werayuth/iStock via Getty Images

Investment Thesis: Target Hospitality (NASDAQ:TH) has seen strong growth as a result of strong revenue performance across the Government segment. However, this segment will need to continue showing strong growth to justify further upside from here.

Back in May, I made the argument that Target Hospitality could stand to see further upside, as lodging demand for oil and gas workers increases in light of the situation in Ukraine.

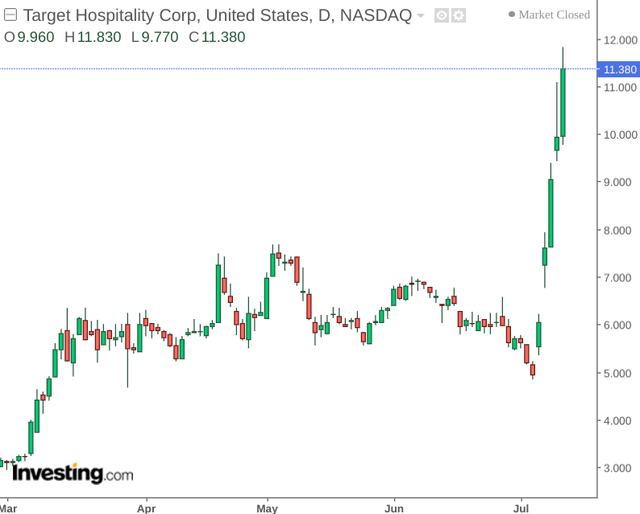

Investors were clearly impressed by the company’s recent earnings performance, with the stock up sharply to $11.38 at the time of writing:

The purpose of this article is to assess whether the stock could see further upside in light of the sharp appreciation.

Performance

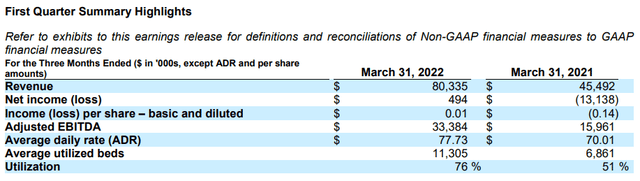

When looking at performance in the most recent quarter, we can see that revenue has almost doubled – while utilization is up strongly even with a rising ADR (average daily rate):

Target Hospitality First Quarter 2022 Results

When looking at segment performance specifically – we can see that Government – which marks the largest segment by revenue – also saw the strongest growth in revenue, average daily rate, and average utilized beds on a percentage basis (from March 2021 to March 2022):

| Government | Hospitality & Facilities Services – South | Hospitality & Facilities Services – Midwest | |

| 2022 Revenue | $46,790 | $31,576 | $977 |

| Revenue (%) change | 159.38% | 25.84% | 63.65% |

| Average Daily Rate (%) change | 23.42% | -0.05% | 7.94% |

| Average utilized beds (%) change | 111.78% | 25.56% | 51.48% |

Source: Revenue figures sourced from Target Hospitality First Quarter 2022 Results. Percentages calculated by author.

As we have also seen – the most recent quarter saw a recovery in income per share to positive territory (basic and diluted) – which was a significant driver of the recent spike in share price.

From a balance sheet standpoint – we can see that while the cash ratio has dropped slightly from March 2021 – this has not been by a great margin and total current liabilities are also down slightly on that of last year:

| March 2022 | March 2021 | |

| Cash and cash equivalents | 5824 | 6373 |

| Total current liabilities | 32799 | 33299 |

| Cash ratio | 17.76% | 19.14% |

Source: Figures sourced from Target Hospitality First Quarter 2021 and 2022 Results. Cash ratio calculated by author.

Holistically, the fact that earnings are back in positive territory, revenue across the company’s largest segment has shown the most growth, and that the company continues to manage its cash position effectively are encouraging signs.

Looking Forward

One of the encouraging signs from recent results has been the fact that earnings has rebounded into positive territory.

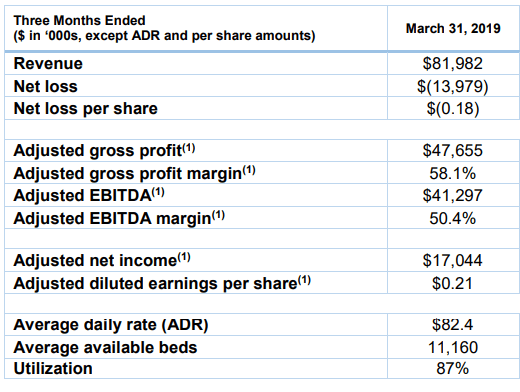

When looking back at March 2019 results, we can see that Target Hospitality saw an adjusted diluted earnings per share of $0.21, with slightly higher revenue and ADR than in March 2022.

Target Hospitality First Quarter 2019 Results

In this regard, the recovery in earnings has been encouraging. However, the flip side of this is that investors will continue to expect earnings growth from here – particularly towards prior quarterly levels seen pre-2020. Should we see the company’s earnings growth dip into negative territory once again – then the stock could see sudden downside.

With the Government segment having led growth, Target Hospitality remains the government’s largest provider of hospitality solutions for domestic humanitarian aid missions.

While the rebound in demand has been encouraging – potential risk factors could include inflationary pressures limiting the governmental budget for domestic humanitarian aid going forward. This could also be further limited by potential redeployment of funding for foreign aid initiatives, including continuing aid for Ukraine in light of the ongoing situation in that country.

In this regard, while we have seen revenue across the Government segment show sharp growth – investors will be looking to see if this continues. Should we see continued revenue growth as well as rising average ADR and utilization, then the stock could still see further upside going forward.

Conclusion

To conclude, Target Hospitality has shown strong performance in the most recent quarter, which has led the stock price sharply upwards.

With that being said, investors are likely to pay significant attention to performance across the Government segment going forward – and will continue to expect strong revenue growth to justify further upside.

Be the first to comment