AndreyPopov/iStock via Getty Images

Guidewire Software, Inc.(NYSE:GWRE) is an IT services company founded in 2001. It offers software platforms with services and products that support the entire insurance lifecycle for P&C industry carriers. The stock has been a stable performer since its IPO in 2012, except for the recent stock price plunge to the level of 2017. Serving the P&C insurance industry, GWRE has lots of strength to survive the 2022 crisis. While it is not super profitable yet, I felt this is a name worth looking into for investors who focus on long-term growth.

Business and product lines

GWRE has product lines that cover product definitions, distribution, underwriting, policyholder services, and claims management. It is a global company that has localized its platform internationally to fit different regulatory, language, and financial environments.

GWRE is known for its ecosystems of large partner base that provides applications and content for insurers through the GWRE marketplace. As of July 31, 2022, over 170 partner-developed integrations have been offered to customers, and hundreds of applications and resources are available for download. GWRE also has a very good reputation for its claim systems which include rich and mature functionalities.

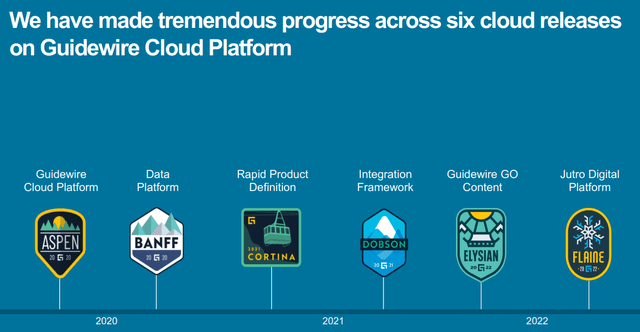

Recently, GWRE has transformed its business strategy from On-premise to cloud, which consists of 90% of its sales activities. Most product development efforts are also concentrated in the cloud business, as the company has had six major product releases since late 2019. This quarter, its subscription revenue has now surpassed licensing revenue.

Product release (Guidewire presentation)

Why Cloud will offer tremendous value

As the P&C insurance industry continues to face an increase in pressures from catastrophes and natural disasters, carriers need to adopt technologies with more agility and efficiency. Transitioning products and services to the cloud will leverage a wealth of data and analytics to engage customers better and offer personalized pricing. By allowing third parties like GWRE to manage platform infrastructure, insurers could focus more energy on differentiating activities. In the long term, substantial cost savings on maintenance and updates could be achieved. Cloud systems were also known to have lower security and reliability risks when compared to mainframes. With more new technologies introduced to the insurance industry, such as drones, Ai, IoT, chatbots, and telematics, more carriers will have to move their platform to the cloud.

P&C insurers are very behind on new technologies and transitioning to the cloud. There are still lots of opportunities for growth in this area. Moving to the cloud essentially prolonged the product life cycle as the transition often takes 6 to 15 months. This is often a very long-term commitment for customers.

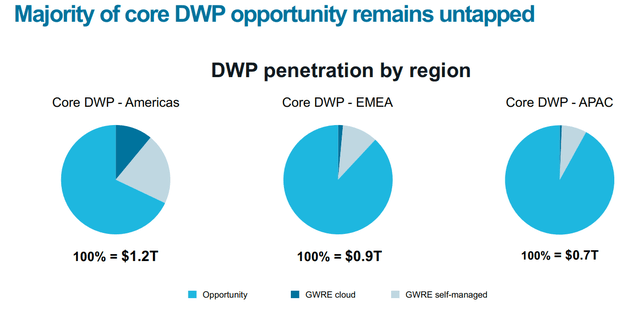

Currently, cloud deals are easier for small to mid-sized carriers as they have fewer layers in the management and their workflows don’t require high customization. Many out-of-box tools could serve them well especially combined with low-node/ non-code functions like GWRE and Duck Creek (DCT). According to the company, there are huge untapped DWP opportunities (chart below) for cloud expansion and adoption.

Untapped DWP opportunity (GWRE presentation)

The recent quarterly results showed some resilience

GWRE has reported Q4 fiscal year 2022 results with ARR growing 14% to $664M and total revenue growing 9% to $813M. Revenue at per share basis is at an almost all-time high of $2.91 (near mid-2020 level). Given the tough macro environment, the growth has slowed down. Most carriers adopt a conservative stand on new spending and have to commit smaller upfront investment on their deals. However, GWRE could still land 16 new cloud deals (40 for the full year) and grow its business. This is better than many other SaaS businesses, indicating its resilience under tough times. Notable logos adopted include Kemper Corporation, OnStar Insurance, Automobile & Fire Insurance, etc.

The guidance for the fiscal year 2023 expects more growth with ARR between $745 million and $760 million; Total revenue between $885 million and $895 million; Operating cash flow between $50 million and $80 million. While necessary investments and costs may drag some profitability numbers, the current operations can clearly make money and grow its customer base at the same time.

GWRE price its services and products based on the DWP through its platform. Subscription revenue is recognized by term licenses with an initial two-year term and optional renewal afterward. This gives GWRE more stability since DWP usually goes up and P&C insurance is often not discretionary spending. GWRE has a long record of growing its ARR regardless of macroeconomic ups and downs. The Cloud strategy even accelerated this growth as the chart below shows.

Bottom Line

I think GWRE will do well in the long term since it offers mission critical services for insurers. The company has been dominating the P&C industry for a while and it has the scale advantage to continue executing its business plans (below).

GWRE market scale (GWRE presentation)

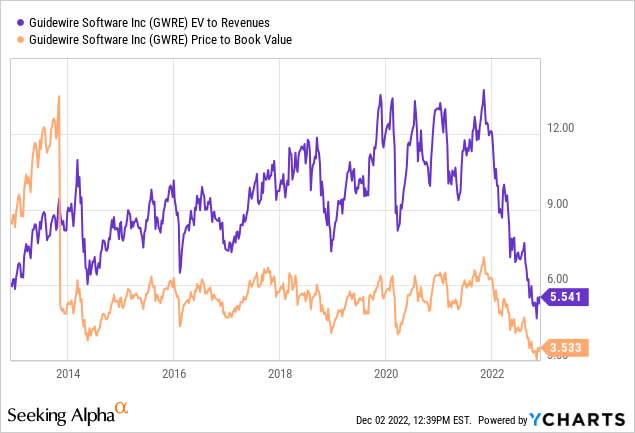

As the chart below, GWRE’s EV to Revenue ratio and Price to book value haven’t been this low for a long time. Moreover, the $400M repurchase plan offers an absolute return to shareholders and will be more valuable as the stock dips.

Regarding concerns, GWRE still has negative net income given a large portion of its revenues (59.4%) were used in SG&A and R&D. I wonder what GWRE’s business looks like when they cut those costs. It is unclear what portion of those costs are for growth or maintaining existing business. There is also a huge turnover in its management teams since late 2019. This showed their determination to transition to the cloud. However, I prefer a company with some consistency in management.

Overall, GWRE looks fairly attractive here as the price has been crushed for a while.

Be the first to comment