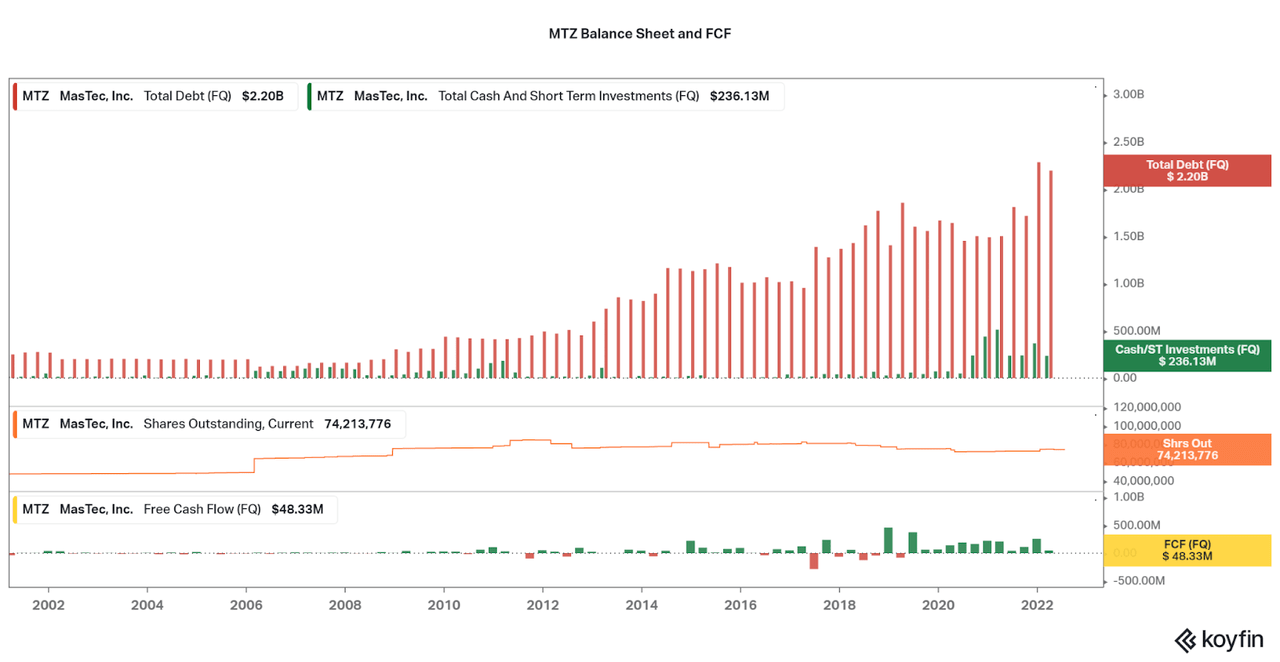

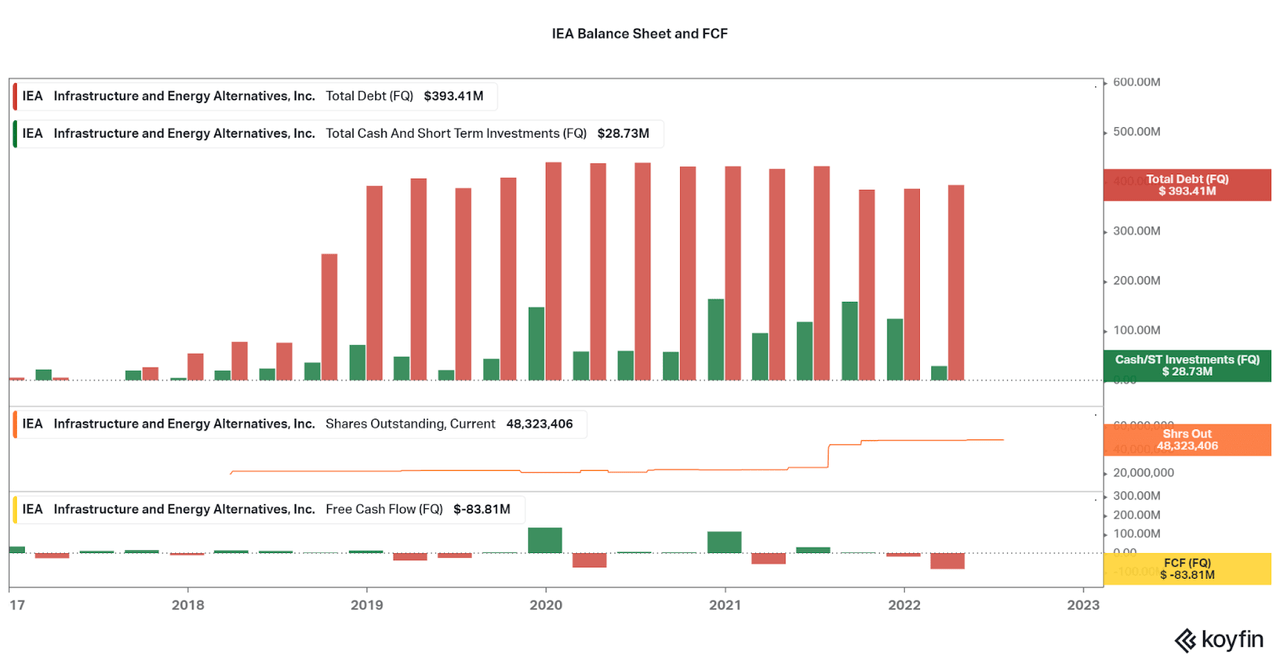

The acquisition exacerbates two major issues: debt and profitability. IEA is known as having profitability issues, even as revenue growth has averaged over 50% per year for multiple years. Meanwhile, MasTec has tried hard to maintain positive net income, but this has come with debt and at the expense of growth. It is difficult to expect that current profitability will be maintained, and so, investors may sell-off as the company attempts to consolidate the joint businesses. While this may lead to an opportunity later on, the shares may be weak in the intermediate term. As you can see in the two charts below, management will have a lot of work to do to find synergies and increase profit margins. Perhaps economies of scale, internal supplier/client relationships, and other catalysts will allow for improvement. Unfortunately, more stimulus/favorable contracts will be necessary.

Koyfin

Koyfin

Moving to balance sheet issues, we can see that MasTec is already significantly levered. Now, IEA will be adding a further $400 million in debt to the combined company, a total over $2.5 billion. The deal will also be dilutive, so look for MasTec’s share count to increase. Lastly, IEA’s current losses are greater than MTZ’s current FCF, so it is unknown whether the balance sheet will be improved moving forward. This uncertainty further lowers investor sentiment, and in turn, share price. This is why the MTZ is already down 6% after the announcement, and selling may continue.

Koyfin

Koyfin

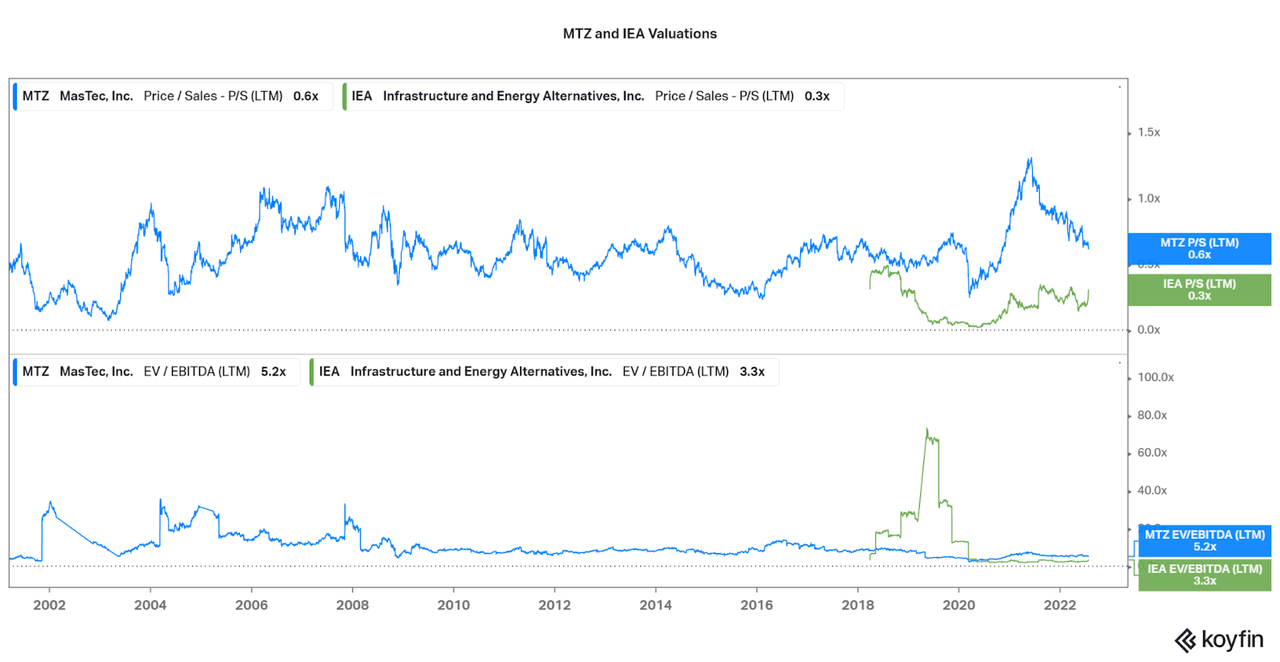

One of the few positives I can see is the cheap acquisition price, and the continued opportunity for the value to rise. While reliant on both companies seeing increases in profitability, the opportunity arises thanks to fiscal stimulus. Further, IEA has access to the important clean energy industry that remains in a secular growth cycle. As MasTec’s valuation reaches all-time lows, one should expect this poor cycle to end, and a positive one to begin. While leverage will continue to hamper the EV/EBITDA value, the P/S indicates that any changes in profitability has the ability to quickly bring the value above 1.0x. This would account for over 60% return, and may occur within a few years based on current guidance. However, in the short-term, I would wait for the valuation to continue falling, and prices below 0.5x P/S are historically better times to buy MTZ.

Koyfin

Conclusion

While the acquisition of IEA certainly makes MTZ a leader in a variety of construction segments, any difficulty in improving profitability across the board will continue to hurt the valuation. Therefore, I believe it may be fruitful to sell IEA shares, rather than continuing to hold MTZ after the acquisition. Then, if the opportunity presents itself, you can either reallocate your capital to other industries, or reinvest into MTZ at a lower price later on. While I believe the likelihood of this occurring is high, low-risk investors (if there are any) may be comfortable just holding on to MTZ shares indefinitely, especially as any increase in infrastructure spending is sure to improve the current financial fundamentals. Personally, I believe I will do the former, and wait for a better buying opportunity, much as I believed IEA was valued far too low. I will certainly write a new article if the need arises.

Thanks for reading.

Be the first to comment